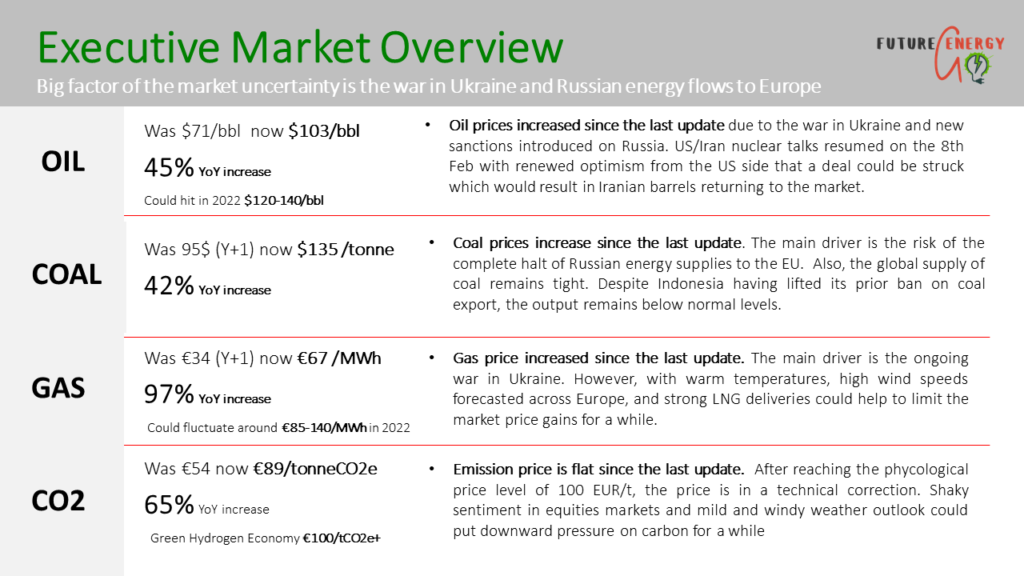

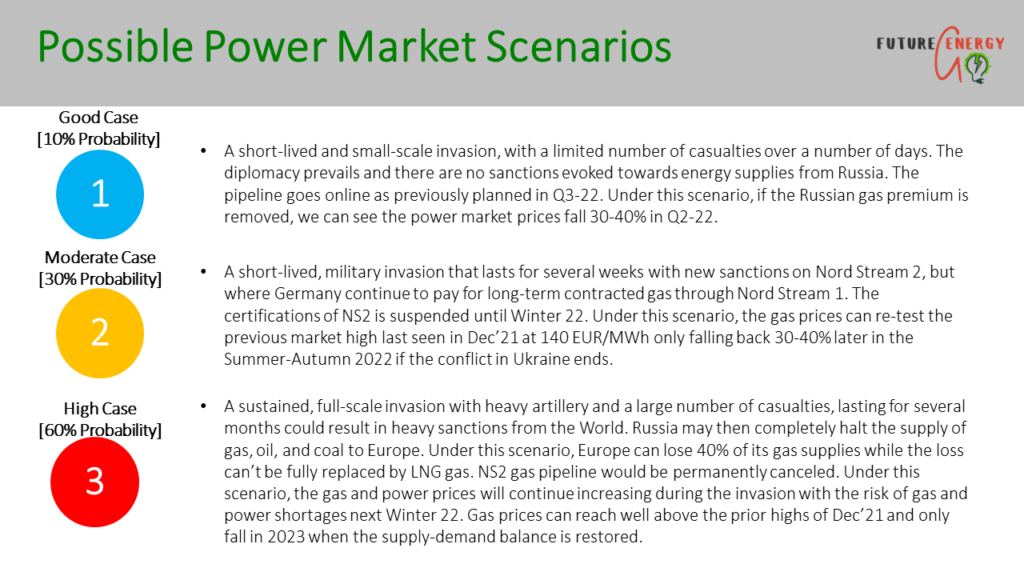

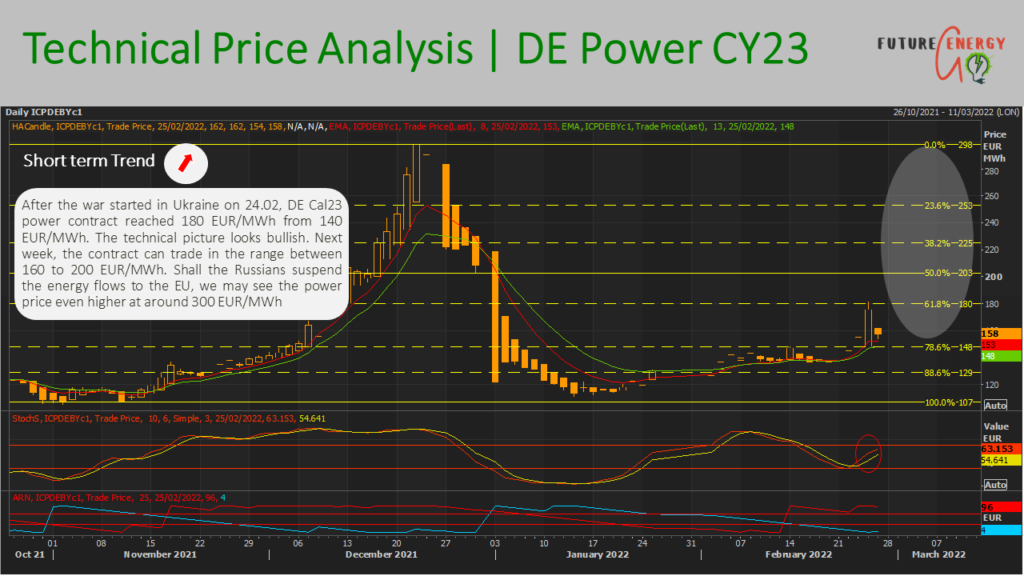

The hopes of a peaceful resolution to the conflict in Ukraine are now gone. The energy markets are now pricing some worse-case scenarios.

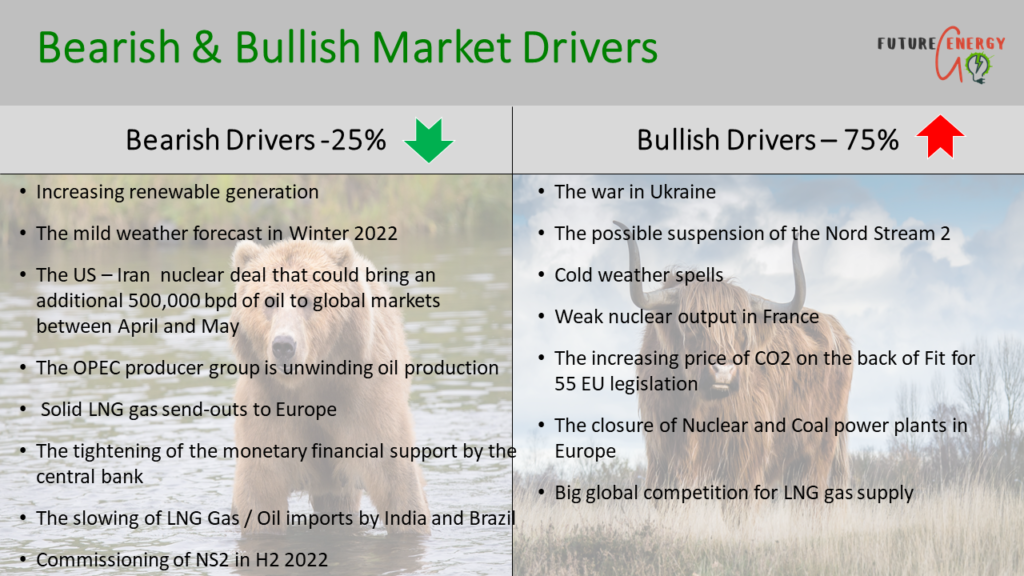

Oil and gas prices continue to rise in the short term following Russia’s attack on Ukraine. Now, it’s not expected that the Nord Stream 2 pipeline is being able to go online in the short or medium term.

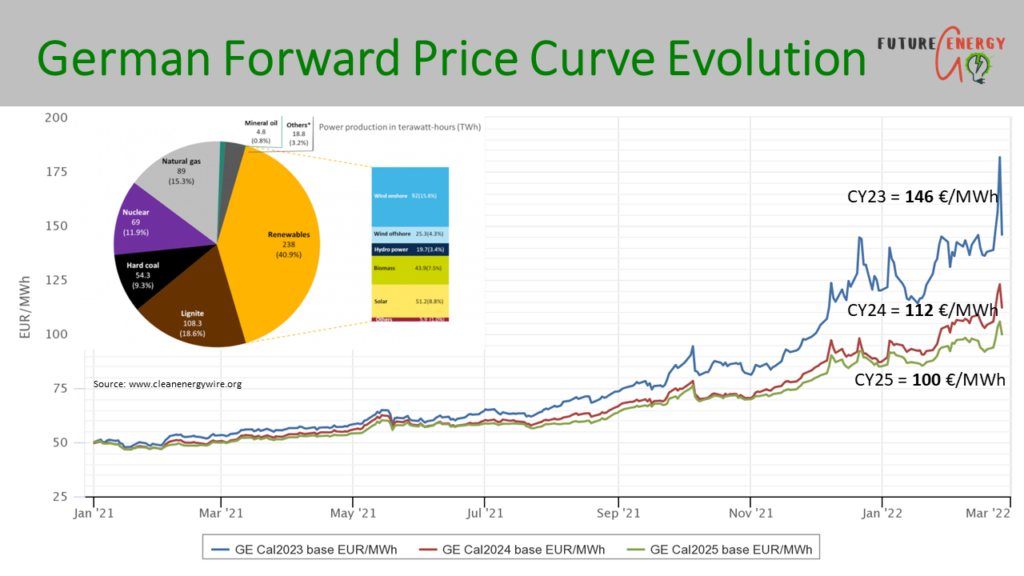

As a result, the market price volatility remains to be elevated throughout the year with power prices oscillating at historically high levels.

The warmer than normal weather and the increasing wind renewable generation with the strong LNG deliveries to Europe may help to cap the market price gains, but the impact on the futures market is rather insignificant.

More favorable energy buying opportunities in Mar’22 – June’22 are now diminishing.

Companies with an open volume position for Cal23-24, shall consider limiting their exposure to the volatile energy market prices via planned hedging.

To read the prior week’s Energy Market Update, please follow the link here.