Table of Contents

Introduction: PPA Transaction Growth in 2023

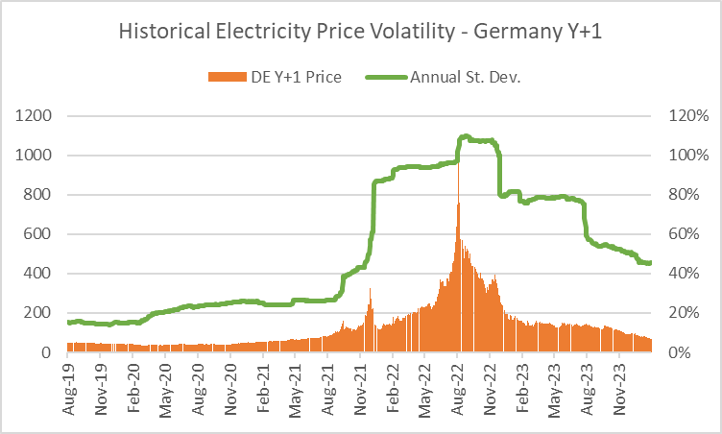

European power prices experienced a notable decline at the end of 2023, which can be attributed to several key factors. A warm winter, coupled with robust liquefied natural gas (LNG) supply and diminished industrial demand, has fuelled this decline. A prominent indicator of this trend is the DE Y+1 forward contract (green line), which dipped below the generation costs of coal and gas-fired plants in Q4 2023. This divergence between generation and electricity market prices suggests a potential upward market correction could be on the horizon.

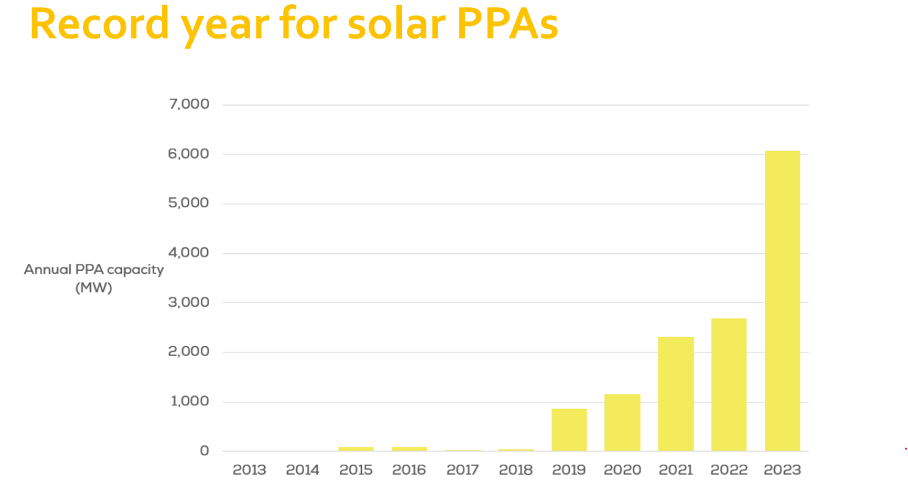

Even though the European Union’s economic activity was a bit slow in 2023, the PPA market (Power Purchase Agreement) kept growing because more and more businesses require sustainability-friendly energy solutions by 2030-2040. The uptick in the PPA transactions was previously fueled by skyrocketing energy market prices.

But PPAs not only help corporates reach Net Zero goals by sourcing renewable electricity directly. Simultaneously, they could help optimise energy costs through long-term pricing structures, providing financial predictability.

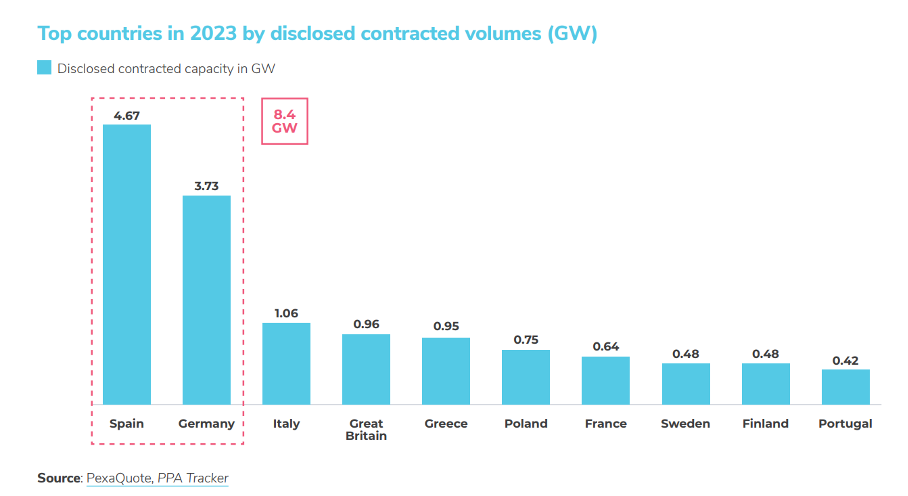

According to Pexapark market research, Spain and Germany led the way in adding new power capacity through corporate PPAs in 2023.

Italy came as the number 3 most active PPA market. It is very likely that the country will continue to advance in the list of top countries as the business case is still there due to the country’s high reliance on gas for power generation. On average, the electricity bill in Italy is higher than in the EU. Also, the market can be interesting for cross-border PPAs because of lower cannibalisation risk vs Spain.

In Spain, installed renewable capacity increased by more than 3GW in 2023, but most new capacity was solar photovoltaic (PV) rather than wind capacity, as slow permitting and turbine manufacturing backlogs delayed development.

The prospects for renewables in Poland also appear promising, with the winning coalition in the October general election signalling intentions to amend restrictive policies regarding onshore wind farm locations and streamline the process for renewable plants to connect to the grid.

PPA Energy Market Prices: 2024 Outlook?

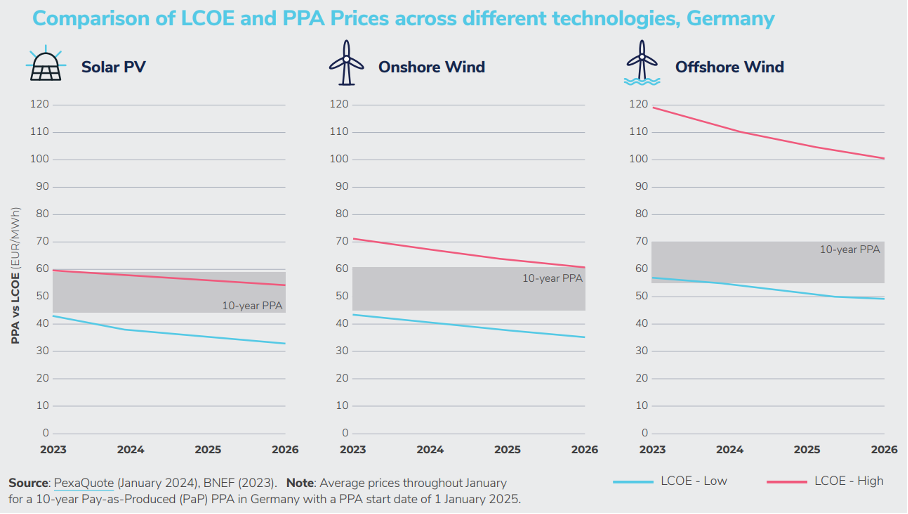

The decline in conventional energy market prices towards the end of Q4 2023 put downward pressure on Power Purchase Agreement (PPA) prices. This trend is expected to continue into Q1 2024, supported by improvements in the supply chain and ongoing reductions in the Levelized Cost of Energy (LCOE) for solar and wind power.

However, potential constraints on further price decreases may arise from increased capital costs, labour shortages and delays in grid connections. These factors could limit the downside in PPA prices despite the overall downward trajectory driven by declining conventional energy prices at the start of 2024.

| Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q3 2023 | Q4 2023 | |

| Market | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh |

| France | 95 | 130 | 90 | 70 | 85 | 80 |

| UK | 100 | 100 | 100 | 85 | 90 | 85 |

| Germany | 85 | 100 | 90 | 80 | 85 | 80 |

| Italy | 80 | 90 | 85 | 75 | 85 | 80 |

| Poland | 140 | 150 | 90 | 55 | 95 | 90 |

| Portugal | 44 | 45 | 50 | 45 | 43 | 42 |

| Spain | 44 | 45 | 48 | 45 | 40 | 40 |

While the PPA PaP prices decreased in Q4 vs Q3 2023, the shaping/balancing premiums are still at a historical high, especially for Solar PV, given the strong growth of this technology. Analysts forecast that shaping PPA premium for Solar PV can be as high as 40% on top of the PaP price, 20% on top of the PaP price for Onshore Wind and 10% for Offshore Wind when accounted for non-RE generation hours.

France – ARENH Price Mechanism Update

The current ARENH mechanism in France will continue to function until December 2025. Starting Jan 2026, however, a new regulated price will be introduced.

In France, the amount of nuclear power sold by French state-owned utility EDF to alternative suppliers at the regulated price of EUR 42/MWh under the ARENH law decreased from 120 TWh in 2022 to 100 TWh in 2023, which added upward pressure on prices.

Government and EDF reached an agreement on the post-Arenh. Mechanism targeting a long-term average. selling price around €70/MWh for all EDF’s nuclear production from 2026.

- 50% of captured price ≥ 78 €/MWh taxed for redistribution to consumers

- 90% of captured price ≥ 110 €/MWh taxed for redistribution to consumers

These thresholds are regularly renegotiated. The agreement remains subject to approval by the European Commission.

PPA Market Observations

- Despite the reduced energy market price volatility in 2023, cannibalisation risk is still one of the main risks in the Pay-as-Produced (PaP) PPA price structure.

- Not easy to find fixed fee for Shaping/Balancing PPA services. The contracts are usually priced at day-ahead market prices, where the risk is passed to a buyer.

- Baseload PPA is still hard to find as sellers are increasingly cautious.

- Regulatory and change-in-law risks are back in focus following the Russian-Ukraine war.

- According to the latest market research by Pexapark, since 2018, PPA’s contracted volume capacity has grown on average 37% CAGR.

- PPA pricing becomes a challenge as the market prices and volatility declined in 2023 vs 2022 while interest rates increased, resulting in higher capital costs.

- Utility PPAs can offer more flexibility for corporate buyers to manage market price risk exposure when compared to PPAs with IPPs. Utility PPA will likely dominate in 2024 as the market begins to consolidate.

- The power generation costs by fossil fuels, such as Gas and Coal, have fallen sharply at the end of 2023. As a result, the German Y+1 futures contract had fallen below 70 EUR/MWh, which was difficult to imagine in 2022 when the price reached almost 1.000 EUR/MWh. This is a decline of >90% in less than 2 years, highlighting the significant volatility of the commodity market prices that often influence PPA market prices.

- Physically settled PPAs are still one of the most preferred structures in the EU despite the existence of the VPPA solution due to the IFRS16 hedge accounting requirements for EU-based companies.

- Increasing interest among corporations in a PPA portfolio approach through a mix of renewable solutions/technologies, i.e. wind+solar, solar + batteries.

- Grid connection is becoming an issue in several countries where RE projects get significant delays due to the grid capacity oversubscription, i.e. Italy.

- Post-subsidy existing PPAs, i.e. projects that received FiT tariff under various local governmental subsidies, can be interesting for corporate buyers to transact as those projects have usually made a return on invested capital; they are priced at the market rates. With the current future rates below 70 EUR/MWh, the corporate buyers can enter into a short-term hedge agreement at a competitive rate. Most of the PPA signed in Germany today is for the existing Wind assets that are coming out post EEG subsidy support. The contract duration is often between 1 and 5 years.

- A multi-buyer PPA contract, i.e., one that is especially interesting for buyers with low electricity volume consumption, is becoming increasingly interesting, with the first transaction happening last year. Government-backed credit guarantee schemes would be a more impactful tool to increase the pool of SMEs willing to subscribe to a PPA agreement.

- The 24/7 clean energy procurement approach is a new concept that was actively discussed last year. New players (“energy aggregators”) can pull together consumption with multiple production sources, including batteries, and offer a Baseload supply product solution.

- Due to the unprecedented expansion of solar PV energy, the price gap between wind and solar PPA will likely widen.

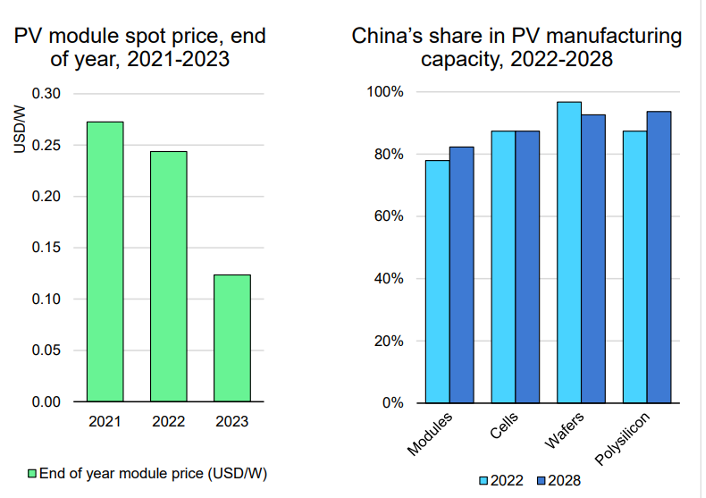

- PV Module prices continue to decline as production capacities are ramped up, outstripping the demand. China dominates the Solar PV manufacturing market.

Conclusions

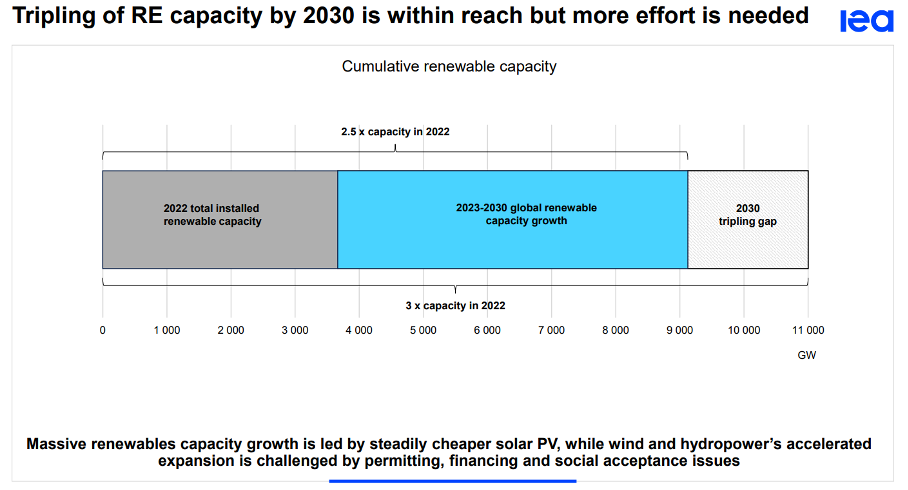

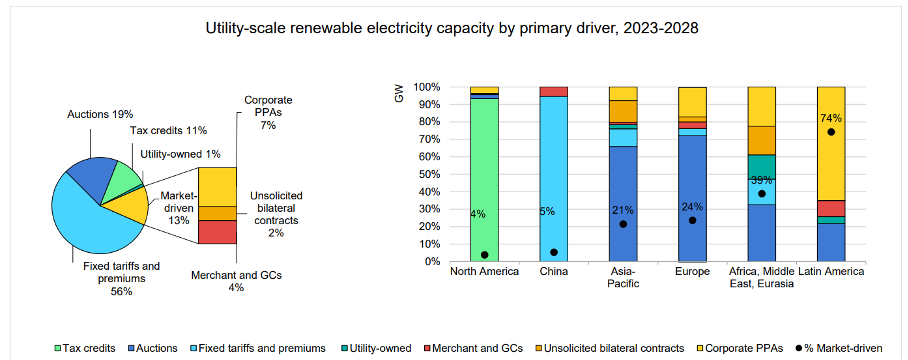

Policies de-risking investment and low-cost financing are key to unlocking the full potential of renewables. PPA business models do play a larger role in some markets. However, policy remains a major driver for renewable growth, according to the IEA.

Electricity demand is poised to remain high due to the macroeconomic trend towards electrification across sectors like transportation and industry, according to the IEA. Additionally, the European Union’s renewable energy directive, requiring 42.5% of electricity to be renewable by 2030, will push corporate buyers to subscribe to renewable energy through Power Purchase Agreements (PPAs). Also, corporate appetite for PPAs was further strengthened from a regulatory point of view by more stringent sustainability reporting requirements, such as the EU Corporate Sustainability Directive, which came into force in January 2023.

Therefore, we can expect the PPA market activity to remain high towards 2030 as more corporations join the PPA renewable energy movement. However, the end of 2023 and 2024 are likely to be characterised by difficulties in finding NPV-positive deals for corporate buyers as energy market prices fall.

If you found the article on PPA Price Trends Q4 2023 insightful, we encourage you to share it with friends. Feel free to leave your comments below to engage in further discussion on this topic. Your feedback is valuable to us!

What is a multi-buyer PPA?

A Multi-buyer PPA is a joint negotiation of corporations that want to buy together. Typically, there’s a creditworthy anchor off-taker which is creditworthy to balance out non-investment grade corporates. Still, the allocation of default risk is one of the largest discussion points.