Weekly energy market update:

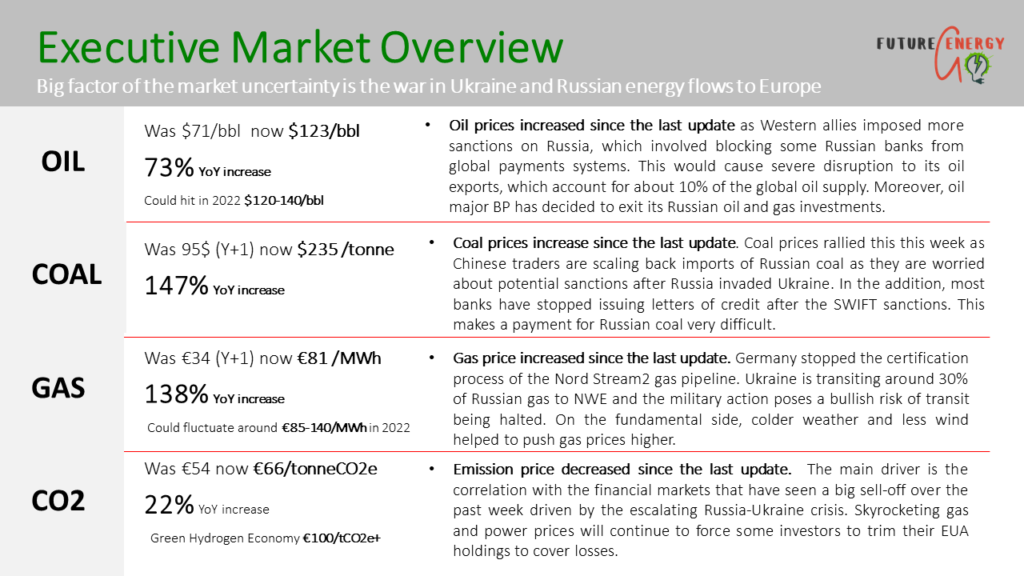

EU gas and coal prices hit an all-time high due to the Russian invasion of Ukraine, while carbon retraces 30% softening the impacts on the power price created by gas & coal due to the fall of the global equity markets.

Western allies imposed more sanctions on Russia, which involved blocking some Russian banks from global payments systems.

Germany stopped the certification process of the Nord Stream 2 gas pipeline, while the Nord Stream 2 operator declares bankruptcy this week. The war in Ukraine poses a big risk for the import of Russian energy sources to Europe.

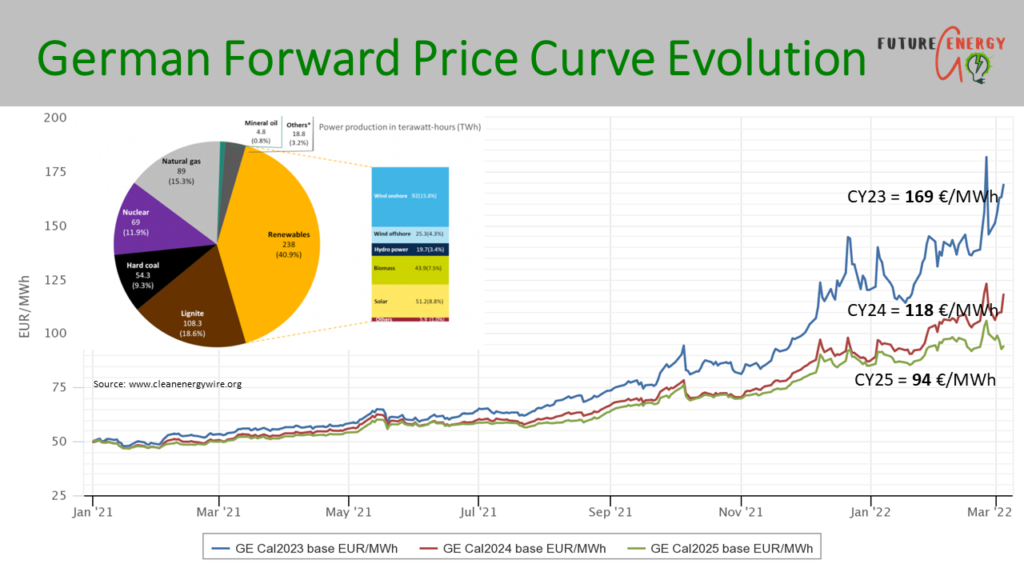

As a result, the market price volatility remains to be elevated throughout the year with power prices oscillating at historically high levels.

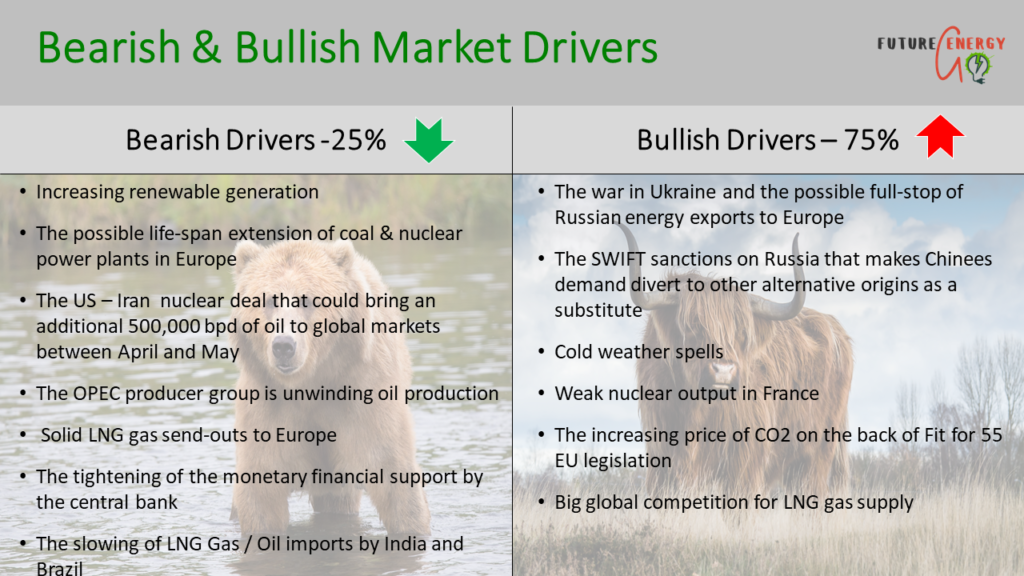

However, the increasing renewable generation with the strong LNG deliveries to Europe as well as the possible decision by German authorities to slower exit from coal-powered energy could help to cap the market price gains.

More favorable energy buying opportunities in Mar’22 – June’22 are now gone.

Companies with an open volume position for Cal23-24, shall consider limiting their exposure to the volatile energy market prices via a planned hedging strategy.

To read the prior week’s Energy Market Update, please follow the link here.