Energy Market Highlights:

- The prices of natural gas in Europe continued to fall due to the mild weather this Winter in Europe and high gas storage. The average EU gas storage level is at 83% full capacity.

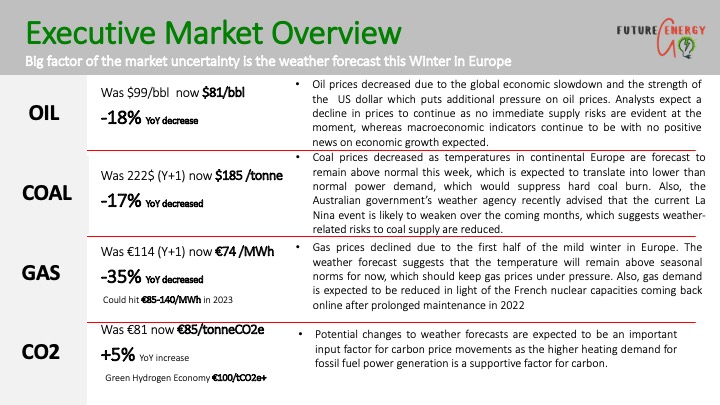

- Due to increased pressure from the US dollar’s strength and the global economic slump, oil prices declined. Analysts predict that prices will continue to fall as no signs of positive economic development are anticipated.

- Since temperatures in continental Europe are projected to stay above average this week, there will likely be less demand for electricity, which will reduce the burning of hard coal. Additionally, the weather service of the Australian government has warned that the current La Nina phenomenon is anticipated to wane over the upcoming months, reducing the dangers associated with weather to the supply of coal.

- The EU agreed on a new deal for the EU ETS scheme under the Fit for 55 program. The scheme is now being expanded to cover more sectors to comply with the climate objectives aim to reduce GHG emissions by 55% by 2030 and to 0% by 2050.

- EU energy ministers have agreed to a temporary price cap on TTF forward gas contracts of 180 EUR/MWh. The price cap will apply as of the 15th of Feb’23. However, the mechanism can be abandoned at any time if the mechanism proves to be inefficient.

- European countries together reduced their gas consumption by 20% compared to the average of the same months between 2017 and 2021, according to Eurostat. Prior, EU nations committed to voluntarily reducing their natural gas use by 15% between 1 August 2022 and 31 March 2023 in a bid to fill gas storage up before winter.

- EDF is planning to tackle corrosion issues at all 12 of its 1 300 MW reactors by the end of 2023

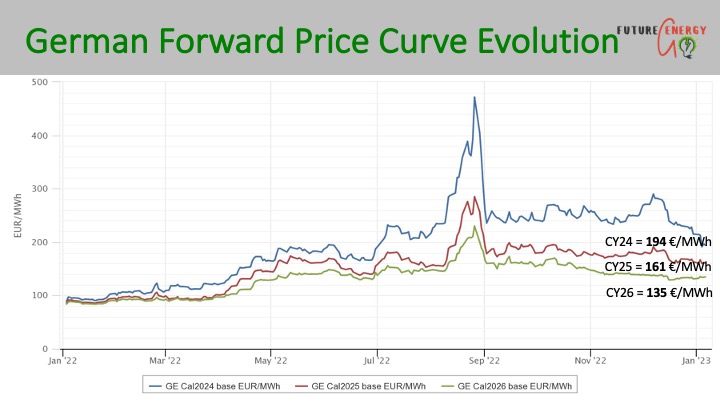

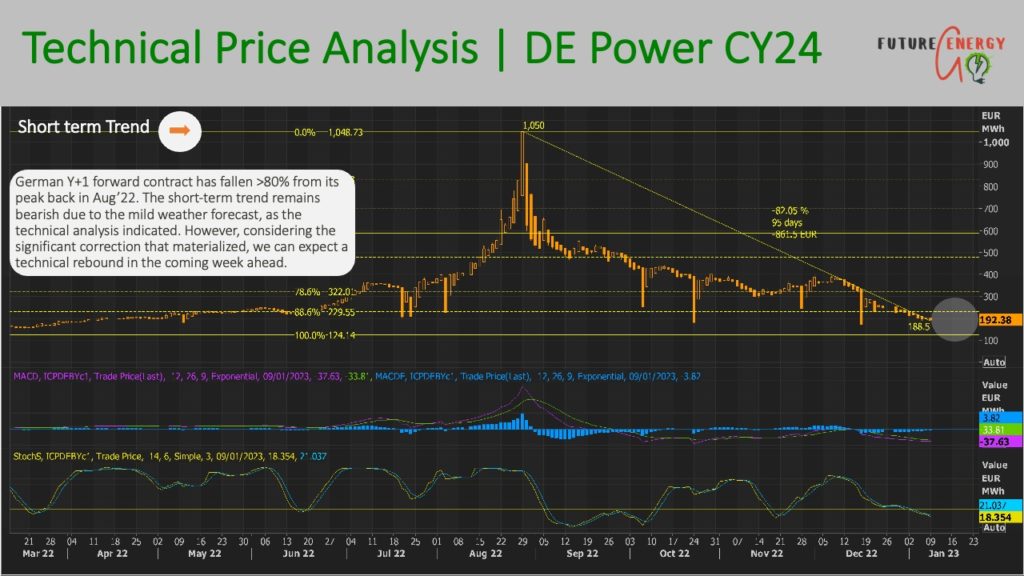

- Overall, as the weather temperature is expected to stay above seasonal standards for the time being, power prices should remain under pressure. However, peak winter demand is still ahead.

- In addition, a decrease in gas consumption is anticipated as a result of the French nuclear capacity coming online in 2023 following a protracted maintenance period.

To read the prior week’s European Energy Market Update, please follow the link here.