Energy Market Highlights:

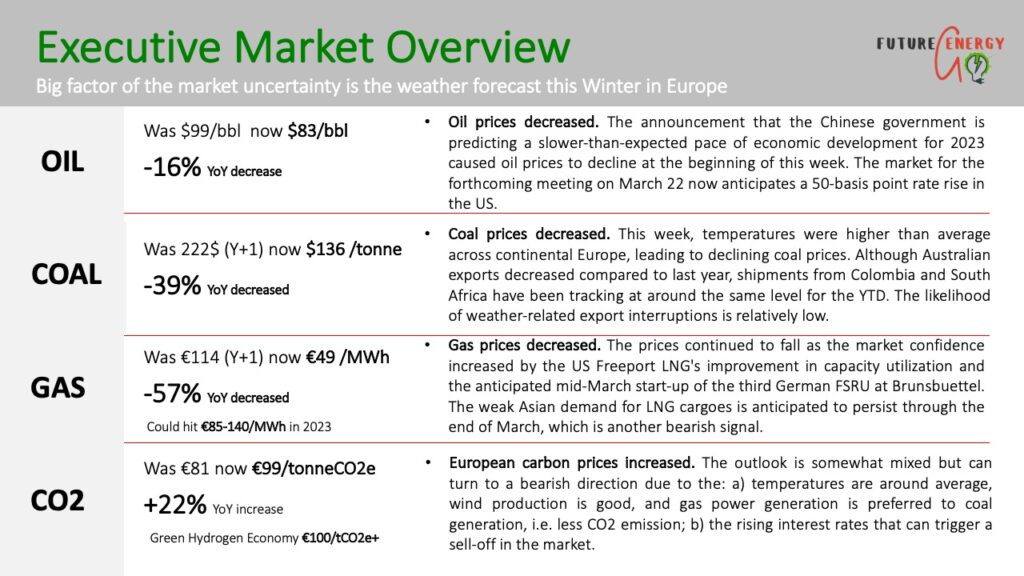

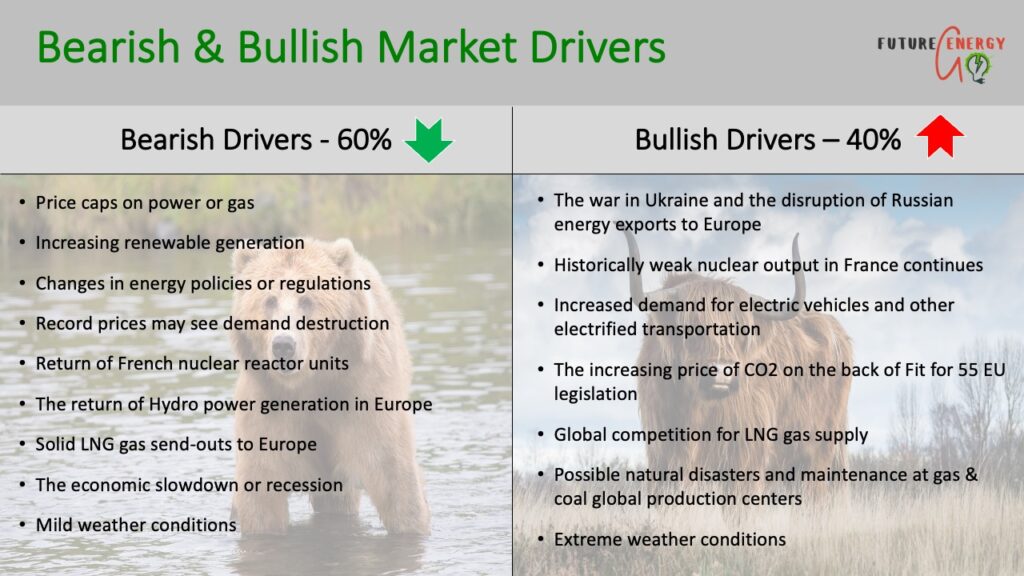

- European gas prices continued to fall amid healthy supplies and high storage levels. The gas storage levels across the EU stood at 57% full capacity.

- The weak Asian demand for LNG cargoes is anticipated to persist through the end of March, which is a bearish signal for the EU power markets. At the same time, the weather forecast continues to stay above the historical average.

- European coal imports dropped to a one-year low in February due to high stocks and weaker demand. Although Australian exports decreased compared to last year, shipments from Colombia and South Africa have been tracking at around the same level for the YTD. The likelihood of weather-related export interruptions is low.

- The energy market participants remain opimistics about the future of the European energy market complex since the US Freeport LNG terminal is back online and the third German FSRU at Brunsbuettel will start in March.

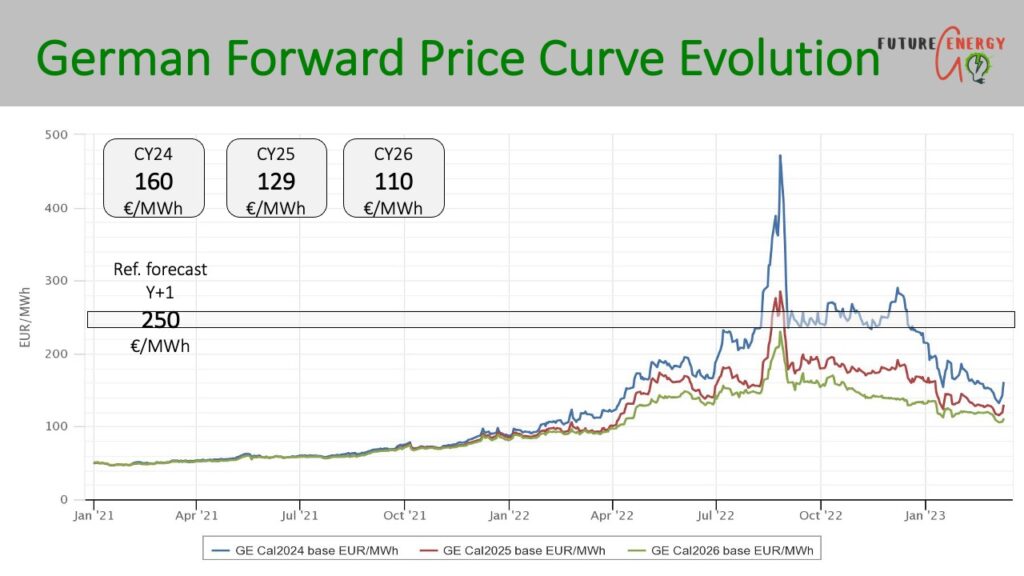

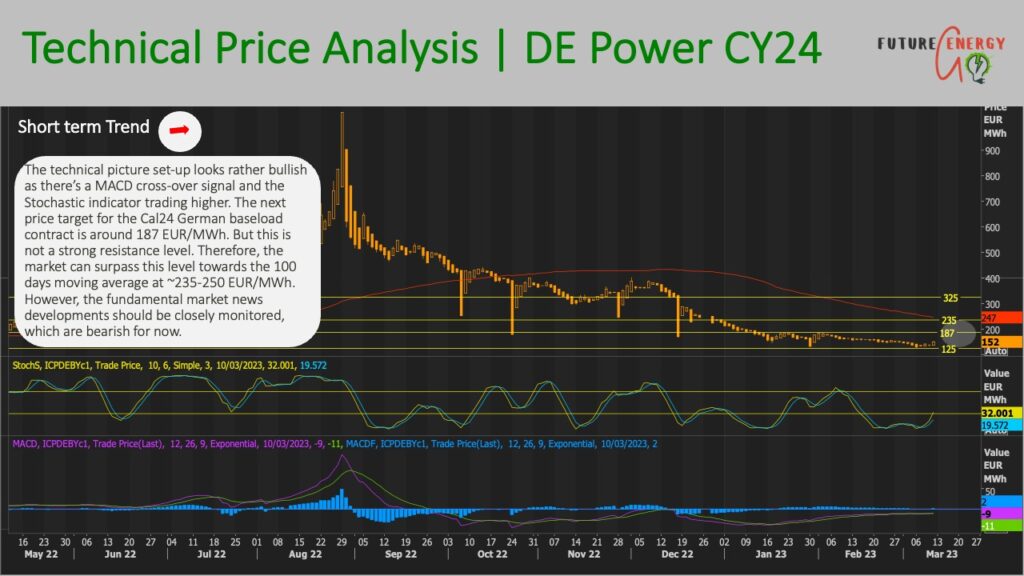

- As a result of the above, the European power prices continued to decline this week until Fri when Cal24 German Power Futures increased by almost 20 EUR/MWh in a single day, closing the week at 160 EUR/MWh.

- The rebound of more than 10% in the market price in a short period of time often indicates a change in the market trend direction.

- Therefore, we believe that the current energy market situation presents a significant opportunity for forward hedging. It’s essential not to forget the prices several months ago, and the risks still exist. As such, taking advantage of the current market conditions by hedging against future price fluctuations is a prudent risk-management decision.

- The above recommendation, however, doesn’t take into account the economic recession scenario in Europe. Shoud this scenario materialitze, the energy prices can be seen lower from here.

To read the prior week’s European Energy Market Update, please follow the link here.

Are you interested in staying up-to-date on the latest trends and developments in the energy market? Look no further than our Weekly Energy Market Update Newsletter Subscription Service! Each week, you’ll receive a comprehensive report on the latest news, pricing trends, and regulatory changes affecting the energy market. Stay ahead of the curve and subscribe today!