Energy Market Highlights 2021

The European energy market price has witnessed completely new levels in 2021 by far surpassing those we had in 2008. The European day-ahead power price was seen >400 EUR/MWh mark in Dec’21 vs the historical market average of around 40-50 EUR/MWh, which is a 10-times increase.

The main drivers of the European energy market price increase throughout 2021 are the low level of gas reserves in Europe, low renewable output, supply uncertainty, and the rise of CO2 certificate prices.

As a result of the wider EU transition towards renewable energy and the planned reduction of the CO2 footprint, it is expected that electricity market prices won’t return to pre-Covid levels for the foreseeable future.

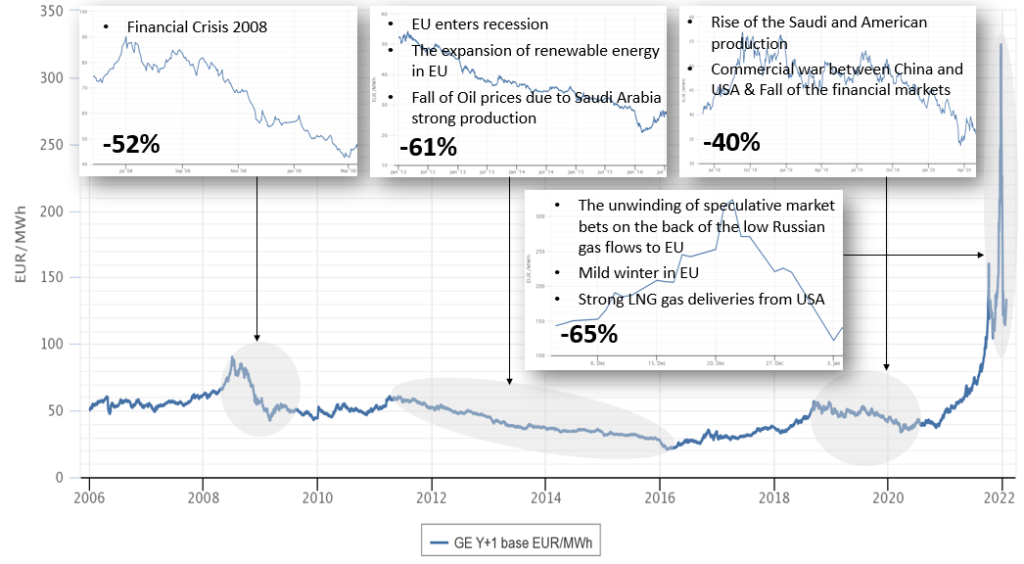

The European Energy Market Price History

As a result of the energy market price increase as well as increased consumption, many businesses face huge OPEX challenges and are even at the risk of their business continuity beyond 2022 if no price relaxation comes soon.

Despite the EU inflation is already at a multi-year historical high, likely, it has not reached its peak yet. One of the main reasons is that many large businesses forward purchase their electricity using futures on the energy exchanges and/or leave have floating energy positions on the day-ahead markets. In many cases, the electricity is hedged forward for up to 1-2 years ahead only due to internal policies and market liquidity. And as most of the hedges are about to expire in 2022, the energy crisis has made it very challenging to agree on new contracts beyond 2022 hampering future business profitability.

Therefore, unless we see a relaxation in the energy market prices in 2022, many EU businesses will have no choice but to pass the costs to their end-consumers, fuelling the already high inflation.

Market Price Outlook Post Winter 2022

Although there was already a market price correction by -65% in the futures market, the market prices remain historically high. As we are still halfway through the Winter on January 22, the low gas storage volumes in Europe and replenishment rates remain a significant concern providing ongoing support to prices.

And the ongoing military tension in Ukraine doesn’t help the already volatile market situation at all. One of the few solutions to the tight situation with the gas supply to the EU is the approval of Nord Stream 2 – a notable gas pipeline from Russia to Germany that does not transit through Ukraine. This pipeline will deliver considerably increased capacity to Europe but remains in the midst of a geopolitically complex approval process.

The approval decision is expected in the second half of 2022 but could be delayed further on the back of the Russia-Ukraine situation. However, once the uncertainty is resolved, the gas price shall return to a level of 30 – 50 EUR/MWh vs the historical level of 20 EUR/MWh before 2021. The forecast of the higher gas level is due to the phase-out of coal-fired power plants and increased gas demand from Asia and India.

In addition to the gas crisis, the commitment of world nations to continue to fight climate change has strengthened initiatives such as EU Emission Trade System (ETS), which aims to combat climate change with the biggest carbon market trade in the world. The price of CO2 emission certificates increased by ~300% from an average of € 20-25 / tonne pre-Covid (for more detail about the impact of the CO2 EU ETS system on the electricity price, please read my other article).

Carbon prices are set to remain high as it’s expected fewer certificates to be issued in order to encourage the acceleration of the transition toward a net-zero carbon economy. Multiple economic models foresee Carbon price of around €100/tonne to sustain.

Pre-pandemic, the 20-year historical average price of electricity prices was in the €40-50/MWh region. The new paradigm would mean that on average electricity prices should settle around €70-90 / MWh in Europe, depending on the market. This would lead to an inevitable increase in production costs of various goods and services.

One additional big factor of the market uncertainty in 2022 is the risk of an escalation between Russia and the Western block leading to an armed conflict. Should this scenario come true, the short-term impact on the energy market would be bullish because this scenario would lead to a strong disruption of gas supply from Russia to Europe.

However, despite all the bullish market price risks above, there is still a probability of the market price correction materializing after this winter on the back of:

- The OPEC producer group is unwinding record-high production cuts of 10 million bpd

- Solid LNG gas send-outs to Europe from USA

- The upcoming Lunar New Year holiday in China from 31st Jan to 16th of Feb

- The mild weather forecast

- The tightening of the monetary financial support by the central bank

Therefore, we should continue to closely monitor the market price evolution and wait for possibly better energy buying opportunities in Mar’22 – May’22.

To stay connected to the latest trends and dynamics in the European power markets, please check my weekly market reports.

Liked the article? Please comment below. This means a lot to me!