Table of Contents

As the world continues to grapple with climate change, the transition to renewable energy has become a critical focus for companies aiming to reduce their carbon footprint and meet sustainability goals. The Guarantees of Origin (GO) market, which certifies the renewable origin of electricity, plays a pivotal role in this transition. This article delves into the current market dynamics, explores bearish and bullish drivers, highlights challenges and opportunities and provides actionable steps for corporates sourcing renewable electricity.

Guarantees of Origin Price Market Dynamics

Although the demand for GOs is expected to increase in Europe by around 10% in 2024 vs last year, as per the latest AIB database statistics, the GO market has been characterized by significant oversupply and declining prices. This oversupply is primarily driven by increased renewable energy generation throughout 2024 and the recovery of nuclear energy generation.

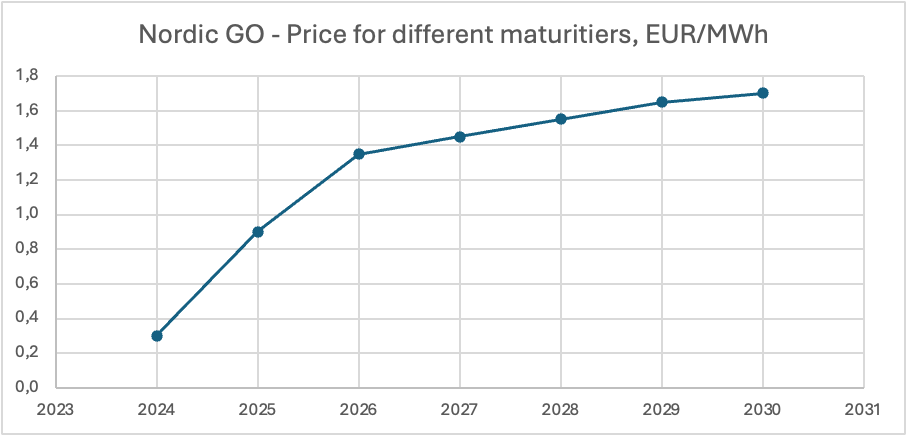

The EU GO market prices fell from 7-10 EUR/MWh back in 2023 to less than 1 EUR/MWh for next-year maturities as of the end of 2024 – begining 2025. However, it is important to note that the forward curve is in a contango structure, meaning longer-maturity GO contract have a significant premium over the Y-1 contracts, indicating the market anticipates a recovery in GO market prices going forward.

An example, while the Nordic Hydro Cal25 GO contract traded at approximately 1 EUR/MWh as of the end of 2024, Cal 26 Hydro GO sold at 1.4 EUR/MWh (see the graph below). However, the contract for Hydro Cal24 GO was traded at a significant discount at approximately 0.3 EUR/MWh, showing the market oversupply, which is likely to continue into 2025.

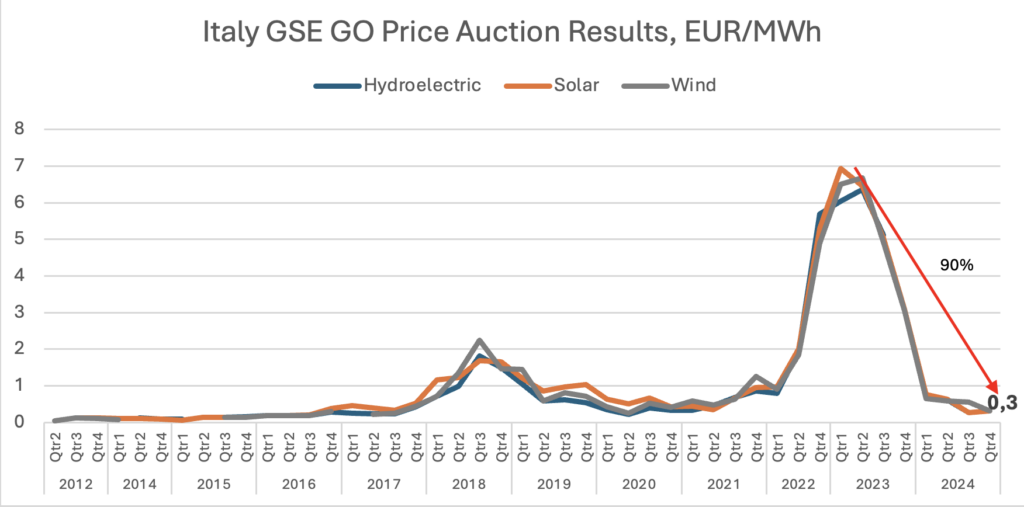

GSE GO Auctions: The Gestore dei Servizi Energetici (GSE) organizes periodic auctions for GOs, where prices are established through competitive bidding. Participants submit bids, and the auction mechanism determines the allocation and pricing based on these bids.

Italy was one of the first to introduce the GOs auctions back in 2013. Every year, five auctions are organized by GSE. GOs are differentiated according to the type of plant and production period. The published auction price information by GSE serves as a good indicator of the latest GO market price trend.

From the graphs above, we can see that the prices for Italian GOs experienced a big decline starting in CY2024, falling by nearly 90% compared to 7 EUR/MWh auction price results in 2023.

As of the latest GSE GO auction held on the 20th of Dec 2024, the average CY24 GO prices were recorded at 0.3 EUR/MWh (this includes GOs produced at the end of 2023). As an example, UK REGO equivalent renewable energy certificate market instrument was traded at around 4 £/MWh, commanding a premium to the European GO counterpart. Please note that although global EAC market prices often follow similar trends, final prices can vary depending on country and technology.

| Bullish Market Drivers | Bearish Market Drivers |

| Regulatory Changes: New regulations like CSRD, Green Claims Directive, and potential revisions to the GHG Protocol could drive mandatory use of GOs, increasing demand. | Increased Renewable Generation: Growth in solar and recovery of hydro reserves led to oversupply conditions in 2024. Hydro still remains the primary source of GO supply in Europe. |

| Demand Recovery: Positive economic outlook, legislative changes and 2030 corporate sustainability targets could boost demand. | Economic Slowdown: Lower industrial output, recession fears and inflationary pressures contributed to bearish sentiments. |

| Weather Conditions: A drier 2025 compared to the wet 2024 could reduce hydro generation and increase GO prices. | Lower Corporate Demand: Companies might reduce/abandon their GHG targets and/or reduce their reliance on GOs to prioritise other renewable solutions, such as power purchase agreements (PPAs) |

Regulatory Changes

The introduction of new regulations, such as the Corporate Sustainability Reporting Directive (CSRD) and the Green Claims Directive, is expected to impact the GO market by increasing the mandatory use of GOs for corporate sustainability reporting.

Companies will need to substantiate their sustainability claims and report on their environmental impact more rigorously. The mandatory use of GOs for corporate sustainability reporting will ensure that companies provide credible and verifiable information about the renewable origin of their electricity, thereby likely boosting the demand for GOs.

The most significant of these regulations is the Corporate Sustainability Reporting Directive (CSRD). By 2029, this directive will require 50,000 companies operating in the EU to report on the origins of the energy they consume, a significant increase from the 11,700 companies previously covered under the Non-Financial Reporting Directive (NFRD).

Gradual implementation will extend to other businesses based on their size:

- 2025: Large companies not previously under NFRD will report on the 2024 financial year.

- 2026: Small and medium-sized enterprises (SMEs) and non-EU companies meeting certain criteria will begin reporting on the 2025 financial year.

Conclusions & Outlook

The current market dynamics present several challenges for corporates aiming to source renewable electricity. Price volatility makes it difficult for companies to predict and manage costs effectively. Additionally, staying updated with regulatory changes and ensuring compliance can be complex.

However, despite these challenges, the market also offers numerous opportunities. The recent decline in the EU GO market prices could present a great opportunity for corporates to source renewable electricity at reduced costs, especially as the CSRD regulation came into force which is likely to support the corporate demand in the long term.

The GO market in 2025 is expected to remain volatile. Analysts predict that in the short to medium-term, we may have a market oversupply situation that would keep the GO market prices at the historically low levels (currently less than 1 EUR/MWh for the next year maturities). However, the impact of the recent EU regulations can shift the supply and demand, potentially pushing the prices somewhat between 2 to 5 EUR/MWh, as per analysts’ long-term forecasts.

And while a repeat of the exuberant GO market price situation seen in 2023 appears unlikely, the possibility of occasional spikes cannot be entirely ruled out. However, what seems more plausible is that the historical average of 1 EUR/MWh is now anticipated at a higher level. This change is largely driven by evolving policies and regulations, as well as stricter corporate reporting and compliance requirements. For the short term, however, the prices are likely to remain relatively low.

It’s important to remember that the GO market remains fundamentally tied to the principles of a commodity market, where supply and demand dynamics are the key to watch. Factors such as increased renewable generation capacity, energy transition policies and shifts in corporate purchasing behaviour will continue to influence price trends.

If you found this article on Guarantees of Origin Price Trends useful, feel free to share it with your friends and colleagues. And if you have any questions or comments, you can leave them below.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.