PPA Price Trends

Table of Contents

As we approach 2023, it’s important to know that the renewable energy industry is likely to expand more in the next years, driven by several factors such as:

1. Declining costs: The cost of renewable energy technologies such as solar and wind power has decreased, making them more cost-competitive with traditional fossil fuel-based power generation.

2. Government policies and regulations: Governments all over the globe are expanding their pledges to decrease greenhouse gas emissions and transitioning to a low-carbon economy, which will boost future demand for renewable energy.

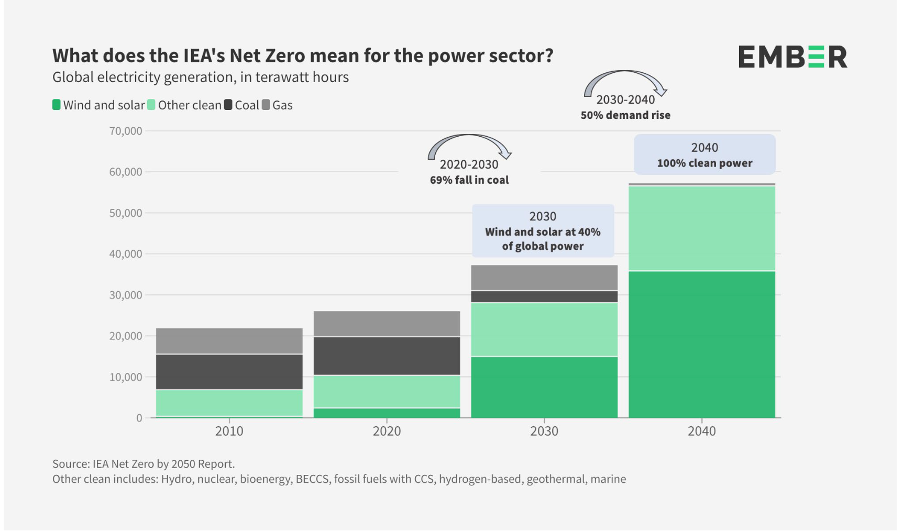

The IEA’s 1.5-degree pathway shows wind and solar as the powerhouse of clean electricity, providing three-quarters of all new clean electricity to become 40% of the world’s electricity by 2030, up from 10% now.

3. Growth in corporate and industrial PPAs: Corporations are increasingly relying on power purchase agreements (PPAs) to satisfy their energy demands while also supporting the expansion of renewable energy.

4. Battery storage: Battery storage is becoming increasingly crucial in assisting renewable energy integration into the grid, and it is likely to increase substantially in the future years.

5. Rising demand for electric cars and electrification of heating systems will drive up demand for renewable energy.

And, with the volatility and pressure on Europe’s energy markets set to remain in the next year, PPAs will continue to spark the interest of corporate purchasers seeking to hedge their exposure to uncertain energy market prices.

What are the main PPA contract trends for 2023?

- The European PPA market has traditionally been a buyer’s market, as the availability of projects willing to sell their energy through a PPA has been larger than the number of buyers. But this started changing in 2022. And this trend is expected to remain in 2023. More and more large renewable developers will be launching their own led tenders where corporate buyers must compete.

- Corporate buyers are willing to participate in joint equity investment in renewable projects to get preferential access to renewable capacities and hedges. And with corporate price hedging needs growing exponentially, it’s expected that such trends to continue.

- PPA merchant appetite is expected to increase, and investors will continue to accept short-term PPAs as the high-pricing market environment presents new opportunities for subsidy-free renewables and the PPA market

- Existing projects opting out of government subsidy schemes to explore market opportunities. Therefore, a long-term PPA covering the entire output of an asset is no longer the benchmark for quality financing, and some investors believe that it could even result in losses over its tenor.

- As conventional power becomes more and more unpredictable, PPA renewable energy is viewed as a highly competitive option for industries across Europe.

- Renewable players continue to lose their trust in the ability of governments to keep their promises following a series of retroactive subsidy cuts and contract breaches. As a result, fewer renewable developers should be interested in governments’ feed-in tariffs and renewable auctions.

Where are PPA prices heading in 2023? PPA Price Index

Gas scarcity and worldwide inflation have had a significant influence on the cost of constructing new renewable energy plants. As a result, developers increased the price of the PPA contract to cover all expenditures and secure the project’s bankability.

Inflation is a big driver here because it undermines the costs of borrowed capital to invest and develop new renewable projects. If prior to the war in Ukraine, long-term inflation was forecasted at around 2% a year. In the current market environment, analysts believe that it is around 4-5% now.

In addition to the rising interest rate, there is a growing emphasis on reducing greenhouse gas emissions and transitioning to a low-carbon economy, which is leading to an increase in demand for renewable energy PPAsamong corporate. Therefore, it’s expected that the corporate demand will continue to outpace the supply in 2023 despite the rapid growth of renewables.

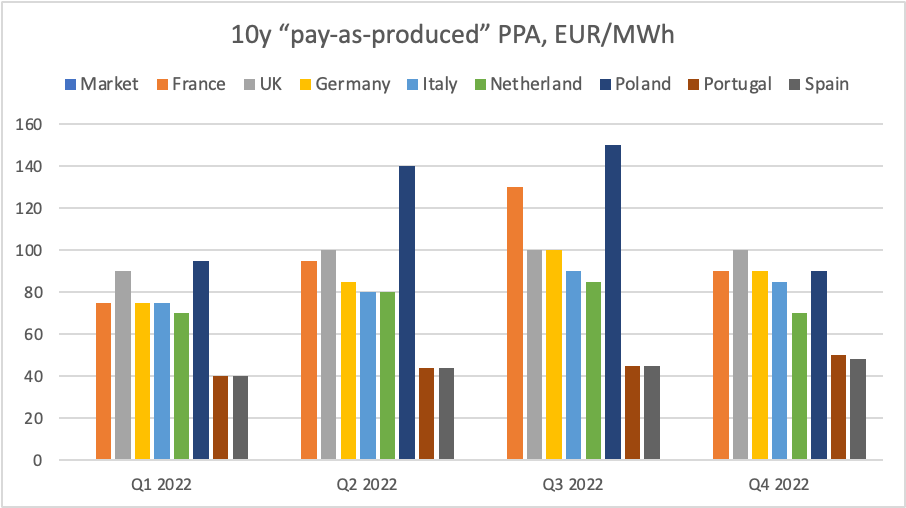

PPA “pay-as-produced” price indication as of December 2022

The table below indicates an indicative 10-year PPA price overview for newly built Solar/Wind renewable assets as of Q4 2022. You can check the PexaPark PPA average index here.

| Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | |

| Market | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh |

| France | 75 | 95 | 130 | 90 |

| UK | 90 | 100 | 100 | 100 |

| Germany | 75 | 85 | 100 | 90 |

| Italy | 75 | 80 | 90 | 85 |

| Netherland | 70 | 80 | 85 | 70 |

| Poland | 95 | 140 | 150 | 90 |

| Portugal | 40 | 44 | 45 | 50 |

| Spain | 40 | 44 | 45 | 48 |

The PPA prices in the table above represent average 10-year PPA deals for newly built assets across different technologies, such as Solar and Wind. PPA prices can vary depending on a number of factors, such as the type of renewable energy being generated (e.g., solar or wind), the location of the project, and the term of the agreement. You can learn more about the most popular PPA Head-of-Terms condition in the article here.

So is it still worth locking in a long-term renewable energy price in this market in 2023?

Although PPA prices climbed in 2022 compared to before the Ukraine war, PPAs continue to offer lower energy costs than traditional methods of obtaining power. Furthermore, since market pricing becomes more unpredictable and is expected to stay high in the long run, signing a power purchase agreement provides long-term budget certainty.

Some energy market consultants suggest that baseload prices in Europe might remain above 100 EUR/MWh until 2030. Therefore, a PPA at a fixed price at a below-market rate will ensure green credentials, accounting certainty, and potential financial benefits for up to 10-15 years.

Also, it’s worth noting that while PPA markets in Germany and Italy have been growing in recent years, with a significant increase in corporate PPAs, Spain as well as Nordics remain the most competitive PPA market landscape this year.

Overall, we expect the PPA market to continue to grow in the coming years as demand for renewable energy increases and the cost of renewable energy technologies continues to decline.

If you want to learn more about renewable energy sourcing and best market practices, please check out the buyer’s renewable energy procurement toolkit here.