Is natural gas going up 2022?

The Energy Markets Regulatory Authority (EMRA) regulates the Turkish gas sector. The state-owned Petroleum Pipeline Corporation (BOTAS) dominates the sector and has almost a monopolistic position over gas imports and exports. BOTAS also constructs and runs gas pipelines in Turkey. It’s also responsible for the monthly setting of gas tariffs for electricity generation purposes and other customers.

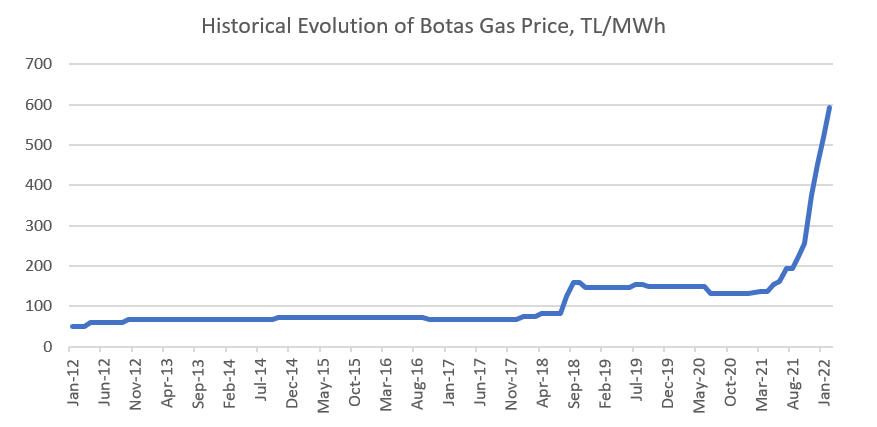

Since August 2021, Turkey increased natural gas prices for electricity generation purposes 6 times in a row. Starting February 2022, the gas price was increased once again by +14% vs the prior month. The current rate is 592,1 vs 134,2 TL/Mwh a year ago which is 341% YoY increase.

Macroeconomics

One of the reasons for the gas price increase is the halted gas supply from Iran. Iran supplies about 16% of gas in Turkey. After Iran cut the flow of gas back in Jan’21, Turkey’s state pipeline operator BOTAS had no choice but to slash gas supplies to industrial zones. The bad news came on top of the already deteriorating situation with global energy prices skyrocketing to the highest levels.

Gas is one of the main energy sources in Turkey. It’s used widely for household heating and industrial production as well as for about 40% of power generation in the country. Although in recent years, the government tried to reduce its reliance on gas and use more domestic coal and invest in renewables.

For Turkey, gas imports from Iran serve the purpose of diversification and reducing reliance on Russia, which is the country’s largest supplier, providing 33% of its gas imports. In addition to gas pipelines with Iran, Russia, and Azerbaijan, Turkey buys liquefied natural gas (LNG) under long-term contracts with Algeria and Nigeria as well as from the US and Egyptian suppliers on the spot market to meet short-term needs.

Gas imports from Iran provide diversity for Turkey and lessen reliance on Russia, which is the country’s major supplier, accounting for 33% of its gas imports. Turkey imports natural gas under long-term contracts. These contracts are usually indexed to the international dollar exchange value. However, the Turkish lira’s depreciation of about 80% of its value since Jan’21 is only worsening the situation with the cost of energy fuels.

On top of the depreciated lira, we have global commodity prices that started to sharply increase from 2021 up to today. And because the Turkish gas price has a close correlation/indexation with other EU major gas hub indices such as TTF/NCG or Oil, it’s not a surprise we have seen those hikes in the gas price by Botas.

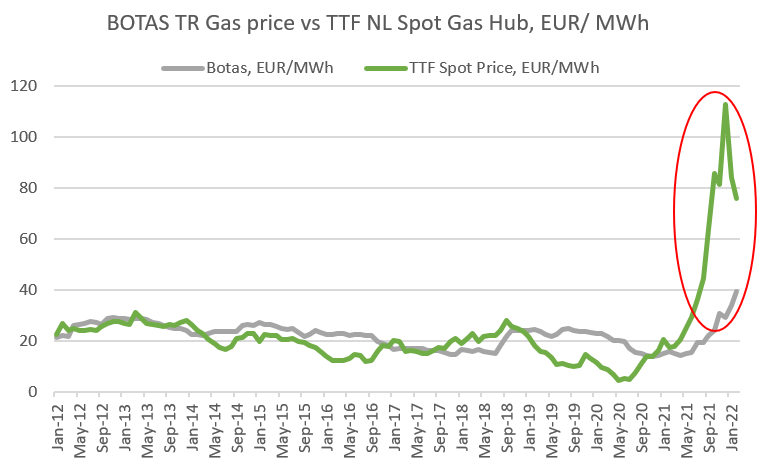

If we take a look at the chart above, which shows the historical evolution of TR Botas Gas price and EU TTF average spot price in EUR/MWh, we are going to notice 2 things:

- Turkish gas price correlates with other EU Gas indices

- Historically, Turkish gas price was selling at a premium vs EU gas before the end of 2020

However, as the global commodity markets increased, it’s likely that the Turkish government decided not to hike the gas price immediately so as not to fuel the country’s inflation. Eventually, the laws of economics can’t be ignored, and prices need to follow the free-market rules.

H1 2022 Outlook

The current price gap between the Turkish gas price and those in the EU is very widened. The current Turkish gas price is around -50% discount vs EU TTF gas spot price. And since the gas price is determined by a single, state-owned, player Botas, we can imagine that the current tariff is rather controlled by the government than the free-market rules.

We don’t know for how long the government can continue to subsidize the gas tariff to keep it at the current level, but unless we see a big correction in a gas price in the EU, that doesn’t seem to happen in the short term, we will likely see new gas price hikes in Turkey in 2022. And the higher the gas price, the higher costs to generate electricity. As a result, Tedas electricity tariff can increase too.

One additional factor of uncertainty regarding electricity markets is the tensions around Ukraine and the risk of an armed conflict. Should this scenario materialize, the short-term impact on the energy market would be extremely bullish.

If you want to learn more about Turkish power market, please check out my blog. And if you want to know whether you should switch to the regulated Tedas electricity market tariff in 2022, please read this article.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.