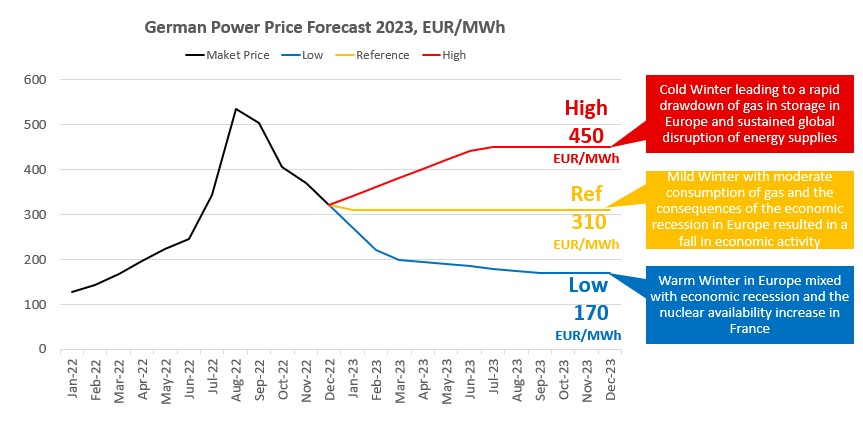

Gas and electricity prices in Europe are expected to remain elevated until H1 2023 amid prolonged disruptions to Russian supply and cyclical heating demand fuelling Europe’s Energy Crisis. However, it’s expected that prices are projected to retreat from peaking in H2 2023 because of a likely demand destruction/energy rationing along with improved supply from non-Russian sources. However, as many corporates and customers are at risk of not affordability of energy skyrocketing energy bills, European Energy Subsidies 2022 are being considered by the governments.

Bullish Risks:

- for an indefinite period

- Increased global competition for LNG gas

- Reduced LNG imports from the US and Norway amid outages

- Rapid drawdown of gas in storage in the event of a colder-than-normal winter season

- Escalation in Russia’s military action against Ukraine

- Low nuclear and hydropower output

- Harsh winter in the EU

Bearish Drivers:

- EU countries agreed to curb gas usage by 15% of their average annual gas use

- Nuclear availability increases in France

- Foreseen increase in LNG import volumes through new floating storage and regasification units opening in Europe

- The attempt by the EU to reduce gas demand through intervention in the electricity market

- Higher-than-average inventory levels

- Economic slowdown

- Mild weather temperatures in the EU this winter

In light of the above developments and macroeconomics, the European governments are contemplating several measures to help consumers and corporates reduce their electricity bill burdens. In the previous article, “Europe to fight the skyrocketing electricity prices”, we have already discussed likely measures to calm down the skyrocketing electricity prices and help Europe’s Energy Crisis.

European Energy Subsidies 2022

GERMANY: To help German households and businesses cope with rising energy prices, the German government is contemplating providing almost €200 billion in subsidies in 2023. Large companies are also covered with a 70 EUR/MWh ceiling for 70% of their gas usage in 2021. Even though many corporations only use a tiny amount of gas, the approach might be applied to other energy sources, including electricity bills. The state has also declared that the gas charge of 2.4 cents per KWh will be eliminated starting on January 10, 2022, and that the gas sales tax will be reduced from 19 to 7%.

IBERIA: The “Peninsula pricing cap” was created by Spain and Portugal and accepted by the EU. A fixed gas price is used as the basis for determining the price of electricity. Initial gas price caps are 40 EUR/MWH (April 2022) and 5 EUR/MWh a month from October 2022. The present mechanism will last until May 2023. This gas cap action has caused power costs to fluctuate between 150 and 200 EUR/MWh throughout 2022, a significant decrease from the rest of Europe, where electricity prices ranged from 300 to 500 EUR/MWh.

FRANCE: France has implemented some tax reductions, but the main initiative is the so-called AREHN mechanism that has existed for a while. This mechanism allows companies to purchase electricity from EDF nuclear sources at a big discount to the current market prices. The quantity available to companies that want to participate in the scheme depends on the overall demand. Therefore, there’s a risk that it will get a lower allocation in 2023 as more companies are opting for this scheme. The French state may decide to increase the capacity available to companies, but the nuclear generation capacities have been historically low in France in 2022.

UK: Former PM announced a price cap on energy cost at 211 £/MWh for the whole of 2023. However, the new Chancellor, Jeremy Hunt, has indicated that the cap will only last until April 2023 vs the initial plan to cap prices for the whole 2023. There are still several uncertainties on how the relief is going to be calculated and applied to companies and consumers. Yes, the relief at 211 £/MWh is quite significant vs the market prices of 300-500 £/MWh. The government will publish a review of the operation of the scheme in three months to inform decisions on future support after March 2023.

GREECE: The Greek government has been subsidizing energy bill for consumers and businesses. The subsidy amount is determined each month and, on average, the relief is in the area of 40-60% of the price increase.

ITALY: The Italian State has put in place a scheme to reduce electricity grid transportation costs to almost zero. This decree has been extended to 2023. Separately the state is considering a 15 to 40% tax credit for energy costs of companies that are considered high consumers of energy.

Czech Republic. A recently published CZ government order states that the electricity price cap (5000 CZK/MWh or ~200 EUR/MWh commodity price excluding regulated costs) will apply to all low voltage offtake points between 1 January 2023 and 31 December 2023.

To learn more about European Energy Subsidies to lower electricity market prices, please check out this article, where we talk about what Europe is doing about Europe’s energy crisis and what’s next.

If you liked this article, please share and leave your comments below. You can also subscribe to our newsletter to get all important energy market news and updates like this one.