Weekly Energy Market Highlights:

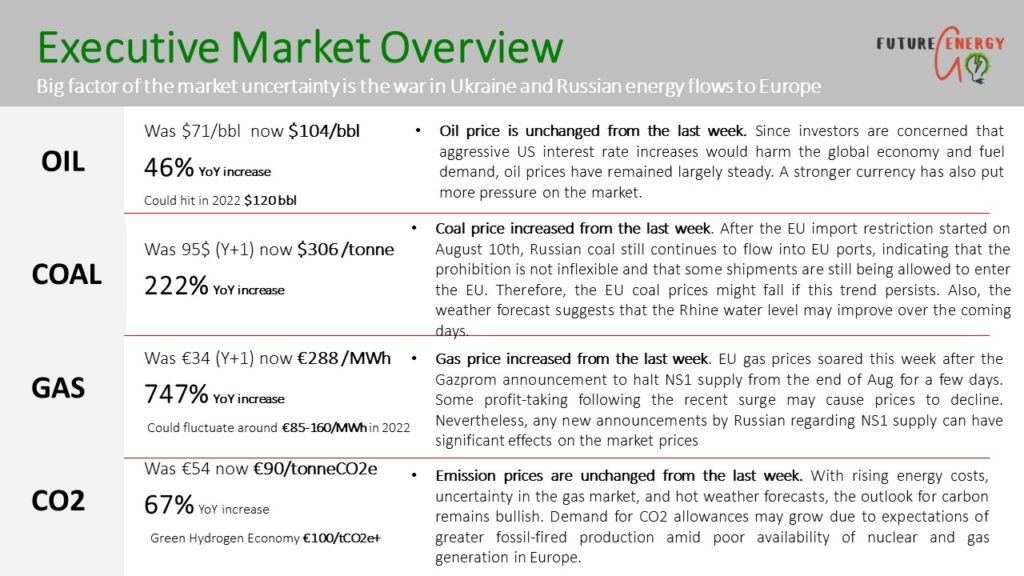

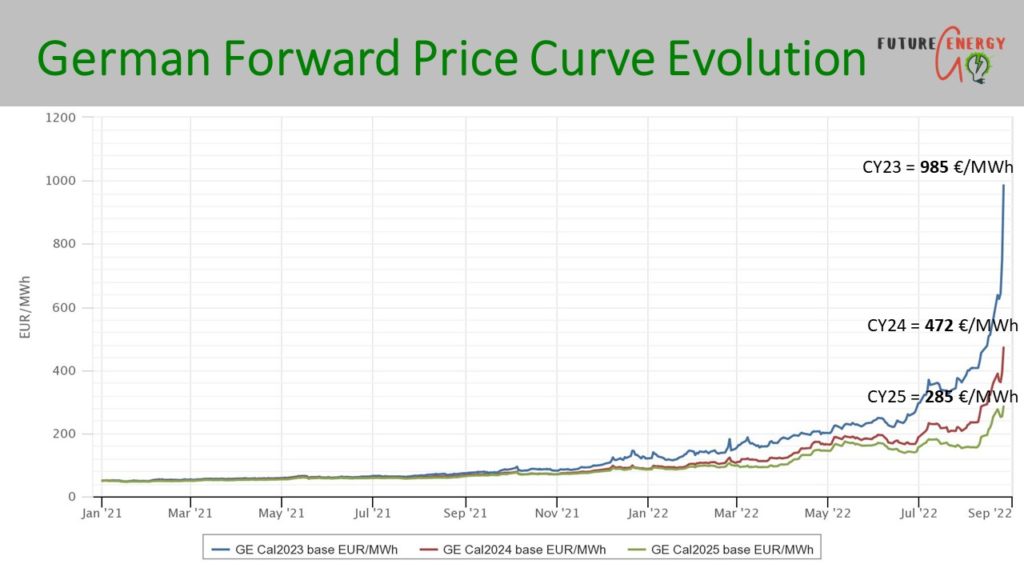

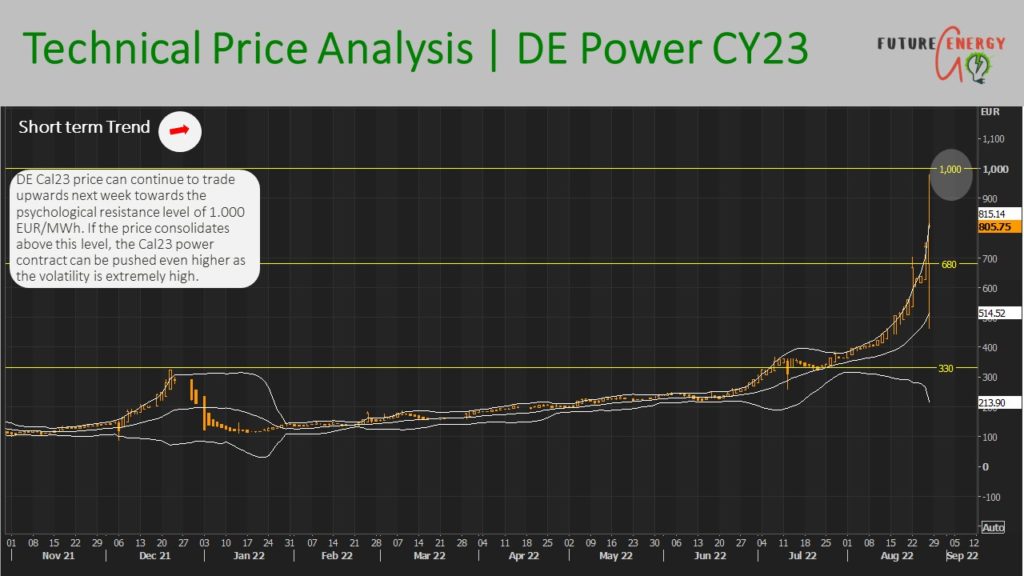

- EU electricity prices soared this week to extreme levels. German Q1 2023 forward contract increased 100% from the week ago to 1.300 EUR/MWh as of Fri, 26th of August.

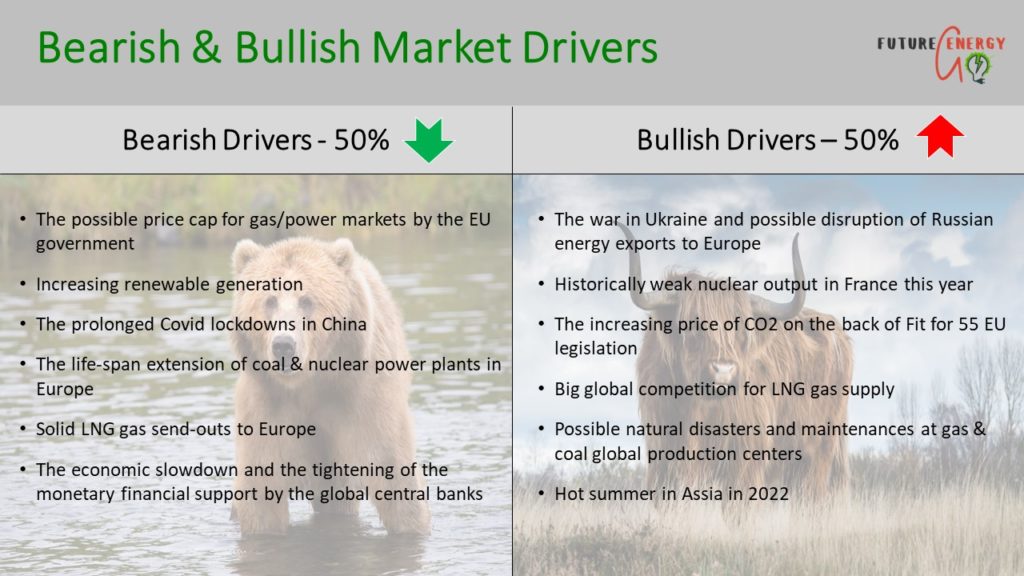

- On the 19th of August, Gazprom announced Nord Stream 1 pipeline to shut down for three days at the end of the month. The shutdown is to run from Aug. 31 to Sept. 2

- LNG gas supply to Europe is still strong, with gas storage capacities reaching 79% this week. Germany said that coming ahead, all public buildings would only be heated to a maximum of 18 degrees as part of its ongoing efforts to conserve energy.

- Italy demands EU price cap on gas to help to lower electricity bills for its consumers. The issue is expected to be discussed in October.

- Europe’s heatwave should end, leading to a relaxation in demand for electricity. However, as winter is approaching, the market participants are still concerned.

- This week, EDF (French Nuclear Powerhouse) announced a further shutdown extension of four nuclear reactors due to corrosion. As a result, the French Q1 2023 forward contract has spiked to nearly 2.000 EUR/MWh this week from 1.300 EUR/MWh a week ago.

- Overall, the market outlook remains bullish as it’s likely that the market participants are trying to price in a complete end of Russian gas deliveries to Europe. And as the market volatility attracts a lot of speculation and panic, a return of Russian gas on the 3rd of September can lead to a significant energy price correction.

To read the prior week’s European Energy Market Update, please follow the link here.