Table of Contents

Introduction to CBAM

In this article, we will delve into the EU’s Carbon Border Adjustment Mechanism (CBAM) and its role in shaping a sustainable future. We will also explore the history, legislation, and objectives of CBAM and examine its potential impact on global trade and climate action.

The European Union’s Carbon Border Adjustment Mechanism (CBAM) represents a groundbreaking development in international climate policy. Envisioned as a means to level the global playing field in the fight against climate change, CBAM is a bold regulatory measure aimed at addressing carbon leakage and ensuring that imports into the EU meet the same stringent environmental standards as domestically produced goods.

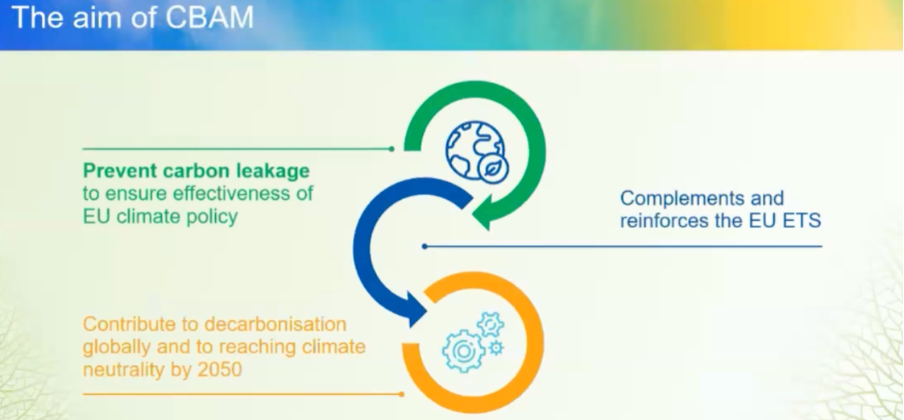

The CBAM is a cornerstone of the EU climate policy (the EU Green Deal). This regulation should help the EU reach, at least, 55% GHG Reduction by 2030 and climate neutrality by 2050.

The CBAM regulation officially entered into force on 17 May 2023, and the CBAM transitional period will start from 1 October 2023 until 31 December 2025. The importers will need to well cooperate with their suppliers (operators) to get the necessary data for CBAM reporting.

What is Carbon Border Adjustment Mechanism CBAM?

The idea of a carbon border tax is not new, but it gained significant momentum as climate concerns intensified. The EU, a frontrunner in climate policy, has been advocating for more ambitious targets to mitigate climate change. In December 2019, the European Commission presented the European Green Deal, a comprehensive roadmap for making the EU climate-neutral by 2050. As part of this initiative, the concept of a carbon border tax gained prominence.

In July 2021, the European Commission unveiled the legislative proposal for the Carbon Border Adjustment Mechanism (CBAM), which was met with both enthusiasm and apprehension. The proposal marked the formalisation of a carbon border tax mechanism, demonstrating the EU’s commitment to addressing the carbon footprint of imported goods.

The Carbon Border Adjustment Mechanism (CBAM) is a tax levy implemented to provide a fair playing field for both domestic businesses and importers of goods. CBAM is specifically designed to account for the carbon emissions associated with imported goods, ensuring that foreign products meet similar environmental standards and preventing a competitive advantage for imported items with lower carbon footprints outside the EU ETS Carbon Allowance scheme.

CBAM Legislation

CBAM is a key component of the EU’s climate strategy, and its legislation reflects the EU’s determination to integrate environmental concerns into its trade policies. The core principles and objectives of CBAM can be summarised as follows:

- Carbon Pricing: CBAM applies a carbon price to certain imported goods based on their carbon footprint. This aims to ensure that imported products do not have an unfair advantage over domestically produced goods that are subject to the EU’s ambitious emission reduction targets.

- Equal Treatment: The mechanism is designed to provide equal treatment to both EU and non-EU producers. Foreign producers are required to meet the same environmental standards and carbon pricing as EU producers.

- Tackling Carbon Leakage: CBAM is intended to prevent carbon leakage, where businesses shift production outside the EU to avoid environmental regulations, thereby undermining the effectiveness of the EU’s emissions reduction efforts.

- Legal Compatibility: The EU aims to implement CBAM in a manner consistent with international trade rules. To avoid trade disputes, the mechanism will operate in harmony with the World Trade Organization (WTO) agreements.

CBAM Tax Declarations

The EU’s Carbon Border Adjustment Mechanism (CBAM) will have implications for tax declarations, especially for companies that import goods into the European Union. CBAM aims to address carbon leakage by applying a carbon price to certain imported goods. This carbon pricing mechanism means that companies importing these goods will need to consider the following aspects in their tax declarations:

- Carbon Tax Payments: Importers will be required to pay carbon taxes on certain goods that have a significant carbon footprint. These carbon taxes are designed to ensure that imported products are subject to the same environmental standards as domestically produced goods within the EU.

- Documentation and Reporting: Companies will need to provide documentation and reports to customs and tax authorities that detail the carbon emissions associated with the products they are importing. This information is crucial for calculating and assessing the appropriate carbon taxes. The emissions can be calculated as an input fuel-based or as an output real measurement.

- Accounting and Record-Keeping: To comply with CBAM, importers will need to establish robust accounting and record-keeping systems to track and report the carbon emissions associated with their imports accurately.

- CBAM Certificates: Importers may be required to purchase and hold CBAM certificates for the carbon content of their imported goods. These certificates act as proof that the carbon taxes have been paid, and they will be part of the documentation provided in the tax declaration process.

- Cross-Verification: Tax authorities may cross-verify the carbon emissions and taxes declared by importers with the data provided by the European Environment Agency (EEA) and the EU Emissions Trading System (EU ETS). This verification process ensures that companies are accurately reporting their carbon emissions and tax liabilities.

- Compliance with Legal Requirements: Importers will need to ensure that their tax declarations align with the legal requirements and regulations specified under CBAM. Non-compliance may result in penalties and legal consequences.

Therefore, it’s important for companies involved in international trade and subject to CBAM regulations to work closely with their customs and tax advisors to understand the specific reporting and tax declaration requirements. These advisors can help ensure that companies are in compliance with CBAM and can assist in managing the financial and administrative aspects of carbon taxes associated with their imports.

CBAM in Action

CBAM will initially focus on sectors highly exposed to the risk of carbon leakage, such as

- Steel & Iron,

- cement,

- aluminium,

- electricity generation,

- fertilizers and

- Hydrogen.

These sectors have significant carbon emissions and are thus vital to achieving the EU’s climate targets. The full inclusion of all EU ETS products is planned by 2030.

Through CBAM, the EU intends to make importers accountable for the carbon emissions associated with their products, effectively pushing them to reduce emissions in their supply chains. Importers will be required to purchase CBAM certificates to cover the carbon emissions embedded in their products, which are priced according to the EU’s carbon market.

The EU ETS is an existing mechanism for regulating greenhouse gas emissions in the EU. You can learn more about it here. CBAM interacts with the EU ETS, as the carbon pricing component of CBAM is linked to the prices of carbon allowances in the EU ETS. CBAM, when fully phased in, will capture more than 50% of the emissions in ETS covered sectors.

The revenue generated from the sale of CBAM certificates will be channelled into the EU’s Just Transition Fund, which aims to support regions and industries heavily reliant on carbon-intensive activities in their transition to more sustainable practices.

The importers will need to report on a quarterly basis

- Total quantity of goods imported during the preceding period;

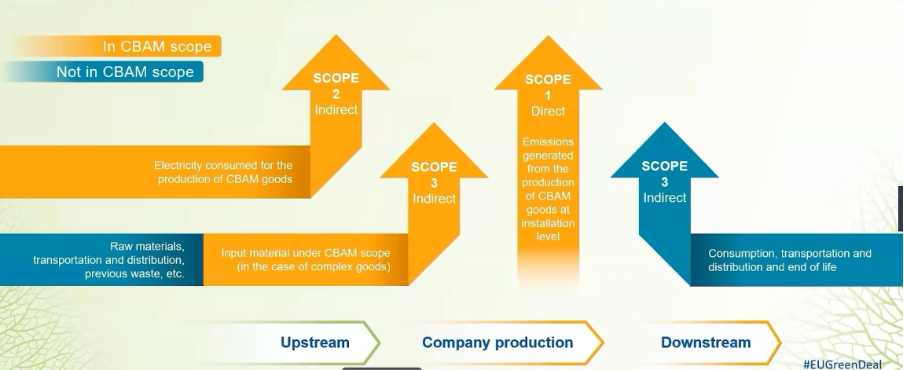

- Total embedded direct and indirect emissions (Scope 1 and Scope 2 Emissions)

- (if applicable) The carbon price due in the country of origin for the embedded emission, i.e. all countries which are not part of the EU ETS Carbon System

Failure to comply with the reporting obligation during the transitional period will be applied.

- CBAM reporting (quarterly). By the end of the following month.

- The declarants must then demonstrate to the relevant authorities quarterly that they hold enough CBAM certificates in their accounts to cover the reported emissions. The CBAM certificates can be kept valid for 2 years in the account of the declarant after its purchase.

- CBAM declaration (annually). By the 31st of May of the following year.

Timeline for CBAM Reporting Declaration

The European Commission provides a transitional reporting system for importers or their representatives to report. The obligation is on the reporting declarant. To gain access to the tool, importers are asked to contact relevant authorities in their member states. Penalties will be applied to importers who are not compliant with the reporting obligation. The reports are to be submitted to customs authorities.

On a quarterly basis, reports for imported goods would need to be submitted while emissions related to be calculated annually. The first reporting obligation will start on the 1st of October 2023 and will last until the end of the transitional period on the 31st of December 2025. No payment obligation linked to the CO2 emission abroad will be in place during this time. A 3rd party will need to verify the reporting once the official system comes into force in 2026. The declarant must have a CBAM license to continue importing CBAM goods.

The obligation to fulfil the reporting obligation falls on an importer or his declarant, i.e. 3rd party appointed for the procedure (customs brokers). Importers have to appoint an EU-based declarant firm. However, the final responsibility for the CBAM declaration and the data provided is with the importer. Declarant only acts as an agent on the importer’s behalf.

All countries that are not part of the EU ETS Carbon Scheme will fall under the CBAM reporting obligations that importers would need to fulfil.

CBAM will focus mainly on direct CO2 emissions

CBAM Latest Developments

On 1 October 2023, the CBAM entered into application in its transitional phase, with the first reporting period for importers ending 31 January 2024. The transition period will take 2 years before the permanent system enters into force. The transition period will focus mainly on reporting.

Starting on January 1, 2026, when the permanent system comes into effect, importers will have to do the following each year:

- Report the amount of goods they brought into the EU in the previous year and the greenhouse gas emissions associated with those goods.

- They will need to hand over a corresponding number of CBAM certificates. The certificate price is based on EU ETS allowances’ average weekly auction price, measured in euros per metric ton of CO2 emissions.

- As CBAM gets fully implemented from 2026 to 2034, the free allocation of allowances under the EU ETS will be gradually reduced to coincide with the introduction of CBAM.

The EU importer must declare by 31 May each year the quantity of goods and the embedded emissions in those goods imported into the EU in the preceding year.

At the same time, the importer surrenders the number of CBAM certificates that correspond to the amount of greenhouse gas emissions embedded in the products.

Objectives of CBAM

The objectives of the Carbon Border Adjustment Mechanism are multi-faceted:

- Climate Impact Mitigation: CBAM aims to reduce the carbon footprint of imported goods, ultimately contributing to the EU’s goal of becoming climate-neutral by 2050.

- Levelling the Playing Field: By ensuring that imported products meet the same environmental standards and carbon pricing as domestic products, CBAM promotes fair competition and discourages carbon leakage.

- Global Climate Leadership: The EU hopes that CBAM will inspire other nations to adopt similar measures and raise their climate ambitions, fostering a global race to tackle climate change.

- Trade Harmony: The EU intends to implement CBAM while respecting international trade rules, ensuring legal compatibility and avoiding trade disputes.

Conclusion

The EU’s Carbon Border Adjustment Mechanism (CBAM) is a pioneering approach in the fight against climate change and carbon leakage. By integrating carbon pricing into its trade policies, the EU is taking significant steps to ensure imported goods align with its ambitious climate goals. While there are challenges and concerns, the introduction of CBAM reflects the EU’s unwavering commitment to achieving a sustainable, carbon-neutral future. To learn more about the EU electricity market redesign, click here.

To learn more about CBAM and its implications, here are some recommended links:

- https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

- Provisional list of National Competent Authorities (CBAM)

- https://taxation-customs.ec.europa.eu/Q&A

These resources will provide a comprehensive understanding of CBAM and its potential impact on global trade and climate action. To learn more about CBAM, Deloitte hosts a webcast on the topic of CBAM that well explains the new mechanism.

If you found this article informative, I encourage you to leave your comments below and share it with your friends and colleagues to spark meaningful discussions and broaden the collective understanding of the EU’s Carbon Border Adjustment Mechanism.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.

What is CBAM?

The Carbon Border Adjustment Mechanism (CBAM) is a tax levy implemented to provide a fair playing field for both domestic businesses and importers of goods. CBAM is specifically designed to account for the carbon emissions associated with imported goods, ensuring that foreign products meet similar environmental standards and preventing a competitive advantage for imported items with lower carbon footprints outside the EU ETS Carbon Allowance scheme.