Tedas electricity Tariff Update – June 2022

Global electricity markets have been on the rise since the post-covid recovery, and this trend has been exacerbated by the outbreak of the armed conflict between Russia and Ukraine. Current market fundamentals point to a bullish evolution well into CY2023. Obviously, some bearish factors are on the table as well, such as regulatory market price interventions, the economic slowdown with a possible recession in sight, and solid renewable generation, but probabilities for this to materialize in the current year 2022 are still relatively low.

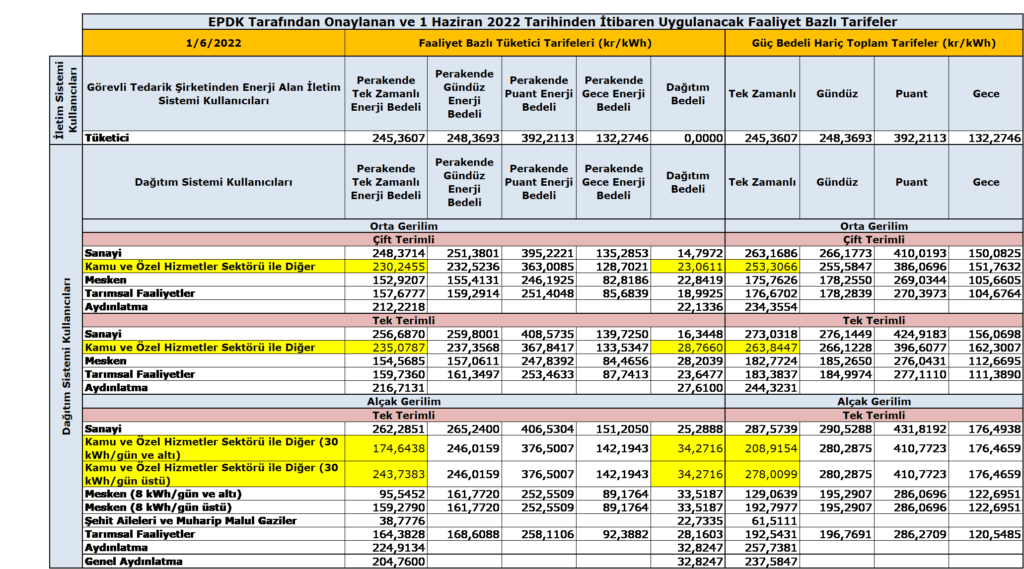

Therefore, as a result of the rising global commodity markets, Turkey announced a new TEDAS electricity tariff for business clients as of 1st June 2022. The power price increase vs. the previous month is 25%. The main price increase driver is the electricity generation costs, which have risen significantly in recent months. Now, the commodity price (excluding grid costs and taxes) for commercial users with consumption of above 30 kWh/day is 2.437 TL/MWh vs. 1.885 TWh in May 2022.

Tedas Electricity Tariff as of June 1st, 2022

In the previous article here, we have discussed the risks associated with the Tedas electricity tariff and whether the government will be able to sustain this low price environment in comparison to the free market actual costs of electricity generation. The main driver for the price increase remains gas and coal as the power market prices are set based on the marginal production costs and a merit order effect. You can learn more about how electricity markets work in this article here. We have also talked about Botas gas price policy in Turkey and whether the government will hike it again in 2022 in this article.

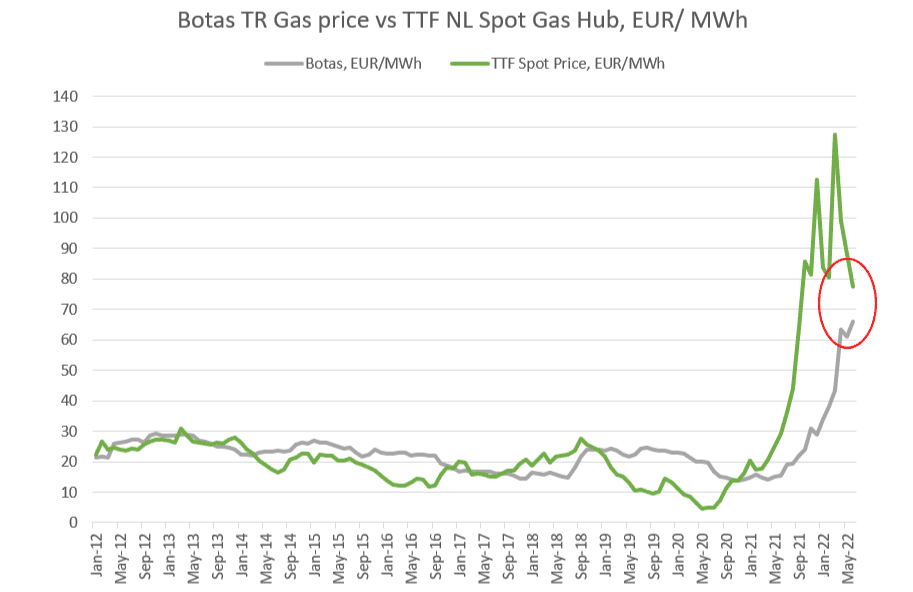

In February 2022, I highlighted a risk that the gas price would likely increase again this year because TR Botas Gas was trading at a significant discount to the European TTF gas index, which is very difficult to sustain long-term. Therefore, the increase was inevitable as the European gas price remained high since the war outbreak in Ukraine.

The new Botas gas selling price for electricity generation purposes is 1.175 TL/MWh as of June 2022, which is a +16% increase vs. the prior month. Although the price gap between Turkey and Europe is narrowed down now, Turkish gas is still selling at a discount vs. other EU major gas hub indices. Therefore, we will likely see new gas and power price hikes in Turkey again this year.

Yekdem Cost Evolution

Yekdem is a part of electricity bill costs which fluctuate monthly depending on the 3 factors: the day-ahead electricity market price, the US dollar exchange rate and the renewable production in the Yekdem portfolio. You can read my other article here for more details on how Yekdem works.

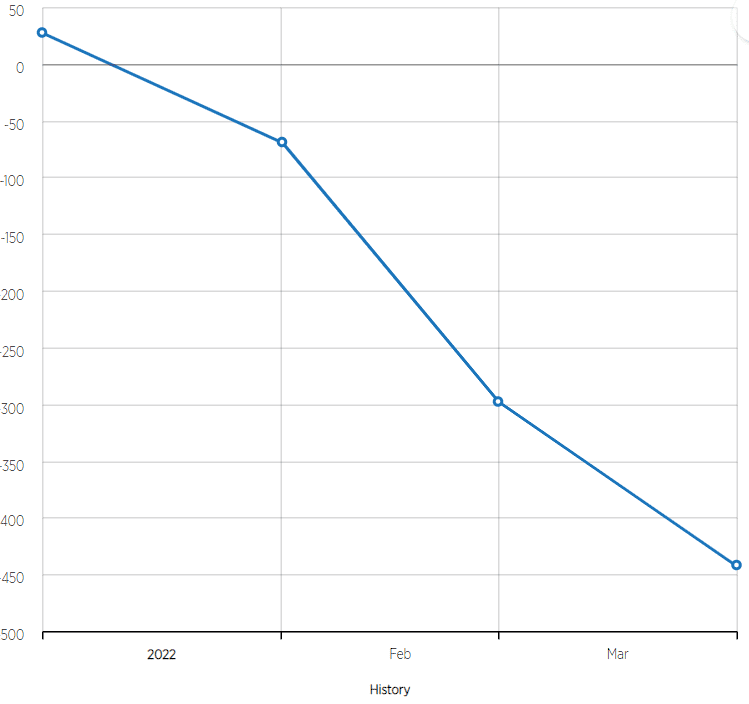

The initial government’s forecast of Yekdem cost for CY2022 was a negative one of -58 TL/MWh. However, over the first 4 months of CY2022, Yekdem has averaged -195 TL/MWh mainly due to the exceptionally high day-ahead market price and historically low hydropower generation. As the power market prices are not expected to come down in the foreseeable future, we can now expect the Yekdem cost to be negative in CY2022, which will be the first time in Turkish power history. Therefore, a recommendation is not to fix Yekdem cost for Calendar Year 2022 and even 2023.

Yekdem Cost Historical Evolution, TL/MWh

H2 2022 Outlook & Conclusions

The year 2022 is the most challenging power market environment in Turkish history. Due to the exceptionally high-power price environment, there’s a considerable risk that some suppliers may decide to cancel their power supply commitments in front of their clients. Also, those customers switching back to TEDAS state electricity tariffs are unlikely to find safety there. The TEDAS electricity tariff will likely be hiked again in 2022 or redesigned, focusing mainly on SMEs and important Industrial clients.

Therefore, companies wishing to hedge their electricity costs for 2022 and 2023 should start looking for free market suppliers, which will be challenging as there are not many market players willing to make an attractive fixed-price power supply proposal for CY2023 at this moment. Their advice is to wait for the autumn-winter period to have such negotiations, but the upside power price risks can increase while we approach the next winter heating season in Europe.

Right now, the best fixed-price power supply agreement for CY23 can be found in a range of 2200 – 2300 TL/MWh commodity price incl. Yekdem. In the graph below, you can see the historical evolution of the Turkish Year-Ahead forward power price based on the electricity generation costs.

Turkey Y+1 Forward Curve Simulation, TL/MWh

The price is in line or even below the current Tedas commodity market tariff as of June’22. As an alternative, a customer may decide not to fix 100% of its energy needs for CY23 today but rather a portion or fix a price only for the first quarter of Q1 2023 when the winter-related risks are the highest. Unfortunately, there are no signs in sight pointing to a better market price situation this and next year. Hence, a recommendation would be to start dialogs/negotiations with your power supply companies today.