Energy Market Highlights:

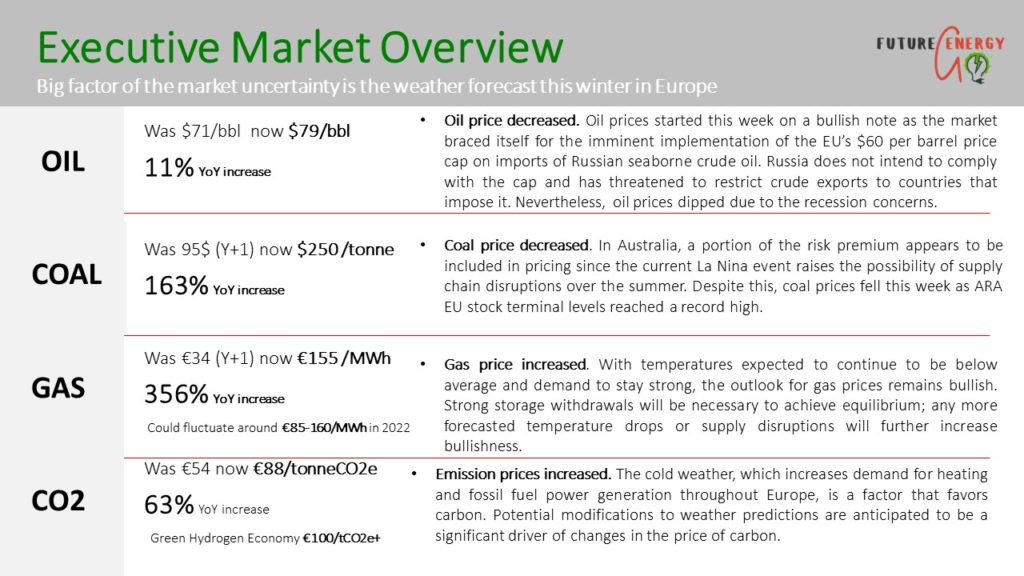

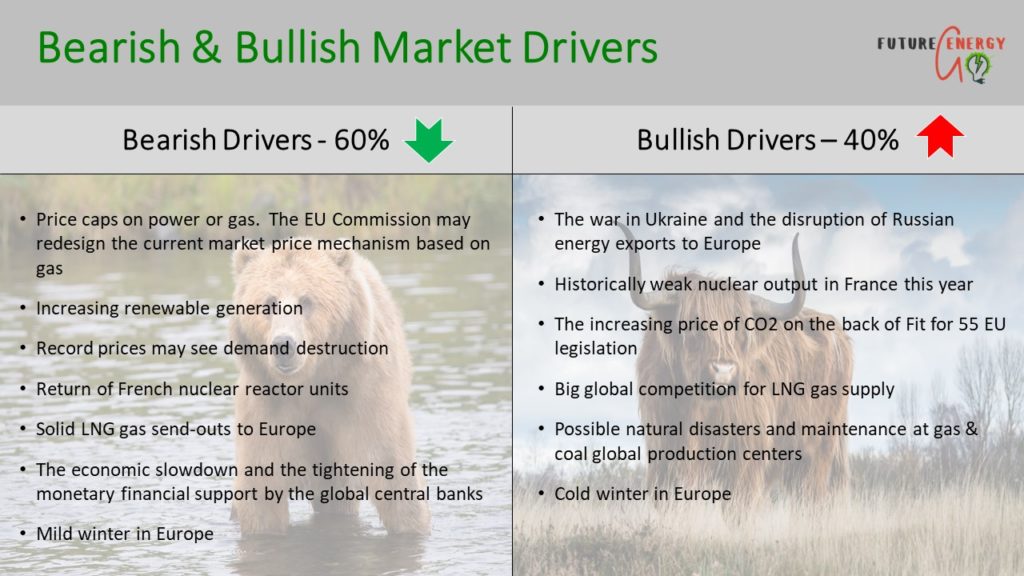

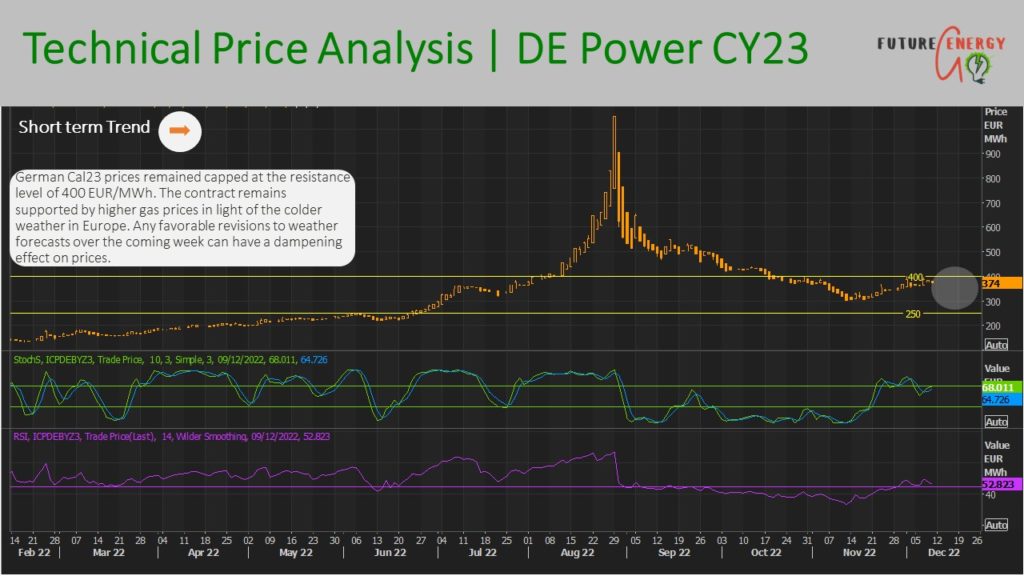

- The prices of natural gas in Europe continued to rise this week as the EU gas stock levels decreased w-o-w in light of the colder weather but are still at 89% full capacity.

- The Commission proposed a compromise proposal for the gas price ceiling in the latter half of November. This was done in the form of a “TTF minus” corrective mechanism, which would act as a fixed ceiling on the TTF for the upcoming month. This system would effectively serve as a ceiling price, but it would not apply to spot or day-ahead products. The first suggested level of 275 EUR/MWh.

- The divide between opposing viewpoints on the gas price ceiling remains great, with nations proposing changes to the Commission’s plan as a whole rather than ironing out the details. Therefore, it is unlikely that an agreement will be achieved before or during the upcoming ministerial conference on December 13.

- The EU agreed to implement the $60 per barrel price cap on imports of Russian crude oil. However, Putin said that Russia wouldn’t comply with the price cap. Hence, the world’s oil supply is projected to decline, supporting oil prices at a higher level.

- Despite the EU sanctions and bans, Russian coal exports increased 6% YTD due to higher deliveries to China, Turkey and India.

- Due to a stringent reactor maintenance schedule and unanticipated outages owing to corrosion, French nuclear availability has fallen to a record low for the last 30 years this year. The 18 reactors out of 56 that are not operating account for 21.6 GW, or 35% of the total producing capacity.

- For solar and wind energy generation, the Netherlands set a profit cap of 130 EUR/MWh. While the Italian government intends to impose a new windfall tax on electricity produced by coal, oil, or renewable energy sources. The 180 EUR/MWh price ceiling will be effective from December 1, 2022, through June 30, 2023.

- In Germany, the gas price ceiling (at 12 cents per KWh) will be applied to individuals, small enterprises, and public organizations like hospitals or universities up to a level of consumption equal to 80% of their anticipated yearly use.

- For 70 percent of their use in 2021, gas rates for large industrial clients will be capped at 7 cents per kWh.

- For homes and small companies, the electricity cost will be set at 40 cents per kWh, which will cover 80 percent of anticipated demand, and at 13 cents per kWh for larger industrial organizations, which will cover 70 percent of consumption from the previous year.

To read the prior week’s European Energy Market Update, please follow the link here.