Table of Contents

What is a PPA market landscape in Spain?

Today, PPA market landscape in Spain is one of the most attractive when compared to the future wholesale price of electricity which has increased a lot since 2021. Demand for PPAs continues to grow rapidly as customers are looking for other cheaper hedging alternatives to meet their green corporate objectives. Both newly built, subsidy-free solar and onshore wind assets are available for PPA contracts in Spain.

There’s a large pipeline of PPA projects under development ranging from different sizes and technologies. Most of the projects in the pipeline are Solar PV, whereas on-shore Wind has rather limited availability and longer time-to-market.

Spain has multiple types of PPA agreements. Some of the structures available can be already known from other EU markets, yet there are few market specifics that need to be considered for a power-purchase agreement in Spain.

In this article, I will try to go through the main types of PPA agreements available in Spain.

First Considerations

PPA contract can be bundled or unbundled from the main electricity supply, i.e. if a Utility acts as both electricity supplier and RES developer, it can offer a bundled PPAs solution. Often, it would be their most preferred option to contract a PPA and usually, the power will come from a big-size renewable portfolio of 50 MW+.

PPA can be signed with a newly built or existing asset, or a pool of existing assets. A customer eliminates project development risk by signing with existing assets, but it may fail in additionality assessment. Bundled PPAs offered by large-scale utilities are often derived from a pool of existing assets. A client needs to take this into consideration when comparing the commercial attractiveness of different offers during negotiations.

Fixed or Variable PPA price structures can be available in PPAs. PPAs often signed at a fixed price with or without an annual CPI index as it’s the most preferred option by many debt lenders. A customer, however, may want to assess variable price options for any deal that is longer than 5 years to stay connected to avg. market prices and lower the price risks.

Pay-as-consumed (“baseload”) or Pas-as-produced (“non-baseload”) price concepts are possible. Renewables are intermittent generation, i.e. volume amount is different every hour. Therefore, by a definition, PPAs have a “pay-as-produced” price structure that doesn’t account for a difference between customer’s volume demand vs renewable asset generation supply. This difference is called “shaping cost”. You can learn more about different PPA price types in this next article.

A buyer may choose to manage the shaping risk himself at real-time market costs or decide to outsource this risk to an electricity supplier for a fixed fee. There’s no, however, standard market approach to calculate these extra costs because they vary from assets technology, size, and locations.

A standard rule in Spain is to consider ~20% on top of “pay-as-produced” PPA price in order to estimate a baseload power price. A client may be better off requesting “pay-as-produced” offers in unbundled PPA RFQ because it would provide better price transparency and control among bidders. However, this approach usually requires good market knowledge as well as time and effort to deal with the shape risk. Therefore, a baseload PPA offer would be more suitable for most buyers. I have talked about the shape and other PPA contract-related risks in my article here.

PPA Contract Structures

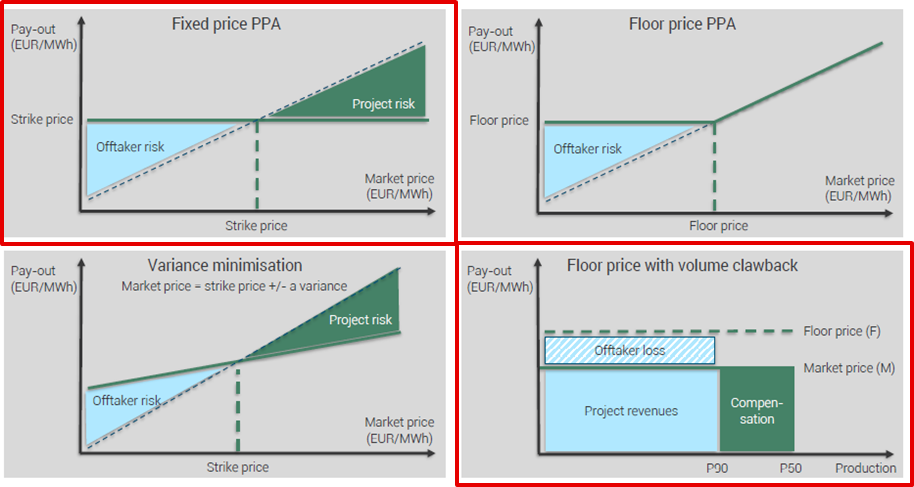

To achieve the best commercial outcome in PPA procurement, it’s important to choose the right price scenario and contract structure that would meet expectations of both a buyer and a seller. While Fixed price is the most preferred option by sellers, fixed may not be the best outcome for a client if the wholesale market price index drops later in the future. On the other hand, flexible PPA price structures are not able to raise big amounts of project financing, leading to higher project development and price risks. Therefore, there’s so-called “Floor price with volume clawback” that can meet interests of both developers and off-takers.

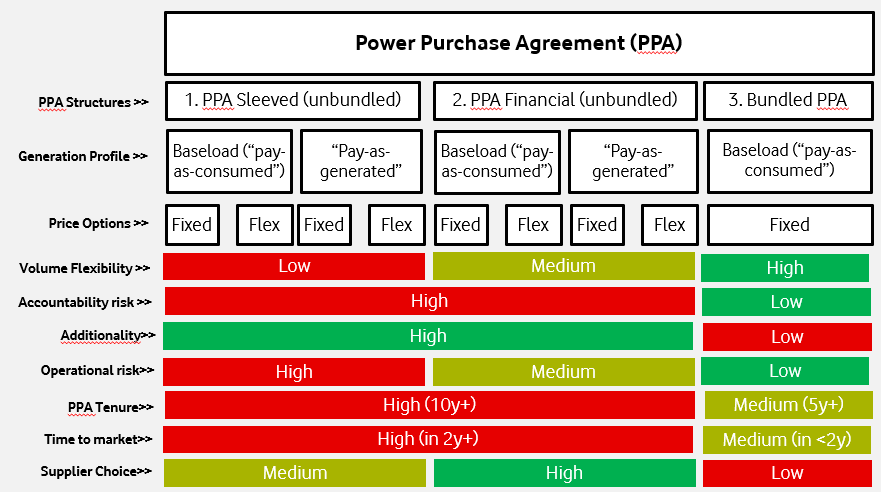

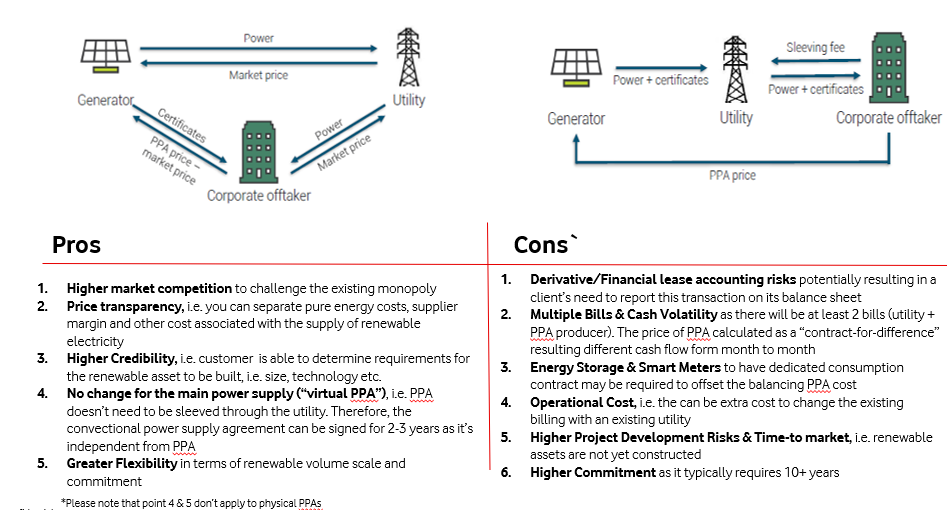

PPA Structures are already explained in my previous article. There are different contract structures available to procure renewable electricity from an off-site renewable asset: Physical (sleeved), Financial, and Bundled PPAs. While the first 2 structures are already known.

Physical & Financial PPA Pros/Cons

The bundled PPA is similar to a physical one with the only difference being that the renewable and conventional electricity is supplied by the same utility company. One of the advantages of this PPA deal structure are:

- Single contract for 100% of a company’s energy volume needs

- Often competitive PPA Pricing with shorter tenure, i.e. bundled PPA contract tenure for newly built renewable assets can be potentially reduced to 5 years instead of 10+ years

- Shorter Time-to-market in terms of contract negations for existing asset

- Operational Easiness, i.e. there can be 1 single electricity invoice for both PPA and conventional power supplied

- Easier to Understand, i.e. supplier assumes the responsibility for the complexity of asset management and takes balancing risks of intermittent renewable generation

- No Risks of Accounting risks as the PPA contract structure is similar to the conventional utility electricity supply

- Reduced Counterparty Risks, i.e. the negotiations are typically with a large scale utility with a proven track record

On the cons side, we can list the following risks:

- 5-years+ exclusivity commitment for 100% of a client’s energy needs to a single Electricity Supplier

- Limited transparency of PPA cost, i.e. project development costs as well as shaping/imbalance not typically disclosed in a bundled PPA price

- Credibility risk, i.e. more difficult to claim additionality criteria vs signing an unbundled PPA with an independent renewable power producer

- Limited choice of suppliers offering PPA bundled solutions for big consumers in Spain. The list is often limited to the dominant power utilities.

Those are the main considerations in signing a bundled PPA deal. However, there could be also market regulatory limitations that may not allow signing a PPA deal with a 3rd party independent renewable producer, e.g. sleeved unbundled PPA.

For instance, according to the current interpretation of articles, 53.5 – 53.6 of Royal Decree 413/2014 by the regulator (CNMC), physical PPA delivery to the Utility which is providing the supply to a customer is not possible if the supplier belongs to an “Operador Dominante”. The list of dominant operators is published annually, typically in December. The latest you can find here. The current list of dominant electricity utilities in Spain includes:

- Endesa, S.A.

- Iberdrola, S.A.

- Naturgy Energy Group, S.A.

- EDP Energías de Portugal, S.A.

- Acciona, S.A.

Therefore, if a customer receives electricity from a dominant supplier, PPA options are narrowed down to the following:

- Signing a financial (virtual) PPA. Financial PPA structures are a common solution in the USA and now it’s becoming popular in the EU. One of the main advantages is that it doesn’t require any changes to the main supply, and it is easier to agree on terms and scale PPA volume in time to meet buyers’ needs.

- Transferring the electricity to the OTC registration platform for registering purchase/sale contracts in Spain. In Iberia, either ECC (EEX) or OMIClear (OMIP) can be used as a clearing house for this transaction. However, transactions in these platforms will typically require PPA contract counterparties to provide a bank guarantee to meet margin requirement calls. Also, PPA price deals that go through the clearing houses can become public to other market participants, though confidentiality can still be kept as long as the actual counterpart on the buyer side is an agent.

- Signing a bundled PPA deal with the existing power utility that will deliver renewable electricity from its own renewable fleet.

Current Situation

With the war outbreak in Ukraine and the gas market crunch in 2021, the PPA market landscape and prices have changed a lot.

PPA 10y baseload prices have increased from an average of 40 EUR/MWh before 2021 to around 50 EUR/MWh in 2022. This is a 25% PPA price increase and the war in Ukraine has only worsened the current situation. The increase in PPA prices across the board is mainly due to increased CAPEX and wholesale power prices to cover Solar/Wind power shape risks.

Nevertheless, despite the PPA price increase, the long-term agreement can offer -40% vs the forward market curve and allows corporates to hedge against fluctuating energy prices.

Are you interested in learning more about energy market trends? You can check my weekly energy market reports, including electricity price evolution and technical and fundamental electricity price forecasts for the week ahead, here. And please comment below if you liked this article!