Table of Contents

Vietnam’s Electricity Market Overview

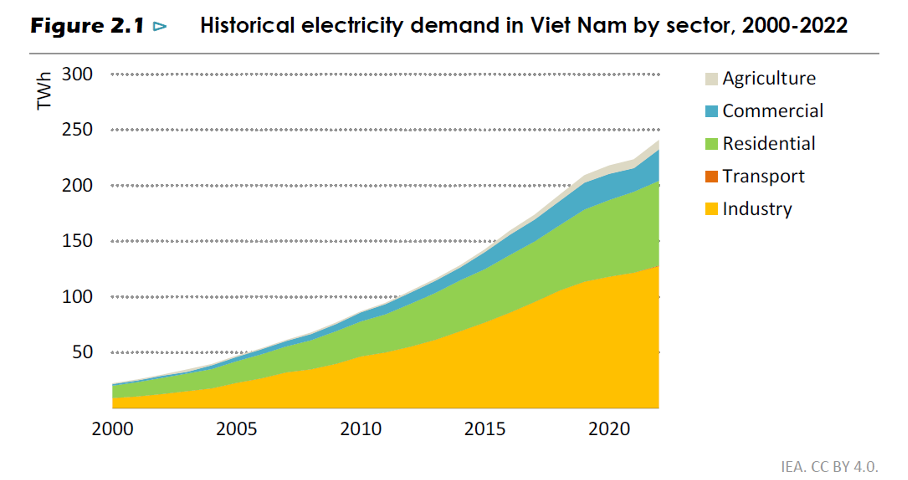

Vietnam’s electricity use grew rapidly from 30 TWh in 2002 to over 240 TWh in 2022, an eightfold increase. This growth was mostly due to the expansion of industries, especially light industries like manufacturing. Today, over half of the country’s electricity is used by industries.

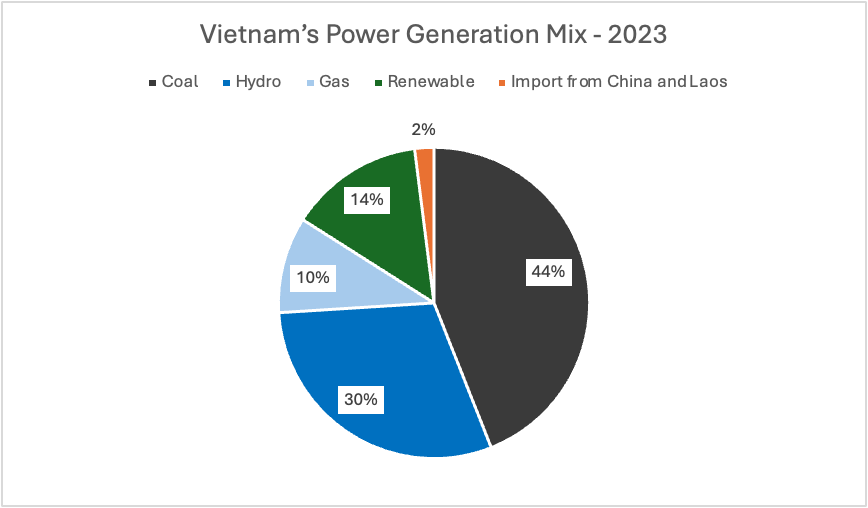

Most of the increased electricity demand was met by coal-fired power, which grew from 5 TWh in 2002 (14% of the supply) to 111 TWh in 2022 (41% of the supply). Coal became Viet Nam’s main source of electricity after 2010, overtaking hydropower. According to the IEA, between 2020 and 2050, the average industrial demand for energy is projected to grow by a factor of 4-7.

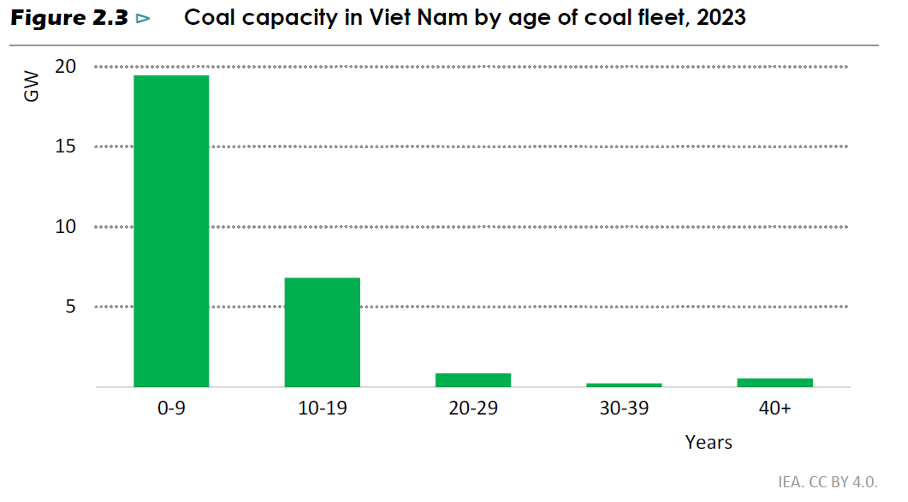

Vietnam’s coal power plants are relatively new, making up about 40% of the country’s electricity. Most of these plants were built after 2015, showing a recent boost in coal power infrastructure. These plants are expected to keep running for the next decade, highlighting the country’s ongoing reliance on coal. Plus, there are several more coal plants under construction, set to start up by 2030, which further emphasizes coal’s crucial role in Vietnam’s future energy plans.

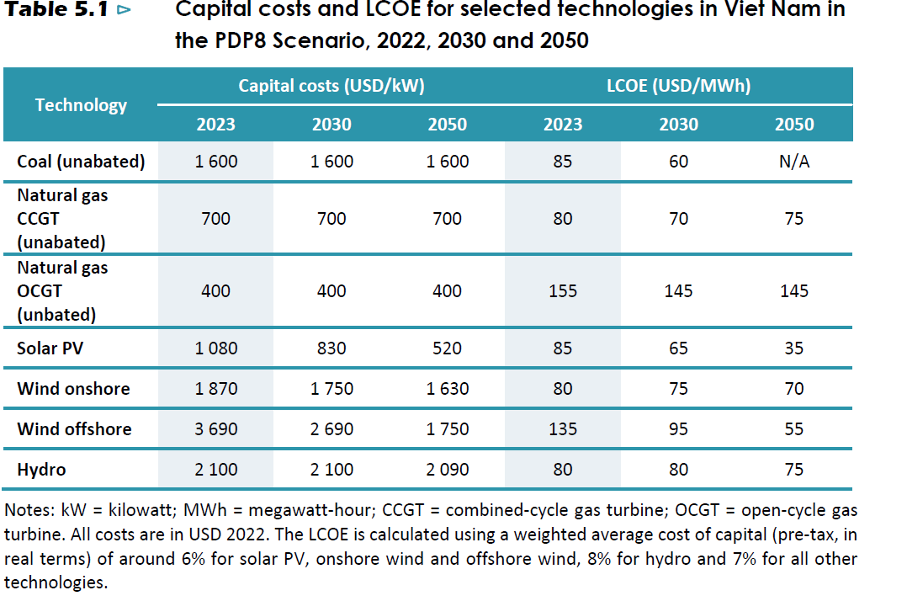

According to the IEA, by 2030, the cost of producing electricity (LCOE) from new solar panels and offshore wind farms will be at least 25% cheaper than in 2023, and by 2050, it will be over 50% cheaper. Although the cost of onshore wind power will drop less, it will still be more than 10% cheaper by 2050 compared to 2023.

In 2024, solar and wind are the most cost-effective options for new power generation, with their levelized cost of electricity (LCOE) lower than that of traditional thermal sources. Over the last five years, significant reductions in capital costs have made these renewables more competitive. Currently, the LCOE for new solar projects is $53 to $105 per megawatt-hour (MWh), compared to $74 to $94/MWh for coal, according to BNEF.

By 2030, solar paired with batteries will achieve a cheaper LCOE than new thermal power plants. Onshore wind with batteries will also become competitive. Power Development Plan VIII: Vietnam’s latest power development plan aims to double its power capacity by 2030, with significant additions from wind and gas. Capacity Targets: The plan includes 17.9 GW of onshore wind, 6 GW of offshore wind, and 22.4 GW of LNG plants by 2030.

According to EVN, the total average cost of electricity generation and supply is approximately 78 EUR/MWh (2,092.78 VND/kWh) in Vietnam as of January 2024. Whereas the pure cost of electricity generation is approximately 60 EUR/MWh (1,620 VND/kWh) as of Jan’24. EVN is currently Vietnam’s sole electricity supplier and corporates are not allowed to buy electricity directly from producers.

EVN Electricity Tariff

The EVN electricity tariff is based on the end-user profile, voltage level at which electricity is supplied to the corporate users and the Time-of-Use (TOU) Pricing, i.e. standard hour, Peak Hour and Off-Peak Hour.

The specific tariff rates for manufacturing industries as per Decision No. 2699/QD-BCT dated October 11, 2024, are detailed on the EVN website. Here is a summary of the rates:

Tariff Rates for Manufacturing Industries

| Voltage Level | Standard Hour VND/kWh, (EUR/MWh) | Off-Peak Hour VND/kWh, (EUR/MWh) | Peak Hour VND/kWh, (EUR/MWh) |

| 110 kV and above | 1,728 (65) | 1,094 (40) | 3,116 (115) |

| 22 kV to below 110 kV | 1,749 (65) | 1,136 (42) | 3,242 (120) |

| 6 kV to below 22 kV | 1,812 (67) | 1,178 (44) | 3,348 (124) |

| Below 6 kV | 1,896 (70) | 1,241 (46) | 3,474 (129) |

Vietnam DPPA Mechanism Overview – Decree No. 80/2024/ND-CP (“Decree 80”)

Since June 2019, there have been several degrees discussed in relation to the DPPA mechanism between Ministers and relevant parties.

On July 3, 2024, the government of Vietnam approved Decree No. 80/2024/ND-CP (“Decree 80”) allowing large corporates to purchase electricity from renewable energy generators under direct power purchase agreements (“DPPAs”). Renewable energy sources under Decree 80 include solar, wind, small hydropower, biomass, geothermal and other forms of renewable energy and roof solar power systems.

Decree 80/2024, issued on July 3, 2024, establishes the framework for Direct Power Purchase Agreements (DPPA) between renewable energy generators (RE Generators) and large electricity consumers (Large Customers) in Vietnam. This decree marks a significant step in promoting renewable energy development by allowing direct transactions between producers and consumers.

The Decree defines two main types of Power Purchase Agreements (PPAs) in Vietnam: 1. Financial DPPA through the national grid and Vietnam Wholesale Electricity Market (VWEM), and 2. Physical DPPA via private wires.

Off-site DPPAs (Financial/Virtual PPA – Grid-Connected Model)

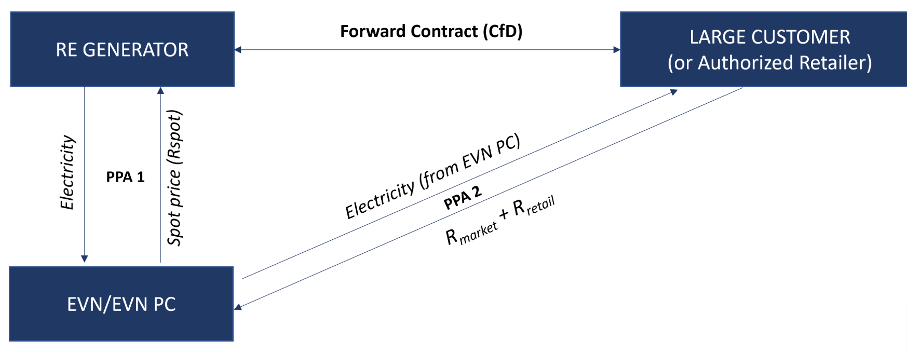

This model involves a financial agreement where the renewable energy generator sells electricity to the grid and the corporate consumer buys electricity from the grid. The two parties enter into a Contract for Differences (CfD), which is a financial contract that settles the difference between the spot market price and the agreed contract price.

The generator sells its entire power output to the Vietnam Wholesale Electricity Market (VWEM) at the spot market price. The corporate consumer continues to buy electricity from the grid at the retail price but receives financial compensation based on the CfD.

Parties Involved:

- Renewable Energy Generator: Must own a renewable energy plant with a capacity of at least 10 MW.

- Large Electricity User: Consumes at least 200,000 kWh per month, i.e. 2.4 GWh/yea

- Electricity of Vietnam (EVN): Acts as an intermediary in the spot market. EVN is currently Vietnam’s sole electricity supplier and companies are not allowed to buy electricity directly from producers.

Contractual Relationships. The transaction will include 3 contracts:

- Forward Contract. The agreement between the renewable energy generator and the large electricity user. Under this agreement, the generator will receive compensation from the Large Consumer as a difference between the PPA agreed strike piece and the VWEM spot market price. However, considering that VWEM spot price is likely to be lower due to more competitive energy generation by state-owned hydro and coal-based generations, the PPA will likely come as a premium vs EVN grid tariff.

- Spot Market Contract: The spot market access agreement between RE generator and EVN. Renewable energy generator sells electricity to EVN in the Vietnam Wholesale Electricity Market (VWEM).

- Retail Power Purchase Contract. The electricity supply agreement between the corporate off-taker and EVN’s distribution companies to allow wheel the power through the national grid to a corporate PPA off-taker. Under this agreement, the large consumer agrees to pay EVN distribution companies a DPPA charge (the system costs for the use of the electricity system services) and the Balancing costs in a situation when there is an imbalance between Large Consumer electricity demand and actual volume output by the RE generator.

Therefore, when evaluating PPA offers in Vietnam, corporate offtakes would need to consider full PPA cost that include: PPA Stike Price + DPPA Charge + EVN Balancing Cost. With respect to the Retail Power Agreement and costs that the corporate consumer would need to pay to EVN distribution companies, there could be 2 scenarios A and B.

| Scenario | Condition | Retail Price (Pretail) | Other Costs |

| A | Generation > Consumption | Pretail = Pspot + DPPA Charge | Transmission, distribution, ancillary services |

| B (i) | Generation < Consumption (for consumed amount) | Pretail = Pspot + DPPA Charge | Transmission, distribution, ancillary services |

| B (ii) | Generation < Consumption (for difference) | EVN Retail price applicable to Consumer | N/A |

| Contract Type | Parties Involved | Description |

| 1. Forward Contract (CfD) | Renewable energy generator, Large electricity user | Generator receives compensation from Large Consumer as a difference between PPA agreed strike price and VWEM spot market price |

| 2. Spot Market Contract | RE generator, EVN | RE generator sells electricity to EVN in the VWEM |

| 3. Retail Power Purchase Contract | Corporate off-taker, EVN’s distribution companies | Electricity supply agreement to wheel power through the national grid to a corporate PPA off-taker |

Electricity Flow:

- Electricity generated by the renewable energy unit is sold to EVN at the spot market price.

- EVN supplies electricity to the large electricity user through the national grid.

Pricing:

- Spot Market Price: Determined by the market price VWEM.

- Contract Price: Fixed price agreed upon in the forward contract. Agreed upon by the RE Generator and the Customer to hedge against price fluctuations.

If the spot market price is lower than the contract price, the large electricity user pays the difference to the generator, and vice versa.

Note: Unlike other forms of corporate PPA, the agreement between the generator and the corporate offtaker in an off-site PPA structure does not involve the actual purchase or physical delivery of electricity. Instead, the generator continues to physically supply electricity to EVN under a traditional PPA and the corporate offtaker continues to obtain its electricity from the grid under a supply agreement with an EVN distribution company as shown above.

Private Wire PPA (Physical PPA – On-Site Model)

Parties Involved:

- Renewable Energy Generator: Can include owners of solar, wind, small hydropower, biomass, geothermal, and rooftop solar systems.

- Large Electricity User: Consumes at least 200,000 kWh per month.

Contractual Relationships:

- Direct PPA: Between the renewable energy generator and the large electricity user.

- No involvement of EVN in the electricity sale.

Electricity Flow:

- Electricity is physically delivered from the renewable energy generator to the large electricity user through a private connection line, bypassing the national grid.

Pricing:

- Negotiated Price: The electricity sale price is negotiated directly between the renewable energy generator and the large electricity user.

Vietnam DPPA Scheme Comparison Summary

| Feature | Direct DPPA Scheme (Grid-Connected) | Private Wire PPA (On-Site) |

| Parties Involved | Generator, Large User, EVN | Generator, Large User |

| Eligibility Criteria | Generator: Wind or Solar power plant with 10 MW or more, participating in the spot electricity market of Vietnam (VWEM) Consumers: purchasing power at a voltage level of 22 kV or higher, with an average consumption of at least 200,000 kWh/month | Generator: solar, wind, small hydropower, biomass, geothermal energy, wave power, tidal, ocean current, other forms of renewable energy sources and rooftop solar systems Consumers: with an average consumption of at least 200,000 kWh/month |

| No of Contracts Signed | 3 contracts: Forward Contract, Spot Market Contract, Retail Power Purchase Contract | 1 Contract: Direct PPA |

| Electricity Flow | Through national grid | Private connection line |

| Pricing | Contract for Difference (CfD) | Negotiated Price |

| PPA Structure | Financial | Physical |

Conclusions & Observations

The new Vietnam DPPA decree is expected to significantly boost the adoption of renewable energy in Vietnam. By facilitating direct transactions between producers and consumers, it reduces reliance on traditional power companies and encourages investment in renewable energy projects. However, the electricity generation mix remains dominated by coal and hydro generation that is predominantly controlled by the state.

When considering the full PPA cost, which includes the PPA strike price, DPPA Charge, and EVN Balancing Cost, the PPA business case in Vietnam may present a premium compared to the EVN national tariff electricity system. Therefore, the main incentives for corporates to sign a PPA in the market are likely to be sustainability goals and cost control, especially given the possibility that EVN tariffs may increase in the future beyond the inflation level.

Some challenges with the Decree:

- Renewable Energy Certificates: The appendices to Decree 80 acknowledge that carbon credits from the use of renewable energy under an off-site DPPA will belong to the generator and can be transferred to the corporate offtaker. However, these template power purchase agreements are for reference only. As such, the title and rights related to carbon credits require further guidance

- DPPA Energy Price. The quote for renewable electricity in 2024 could be higher than the VWEM spot price. This is due to competitive tariff bids from lower-cost hydropower and coal plants, as well as from state-owned enterprises or portfolio generators who are able to rely on a weighted-average cost across a range of generating plants in the portfolio. Also, apart from the exposure to the CfD VWEM market mechanism, the PPA offtaker would need to pay DPPA chage to the EVN distribution companies for the use of the electricity system services.

If you enjoyed this article, feel free to leave your comments below and share it with your friends!

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.