What is Yekdem?

A renewable energy subsidy (Yekdem) is a usual vehicle by which a developer satisfies the underlying asset through guaranteed long-term revenue streams. In general, if subsidies are being given at a high price than the free market electricity, it is unlikely developers will wish to sell their assets to corporate consumers through a PPA structure.

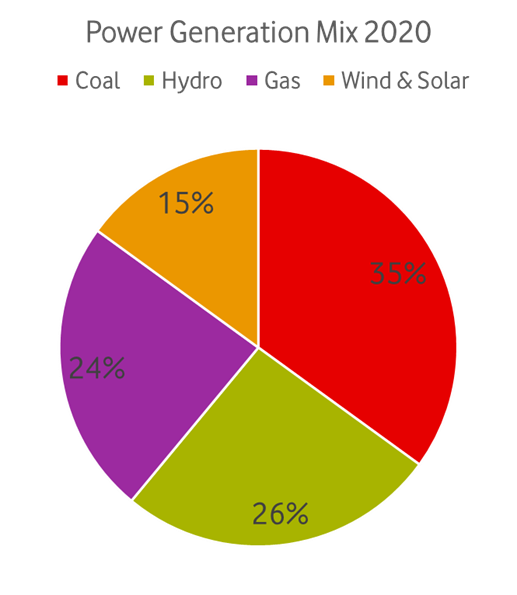

Currently, Turkey has about 40% of its electricity generation comes from renewable sources. Hydro remains the main renewable source in Turkey, followed by Wind and Solar PV. Turkey aims to reach 65% of its energy needs from domestic renewable energy sources by 2023 and have 15 GW of installed solar PV capacity by 2027.

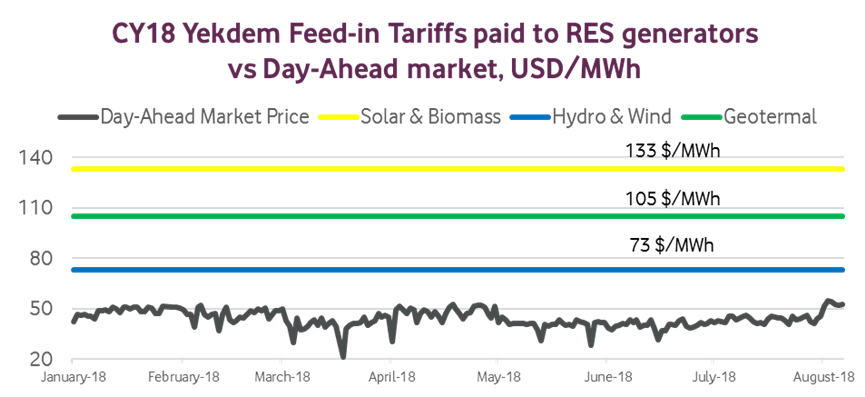

Renewable electricity production is mainly promoted through a guaranteed electricity tariff by the state. New renewable power plant operators are entitled against the grid operator to the payment of a fixed feed-in tariff for all electricity exports to the grid. The feed-in tariff varies according to the source of energy used and whether the components of the plants are made in Turkey or not. The mechanism gives a choice between direct marketing and technology-specific feed-in tariffs. Historically, a high Yekdem tariff was making it a preferred choice for investors. To benefit from YEKDEM, new power plants had to start operating between 01.01.2016 and 31.12.2020. The feed-in tariff was limited to 10 years.

Since 2021, however, Yekdem support is no longer available for new renewable installations in Turkey. Instead, a new government auction-based support “Yeka” was introduced. Under the YEKA scheme, the feed-in tariff is set for 15 years and determined by a tender process (YEKA Solar Tender; YEKA Wind Tender). The latest Solar Yeka auction was conducted in Jan’22 with a price capped at ~45 $/MWh. Auction prices secured in Wind Yeka tenders were even less (~ 40 $/MWh). This is much lower than the prior Yekdem Solar tariff of 133$/MWh and even lower than the current day-ahead market price in Turkey, which is around 65 – 75 $/MWh.

As a result, this new support scheme is not so attractive as Yekdem, leaving investors with no other option but to postpone new projects or sell directly to the day-ahead market or corporate consumers via power purchase agreements (PPAs). Mainly short-term-focused deals (1-3 years) with a price linked to the international dollar value exist in the market today.

Therefore, a regulatory market landscape still needs to be developed to unlock the full potential of corporate PPA agreements in Turkey. Unattractive government subsidies, however, shall spark developers’ interest in signing PPA agreements, so it’s important to continue to closely monitor the market dynamics.

If you are interested to learn about electricity bill structure in Turkey, you can read my article here. Please comment below if you liked this article!

Pingback: (2022) Turkish Renewable Energy Certificates to achieve 100% green electricity target for corporates - Futrue Energy Go