Table of Contents

What is a Guarantee of Origin certificate?

A guarantee of origin (GO) proves that an amount of energy equal to one MWh was produced from renewable sources and fed into the power grid. By purchasing certificates of origin, a company can prove that the electricity it consumes is green, i.e. comes from renewable sources. There are different certifications in different global economic regions and several names, for example, GoOs, I-RECs, and RECs.

The GO is issued by a national or regional certification body, which verifies that the energy has been produced from a renewable source, such as solar, wind, hydro, or biomass. The GO is then transferred to the electricity supplier, who can use it to demonstrate to their customers that a certain percentage of the electricity they are consuming is from renewable sources.

The use of GOs in Europe is regulated by the Renewable Energy Directive (RED II), which came into force in 2018. The RED II aims to increase the share of renewable energy in the EU’s energy mix and to promote transparency and consumer choice in the energy market.

The benefits of using GOs are multiple, including it helps to increase the share of renewable energy in the energy mix and to promote transparency and consumer choice in the energy market. Also, it helps to support the development of renewable energy and to encourage the growth of new renewable energy sources.

However, the use of GOs has its challenges. One of the main challenges is the need for more standardization across different countries to help consumers to compare the renewable content of different electricity suppliers. Additionally, there have been concerns about the potential for fraud and double counting of GOs, which could undermine the system’s credibility.

What is the price of Guarantee of Origin? The Rise of Guarantees of Origin

The price of Guarantees of Origin (GOs) can vary depending on several factors, including the specific country, the type of renewable energy source, and the demand for GOs in the market.

In general, the price of GOs is influenced by supply and demand, just like any other commodity. When demand for renewable energy is high and there is a limited supply of GOs, the price of GOs will increase. Conversely, when demand for renewable energy is low and there is an abundance of GOs, the price of GOs will decrease.

Over the years, the price of GOs has fluctuated in different European countries. In general, the price of GOs has been decreasing due to the increase in renewable energy production, which has led to an increase in the supply of GOs.

For example, in Germany, the price of GOs for wind energy has decreased from around €5/MWh in 2010 to around €1/MWh in 2020. Similarly, in the Netherlands, the price of GOs for solar energy has decreased from around €45/MWh in 2010 to around €5/MWh in 2020.

However, since 2021 price of Guarantees of Origin (GOs) in Europe has been increasing due to several factors about which you can learn in the following article.

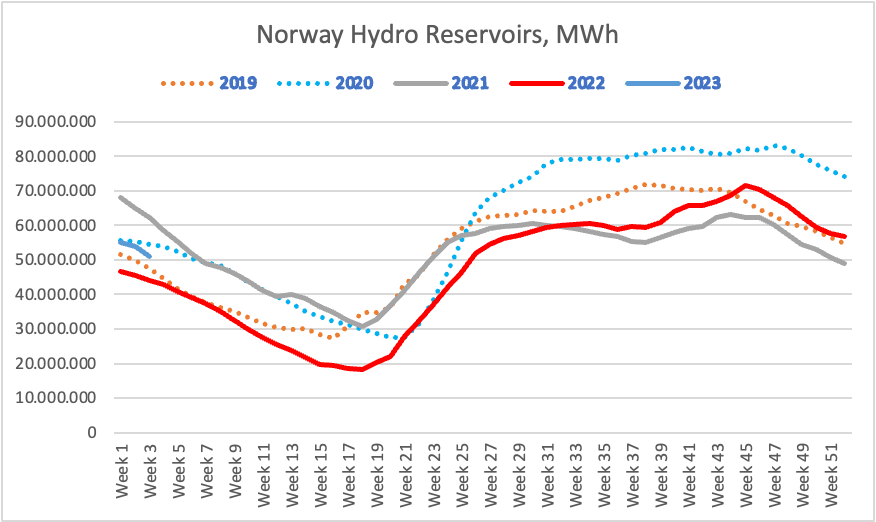

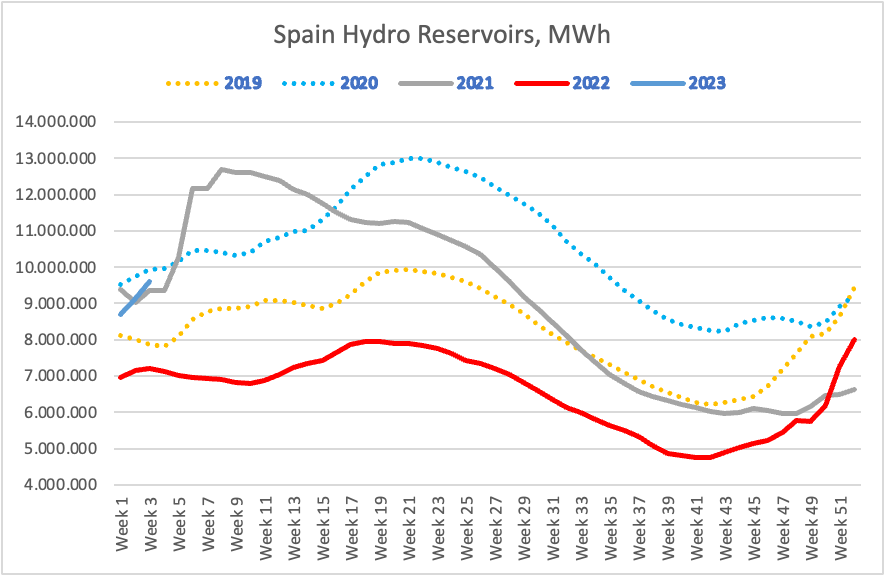

Much of the rise is due to a shortage of hydropower following a summer of drought in Europe, according to GO market players, but also resilient demand from corporate buyers keen to meet emissions targets by buying renewable energy and doing so with certificates.

Hydro Reserves Levels in Europe

Another reason for high GO prices is that electricity producers often sell their planned volume one year ahead, meaning that GOs for 2022 and 2023 are sold out in 2021. Many producers, who had to lower output during 2022, are currently in the market to buy the guarantees they could not issue themselves.

Tighter reporting requirements also reduce the pool of power plants available for companies wishing to comply with international standards. The RE100 recently published a revised version of its reporting criteria, which sets a 15-year commissioning on repowering age limit on power plants.

Analysts at S&P Global Commodity Insights forecast average solar and wind GO prices in the range 5-8 EUR/MWh from 2023 to 2030.

The market for Guarantees of Origin is constantly changing and evolving, so it’s important to keep track of the latest developments and trends.

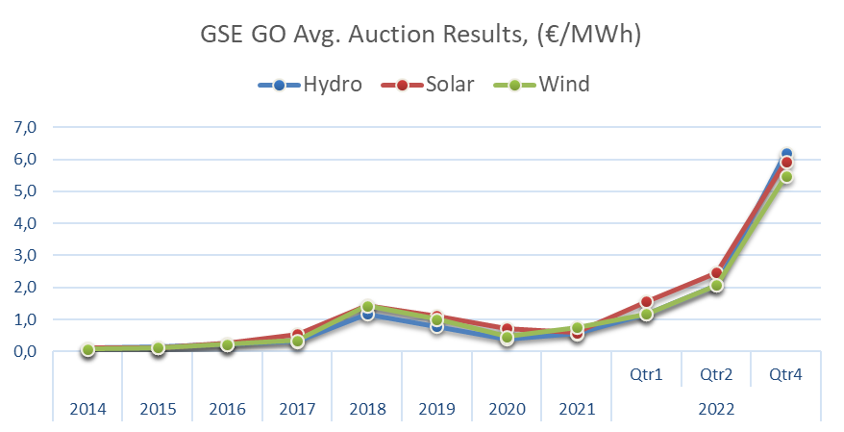

For example, Italian GO prices reached 10 EUR/MWh from less than 1 EUR/MWh on average a year ago, which is a 10-folds increase in just one year.

About GO Market in Italy

Italy issues and auctions GOs for FiT-supported production since 2013.

Gestore dei Servizi Enrgetici (GSE) is Italy’s issuing body for energy certificates and GOs from renewable energy. Hydropower is the largest renewable power source and has accounted for most of the GOs in Italy over the last ten years. However, solar, wind, as well as bioenergy are growing at fast rates.

In 2013, GSE (Italy’s registry) started to issue and auction the GOs from RES generations that received one of the following support mechanisms:

- Feed-in Tariff I (Tariffa Onnicomprensiva),

- Feed-in Tariff II (Ritiro Dedicato),

- Net-Metering (Scambio sul Posto).

Note that Feed-in Premium (FiP)-supported projects are not included in the auctions. The FiT is only reserved for production devices up to 1 MW.

Historically, Italy has been a net exporter of GOs. However, the production decreased in 2021-2022 as a result of low hydro generation as well as due to the Association of Issuing Bodies (AIB) discovered in 2020 that the Italian GO administrator GSE was issuing GOs for electricity production from synthesis gas from fossil origin, which is not recognized by the AIB.

Issuing of these GOs has now ceased, and further exports from GSE have been blocked. GSE is cooperating with the relevant issuing bodies to replace the GOs in question with valid GOs from renewable sources.

European GO Market Outlook 2023

At the start of 2023, we saw increased Hydro and Wind electricity generation in the Nordics and Iberia that might lead to more supplies coming onto the market and thus impact prices. However, while European Hydro production is expected to pick up in 2023, the corporate demand for GOs and other regulatory market constraints are to keep GO prices above the historical level. 5 to 8 EUR/MWh price level is expected unless corporate demand is reduced in light of the economic recession and companies focus on costs optimizations.

United Kingdom: Should the UK leave the European AIB GO system in April 2023, the market participants can witness an increase in the renewable certificates undersupply gap. Because UK imported a lot of EU GOs over the past several years as corporate demand for renewable energy claims increased. The GO imports in the UK represented >50% of GOs redeemed. Thus, to fill in the gap, the local REGO issuance has to increase a lot, which might not be sufficient to fill the domestic demand in the short-mid term.

Spain: Spanish GO prices increased significantly in 2022 due to dry weather conditions and reduced hydro reserves for electricity generation. GO prices rose from <0.5 EUR/MWh to 3-4 EUR/MWh in late 2022. GO prices in 2023 are likely to remain at this higher level, mainly attributed to the current dry weather conditions. In addition, due to the arbitrage opportunity between Iberian and Central European power markets, we can see unsubsidized renewable installation be incentivized to export Spanish GO elsewhere in Europe, i.e. Italy, where market prices are around 10 EUR/MWh, thus limiting local GO supply while corporate demand is on the rise.

If you wish to stay up-to-date with the latest GO market trends and news, you can subscribe to our newsletter service below.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.