Table of Contents

What is a Power Purchase Agreement (PPA)?

A Power Purchase Agreement (PPA) is a legally binding contract between an electricity buyer and a power producer, typically a renewable energy provider, that outlines the terms and conditions for the sale and purchase of electricity.

PPAs are commonly used in the renewable energy industry to facilitate the financing and development of new power generation projects, such as wind farms or solar facilities. While to the buyer, this arrangement provides with a stable and predictable source of green energy.

Imagine a company that wants to power its operations with renewable energy but doesn’t want to invest in building a solar or wind farm. They enter into a PPA with a renewable energy developer. Under the PPA, the developer agrees to provide the company with a fixed amount of renewable electricity at a predetermined price per MWh for about 10 years. This allows the company to meet its sustainability goals and secure a stable source of clean energy without the upfront costs of building a renewable solar or wind facility.

What are the main PPA contract risks you need to consider before signing a long-term renewable agreement?

The corporate sourcing PPA marketplace has taken off over the past few years. This long-term hedging instrument has become especially attractive in light of the recent energy market price crisis in Europe, with wholesale baseload electricity prices soaring above 200 EUR/MWh. As a result, many corporations look into PPAs as a primary strategy to lower their rising energy bill and to meet the suitability business objectives.

And although PPA can seem like the obvious solution to the rising energy market prices, entering into a corporate PPA may not be straightforward for all counterparties.

There are several risks we need to consider when signing a power purchase agreement for the supply of renewable energy:

- Project Development Risk. This is the risk that the generation facility won’t be commissioned on time.

- Cannibalisation. As more Solar and Wind low marginal cost generations are entering the market, the abundance of cheap power can push market power prices to negative territories at peaks of Solar / Wind generation.

- Base Price Risk. Exposure resulting from overall market price levels and changes. This is more relevant for financial (virtual) PPA contract structures where the reference price of electricity in the PPA contract can be different from the electricity prices that the consumer buys electricity from its utility supplier.

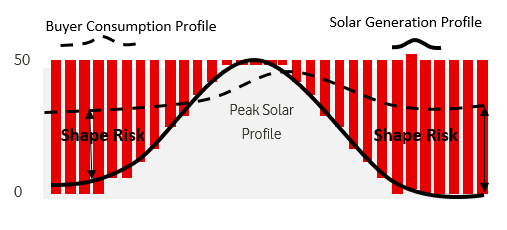

- Shape Risk. Hourly generation profiles as produced by renewable energy sources (RES) have values different from the standard baseload electricity contract. The markdown/-up as compared to baseload prices are referred to as shape costs/risks.

- Imbalance Risk. Renewable energy generation forecasts are never accurate. The fact that actual generation and forecast are at all times different results in imbalance positions and commercial risks. The rules related to the potential liability of an asset’s exposure to power system costs differ from market to market. In general, the less accurate RES asset volume generation forecast is the day before, the higher the imbalance costs.

- Volume Risk. Deviations of seasonal prognosis and realized generation lead to over-/under-hedged positions which result in a volume-driven market price exposure.

- Credit Risk. The creditworthiness of PPA developers is also an important aspect to consider. One of counterparties may fail to fulfil its obligation under a long-term electricity supply agreement.

- Contractual & PPA accounting risks. The risk of a PPA contract being treated as a financial long-term lease or a derivative can lead to additional accounting challenges and impact a company’s balance sheet position.

- Changes in law and Regulatory risks. Changes in the law may affect the balance of benefit or risk between the parties, e.g. the temporary suspension of the electricity generation tax in Spain.

To help you better navigate through the complex PPA procurement environment, please check out the PPA Head-of-Terms (HoT) Playbook. The PPA Head of Terms (HoT) negotiations playbook will give key commercial issues that are important in any long-term Power Purchase Agreement (PPA).

There are of course additional risks that a corporate consumer needs to consider before entering into a PPA deal. But the ones mentioned above would usually be the main ones to discuss during the PPA contracts negotiations phase.

What are the risks of PPA? Key steps to lower the risks

- Project Development Risk. As PPA contracts are usually negotiated 12-36 months before the construction and commissioning of the new renewable power plant, it’s important to manage the risk of the commercial operation date (COD). If the project timeline is delayed for any reason except for a force majeure, it’s important to secure guarantees from the supplier as market conditions can change significantly upon the initially expected delivery date. In this situation, a buyer can request an interim supply power solution under the same terms until the project COD or have a mark-to-market contract guarantee. It’s also common to have a completion deadline by which if the project is not in operation, the buyer is free to walk away from this deal.

- Cannibalisation. A typical PPA contract price would have a fixed “pay-as-produced” price for a duration of 10 to 15 years. However, this type of PPA price structure would be exposed to cannibalization risk. This risk will be especially high for Solar PV PPAs in markets where there’s a material share of Solar electricity generation and/or it’s growing rapidly. In these markets, a buyer could be better off paying a premium for a baseload PPA price, so he doesn’t need to worry about this risk.

- Base Price Risk. To manage the base price risk, which is usually linked to a financial PPA, it’s important to agree on the same market index in both the utility electricity supply agreement and PPA. Apart from the market index, the settlement PPA value amount between the parties is usually based on a volume-weighted average price (WAP), while the utility supply contract can be settled based on an average monthly price index (AP). The difference between the simple average and the WAP is an additional risk factor to consider. In this sense, a physical baseload PPA contract structure could help to eliminate the base price risk.

- Shape Risk. Electricity utilities and PPA aggregators with a dispatching electricity volume mandate can shape PPAs as-generated into other profiles to better fit corporate buyers’ volume needs. Therefore, it’s worth considering PPA negotiations either directly with a public utility or as a 3-party contract arrangement (buyer, utility, and an independent PPA renewable power producer). Utilities can help buyers avoid shape risk in return for sleeving/balancing fees paid to them.

- Imbalance Risk. If multiple renewable assets with different technologies are connected to the same balancing zone, the risk can be lower. Therefore, PPA suppliers with a bigger portfolio of assets would typically have lower imbalance cost exposure. It’s worth checking a PPA offer derived from a pool of several renewable assets rather than a single asset. When asking for a PPA proposal, make sure whether the imbalance risk is already backed into the PPA offer or not.

- Volume Risk. PPA developers may consider renewable asset performance guarantees unnecessary in light of uncontrolled external factors such as a weather forecast. In this situation, it’s common to agree on a minimum capacity available for the renewable project so that the buyer can limit its exposure to unfavorable market prices when the renewable asset doesn’t produce.

- Credit Risk. The counterparty credit risks are also essential to ensure long-term PPA performance. Therefore, it’s important to agree on a credit support guarantee and a performance bond. Shall the supplier fail to deliver PPA at the agreed price, a mark-to-market contract termination amount shall be considered.

- Contractual & PPA accounting risks. Corporate PPAs are often extensive contracts and include multiple clauses and complex price mechanisms that can increase accounting and financial reporting complexity. Under the IFRS16 accounting rules, PPAs can often make a scenario when the contract contains a financial lease and resulting in an impact on companies’ balance sheet and statement of operations. Therefore, in order to determine accounting risks, it’s important to go through this decision tree evaluation process.

- Changes in law and Regulatory risks. The law and regulatory changes can affect the economics of a renewable project. Therefore, it’s important to discuss and evaluate these risks in advance. You may always act to insist on a contract clause that no change in the law/regulation will impact the fixed PPA price agreed.

If you wish to learn more about different types of PPA agreements, please check my next article. Found this article useful? Please comment below!

For those interested in delving deeper into the intricacies of procuring renewable electricity through Power Purchase Agreements for businesses, there’s a comprehensive book available for further exploration of the topic.

What is a Power Purchase Agreement (PPA)?

A Power Purchase Agreement (PPA) is a special contract where one party agrees to buy electricity from another party at a fixed price for a long period. It’s often used to purchase renewable energy and provides both parties with price stability and suistanabilty benefits.

What is energy market price Cannibalisation?

Energy market price cannibalisation occurs when an increase in the supply of energy, often from renewable sources like solar or wind, leads to a decrease in the market price for electricity. In some markets, prices can go even to negative territories. This drop in electricity prices can negatively impact the revenues and profitability of energy generators while buyers can be locked in unfavourable market energy supply rates.

What is PPA Shape Risk?

Hourly generation profiles as produced by renewable energy sources (RES) have values different from the standard baseload electricity contract. The markdown/-up as compared to baseload prices are referred to as shape costs/risks.

What is PPA Imbalance Risk?

Renewable energy generation forecasts are never accurate. The fact that actual generation and forecast are at all times different results in imbalance positions and commercial risks. The rules related to the potential liability of an asset’s exposure to power system costs differ from market to market. In general, the less accurate RES asset volume generation forecast is the day before, the higher the imbalance costs.

What is PPA Volume Risk?

Deviations of seasonal prognosis and realized generation lead to over-/under-hedged positions which result in a volume-driven market price exposure.

What is PPA Credit Risk?

The creditworthiness of PPA developers is also an important aspect to consider. One of the counterparties may fail to fulfil its obligation under a long-term electricity supply agreement.

What is PPA Accounting Risk?

The risk of a PPA contract being treated as a financial long-term lease or a derivative can lead to additional accounting challenges and impact a company’s balance sheet position.

What is PPA COD Date?

The PPA COD Date is when a power plant, like a wind farm or solar facility, officially starts producing electricity for commercial use. It’s the trigger for a Power Purchase Agreement, marking the beginning of the agreed power supply between the generator and the buyer.

Pingback: (2022) PPA Price Trends In Q1 2022. What European Energy Markets Have The Best Corporate PPA Deals? | Future Energy Go

Pingback: (2022) Power Purchase Agreement (PPA) & PPA Price Types Available In The Market? | Future Energy Go