Table of Contents

Introduction

In the dynamic landscape of today’s business world, companies face several challenges, including the management of energy-related risks. The volatility in energy prices has become an inherent feature of the global marketplace, posing a significant threat to the financial stability of businesses across various industries. This brings us to the pivotal question: What is an energy risk management strategy, and how can a company implement an energy policy to effectively navigate the fluctuations in energy prices? In this article, you will learn about energy risk management strategies and how to implement policies to safeguard against fluctuating energy prices.

Understanding Energy Risk Management

Energy risk management is a proactive approach organisations adopt to identify, assess, and mitigate potential risks associated with energy price fluctuations. In simpler terms, it’s a strategic framework designed to shield companies from the adverse impacts of unpredictable changes in the cost of energy prices, such as electricity and fuel.

As energy prices continue to exhibit unpredictability influenced by geopolitical events, market dynamics and environmental factors, having a robust energy risk management strategy becomes imperative for companies looking to secure their energy costs. A well-crafted energy procurement strategy not only safeguards against fluctuating energy prices but also positions a company to capitalise on emerging opportunities within the ever-evolving energy landscape.

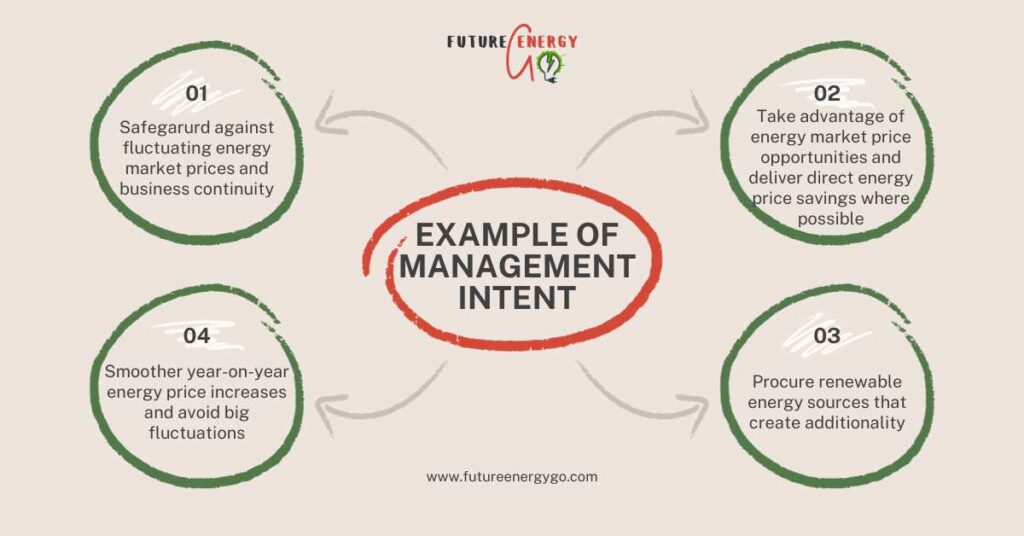

Therefore, a strategic approach to energy procurement is essential, and having an effective energy policy framework is paramount in navigating the complex landscape of energy markets. This framework serves as the guiding force that articulates a company’s sourcing principles, management intent and risk its tolerance. Clearly defined sourcing principles explain which and how energy resources are acquired, aligning procurement practices with the company’s overall mission and objectives. Management intent, embedded within the policy, establishes the purpose and direction of energy procurement efforts, ensuring a coherent and unified approach across the organisation. Equally critical is the explicit articulation of risk tolerance, acknowledging the inherent uncertainties within energy markets and empowering decision-makers to prudently hedge against potential fluctuations.

In essence, an effective energy procurement policy not only streamlines the sourcing process but also fortifies the organisation against the inherent risks, fostering resilience and adaptability in the face of dynamic energy landscapes.

Implementing an Effective Energy Policy

To successfully navigate the intricate terrain of energy price risks, companies need a comprehensive energy policy that aligns with their business objectives and risk tolerance.

The implementation process involves several key steps:

- Risk Assessment: Conduct a thorough analysis of the company’s energy consumption patterns, including identifying areas of exposure to price fluctuations.

- Goal Setting: Define clear objectives for the energy policy, taking into account the company’s financial goals, sustainability targets and risk appetite.

- Diversification Strategies: Explore diversification opportunities, such as investing in renewable energy sources, hedging strategies, and exploring long-term contracts such as Power Purchase Agreements (PPAs) to minimise exposure to market volatility.

- Continuous Monitoring: Establish a robust monitoring system to keep an eye on energy markets, allowing for timely adjustments to the energy strategy as market conditions evolve.

- Stakeholder Engagement: Foster collaboration and communication among key stakeholders, including executives and other team functions, to ensure a collective and informed approach to energy risk management.

What should be included in energy procurement policy?

A robust and comprehensive energy procurement policy is essential. This policy serves as a guiding framework, clarifying key aspects shaping the energy procurement strategy. To begin with, the policy should encapsulate the company’s overarching objectives, outlining its mission and goals in procuring energy resources. Clearly defined sourcing principles are equally vital, encompassing criteria such as sustainability, reliability, and cost-effectiveness. These principles serve as the foundation for decision-making, ensuring that energy procurement aligns seamlessly with the company’s values and operational requirements.

Furthermore, the policy should articulate management intent, providing a strategic narrative that explains the purpose and direction of energy procurement efforts. This section may include recommendations on diversification strategies, exploring renewable energy sources, and fostering innovation in energy efficiency. Additionally, setting explicit criteria for supplier selection, performance evaluation, and contract negotiation is crucial for maintaining transparency and accountability in the procurement process.

Incorporating a well-defined risk management section is paramount, explicitly stating the organisation’s risk tolerance levels and detailing the mechanisms in place for hedging against market fluctuations.

This involves establishing time, price and volume triggers, which act as thresholds/signals for hedging strategies in response to price movements. The policy should provide clear definitions of key terms, ensuring a common understanding across the organisation, and include mechanisms for continuous monitoring, evaluation, and adjustment.

Recommendations for regular reviews and updates to the policy are advisable to keep it aligned with the dynamic nature of energy markets and evolving organisational priorities. By encompassing these elements, an energy procurement policy becomes a dynamic and adaptable tool, guiding effective decision-making and fortifying the organisation against potential risks and uncertainties in the energy procurement landscape.

Energy Policy Time Trigger, Price Trigger and Volume Coverage Plan

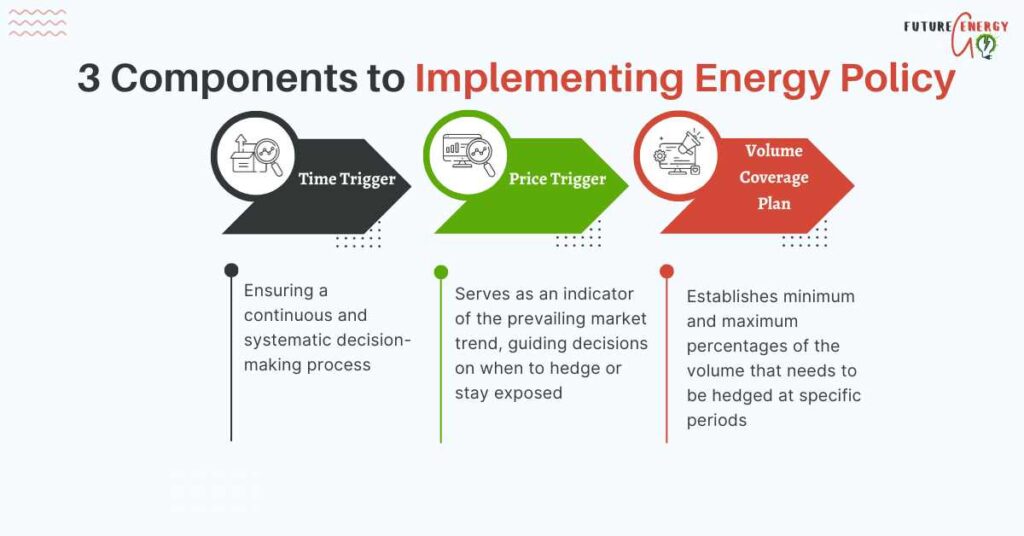

Implementing a robust energy policy requires an understanding of the interplay between time trigger, price trigger and volume coverage plan. All play pivotal roles in shaping effective hedging decisions.

Time triggers, strategically embedded within the policy framework, serve as minimum threshold benchmarks, ensuring a continuous and systematic decision-making process. These triggers are designed to safeguard against impulsive and speculative choices, fostering a disciplined approach to energy procurement. The implementation process involves setting predefined intervals for periodic reviews, allowing decision-makers to assess market conditions and adjust the energy strategy accordingly.

Price triggers are instrumental in leveraging market opportunities, capitalising on the inherent volatility of energy prices. A variety of price triggers can be incorporated into the policy, each serving a distinct purpose. For instance, the 100-day moving average is a widely utilised price trigger, representing the average closing price of a forward energy contract over the past 100 days. This moving average serves as an indicator of the prevailing market trend, guiding decisions on when to hedge or stay exposed. Another example is the use of last year’s price as a trigger, providing a historical benchmark for comparison and aiding in the identification of favourable pricing opportunities.

Incorporating technical indicators such as the Moving Average Convergence Divergence (MACD) further enhances the precision of price triggers. The MACD is a trend-following momentum indicator that reveals changes in the strength, direction, momentum, and duration of a trend in a stock’s price. By integrating such technical indicators into the energy policy, companies gain a sophisticated toolset for gauging market dynamics and making informed decisions.

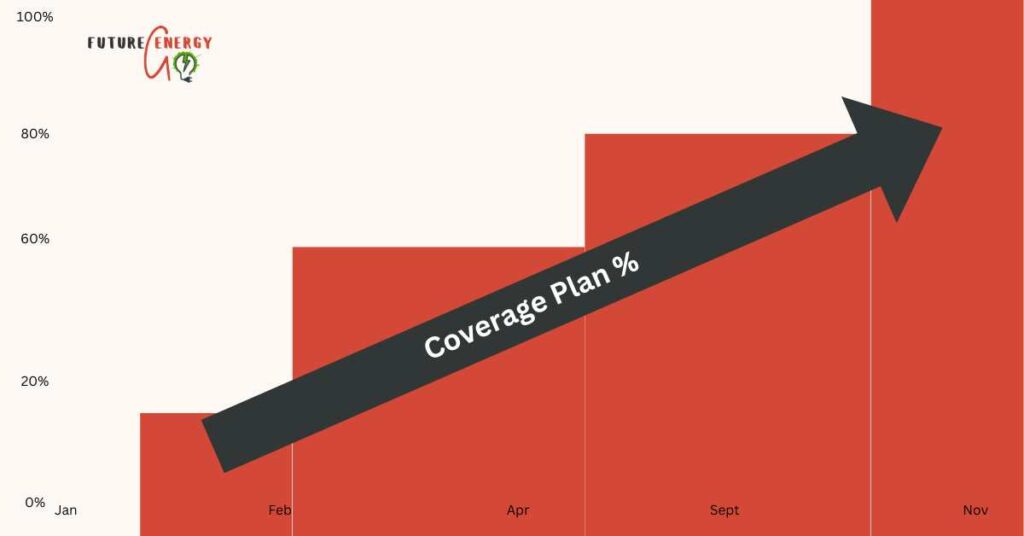

The inclusion of a “volume coverage plan” adds a strategic layer to the policy. The volume coverage plan establishes minimum and maximum percentages of the volume that needs to be hedged at specific periods. This approach ensures progressive hedging, balancing risk exposure and building budget certainty over time.

By setting defined thresholds for volume coverage, the organisation can strategically align its hedging activities with market trends, fostering a proactive stance and optimising budget planning.

The combination of time, price, and volume triggers creates a dynamic framework that not only ensures the continuity and stability of the decision-making process but also positions the organization to seize strategic opportunities and build resilience in the face of market fluctuations.

If you are looking for services to help you implement effective risk management policies and hedging strategies, you can reach out to us via the contact form.

PPAs as a hedging tool. The link between a Power Purchase Agreement and a physical power supply

Power Purchase Agreements (PPAs) stand as powerful tool in the realm of energy hedging, offering companies a structured approach to secure a stable and predictable energy supply.

The strategic linkage of PPAs with physical power supply agreements entails a step-by-step process that demands careful consideration and a forward-looking approach. Firstly, organisations should assess their energy needs and sustainability targets, establishing a clear understanding of the volume and duration for which they seek to secure power. This assessment forms the foundation for negotiating and structuring a PPA that aligns with the company’s objectives.

To enhance flexibility and future-proof the energy strategy, incorporating a PPA volume sleeving clause from a reputable third-party PPA developer into the utility supply agreement becomes crucial. This sleeving clause allows organisations to seamlessly transition to renewable energy sources through long-term power agreements, such as PPAs, at a later stage without significant contractual complications. It acts as a strategic pivot point, allowing companies to adapt to evolving market dynamics and embrace cleaner energy sources when feasible.

The integration of these contracts requires a holistic energy hedging strategy and viewpoint. Balancing the fixed pricing structure of PPAs with the dynamic nature of market prices in physical supply agreements is key to optimising cost-effectiveness and risk management. Given that PPAs are priced at fixed levels, it is imperative not to overhedge in the physical supply with a utility. Instead, a prudent approach involves leaving the equivalent PPA volume to day-ahead market price indexation. This ensures that the unsettled volume aligns with prevailing market prices.

In essence, the strategic integration of PPAs with physical supply agreements is a multifaceted process that involves meticulous planning and negotiation. This approach underscores the importance of a comprehensive and forward-thinking energy hedging strategy that embraces both fixed and market-driven pricing structures.

Conclusion

In conclusion, the increased volatility of energy prices since the war outbreak in Ukraine requires companies to adopt a proactive stance through the implementation of a well-defined energy risk management strategy.

By developing and executing a comprehensive energy policy, businesses can not only weather the storms of market volatility but also position themselves for sustained growth in an ever-changing energy landscape. Energy risk management can help companies be empowered to not only survive but thrive in the face of fluctuating energy prices.

If you liked this article or have any additional questions that you would like to learn more, please leave them below.

And if you wish to explore a tailored approach to energy management with Future Energy Go, you can learn more about our services here.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.

What is Energy Risk Management?

Energy Risk Management is like making smart choices to protect a business from problems related to the cost and availability of energy. It involves planning and strategies to deal with uncertainties in energy prices and ensure a company has a stable and reliable energy supply without unexpected surprises in expenses.

What is Energy Policy?

Energy Policy is like a set of rules and plans a company makes to decide how to use and manage energy. It includes guidelines on where to get energy from, how to use it efficiently, and ways to make energy use more environmentally friendly. Essentially, it’s a roadmap that helps organizations make smart decisions about their energy choices and practices.

What is Energy Hedging?

Energy Hedging is a bit like having a plan to protect yourself from changes in the prices of energy. It’s a strategy where a company makes arrangements in advance to buy or secure energy at set prices, so they can avoid unexpected and potentially higher costs in the future. It’s like locking in a good deal to ensure stable and predictable energy expenses.