Energy Market Highlights:

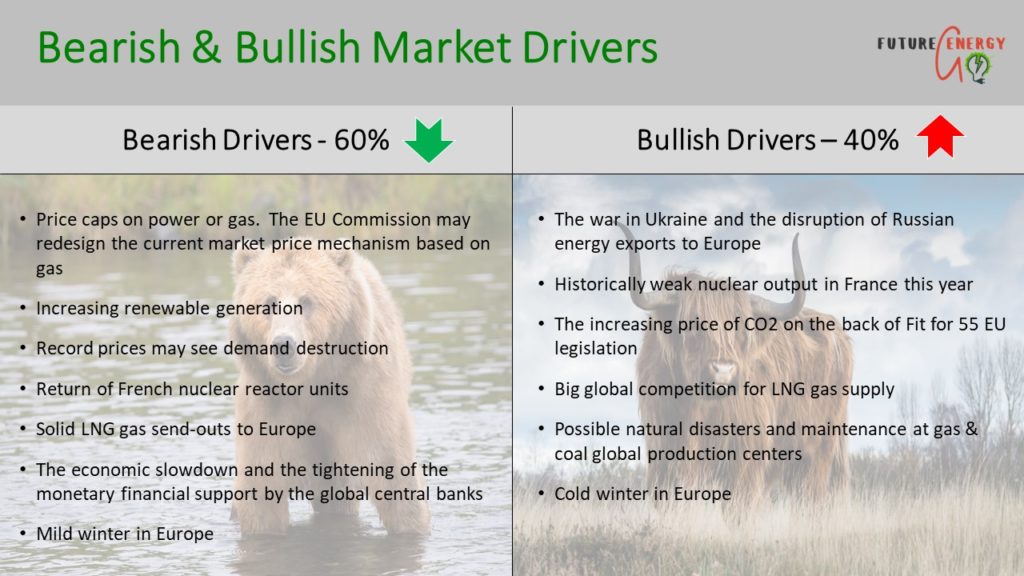

- According to reports, EU states disagree on the price cap to impose on Russian oil; however, if the price falls between $65 and $70 per barrel, the impact may be lessened.

- Australia, which is entering the summer wet season with a La Nina event with a higher-than-normal possibility of above-average rainfall and flooding for the major coal mining regions, has raised coal supply threats.

- Although this year’s increasing coal output in China and India may pressure the market prices. Also, on the bearish side, higher-than-expected French nuclear availability might reduce coal production.

- TTF forward gas prices rose on a weekly basis as EU energy ministers failed to reach a consensus on a gas price cap. The uncertainty regarding Russian imports via Ukraine provided additional support.

- China’s zero-covid policy and recent lockdowns will continue to reduce the country’s demand for LNG cargos, sending bearish price signals to Europe, which is eager to take advantage of the rush of LNG arrivals into the Continent.

- The prices of natural gas in Europe rebounded as the EU gas stock levels slightly decreased w-o-w in light of the colder weather but still at 92% full capacity.

- According to the European Commission, in order to assure the energy security of the regional bloc by 1 February, EU gas stockpiles must be at least 45% full.

- Spanish utility Endesa estimates that electricity costs might increase by more than 20% from present levels in the forward market. And the cost of electricity in Spain in 2025 may be about 117 EUR/MWh.

To read the prior week’s European Energy Market Update, please follow the link here.