Weekly Energy Market Highlights:

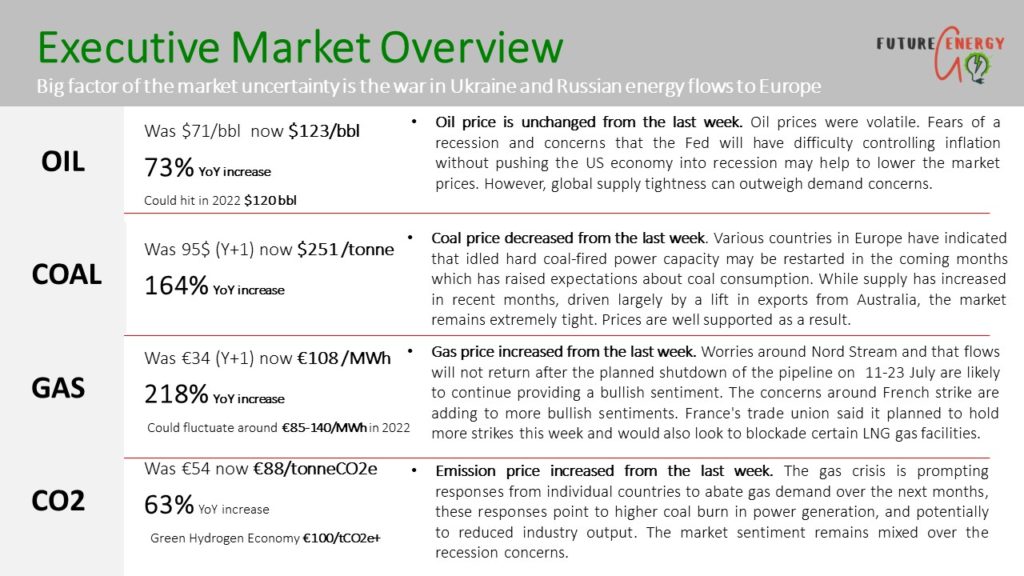

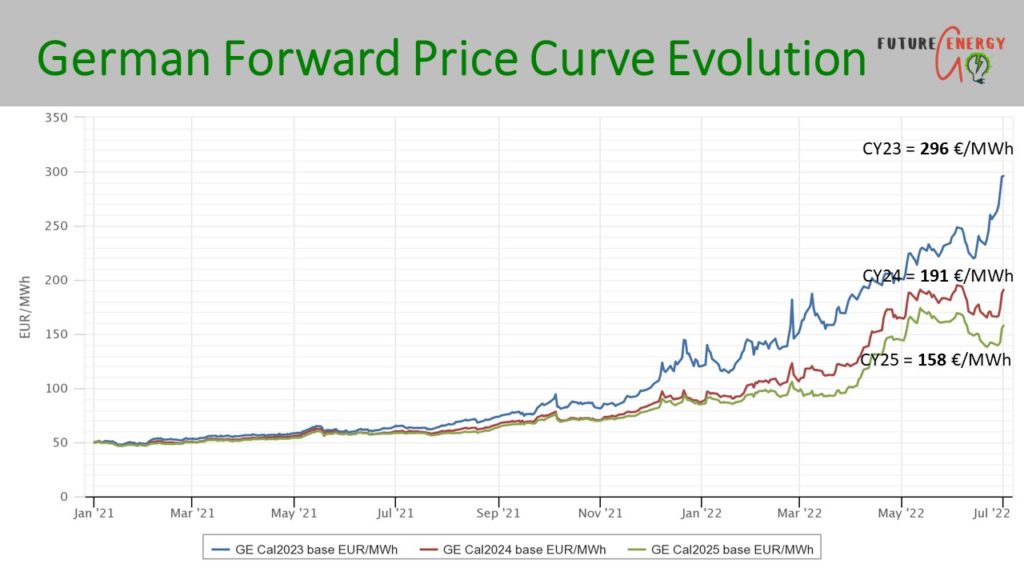

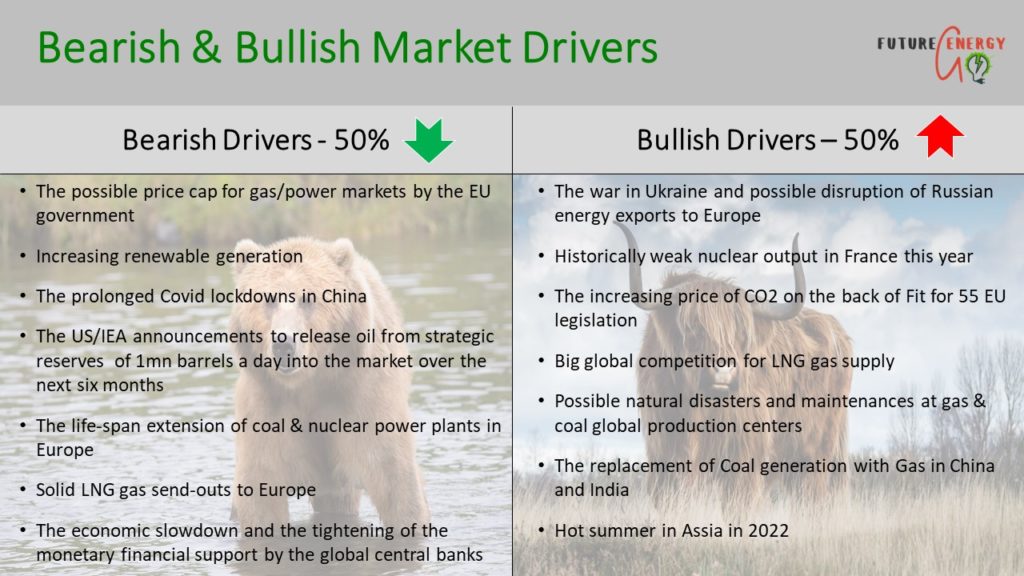

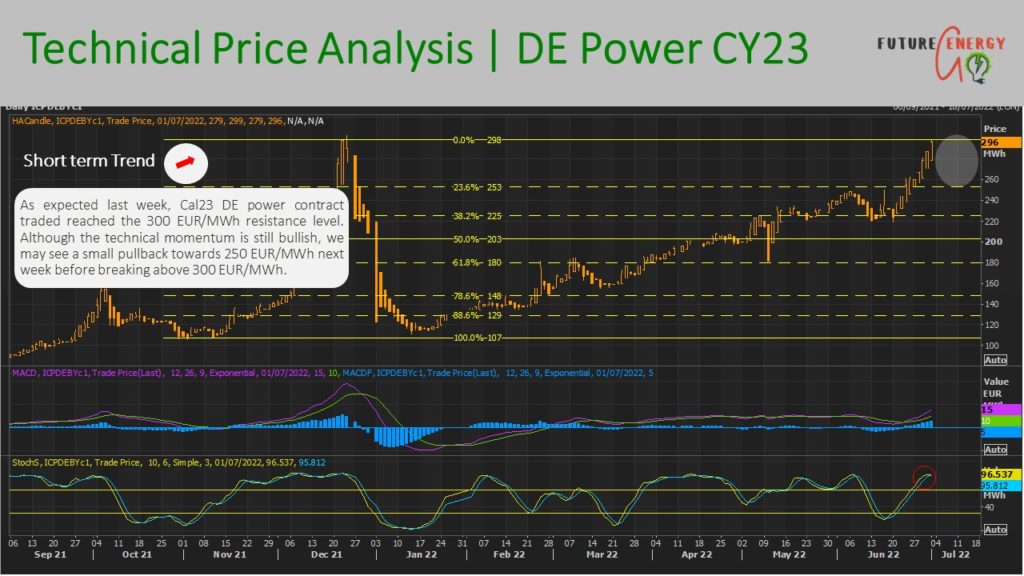

- European power prices remain extremely bullish over concerns around Nord Stream and that flows will not return after the planned shutdown of the pipeline on 11-23 July.

- Market analysts expect that if Europe were to lose Russian gas this year, the gas prices can reach well above 200 EUR/MWh. This will result in a power price of ~400-500 EUR/MWh unless the EU disconnects the power from gas prices and/or regulates gas market prices.

- Germany raises the gas crisis level to “alert” as lower flows from Russia endanger the country’s storage targets. It plans to activate a 10 GW reserve of coal-fired power capacity to lower reliance on gas for the upcoming winter.

- The gas stocks in Europe continued to recover to 58% capacity this week amid strong LNG gas flows from the USA and Qatar.

- On the 22nd of June, 2022, the European Parliament adopted the negotiating position on EU ETS reforms at the second attempt, paving the way for talks with national governments to agree on the final legally binding rules. The position includes:

- Phasing out free ETS allowances to sectors covered by CBAM (cement, aluminum, fertilizers, electric energy production, iron & steel). Proposed schedule:

- – 7% in 2027

- – 9% in 2028

- – 15% in 2029

- – 19% in 2030

- – 25% in 2031

- – 25% in 2032

- Implementation of CBAM in 2032

- Cutting 70 million EUA in 2025 + 50 million in 2026 from the ETS market.

- Increase of the Linear Reduction Factor (LRF) – currently @ 2,2% p.a – to

- 4,4% p.a from 2024

- 4,5% p.a from 2026

- 4,6% p.a from 2029

- Extension of the EU ETS to the road transport and building sectors

- Creation of a Social Climate Fund

- Phasing out free ETS allowances to sectors covered by CBAM (cement, aluminum, fertilizers, electric energy production, iron & steel). Proposed schedule:

To read the prior week’s European Energy Market Update, please follow the link here.