Table of Contents

Current EU electricity market design. What is the problem?

The main objective of the EU electricity market design is to balance supply and demand in real-time, while also encouraging competition and innovation. The main objectives of the current electricity market design are:

- Competition: The European Union aims to create a single market for electricity that is open to competition, to ensure that consumers have access to a wide range of energy suppliers and can choose the most cost-effective option.

- Security of supply: aims to ensure that there is a secure supply of electricity for all consumers, even in times of high demand or emergency situations (capacity market).

- Sustainability: aims to reduce greenhouse gas emissions and promote the use of renewable energy sources in the electricity sector to help achieve its climate and energy goals.

- Market integration: aims to integrate the electricity markets of its member states to ensure that electricity can flow freely across borders and that consumers have access to a reliable and affordable energy supply.

However, the current European electricity market design faces a number of challenges, including:

- Integration of renewable energy sources: The increasing share of renewable energy sources, such as wind and solar power, in the electricity mix is challenging the traditional centralized model of electricity generation and distribution. This is because renewable energy sources are often distributed across different locations and can be affected by fluctuations in weather conditions, making it more difficult to balance supply and demand in real-time.

- Market coupling: Despite efforts to integrate the electricity markets of different European countries, market coupling remains a challenge. This is due to differences in regulatory frameworks, market rules, and market practices between different countries, which can lead to inefficiencies and difficulties in balancing supply and demand across borders.

- Energy storage: Energy storage is seen as a key solution to the challenges posed by the integration of renewable energy sources into the electricity market. However, the development of energy storage technologies and the integration of these technologies into the market is still in its early stages, and there are many challenges that need to be overcome, such as regulatory and market design issues, as well as the high costs of energy storage solutions.

- Grid infrastructure: Upgrading the existing grid infrastructure and building new grid connections to accommodate the integration of renewable energy sources is a major challenge. This is due to the high costs of grid upgrades and the need for cross-border coordination and cooperation.

The above challenges intensified in 2022, with the war outbreak in Ukraine, EU consumers have paid power rates that are many multiples of the average cost of production. The record-high power costs led to high inflation, which became the EU’s biggest economic problem in 2022 and this year.

One of the reasons the EU experienced the energy price shock is because the wholesale markets are based on the marginal cost approach. We have a more in-depth discussion of this topic in the previous article.

It’s important to highlight that the marginal cost approach is good for short-term wholesale energy markets because this is the most effective mechanism for ensuring cost-effective dispatch of available generation resources and incentivizing flexible behavior by various assets. This market design reflects the current real value of power.

However, this market design based on the merit order doesn’t necessarily ensure affordable electricity prices for end consumers and doesn’t promote renewable energy sources. Therefore, to ensure inexpensive energy for all customers, it is critical to speed the clean energy transition by assuring investments in additional renewable power generation and supply and demand flexibility solutions.

The problem with renewable power is that many technologies, such as wind and solar PV, have low marginal costs but need significant upfront capital expenditure to build the assets. The rising presence of low marginal cost technologies, like wind and solar, should eventually lead to a downward trend in wholesale power prices. However, to attract the necessary investments into new renewable technologies, the market price design must ensure price certainty and predictability for investors and lenders.

But current energy prices do not represent long-run investment costs, and generators get excessive profits for an extended period when the costs of the marginal technology are exposed to price shocks, as happened in 2022.

In the context of the energy crisis, the current electricity market design has demonstrated several shortcomings. The new energy market reform that the Commission undertakes aims to address those shortcomings and ensure stable and well-integrated energy markets. This is an essential enabler of the European Green Deal objectives and the transition to a climate-neutral economy by 2050.

In addition to these shortcomings, the European electricity sector is facing several long-term challenges triggered by the rising shares of variable renewable energy and the progressive drive towards full decarbonization by 2050.

This includes ensuring investments, not just in renewables but also in large-scale storage and other flexibility solutions. Stronger locational price signals in the system may be needed to ensure that the investments take place where they are needed, reflecting the physical reality of the electricity grid whilst at the same time ensuring incentives for cross-border long-term contracting. Some of these challenges will require ongoing policy reflections going beyond the scope of the current reform.

The importance of liquidity in Energy Futures Markets

The liquidity of the European energy futures markets refers to the ease with which futures contracts can be bought and sold on the market. Liquidity is an important factor in determining the efficiency and effectiveness of a futures market, as it allows market participants to buy and sell contracts with minimal price impact and to easily manage their exposure to price risk.

However, even though the EU energy markets have been liberalized for over 20 years, forward contracts with maturities longer than 1-3 years remain illiquid at best and non-existent at worst.

The WindEurope believes that in order to increase long-term power market price liquidity and attract additional investments into renewables, there can be the following mechanisms considered:

- Designing contracts-for-difference (CfD) government support schemes

- Power Purchase Agreements

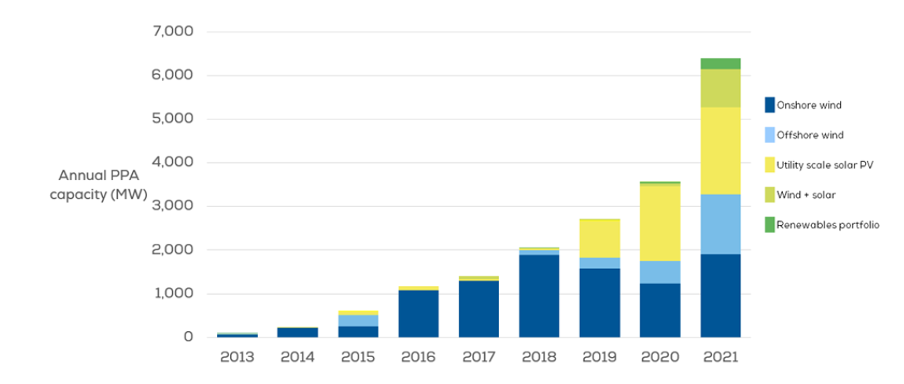

Annual contracted Power Purchase Agreements in Europe

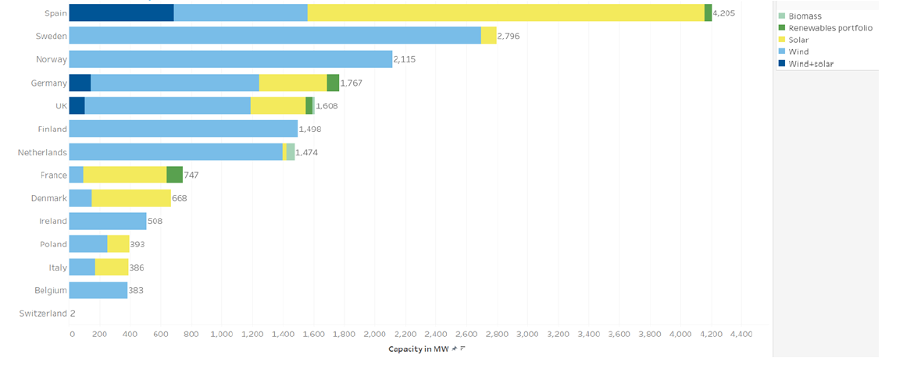

Breakdown of cumulative contracted PPA volumes by technology in different EU countries

To accelerate the growth of renewable energy sources, WindEurope recommends that Governments take measures to streamline and expedite the permitting process for new renewable assets. Because today the permitting process can take several years to complete, which is a significant barrier to the development of new renewable assets. This is due to the need for environmental impact assessments, public consultations, and other regulatory requirements.

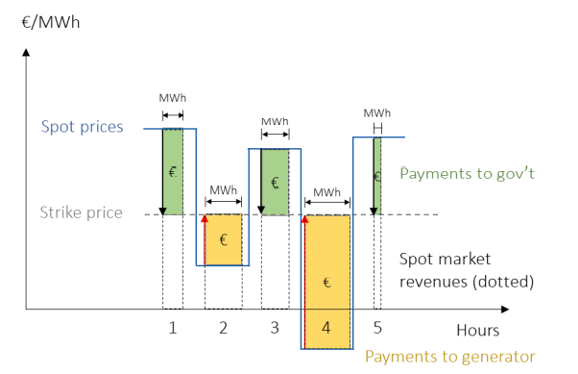

Contracts-for-difference (CfD) government support schemes. How does it work?

The CfD scheme is designed to support the development of low-carbon electricity generation by providing financial support to eligible projects and incentivizing the development of cost-effective, low-carbon electricity generation technologies.

The auction process helps to ensure that the available funding is directed to the most cost-effective projects, while the repayment obligation helps to ensure that the government’s financial support is used in a responsible and sustainable manner. You can learn more about the scheme here.

CfD Scheme Remuneration Mechanism

If successfully implemented, CfD schemes can help to accelerate the EU transition towards renewable energy and help end-consumers (especially small and medium-sized enterprises) gain access to PPAs, which are currently limited to big corporates with good credit ratings today.

Energy supply flexibility. Why is it important?

One of the challenges with the current market system in Europe is the slow rate of grid expansion and insufficient incentives for adding flexibility capabilities. If grid expansion and the deployment of flexibility resources do not keep pace with the rate of renewables electrification and deployment, redispatch and balancing costs will skyrocket. This will raise the transmission and distribution costs that are already included in end-user power rates.

Strong and flexible capacity will be required to provide supply when the wind does not blow or the sun does not shine.

Market analysts believe that in order to overcome these market challenges, it is necessary to complement existing short-term electricity markets with long-term markets for electricity and capacity. To achieve that, Spanish Authorities propose:

- Inframarginal generators: Electricity production from inframarginal generators is contracted, over their useful lifetime, at a fixed price that reflects their average cost, providing a secure cash flow for generators that reduces their cost of capital and price stability for consumers that incentivizes electrification. This can be done via the CfD scheme, like in the UK, as an example. The CfD scheme can encourage more renewables deployment and should help small and medium business access the PPA power, which prior was mainly possible for large corporates. On the cons side, however, the scheme may compete with private corporate PPA market as developers may become more interested in the gov CfD auctions.

- Peaking resources: Long-term capacity contracts remunerate the firm and flexible capacity provided by resources such as gas-fired power plants, storage, and demand response, incentivizing the necessary investments to guarantee the security of supply when renewables don’t produce electricity.

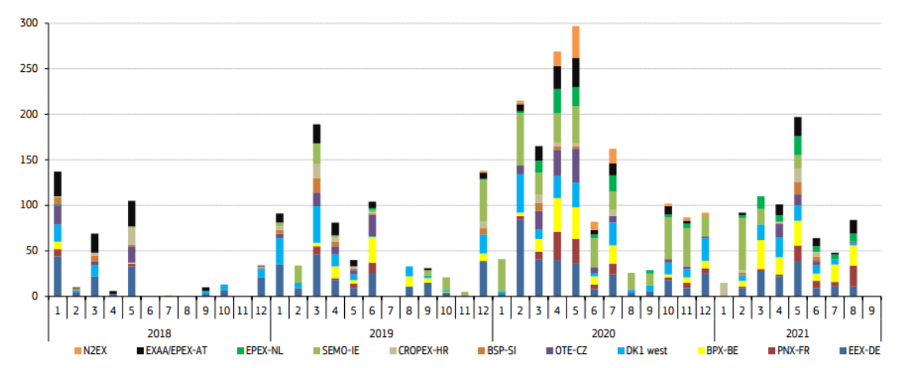

Also, it’s important to note that with the increased generation by renewable energy sources, the overall number of hours with negative pricing in the wholesale EU power market climbed increased a lot over the past several years. This is frequently the result of keeping inflexible conventional generation (e.g., nuclear, lignite, combined heat and power) running when variable renewable generation is abundant in order to avoid the costly and high-maintenance operation of restarting the facility.

Number of negative hourly wholesale prices on selected DA trading platforms

The phase-out of traditional thermal generating will make balancing electricity demand and supply across all periods considerably more difficult than it is now. This would inevitably increase the market exposure of all assets while highlighting the importance of a well-designed and operating balancing and ancillary services market.

Today, the major sources of flexibility are flexible thermal and hydropower plants. This position will be gradually taken over by new non-fossil-fuelled assets and technologies such as short- and long-term storage, renewable hydrogen, grid optimization technologies, demand response, and cross-border transmission. Virtually aggregated renewable portfolios – will also play an important role in increasing flexibility and becoming more system-responsive.

Alternatives to Gas to Keep the European Electricity System in Balance?

There are several alternatives to natural gas that can be used to keep the European electricity system in balance:

- Renewable energy: Renewable energy sources, such as wind and solar power, can be used to generate electricity to help balance the system and reduce dependence on natural gas. The integration of large-scale renewable energy generation into the energy grid can help to reduce the need for natural gas as a source of flexible power generation.

- Energy storage: Energy storage systems, such as battery storage and pumped hydro storage, can be used to store excess renewable energy and release it into the grid as needed. This can help to balance the electricity system and reduce the need for natural gas as a source of flexible power generation.

- Demand-side management: Demand-side management (DSM) strategies can be used to balance the electricity system by shifting energy demand from times of high demand to times of low demand. This can include measures such as load shifting, energy efficiency, and demand response programs, which can help to reduce the need for natural gas as a source of flexible power generation.

- Hydrogen: Hydrogen can be produced from renewable energy sources and used as a fuel for electricity generation. This can help to reduce dependence on natural gas as a source of power generation and contribute to the transition to a low-carbon energy system.

- Bioenergy: Such as biofuels and biogas can be used to generate electricity to help balance the system and reduce dependence on natural gas. Bioenergy can be produced from a range of biomass sources, including agricultural waste, forestry waste, and energy crops, and can help to reduce the carbon intensity of the energy system.

EU Electricity Market Redesign Proposal. How will it work?

There are many options being discussed for the future design of the European energy market, including the integration of renewable energy, the decentralization of the energy market, the role of energy storage, the development of interconnections, market reforms, and carbon pricing.

The Consultation period for the future European Energy market design is taken place between 23 January 2023 – 13 February 2023.

You can learn more about possible energy market redesign structures in this article. Europe has pledged to achieve carbon neutrality by 2050. This will require significant investments in new wind and solar technologies.

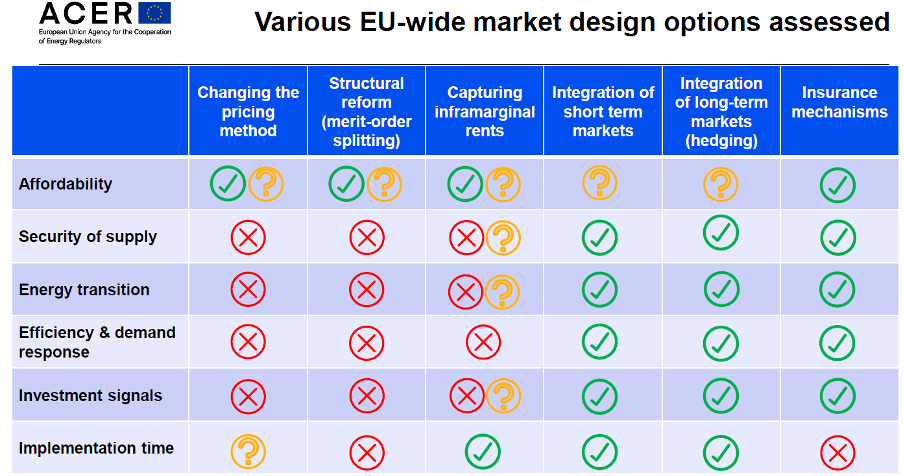

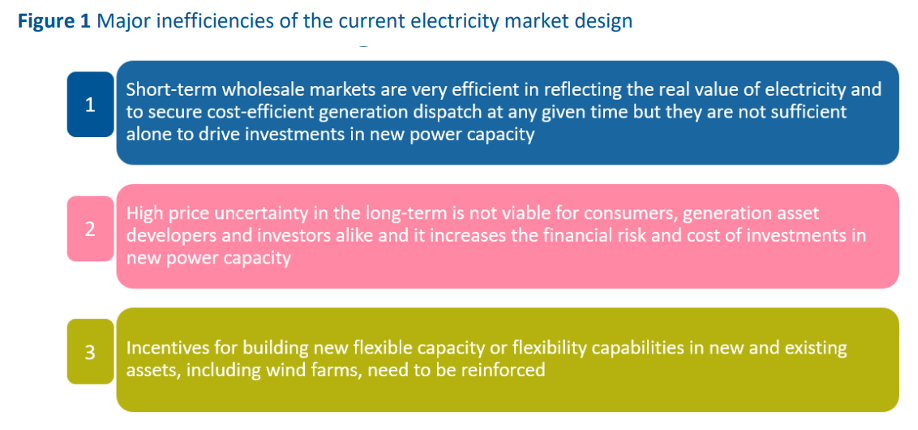

According to the WindEurope research, Europe must adapt its energy market design to address the following challenges:

- Short-term wholesale market signals are not sufficient on their own to drive investments in new renewable power generation capacity in the volumes needed to deliver climate neutrality.

- High price uncertainty in the long term is not viable for consumers, generation asset developers and investors alike and it increases the financial risk and costs of investments in new power capacity.

- Incentives for building new flexible capacity or flexibility capabilities in new and existing assets, including renewables, are inefficient or missing.

To deliver a climate-neutral and energy-secure system, Europe market design must:

- Ensure efficient dispatch: Short-term wholesale markets need to evolve, but they should remain the main mechanism for ensuring cost-efficient power plant dispatch and settlement of electricity market contracts;

- Unlock investments in new capacity: Long-term contracts (2-sided Contracts for Difference, Power Purchase Agreements, “10 year plus” futures traded on stock exchanges etc.) will help unlock the investments needed to accelerate renewables deployment. Long-term contracts provide energy consumers, asset developers and investors certainty and reduce the impact of short-term fluctuations in prices;

- Accelerate grid buildout: System operators, renewable asset developers, technology suppliers and end-users need deeper cooperation since the early design stages to accelerate grid development and optimisation and to create locational investment signals;

- Make the best use of the grid: to alleviate grid scarcity and structural congestion and to create flexible capacity, we will need limited centralised or regional auctions for renewables co-located with storage (short- and long-term) alongside accelerated grid build-out and optimization;

- Ensure energy security: Long-term adequacy mechanisms (Capacity Remuneration Mechanisms) should be fully consistent with the delivery of climate neutrality. They should only be deployed in countries that temporarily need them for the security of supply, while meeting an emissions performance standard;

- Drive energy system integration: The design and implementation of balancing markets, including cross-border trading, but also of 2-sided CfDs must be improved to incentivise a more market- and system-responsive operation of wind farms; and

- Reward flexibility: Ancillary services must be designed to provide long-term visibility and harmonization to drive investments in new flexible resources.

In conclusion, if the introduction of renewables is dependent on short-term market price signals, investments in renewable energies will be both risky and costly. Renewable investments will be jeopardized since renewable entry lowers prices in the day-ahead market when they generate. As a result, the price of renewables in the day-ahead market will most likely be lower than their average cost, preventing future participation. Furthermore, if the revenues of renewables are subject to the volatility of market prices, investors will be uncertain about their cash flows, which would lead to higher capital costs.

The high market volatility is unfavorable for attracting investments in generations with low-marginal costs and high upfront capital needs. Therefore, there’s a strong need to redesign the current EU electricity market.

The last electricity market reform took about 6 – 8 years. Hence, it’s very unlikely the new reform to be implanted in the short term. If prioritized properly and all member states support it, shall we expect 2-3 years for the market redesign?

| PPA | CfD Public Schemes | Forward Market | |

| Definition | A Power Purchase Agreement (PPA) often refers to a long-term electricity supply agreement between two parties, usually between a power producer and a customer (an electricity consumer or trader). The PPA defines the conditions of the agreement, such as the amount of electricity to be supplied, negotiated prices, accounting, and penalties for non-compliance. Since it is a bilateral agreement, a PPA can take many forms and is usually tailored to the specific application. Electricity can be supplied physically or on a balancing sheet. PPAs can be used to reduce market price risks, which is why they are frequently implemented by large electricity consumers to help reduce investment costs associated with planning or operating renewable energy plants. Source: www.next-kraftwerke.com | Electricity generator and a government (“public CfDs”) use the wholesale (daily) prices as underlying. The contract is awarded through a competitive allocation process (e.g. auctions) which determines the pre-agreed price (the “Strike Price”) for X years.The hourly payment is calculated as this price difference multiplied with the electricity produced by a specific asset, such as a wind/solar park. This “weighting” of price spreads with fluctuating volumes sets electricity CfDs apart from other CfDs used in financial and commodity markets, but also from electricity future contracts. The goal of CfDs is to increase long-term stability both for producers and for consumers, intermediated by the state. With price risk mitigated, generation investors have lower cost of capital and hence lower levelized energy costs. Source: Financial Wind CfDs_Dec 22 | The Forward Electricity Market (energy market) is the venue where forward electricity contracts with delivery and withdrawal obligation are traded. The most common financial and physical instruments used in the electricity sector to hedge underlying energy price risks are electricity forwards, electricity futures, electricity swaps, Contract for Differences (CfDs), Electricity Price Area Differentials (EPADs), Spreads and Electricity options. Source: ACER |

Thank you for taking the time to read this article! If you want to help us reach a wider audience, please share it on your social media channels. And if you want to stay on top of the latest energy market trends, subscribe to our newsletter and receive the latest updates and insights right in your inbox.