Table of Contents

How does a PPA work?

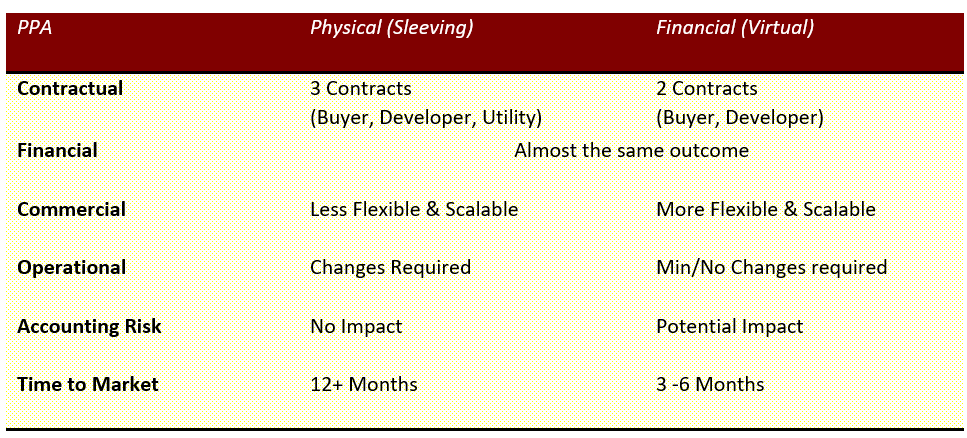

There are different types of power purchase agreements (PPAs). These can be structured as physical or financial PPAs. Both structures achieve the same result for the off-taker in delivering renewable certificates from a specific renewable asset at an agreed price. You can read about the most popular PPA contracts in the article here.

Without a PPA a developer would not have been able to finance, and therefore build, the project. The renewable certificates (Guarantees of Origin “GOs”) that are delivered from the project to the consumer allow the consumer to “prove” that they are sourcing renewable electricity for carbon disclosure and reporting purposes.

Main PPA benefits?

- Cheaper than today’s price of grid power on a forward basis, resulting in potential energy cost savings;

- These long-term agreements allow corporates to hedge against rising and fluctuating energy prices in the wholesale market for a number of years;

- The most recognized instrument of traceable, high-quality renewable energy sources that allows achieving sustainability goals such as carbon reduction targets.

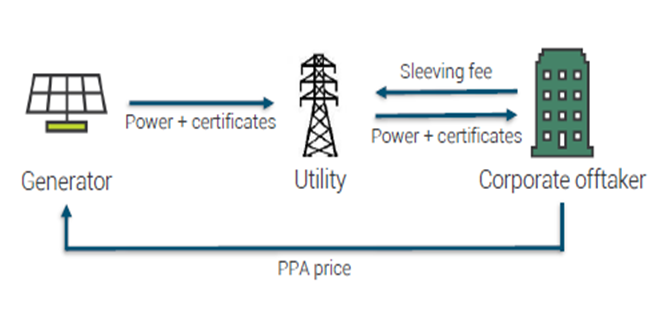

Physical (Sleeving) PPA

In a physical PPA, the corporate buyer takes title to the power generated by a renewable (seller), which is netted off the buyer’s total electricity demand. The power is physically delivered to the buyer from the seller – or via a retail service provider – depending on the market. Where applicable in the relevant market, Green Certificates are bundled with the renewable power produced, proving power consumed is renewable.

The utility company, which is an agent in this arrangement, is remunerated additionally for performing ‘sleeving’ functions in that the utility company will balance the energy output from the Generator. Where the produced energy is insufficient, the utility company will source additional quantities at market price. From an accounting perspective, this arrangement would be treated the same way as there is a long-term commitment for a supplier to provide a product or a service.

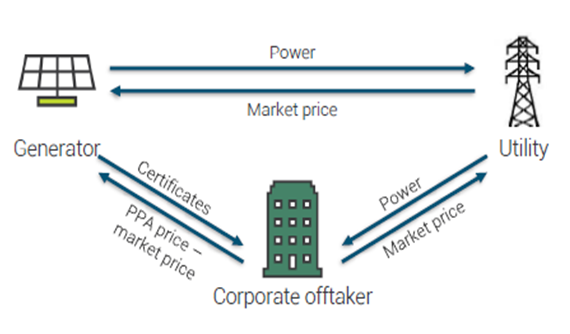

Financial (Virtual) PPA

In a financial PPA (also referred to as a synthetic PPA) the corporate buyer procures electricity from renewable power (seller) at a negotiated rate – or strike price. The power generated is sold into the local grid at the wholesale price (not physically delivered to a Buyer). The buyer and seller settle the difference between the agreed strike price and the local wholesale price, under a contract for difference (CFD) arrangement.

One of the main advantages of a financial PPA is that it usually has little impact on the existing energy procurement process and utility supplier relationships, as well as a financial PPA can be signed with a renewable asset located in a different market/location, e.g. renewable asset location is in Span while the Buyer’s location is in Germany. Financial PPA structures are a common solution in the USA and now it’s becoming popular in the EU.

Private Wire PPA (onsite PPA)

In a private wire PPA (also referred to as an onsite PPA or behind-the-meter PPA), renewable power is generated through onsite assets. This investment can either be made directly or a third party may be engaged to make the investment. The power generated by onsite assets is metered directly to the corporate buyer. This avoids consuming power from the grid. This approach provides the most direct link between the renewable source and power consumed but can be limited by site suitability and scale.

You can learn more about physical or virtual PPAs and their Pros and Cons in the article here. Check out the PPA Head of Terms (HoT) negotiations playbook to help you negotiate a long-term Power Purchase Agreement (PPA).

There is also an option to contract with assets that are yet to be built, for which the developer needs the financial security of a PPA to secure the funding to build, or assets that are already in use—often coming out of a subsidy scheme.

New Asset PPA

A buyer can contract a PPA with a developer who is looking for a fixed-price, fixed-term contract in order to finance their asset. The price is usually related to the ROI desired by the developer and investor. This PPA offers better “additionality” as the buyer is responsible for a new renewable asset commissioning. However, these PPAs can be more expensive when compared to existing assets and have longer lead times to the market (2 years minimum).

Existing Asset PPA

Many assets that have been in government subsidy schemes still have many years of operational function left. After the end of the subsidy support FiT-in tariff, developers usually have a choice between selling the energy to the wholesale energy market or entering into a PPA agreement with a corporation to secure a fixed profit. These PPAs are usually cheaper than newly built renewable assets, while the PPA contract duration can be shortened to 3-7 years vs 10 years+ for a new asset. In this case, however, suitability and operational risks are to be considered.

If you wish to learn more about PPA price trends in 2022, please read the article here. And to understand PPA main contract risks, you can check out this article. Please comment below if you liked this article!

For those interested in delving deeper into the intricacies of procuring renewable electricity through Power Purchase Agreements for businesses, there’s a comprehensive book available for further exploration of the topic.

Pingback: (2022) PPA Contract Risks & How To Address Them | Futrue Energy Go