Why Russian gas is so important?

The Russian invasion of Ukraine skyrocketed European gas and power costs. Meanwhile, European member states scramble to alter their renewable energy programs and ensure gas storage is filled ahead of the winter in order to boost the bloc’s energy independence from Russia. However, the rush to fill the gas storage this summer while reducing the risk of storage deficit for next winter puts additional demand pressure on the summer months ahead.

Despite the fact that Russian gas exports are currently stable. The tight European gas market will almost certainly be used by Russia as a bargaining chip. To offset EU sanctions, pressure is being applied to the West. The EU sanctions against Russia and Belarus are aimed at the central bank, financial institutions, Russian oligarchs, and aviation. The central bank has been suspended from the SWIFT global payment system.

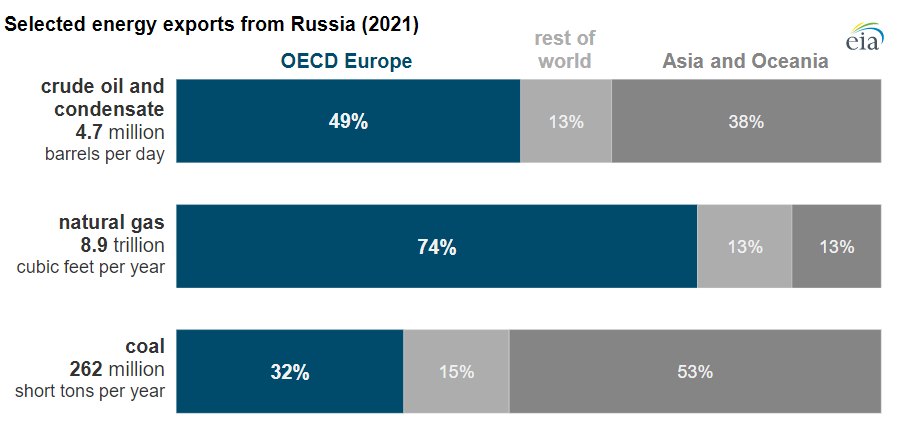

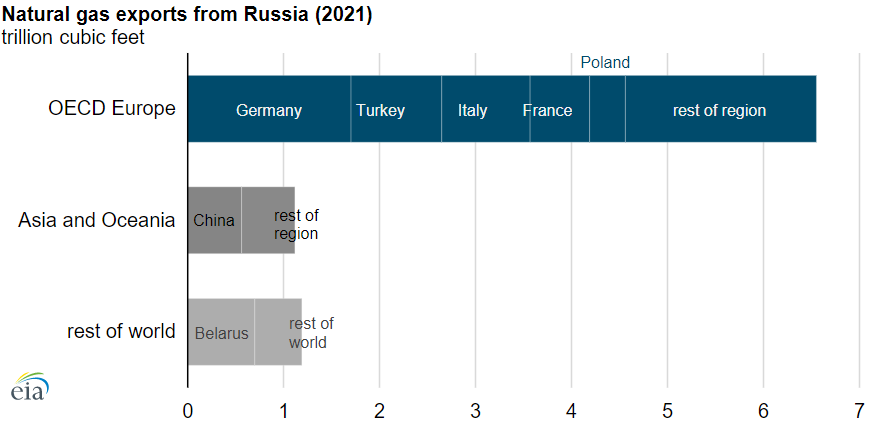

The sanctions may cause a gas supply crisis in Europe. Intense or long-term fighting might destroy Ukraine’s gas infrastructure, causing a supply disruption. Gas specialists are also afraid that, due to production capacity limits, there would be no more LNG supplies from the United States in the near future. At the moment, Europe is significantly reliant on natural gas imports, as the region can only provide about 15% of its gas consumption. Russia is Europe’s largest gas supplier, accounting for roughly 40% of imports. You can read about the 3 possible market price scenarios following the invasion of Ukraine by Russian forces in the article here.

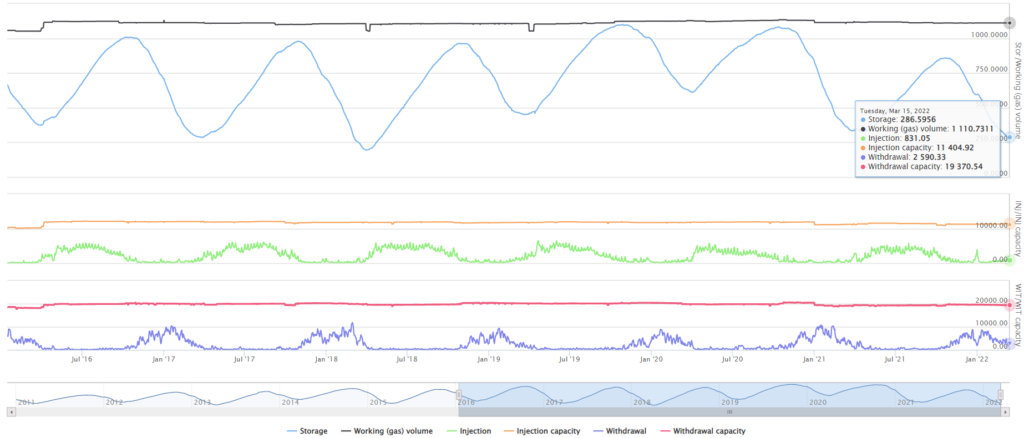

The EU gas storage stood at 26% as of 15.03.2022. Historically, this period coincides with the higher demand/gas withdrawals, while the month of April is usually classified by the start of the storage refilling process. Therefore, market participants will be paying close attention to the gas storage trend next month. If the storage recovery is not on track, we can see a further deterioration in gas prices.

Daily gas prices in Europe hit an all-time high on 07.03.2022, reaching 270 EUR/MWh at one point. And although there was a -50% price correction since then, the price risk is still in sight.

TTF Daily Gas Price in Europe, EUR/MWh

In comparison to the war’s direct influence on gas markets, the impact on electricity markets is primarily caused by a higher gas price, which causes European power prices to rise via the merit order. Gas typically sets the wholesale electricity price in European markets. Each €1/MWh movement in gas price moves power by €2/MWh. If you wish to learn more about the merit order, please read my other article here.

Therefore, if the gas price continues to move up, we can see the German Year Ahead future baseload power contract retest its prior historical peak at >300 EUR/MWh.

German Year-ahead Power Future, EUR/MWh

If you wish to get the latest energy market news and trends, please check out my weekly energy market report here.

Pingback: (2022) European Gas Market Without Russia Leads To The Doubling Of Power Prices | Futrue Energy Go