Table of Contents

Introduction to the European Guarantees of Origin

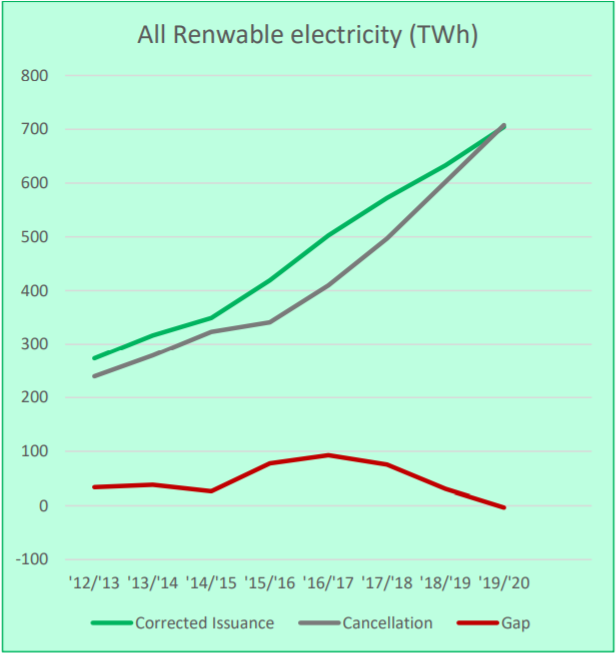

Many believe that the market of the European guarantees of origin (GOs) is oversupplied, resulting in low prices. However, this statement is no longer right because, in recent years, the gap between demand and supply of GOs has narrowed with many corporates implementing their renewable energy objectives and creating new market demands.

Still, it’s important to keep in mind that many renewable generations in Europe remain uncertified (about 40%) due to either regulatory or market reasons. Renewable generators may not request the issuing of GOs for their electricity if the price they can achieve is not worth the effort of obtaining a GO license. If prices begin to climb, this new supply could enter the market.

Also, some EU Member States refuse to give GOs to generators who receive government subsidy support, such as a feed-in tariff, or have some other restriction for the use of GOs. As an example, in Spain, renewable generators who benefit from the government’s 10-15 years feed-in tariffs can still apply for GOs issuance, but they are not allowed to export these GOs outside of Spain, where market prices can be higher.

In July 2021, however, there was a new government proposal to change the European GO regulation which would require the issuance of GOs to all renewable generators regardless of whether they are participating in the government subsidy support scheme or not. But as the regulatory changes take time (2-3 years), we should not expect the additional GO supply to enter the market in the coming years. Therefore, growing corporate demand remains a big risk for GO market prices.

What are Guarantees of Origin (GOs)?

Guarantees of Origin (GOs) are standardized and officially recognized certificates that verify the renewable origin of electricity. The term is usually common for European markets. The certificates serve as proof that a certain amount of electricity was generated from renewable sources, such as wind, solar, hydro, or biomass.

Suppose a company wants to demonstrate its commitment to using green energy and claims that a portion of its electricity comes from renewable sources. To back up this claim, the company obtains GOs for the renewable electricity it consumes. These certificates certify that a specific amount of the electricity used by the company is indeed generated from renewable energy sources.

GO Price Evolution

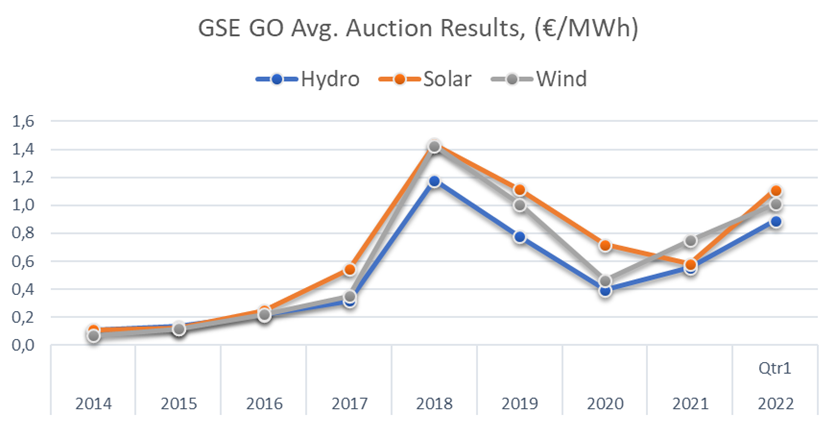

Historically, before 2021, the price of European Guarantees of Origin (GO) was on average under 1 EUR/MWh. There was an abundance of supply, strong hydro generation in Norway, and a few corporations interested in sourcing 100% renewable electricity. These, however, changed over the past few years.

The European GO prices have been rising since 2021 due to the increasing corporate demand, low hydro generation, and inflationary pressure as a result of the enormous fiscal stimuli introduced by the world’s central banks in light of the global pandemic.

As a result, European GO prices for the calendar year 2022 and 2023 have more than doubled from 1 EUR/MWh to above 2 EUR/MWh in the market today. Still, the price has a significant discount when compared to the United States, where renewable certificate prices are above 5 $/MWh. Therefore, it would not be a surprise to see an average price of EU GOs above 3 EUR/MWh in the calendar year 2022.

Below is a historical price evolution of Italian GO prices as published Gestore del Mercato Elettrico (or GME) for renewable generation from 2013 to 2021.

Supply / Demand of European GOs

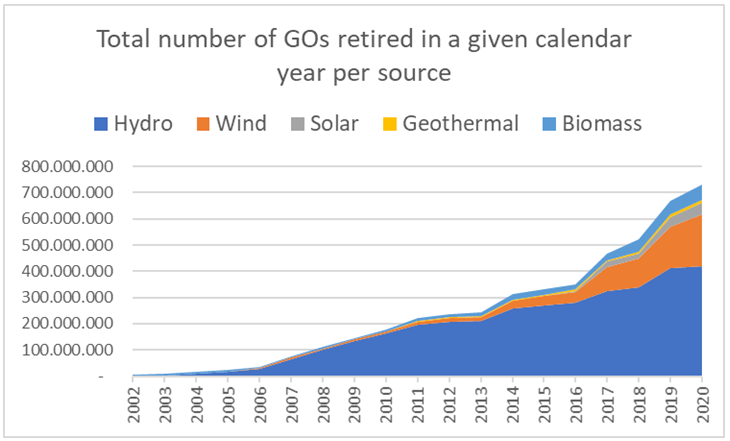

Hydro renewable has the biggest power generation share in the European renewable energy mix. This data can be seen in the European GO market statistics published by the Association of Issuing Bodies (AIB). The Hydro GO share in the total transaction of the number of certificates that have been issued in a given year is between 60-70% over the past 3-5 years. Although other renewable technologies, such as Wind and Solar are growing rapidly, Hydro GOs are still determining the supply and demand balance in the market.

The compound annual growth rate (CAGR) over the past 20 years is about 30%. And this is likely to accelerate in the future mainly due to the voluntary corporate GO demand increase as a result of the growing understanding that GOs are the foundation of all renewable energy claims. Furthermore, regulatory reforms, such as the increased usage of full GHG greenhouse gas disclosure, can encourage people to make active decisions to consume renewable energy. And the supply/demand gap is narrowing steadily. This can be seen on the below chart prepared by the RECS International Association.

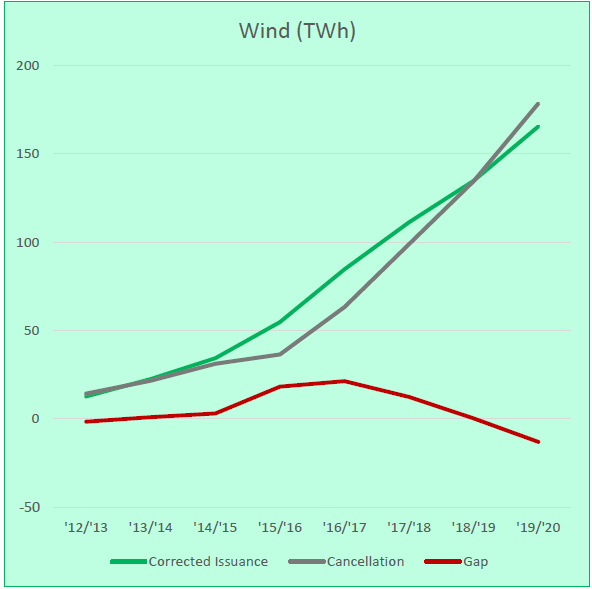

New Solar and Wind generations are usually preferred choices by many corporate consumers as those are perceived to have higher additionality than a large, old hydro generation. As a result, the demand for Wind and Solar GOs is especially high in recent years.

From 2018 to 2020, the Solar GO demand has caught up with the supply. And the same is true also for the Wind GOs.

Conclusions

The GO market supply-demand economics changed over the past years. We are now in a market where demand is higher mainly driven by corporate consumers. This trend is especially prominent for Wind and Solar renewable certificates in Europe. And this is likely to remain in the coming years as more consumers decide to switch to renewable energy sources, while more companies continue to join the 100% renewable energy associations, such as RE100.

As a result, the European GO market price is likely to rise. Therefore, corporates, who are souring 100% renewable electricity via GO procurement, need to consider hedging themselves against the raising price for GO certificates long-term. If you wish to know the best market practices for sourcing renewable energy certificates, you can check this article here.

In addition to the steady corporate demand, there are other regulatory, weather-related risks that can push prices higher in the coming years ahead. As an example, as hydro GOs have the biggest market share, the decreasing hydro balance because of the dry weather conditions and lower than normal precipitation levels in certain regions, leads to lower renewable generation and creates even a greater supply shortfall of renewable certificates in the market. Also, in 2021, there was a Norwegian proposal to exit Europe’s Guarantee of Origin (GO) scheme and ban exports of GOs outside of Norway. To learn more about this topic, you can listen to Montel’s podcast on Norway’s proposed GO exit.

Another regulatory market price risk can be due to the switching from the existing voluntary GO market mechanism to a compliance market. The EU may greatly enhance the uptake of renewable energy. This would oblige suppliers to ensure that a certain percentage of the energy they sell comes from renewables. Consumers could also be required to ensure that a certain percentage of their energy consumption comes from renewable sources. If all customers, both businesses and residential users, had to acquire energy attributes and authenticate the origin of their energy usage, this would very certainly increase the demand for renewable energy.

If you wish to learn more about renewables, check out my next article here. To read weekly energy market updates, including electricity market price evolution, the latest power news and forecast, check my market reports here.

For those interested in delving deeper into procurement of renewable electricity, there are other articles available for further exploration of the topic.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.