Weekly energy market update:

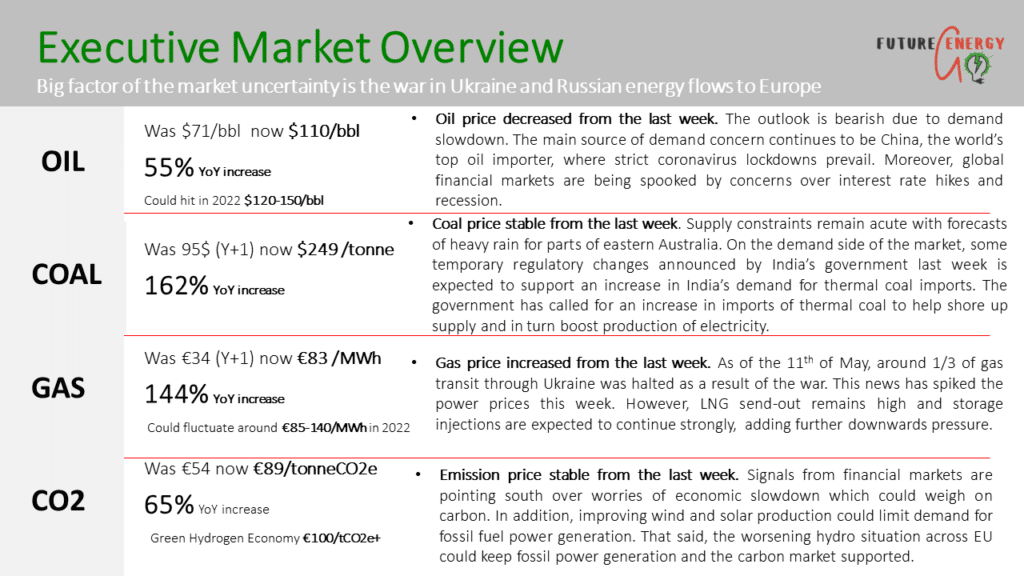

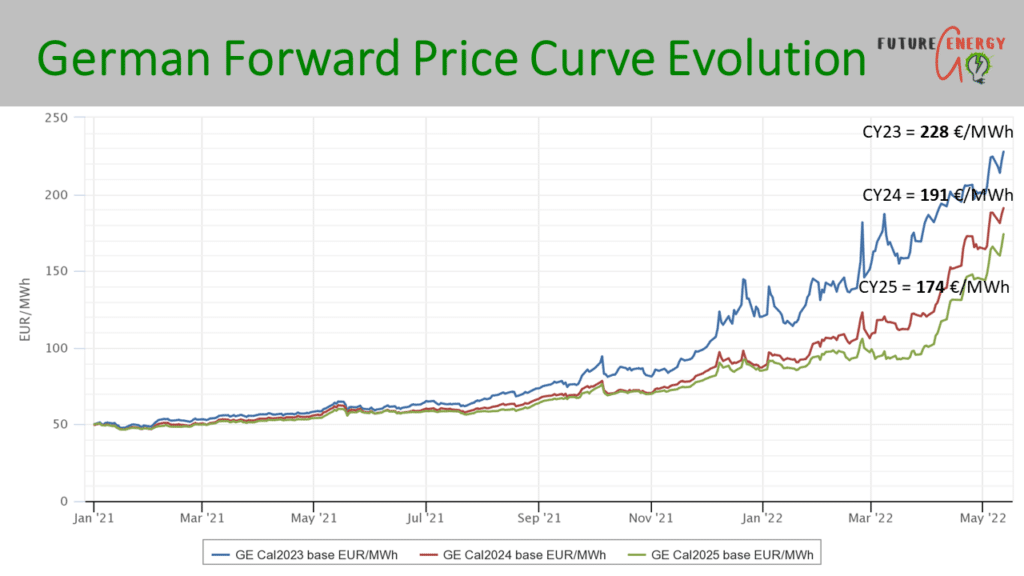

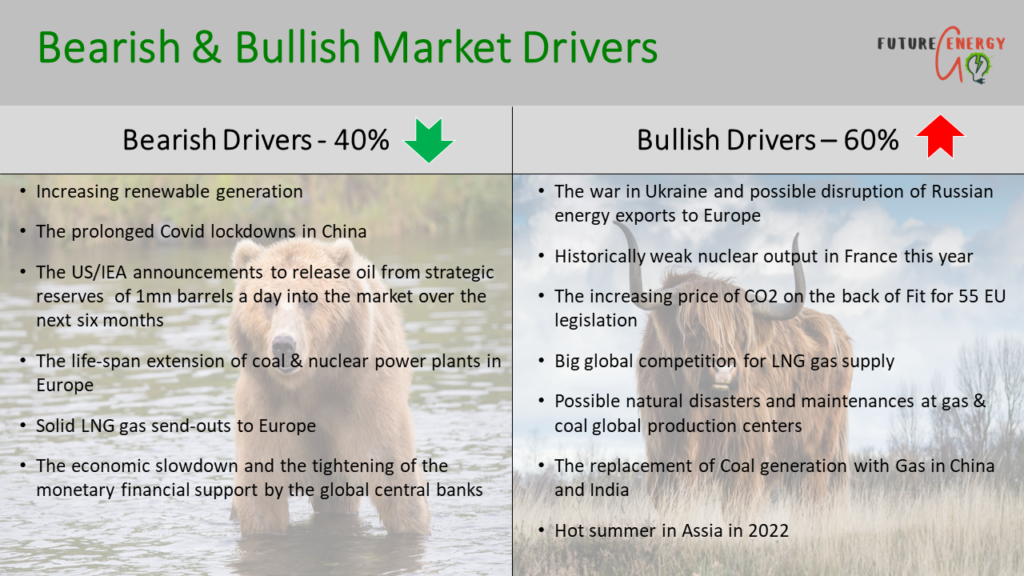

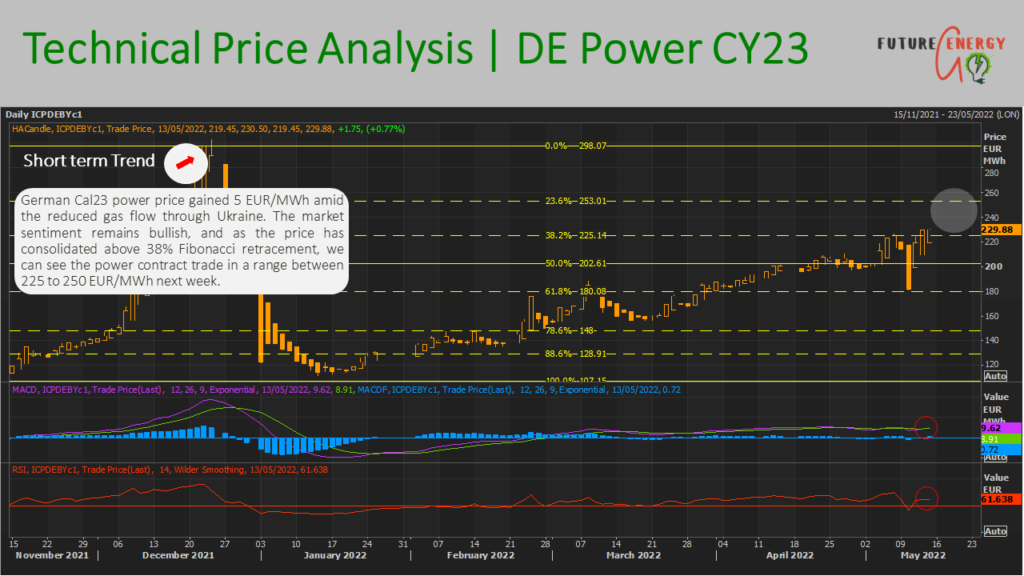

- Since the start of May, the European energy market has been bullish, with a slight mini-correction in the last 14 days.

- News on 10th May of the Ukrainian gas shipper refusing to operate a major gas compressor plant in the east of the country has removed 10-30mil m3 of gas transit per day. The market reaction has been limited thus far but reminds people that the system remains fragile both politically and in terms of operational delivery.

- The gas stock levels have been recovering to 38% in Europe amid the strong LNG gas deliveries from USA and Qatar.

- The concerns over global demand slowdown help to limit the energy price increase. The main source of demand concern continues to be China, the world’s top oil importer, where strict coronavirus lockdowns prevail. Also, global financial markets are being spooked by concerns over interest rate hikes and recession.

- India’s government has called for an increase in imported coal to boost the production of electricity and ensure necessary supply stocks amid recently high temperatures. All power plants designed to run on imported coal must operate now. This will add additional demand to the market.

- Nuclear & Coal no material changes or updates since the last briefing – coal remains bullish and expensive as a backfilling fuel for gas, Nuclear remains capacity constrained in France.

- Oil prices decreased this week as EU members failed to agree on a progressive embargo on Russian oil. Hungary, Slovakia and Czech Republic are seeking exceptions. While US oil production reached 12m bbl/day. This is still below the pre-Covid period of 13m bbl/day.

To read the prior week’s European Energy Market Update, please follow the link here.