Weekly European energy market update:

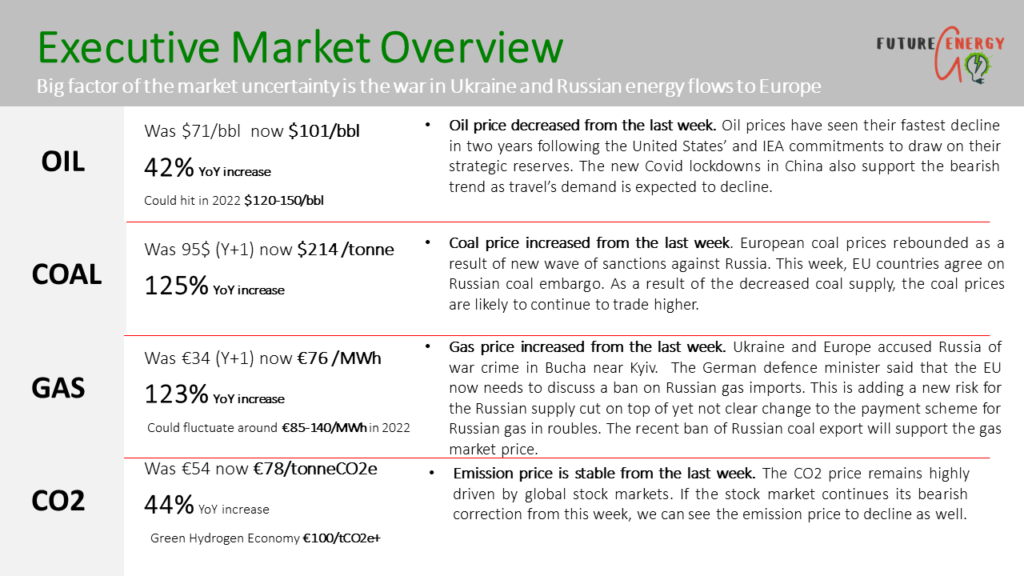

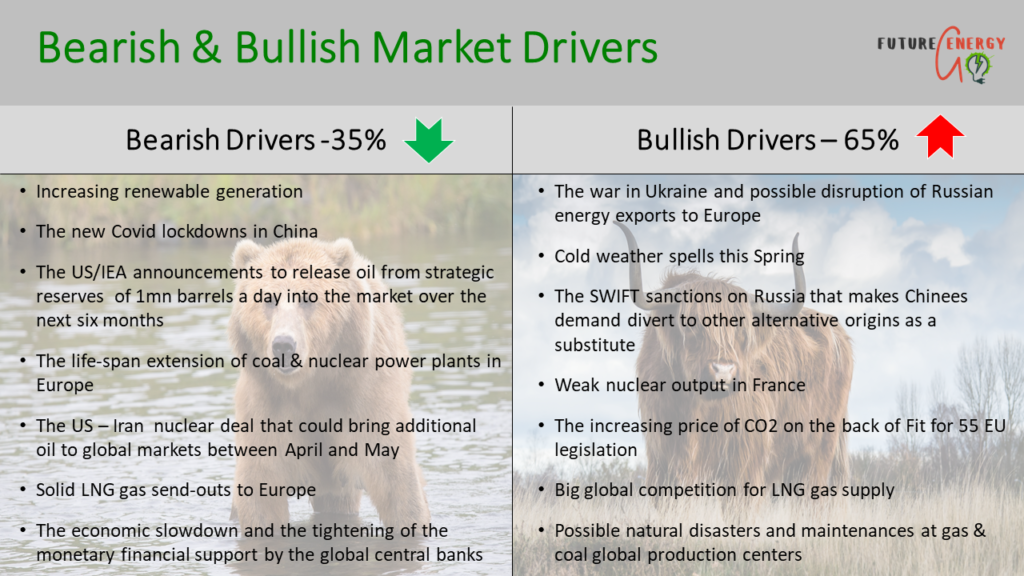

The USA announced last week it would release 1 million bl/d from its strategic reserves over the next 6 months. The IEA Member Countries also agreed to a new emergency oil stock release in response to market turmoil.

EU countries agree on new Russia sanctions, including a coal embargo. The estimated impact of the sanctions is going to be worth €4 billion per year.

The gas supply remains stable in spite of the recent Russian demand to pay for gas in Rubbles. This, however, can change anytime after the new pack of EU sanctions.

The European Parliament seeks urgent approval for the EU gas storage obligation (proposal to refill gas storage sites to 80% by 1 November 2022).

The temperature is excepted to return above seasonal norms next week which should help to ease demand for gas across the European energy markets.

The only bearish news stemmed from the decisions by the Chinese authorities to implement lockdowns due to COVID and the US announcement to release oil from strategic reserves.

To read the prior week’s European Energy Market Update, please follow the link here.

Pingback: (2022) European Energy Market Update - Week 15 (Apr 17th, 2022) | Futrue Energy Go