Table of Contents

Where to find the best PPA deals?

The world’s energy market is in a big shock. The energy price in the market across the EU is set based on the merit order principle. Plants with the highest marginal costs needed to fulfil the electricity demand drive the electricity price. Renewable is the cheapest generation source, while oil and gas are the most expensive. The outbreak of the war in Ukraine has increased the risk of disruption of the supply of gas from Russia to Europe, and as a consequence, the high gas prices drove the electricity market prices, including PPAs.

European nations are racing to reduce their reliance on Russian gas, but this is likely to take several years before the EU can be entirely independent. Sourcing gas from elsewhere will not happen overnight as the European Union lacks the necessary infrastructure to receive LNG gas from the USA, Qatar, and elsewhere.

Given that wholesale electricity prices in Europe have fluctuated well above the 200 EUR/MWh mark since the beginning of the war outbreak in Ukraine, long-term power purchase agreements (PPAs) look like an attractive option for a corporate buyer to reduce the cost of electricity bill and meet sustainability GHG corporate objectives. The divergence away from natural gas creates an attractive investment climate for renewable energy sources in Europe. It also presents an enormous opportunity for emerging green technologies to grow in the near future.

Exceptionally high and volatile power market prices press buyers to lock in their electricity bills for as long as possible. At the same time, corporations scramble to meet their obligations to decarbonize their operations and supply chains pledged. Demand for PPAs has increased significantly and shows no sign of slowing.

However, significant bottlenecks in the supply chain are the main issue. Backlogs in planning approval and grid connections have yet to be cleared following the COVID-19 outbreak. China’s periodic lockdowns of specific cities impact the production of materials needed for new renewable projects to be built.

These factors are tipping the balance from the buyers’ market of last year to a sellers’ market, where sellers have some leverage in negotiating contracts and prices.

This is seen, for example, in a recent trend where developers try to transfer some inflation and shape power price risks to the corporate PPA buyers. It’s becoming more difficult for buyers to push back in these negotiations. Despite this transition in the market, the PPA business case economics in many regions remain positive, with a fixed PPA pricing that is advantageous compared to high and unpredictable wholesale prices.

Because the geopolitical turmoil caused by the Ukraine crisis shows no signs of slowing down — and because the demand to decarbonize is only expected to grow — PPA contracts will continue to attract buyers.

PPA Market Developments:

- Spain. The PPA market activity is recovering after the Royal decree last September to curb presumed excess profits by suppliers during the high market prices. PPA prices are broadly unchanged from the past year, but they can start peaking towards the end of the Summer as more and more corporates are looking for power savings opportunities. For now, however, Spain and Portugal have the best PPA deals out there.

- United States. PPAs increased by 11GW in 2021, up 3% from 2020. However, due to supply chain restrictions, costs have risen by more than 30%, with solar being hampered by a Department of Commerce inquiry into East Asian imports. Therefore, PPA prices have been rising as more companies compete for fewer renewable projects.

- UK. In recent months, PPA market has become more complicated since the corporate PPA market has remained strong, with many new purchasers. PPA prices have risen due to higher wholesale pricing, increased capital expenditures, and competition. The PPA market price volatility remains very high, which results in significant challenges for corporates to secure a competitive PPA deal because the PPA offers’ validity can’t remain valid for a long-time.

- Nordics. The region continues to attract corporate PPA partnerships despite being a traditional early mover in the European PPA market. There are fewer ready-to-build projects now than there were previously. Delays in planning processes and grid enhancements caused by COVID-19 are proving difficulties, forcing sellers and purchasers to be patient.

- Germany. PPA market remains in short supply for newly built projects. However, as the EEG subsidy is ended in 2022, there are existing Wind assets available to corporate PPAs. Also, Germany has made bold renewable energy goals, pledging to reach 100% renewable electricity by 2035, 15 years earlier than previously planned. A near-term objective of 80% by 2030 has also been established, with the market pledging that Russian oil imports will be phased out by the end of 2022. Renewable energy currently provides around 40% of the country’s power. In late February, a new law was unveiled that aims to triple annual onshore wind additions from 3GW to 10GW. Offshore wind capacity will double by 2045, with a total capacity of 70GW. The solar expansion will nearly quadruple, from 7GW to 20GW per year, in 2028. This comes as Germany decided to phase out nuclear power, with the remaining three reactors set to shut down in 2022.

- Italy. The PPA market in Italy is still growing. No major corporate PPA deals have been signed in the market yet because of a few challenges: VAT taxation for financial PPAs, the constant delays in grid connections and permitting of new projects, and the land unavailability to develop new projects. However, the availability of solar resources, particularly in the Southern areas of the country, is among the highest in Europe, leading to a favorable return on investments. The government targets of additional 30 GW PV by 2030 and it has announced the ineligibility of agricultural lands for the government RES subsidies. Therefore, projects developed on agricultural lands would have mainly two options: sign a corporate PPA deal or go merchant to the market. Therefore, there could be few corporate PPA opportunities found in the market. Although PPA pricing is much higher than in Spain and Portugal, signing a long-term fixed-price PPA contract can be an attractive business opportunity for corporate wishing to lower their energy bills. Italian wholesale prices are among the highest in Europe. The future price prediction shows an upward trajectory due to the high exposure to gas.

Is a PPA a good deal?

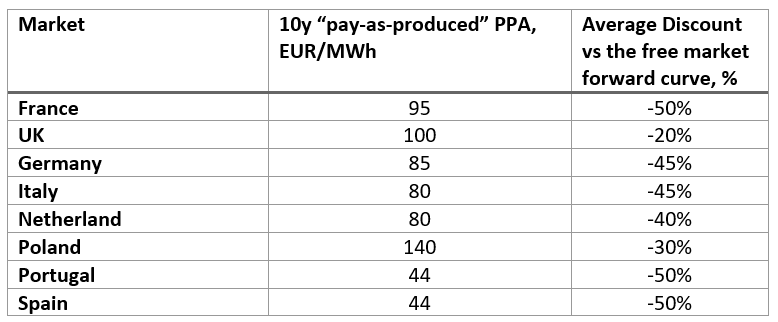

In the table below, there’s an indicative 10-year PPA price overview for newly built Solar/Wind renewable assets as of Q2 2022. You can check the PexaPark PPA average index here.

PPA “pay-as-produced” price indication as of May 2022

The PPA prices in the table above represent average 10-year PPA deals for newly built assets across different technologies, such as Solar and Wind. The PPA prices are then benchmarked against the free-market baseload forward curve for the next 2-3 years, depending on the market liquidity. To convert the “pay-as-produced” PPA price into a baseload contract for comparison reasons, a 20% balancing premium was assumed on top of the “pay-as-produced” PPA price in the table.

If you want to check the prior PPA price trend report for Q1 2022, please check the next article here.

Iberian PPA pricing is less sensitive to upward price pressures due to the prevalence of low-cost solar plants. Spain and Portugal are the markets with the best PPA deals at this moment after the Nordic PPAs. Please note that Portugal is only a growing PPA market as there are not many subsidy-free existing or newly built projects available for a PPA contract in 2024-25.

Although there were some first deals made in Portugal recently, it could be very difficult to find and negotiate a competitive PPA deal. Therefore, corporates interested in signing a PPA in Portugal can look for projects in Spain as it has the same power market and the same players. This could be a great arbitrage power price savings opportunity in 2022-23.

If you wish to learn more about the most popular PPA contract architectures in Europe to reach renewable energy goals, please check out my other article here. And if you liked this article, please leave your comment below.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.