Energy Market Overview in Q3 2022 (Gazprom halts gas supplies to Europe)

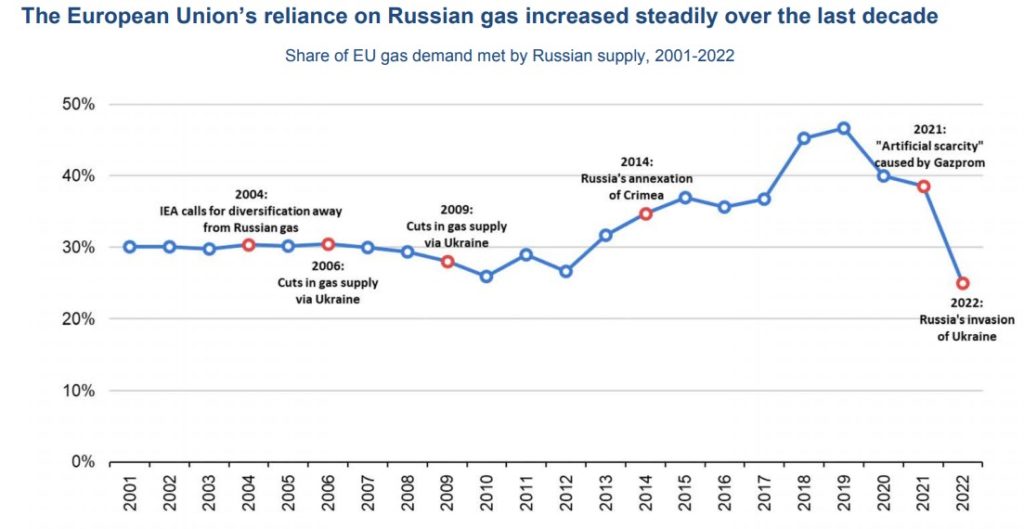

Over the past ten years, EU countries have become gradually more dependent on Russian gas. During this time, natural gas consumption in the EU was primarily unchanged. Meanwhile, output has decreased by two-thirds since 2010, and increased imports have supplied the resulting deficit.

The proportion of Russian gas fell to 40% in 2020 due to the significant LNG import and the overall excess of gas globally. Despite having extra supply capacity, Gazprom’s lowered short-term sales to the bloc. The EU gas market became even tenser due to Gazprom’s artificial shortage, which also caused prices to reach record highs and many price spikes during the heating season of 2021–2022.

The invasion of Ukraine by Russia has made the already-tightening natural gas supply even worse, driving up consumer prices. It also makes the market more uncertain in the long run as Europe heavily relies on gas for power generation.

The IEA expects that the demand for natural gas will decrease in 2022 and stay low through 2025. The possibility of persistently tight markets is increased by Europe’s aggressive pursuit of LNG to replace the Russian pipeline supply and the limited expansion of global LNG export capacity.

The IEA assumes that Russian pipeline gas exports to the EU will fall by over 55% between 2021 and 2025. The likelihood that Gazprom halts gas supplies to Europe, as it did in 2022 to some nations, adds to the already significant uncertainties in this area. It’s also expected that the growth rate in LNG liquefaction capacity will decline, increasing the possibility of persistently tight market circumstances over a prolonged period.

This results from a mix of investment decisions made with less money during the mid-2010s time of reduced oil and gas prices and construction delays brought on by Covid-19 lockdowns. In contrast to the 7% growth rate seen over the preceding five years, the global LNG trade is predicted to increase below 4% from 2021 to 2025.

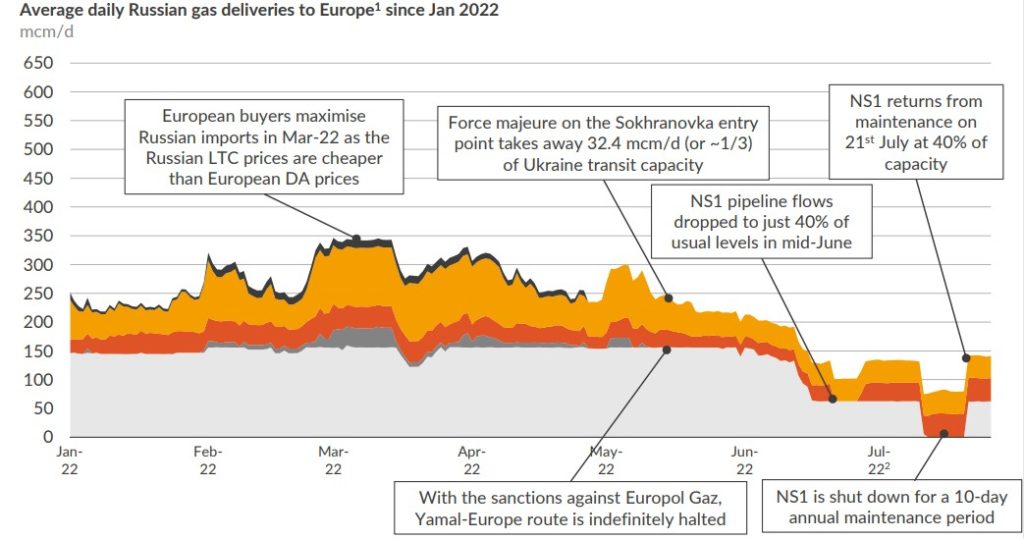

Key Events:

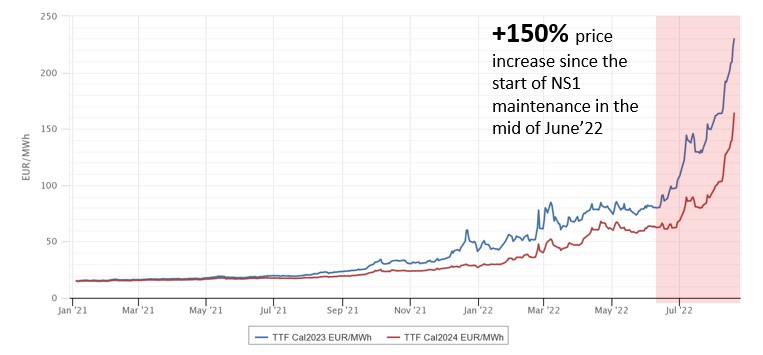

- On 14th June, Nord Stream 1 flows dropped to 100 mcm/d when Gazprom announced that 5 out of the 8 turbines in the Portovaya compressor station are offline.

- On 16th June, Nord Stream 1 flows were further reduced to just 62 mcm/d (or 40% of capacity) after another turbine went offline.

- On 21st of July, Nord Stream 1 was restarted from maintenance at similar levels before the maintenance (62 mcm/d).

- On 27th of July, however, Gazprom announced further reductions to flows that will reach 33 mcm/d (~20% of capacity).

- On 19th of August, Gazprom announced Nord Stream 1 pipeline to shut for three days at the end of the month. The shutdown is to run from Aug. 31 to Sept. 2.

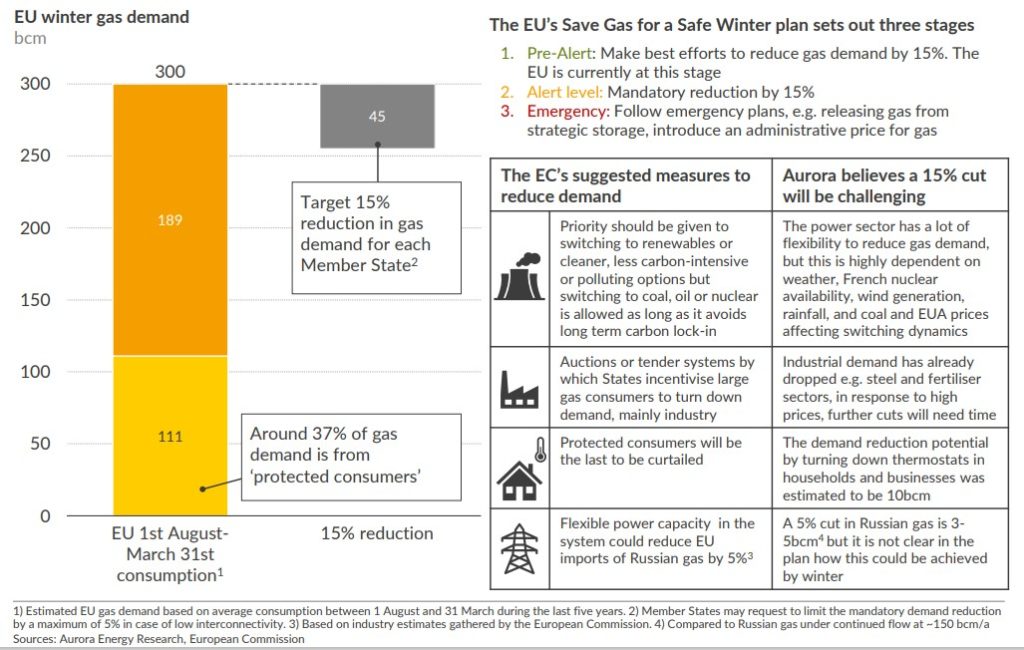

The Nord Stream pipeline has already been operating at only a fifth of its maximum capacity, fueling worries that Russia would stop supplies before the winter heating season and make it more challenging to fill gas storages. The EU has already made efforts to voluntarily reduce its winter gas consumption by 15% (or 45 bcm) from 1 August 22 to 31 March 23, which would more than make up for the decline in Nord Stream 1 flows. The gas storage in the EU increased to 76%, reaching the original targets. However, this might not be enough to survive a cold winter.

It should also be noted that the EU’s Save Gas for a Safe Winter plan foresees different stages of an emergency. The final stage of the emergency envisions releasing gas from strategic reserves and the introduction of an administrative price cap for gas.

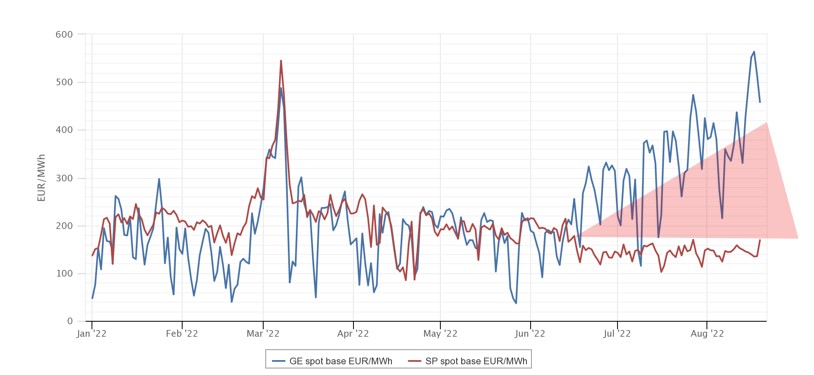

For example, in June’22, Spain and Portugal capped gas prices at an average of €50 per MWh for the next 12 months. As a result of this measure, we can see a big DAM power price discount between Iberia and continental Europe. However, market analysts still doubt that the same measure can be implemented on the continent due to the high reliance on Russian gas. Spain and Portugal argued that because of their limited interconnection with the rest of Europe, the Iberian power market should be permitted to set gas rates for themselves. In addition, the two countries have a significantly lower reliance on Russian gas (which they mainly acquire from Algeria) and a robust renewable generation capacity.

Spain and Germany power price divergence

Conclusions

Russian gas exports to the European Union may decline by nearly 120 bcm/year from present levels in 2021 to only 30 bcm by 2025. This would essentially lower Russia’s percentage of the overall gas consumption in the EU to below 10%, placing it on a path to oblivion by 2027.

Although the EU can diversify away from Russian gas with LNG gas, it is unevenly distributed. More than 40% of that capacity is in Iberia, which has inadequate connections to the rest of the continent. The construction of new LNG terminals on the continent will take at least several years. In the meantime, although we can foresee some bearish drivers, market Experts believe that power prices will continue to increase between now and the beginning of winter 2022-23.

The bearish market drivers can include the following:

- The resumption of Covid measures, although a return to the extensive lockdowns experienced in 2020 is less likely;

- The economic slowdown in 2022 (European gas consumption fell by 10% y-o-y in the first half of 2022 according to the IEA)

- The decreased gas consumption in the EU and personal commitments to reduce heating and cooling;

- The end of the war in Ukraine;

- The possible price cap for gas/power markets by the EU government;

- The life-span extension of coal and nuclear power plants, although the currently available capacities look rather insufficient;

- The strong LNG deliveries to the EU from the USA and Qatar, although the market competition with Asia may intensify in the winter.

However, as long as the gas price remains the main driver for setting power market prices in Europe, we will likely experience a higher power market price environment.

Forward gas futures have been trading at levels never seen before in 2022

Following the repair in Canada, one of the Nord Stream 1 turbines is presently stalled in Germany. Germany has said that it may be moved at any time, but Moscow continues to claim that the equipment couldn’t be delivered back to Russia due to sanctions imposed by Canada, the EU, and Britain. Germany earlier dismissed Russian’s position that the halted Nord Stream 2 pipeline’s resumption may help to ease the country’s gas shortages. The war in Ukraine doesn’t see an end either. As a result, not many factors indicate an improvement in power prices in the near future.

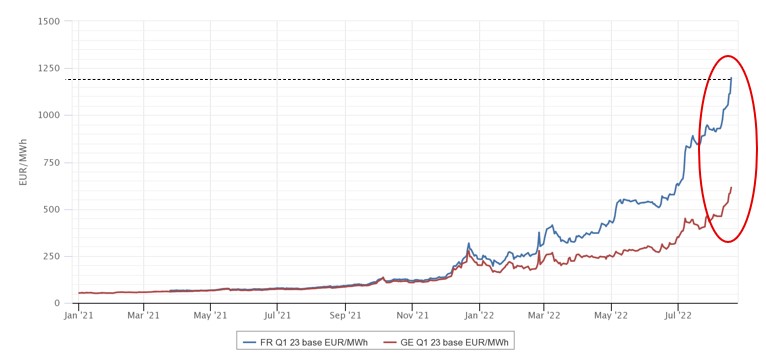

The current gas market price in Europe is around 250 EUR/MWh. A few days earlier, Russia announced that gas prices in Europe can increase by a further 60%, which would mean a gas price of 400 EUR/MWh in the coming months. With the gas price of 400 EUR/MWh, we will see a power price in Germany and the neighboring countries of around 800-850 EUR/MWh. The power prices can reach well above 1.000 EUR/MWh if it’s understood that power demand will exceed supply, as it’s happening in France today, with the historically low nuclear output, for Q1 2023.

Back in July, we already predicted that power prices in Europe could rise to new highs of 400-500 EUR/MWh unless the EU disconnects the power from gas prices and/or regulates gas market prices. You can learn more about the reasons in the article here.