Weekly European energy market update:

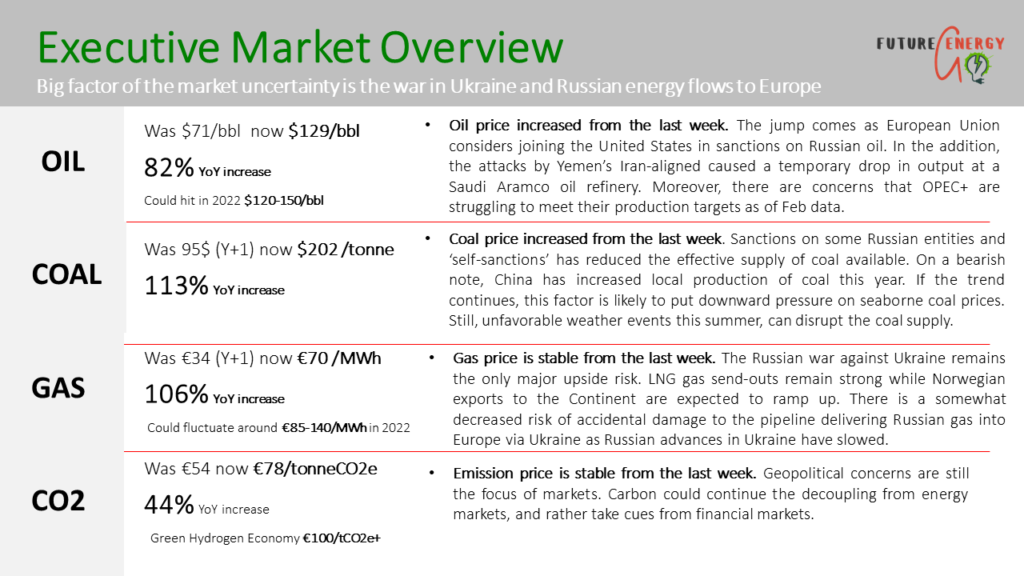

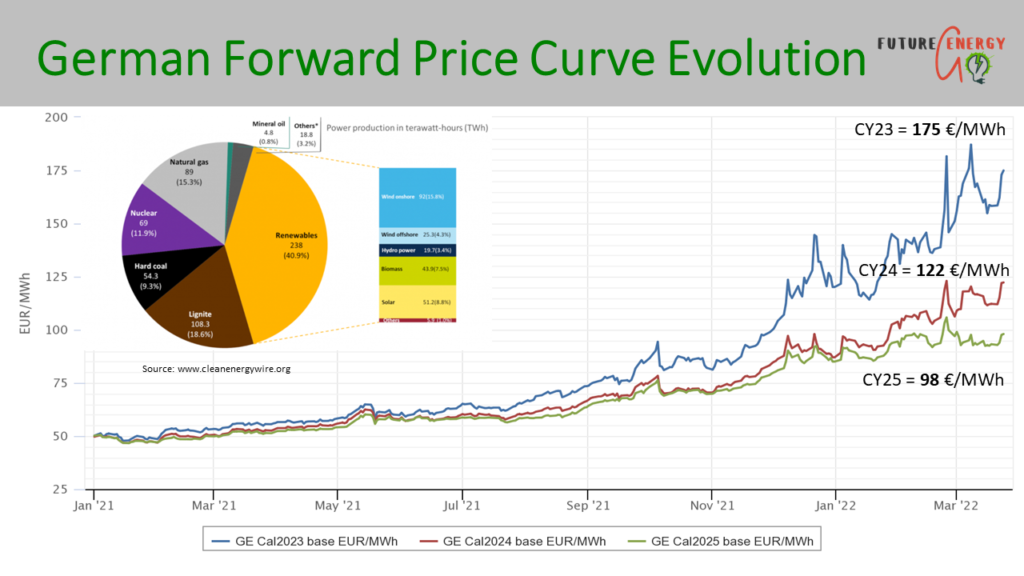

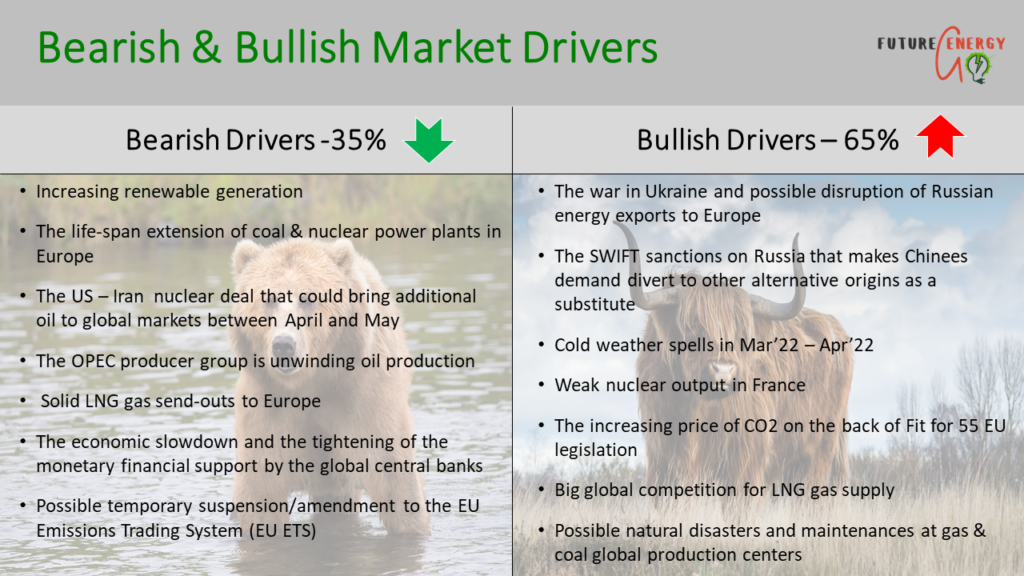

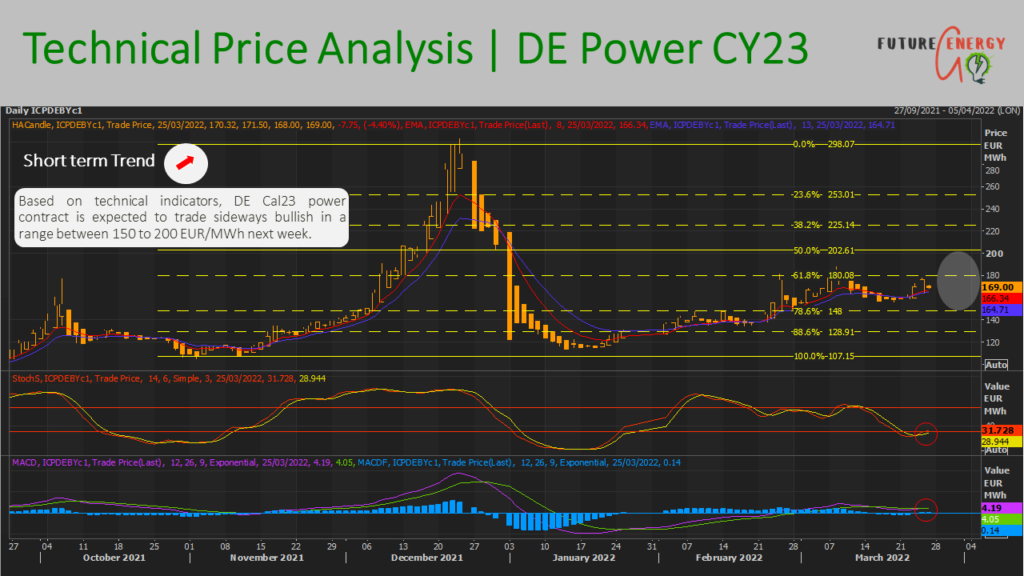

Gas prices are volatile and bullish after a bearish phase a few weeks ago. Power prices surged from Wed 23rd March due to high profile announcements that Russia would demand payment for gas in Roubles to shore up its currency markets as well as on European Union considerations to ban Russian oil imports following the suits by US and UK.

The weather forecast seems to be around normal for the first two weeks of April. Major colder than normal spells are not likely before mid-April according to several analysts’ forecasts.

Germany aims to halt imports of Russian coal from this autumn while China plans to lift its domestic coal supply to curb energy cost risks.

Spain is considering reinstating a 180 EUR/MWh cap on the spot power markets to curb the rising power prices by the Ukraine war. The other EU markets can follow the suit this year.

Belgium has agreed to extend the lifetimes of 2 nuclear reactors (Doel 4 and Tihange 3) by 10 years until 2036. Belgium had previously aimed for a complete phase-out of nuclear power by 2025.

Markets remain highly nervous over the situation in Ukraine. There were no signs of an imminent ceasefire. The power market price volatility will continue to be elevated in the near future.

To read the prior week’s Energy Market Update, please follow the link here.