Table of Contents

Power Purchase Agreements (PPAs)

Power Purchase Agreements (PPAs) have become a cornerstone of modern energy procurement strategies, allowing businesses to secure a stable supply of electricity while also contributing to sustainability goals. However, to harness the full potential of PPAs, it’s essential to understand the diverse price structures available in the market. In this in-depth exploration, we unveil the best market practices by examining the various PPA price structures available today.

PPAs have gained prominence as an effective means for organizations to procure renewable energy and manage electricity costs. A PPA is a legally binding contract between an energy buyer and a renewable energy generator. It outlines the terms and conditions for the purchase of electricity over a defined period. One of the fundamental decisions when entering into a PPA is selecting the appropriate price structure.

The 5 most common PPA price structures

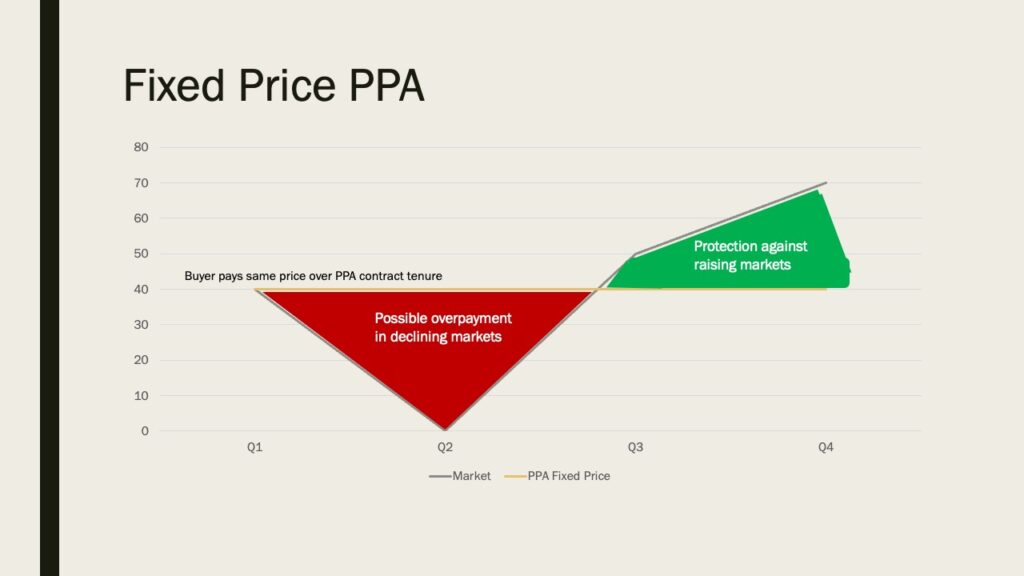

1. Fixed Price PPAs

Fixed Price PPAs are the prevailing choice, accounting for roughly 70% of all PPA agreements signed globally.

A Fixed Price Power Purchase Agreement (PPA) is a contract between two parties, typically a renewable energy developer and a power buyer, in which they agree upon a fixed price for the sale and purchase of electricity over a specified period. Fixed Price PPAs are commonly used in the renewable energy industry to facilitate the financing and development of renewable energy projects.

| Pros of Fixed Price PPAs | Cons of Fixed Price PPAs |

| Price Stability: Offers predictability in energy costs, making budgeting easier. | Potential Overpayment: If market energy prices drop significantly, buyers may pay more than market rates. |

| Risk Mitigation: Shields buyers from market volatility, reducing financial risk. | Reduced Flexibility: Fixed prices may limit the ability to capitalize on market price decreases. |

| Long-Term Budgeting: Provides accurate energy expense forecasts over the contract term. | Limited Opportunity for Cost Savings: In a declining market, buyers miss out on potential cost savings. |

| Environmental Benefits: Supports renewable energy generation and sustainability goals. | Complexity in Negotiation: The negotiation process for fixed prices can be complex and time-consuming. |

| Reduced Market Monitoring: Buyers can focus less on active market monitoring and more on core business operations. | Potential Contract Term Length: Longer contract terms may result in less favorable fixed prices over time if market rates decline. |

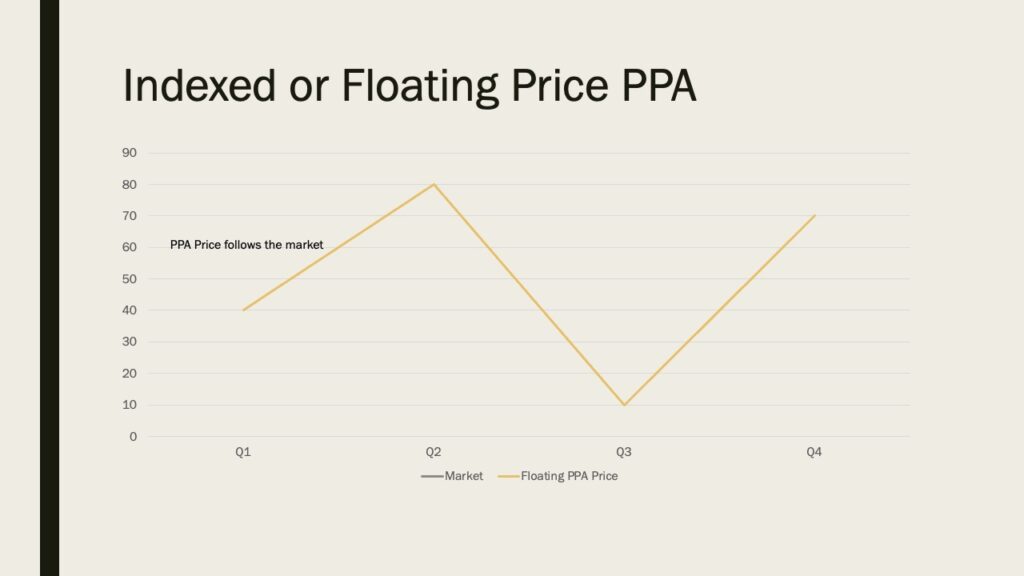

2. Indexed or Floating Price PPAs

Indexed or Floating Price PPAs constitute approximately 20% of global PPA contracts.

An Indexed or Floating Price Power Purchase Agreement (PPA) is like a flexible electricity contract. Instead of having a fixed price for power, the price can change over time based on factors like market conditions or a predefined index. This means the cost of electricity can go up or down as the market changes, which can be good if prices drop but can also be riskier if they rise. It’s a bit like a variable interest rate on a loan – your electricity price moves with the market.

| Pros of Indexed or Floating Price PPAs | Cons of Indexed or Floating Price PPAs |

| Market Sensitivity: Prices adjust to market rates, potentially leading to cost savings. | Price Volatility: Exposure to market fluctuations can result in unpredictable costs. |

| Competitive Advantage: Flexibility to capitalize on favorable market conditions. | Risk Management: Requires active market monitoring and risk mitigation strategies. |

| Cost Efficiency: Potential for significant savings during market downturns. | Budget Unpredictability: The variability in prices can complicate budget planning. |

| Sustainability Benefits: Supports renewable energy generation and sustainability goals. | Potential for Cost Increases: Prices may rise during periods of market upswings. |

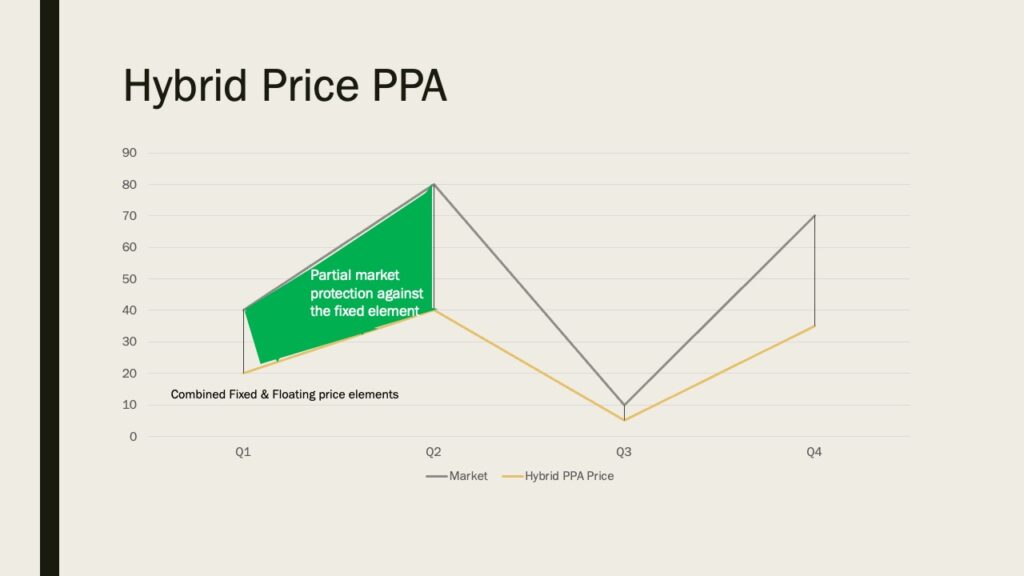

3. Hybrid Price PPAs

Hybrid Price PPAs are relatively rare, constituting approximately 10% of global PPA agreements.

A Hybrid Price Power Purchase Agreement (PPA) is like a mix-and-match deal for electricity. In this type of agreement, you can get some of your electricity at a fixed price, which stays the same, and some at a floating or variable price that can change. It’s a way to balance cost predictability with the potential for savings or flexibility, kind of like having a part of your bill set in stone and another part that can move up and down based on different factors.

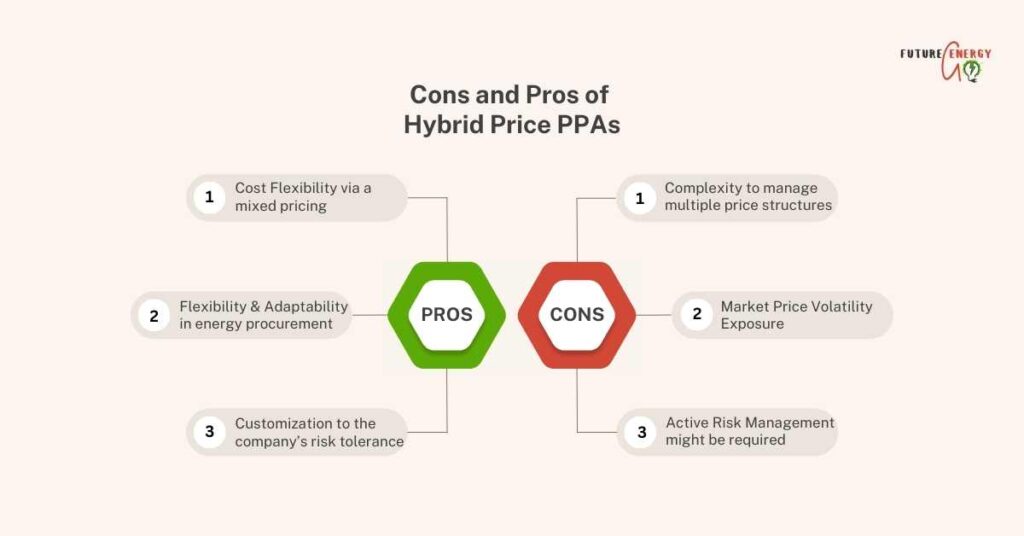

| Pros of Hybrid Price PPAs | Cons of Hybrid Price PPAs |

| Cost Flexibility: Allows for a portion of the electricity to be procured at a fixed price, providing cost predictability. | Complexity: Managing multiple pricing structures can be administratively complex and require sophisticated risk management. |

| Market Opportunities: The variable portion of the PPA can capture potential cost savings if market electricity prices decrease. | Price Risk: If market prices rise, the variable portion of the PPA can lead to higher electricity costs. |

| Risk Mitigation: Offers a balance between price stability (fixed) and potential cost savings (variable), reducing the impact of market volatility. | Risk Exposure: The organization assumes the risk of market price fluctuations on the variable portion of the PPA. |

| Flexibility: Provides flexibility in energy procurement strategies, allowing organizations to adapt to changing market conditions. | Budget Uncertainty: The variable pricing component may lead to budget uncertainty, making financial planning more challenging. |

| Customization: Allows organizations to tailor the PPA to their specific risk tolerance and financial goals. | Negotiation Complexity: Negotiating and structuring hybrid PPAs require expertise to ensure favorable terms. |

4. Market Following PPA Price Structure with a Floor Plus Discount

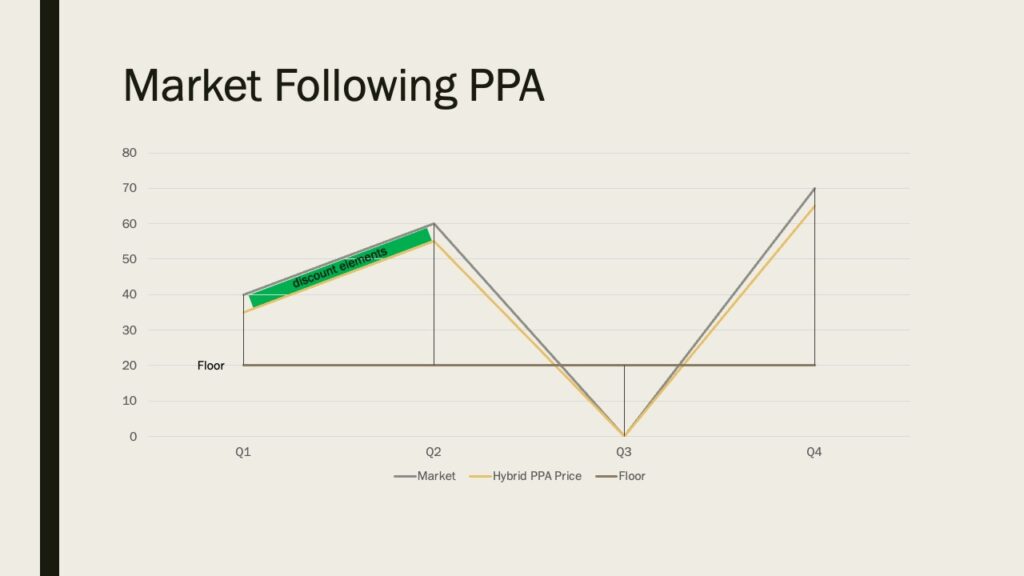

A Market Following Price Structure with a Floor Plus Discount is a way to buy electricity where your price is linked to how much electricity costs in the market. Your price can go up or down with the market, but there’s a “floor” price that is the lowest price you’ll pay. On top of that, you usually get a “discount” which means you pay a bit less than the market price. It’s like having a price safety net and getting a bonus discount when market prices are high.

If you negotiate a favorable floor price with the right discount in a Market Following Price Structure with a Floor Plus Discount for your electricity purchase, it can offer you additional benefits, including the potential to obtain Green Energy Certificates (also known as Renewable Energy Certificates or RECs) at a significant discount.

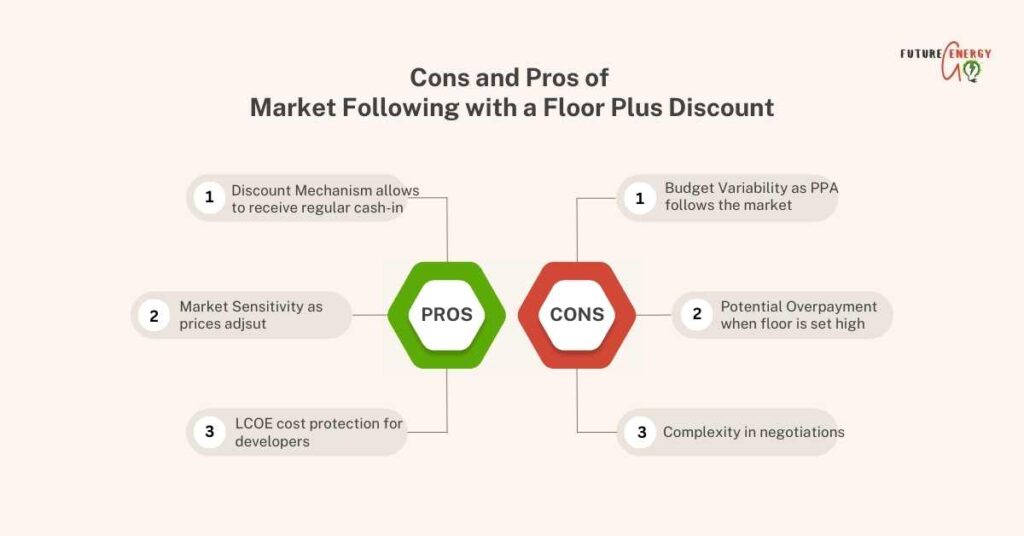

| Pros of Market Following Price Structure | Cons of Market Following Price Structure |

| Market Sensitivity: Prices adjust to market rates, potentially leading to cost savings during market downturns. | Complexity: Combines multiple pricing elements, making negotiations and contract management more intricate. |

| Price Floor Protection: Establishes a price floor, often set at or above the Levelized Cost of Energy (LCOE), which safeguards developers and investors against excessive price drops, providing financial security. | Potential Overpayment: In certain market conditions, buyers may pay more than market rates due to the fixed floor price. |

| Discount Mechanism: Negotiating a discount off the market price offers a degree of price predictability of market-driven savings. | Active Monitoring Required: Organizations need to actively monitor market conditions to maximize the potential for cost savings and ensure the discount is applied appropriately. |

| Competitive Advantage: Flexibility to capitalize on favorable market conditions while enjoying the security of a price floor, making it attractive for both buyers and developers. | Risk Management: Effective risk management strategies are essential to navigate the complexities of market-sensitive pricing. |

| Sustainability Benefits: Supports renewable energy generation and sustainability goals, encouraging investment in clean energy projects. | Potential for Budget Variability: While the price floor provides stability, fluctuations above the floor can impact budget predictability. |

5. Bundled PPA Price Structure

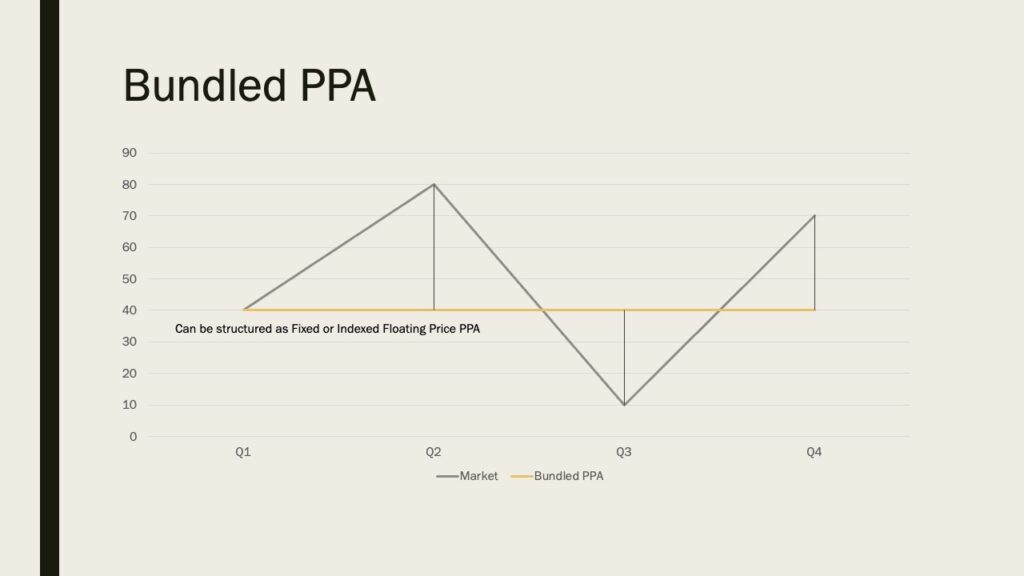

A Bundled PPA is a unique type of Power Purchase Agreement that combines Power Purchase Agreement with the physical supply service of electricity. Unlike traditional PPAs, where the focus is solely on renewable energy from a specific power plant, Bundled PPAs include both the procurement of electricity and its delivery service to your sites.

The physical supply service agreement is a contract between an energy provider, often an integrated utility company, and an energy consumer. This agreement covers the provision of electricity generated from conventional sources that can be coal, natural gas, or nuclear power. The utility company is responsible for supplying the electricity to the consumer’s premises.

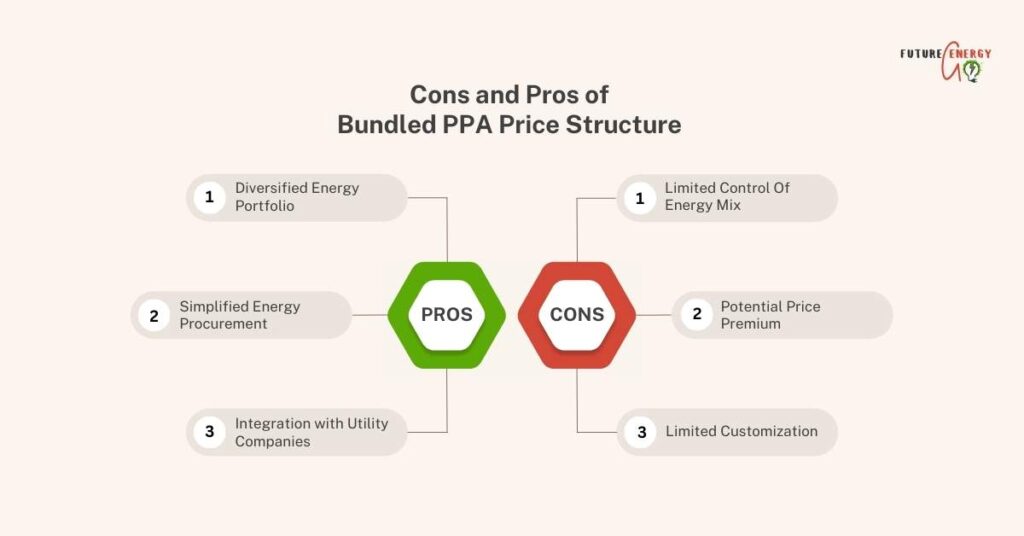

| Pros of Bundled PPAs | Cons of Bundled PPAs |

| Diversified Energy Portfolio: Allows consumers to access usually a pool of renewable assets, contributing to sustainability goals. | Limited Control: Consumers may have limited control over the specific energy mix and sources provided in the bundle. |

| Simplified Procurement: Bundles energy supply service agreement and PPA contract, streamlining the procurement process and reducing administrative complexity. | Price Considerations: Prices in bundled contracts may not always be as competitive as those in separate supply and delivery agreements. |

| Environmental Impact: Supports the growth of renewable energy projects, reducing carbon emissions and promoting cleaner energy generation. | Potential for Cost: Depending on the agreement terms, consumers may face additional costs associated with the bundled delivery service. |

| Contract Length: Bundled PPAs may have shorter contract terms than a traditional PPA. | Limited Customization: Consumers may have limited flexibility in negotiation based on supplier contract terms. |

| Integration with Utility Companies: Often provided by integrated utility companies, ensuring reliable and comprehensive energy services. |

Bundled Power Purchase Agreement (PPA) price structures offer a balanced and effective solution for companies striving to meet their sustainability targets while streamlining procurement processes. By combining both PPAs and physical retail supply services into a single energy contract, Bundled PPAs provide a credible means to support renewable energy generation while simplifying administration complexity.

For organisations seeking a comprehensive and credible strategy to advance their sustainability goals, Bundled PPAs represent a compelling choice in the ever-evolving landscape of energy procurement solutions.

If your organisation requires assistance with the preparation of Bundled PPA RFQ (Request for Quotation) documents or seeks professional guidance on contract negotiations, please feel free to reach out to us via the contact form.

Conclusion

The choice of a PPA price structure is a critical decision for organizations seeking to secure renewable energy sources and manage electricity costs effectively. Each of these pricing models—Fixed Price, Indexed or Floating Price, Hybrid Price, Market Following Price Structure with a Floor Plus Discount, and Bundled PPA Price—offers a unique set of advantages and disadvantages.

As the energy market continues to evolve, staying well-informed and adaptable will be crucial to securing cost-efficient and sustainable energy solutions that benefit both the bottom line and the environment. By understanding the nuances of these PPA price structures, organizations can navigate the complexities of energy procurement and make informed decisions.

https://futureenergygo.com/eu-electricity-market-redesign/Looking to the future, it is highly likely that we will witness a notable surge in the adoption of alternative pricing structures. This inclination towards flexibility and adaptability is driven by various factors. One significant catalyst for this shift is the changing market dynamics as a result of the Ukraine-Russia war.

In this environment, Fixed Price PPAs are gradually losing their corporate appeal due to the increase in price levels. As organizations strive to secure renewable energy sources and manage electricity costs effectively, the emergence of innovative PPA structures, such as Indexed or Floating Price PPAs, Hybrid Price PPAs, Market Following Price Structures, and others, will provide the flexibility needed to adapt to evolving market conditions.

By subscribing to our newsletter, you’ll gain access to exclusive content that will keep you informed about the evolving landscape of energy procurement, sustainable solutions, and innovative PPA structures.

Please don’t forget to leave your comments below and share this article with others. Together, we can promote a sustainable and resilient energy future.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.