The EU Commission is planning to cut excesses profits of non-gas power plants (renewable mainly), which were massively benefiting from the war outbreak in Ukraine and the skyrocketing electricity prices. To do so, the EU is considering setting up a maximum power price that non-gas producers can get. The recent discussions at the EU level indicate that this price cap can be at 200 EUR/MWh or maybe even less.

But what does it mean for a wholesale power market from where most businesses are sourcing their electricity from?

The European electricity market is designed based on marginal electricity production costs, which means that the most expensive power plant in the system dictates a final price for all generators. Gas has been by far the most expensive source in the EU since late 2021 (you can learn more about this topic in the article here). As a result of gas being a dictator of the EU electricity price, non-gas power plants have significantly benefited from it. Especially renewable power plants, as those generation sources have almost no operating costs. They don’t need to employ hundreds of workers and machinery to produce electricity like Coal, Nuclear, or Gas plants.

Average Levelized Cost of Energy (LCOE), the average total cost of building and operating a renewable power plant, such as Wind or Solar, over a lifetime of the power plant (20 to 30 years) is under 50 EUR/MWh. Whereas current electricity market prices are at least 10 times higher than that in Europe, driven by gas costs.

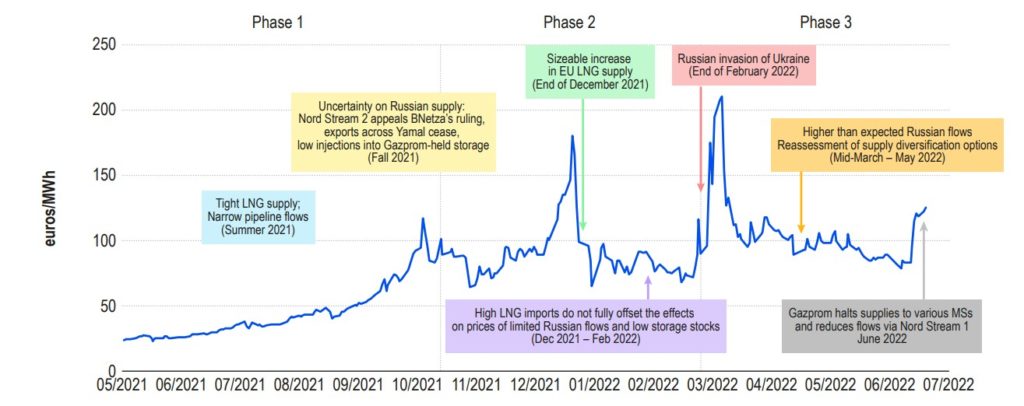

The evolution of the EU gas market price based on TTF Month-Ahead Future Contract

Source: www.acer.europa.eu

This is why the EU commission suggested redeploying excess profit margins the non-gas producers generate to vulnerable customers. The system would be similar to a windfall tax. However, this doesn’t mean wholesale power market prices will be directly impacted and decline. It only means that whatever profits non-gas companies generate, they will need to give back the difference between the price cap (i.e. 200 EUR/MWh) and a wholesale market price. The government will keep this money to likely fund residence and SME businesses as the main priority. While big companies are likely to be the last in this big queue, picking up only “breadcrumbs”.

Long-term structure reforms are therefore needed to calm down the skyrocketing electricity prices.

The UK government has already started discussing decoupling gas from renewable prices and having at least 2 separate markets. It doesn’t look like the EU is considering this plan for now. Instead, the energy ministers speak about a reduction in power demand, energy efficiency measures, and subsidizing vulnerable consumers through tax deductions and redistribution of profits non-gas producers generate.

These measures will come on top of the prior initiatives to diversify away from Russian gas via massive investments in renewables and LNG gas from the USA, Qatar, and other destinations. In addition, an obligation to fill EU gas storage stocks up to 90% of their capacity before November has been established this year. However, these measures still might not be enough for the upcoming and next winters.

The European Union’s reliance on Russian gas has been increasing historically to over 40%. As a result, EU consumers are suffering high living costs today because the skyrocketing electricity prices spiked inflation to double digits in August 2022 across the continent.

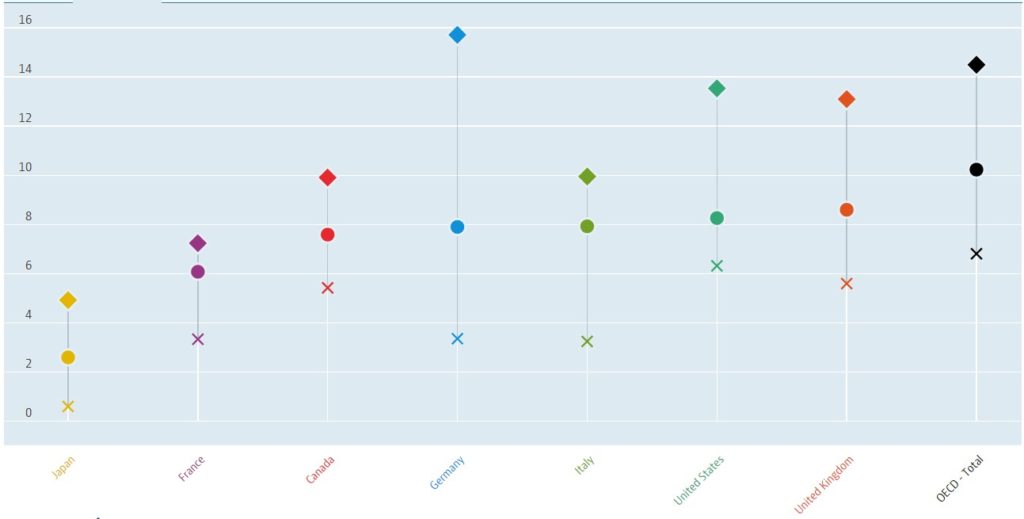

OECD Annual Inflation Reading as of August 2022

Source: OECD

Conclusions

The EU commission and member states have yet to agree on concrete measures and timelines to fight the skyrocketing electricity market prices. The meeting of the EU energy ministers last Fri, the 9th of Sept, didn’t bring more clarity on this topic. Even if those measures are to be implemented, there’s still a risk of a cold winter this year when there’s an increased need of gas for heating.

A possible implementation of a gas price cap, like it was done by Spain and Portugal back in May 2022, will undoubtedly take some time to a couple of months. Longer-term, the EU is still considering reforms to design the power markets. The government has shown that they wouldn’t tolerate such high electricity prices. Still, this process is unlikely to be finished within the following year.

Therefore, this is very likely that gas and power prices to remain elevated much above historical levels. Residential consumers have not yet experienced the full pain of the skyrocketing power prices. This is because the government typically regulates household prices. Electricity suppliers can’t freely pass all production costs increases onto their consumers. However, the bills are typically renegotiated every 12 months. Market analysts expect a typical household electricity bill to increase by 2-3 times this winter.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.