Energy Market Highlights:

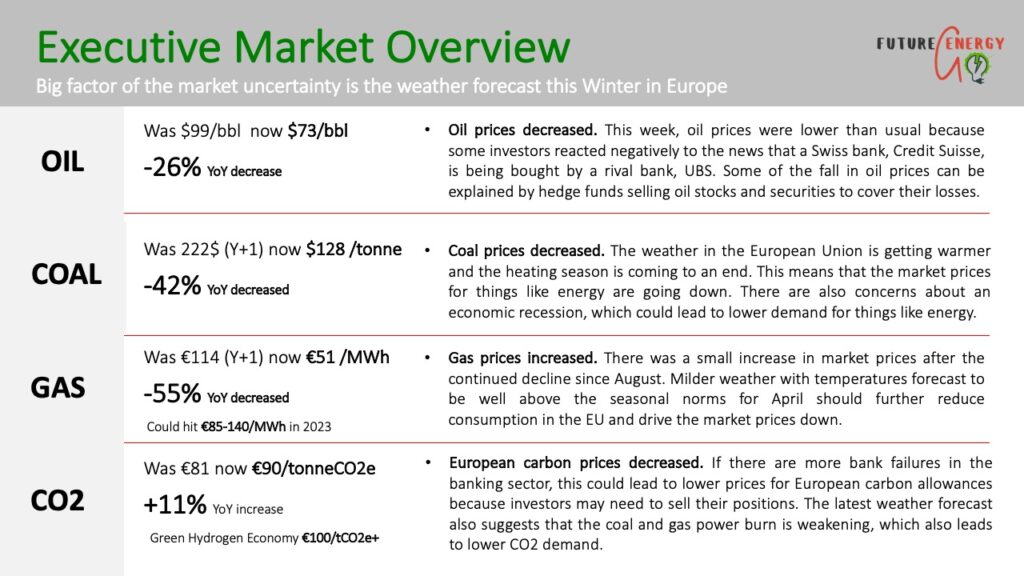

- The likelihood of a recession in the US and EU may dent oil demand and lead to a revaluation of the energy complex. As a result, the European energy market complex remains under pressure in Q1 2023.

- European gas prices remain almost unchanged amid healthy supplies and high storage levels. The gas storage levels across the EU stood at 56% full capacity.

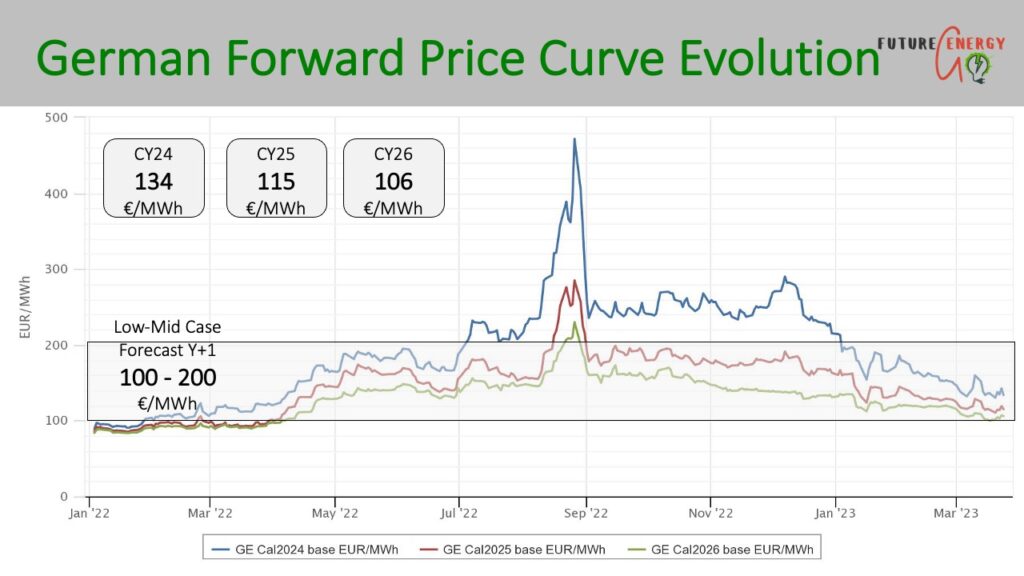

- Market analysts predict that the EU will exist this winter with average gas stocks of around 50 to 55%. This should provide a margin of safety to allow the EU to restock before the next winter. As a result, we can see the spread between Cal24 and Cal25 forward power contracts declining (the current market price spread between Y+1 and Y+2 forward contracts is about 20 EUR/MWh today).

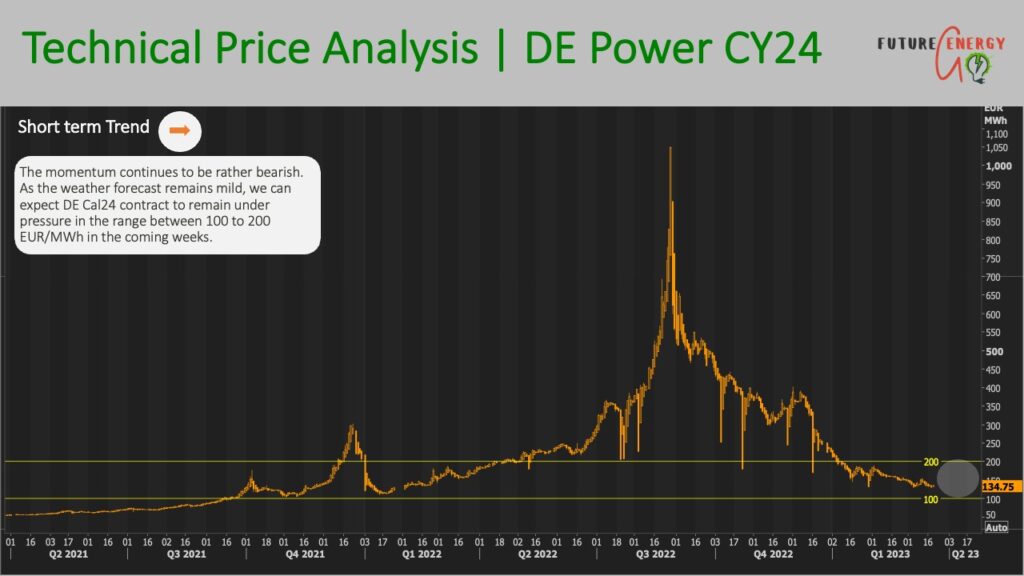

- Milder weather with temperatures forecast well above the seasonal norms should further reduce consumption in the EU. In addition, the turmoil in the banking sector could weigh on the energy market.

- Considering the above events and the healthy gas stocks in Europe post-winter period, a scenario of skyrocketing power prices is now low. Instead, we can continue to see the power prices oscillate in a range between 100 and 200 EUR/MWh. Which is still more than double the historical market price average but not as high as during the peaks of 2022.

If you found our latest update on the European energy market update insightful, then leave a comment below and share it with your friends and colleagues who could also benefit. Our blog is your go-to source for in-depth analysis and expert insights on the European energy market. Don’t miss out on the opportunity to stay informed and stay ahead of the curve. Visit our blog now to learn much more!