Table of Contents

Market Update

The year 2022 proved to be a turbulent and challenging period for the renewable energy sector in Europe. Amidst an energy crisis characterized by supply shortages and soaring costs, Guarantees of Origin (GOs), the vital system used to document and certify renewable energy consumption in the European Union, reached unprecedented highs. Several factors, such as a dry summer and surging energy demand, led to GO prices reaching historic levels, exceeding 10 EUR per unit during the winter months of 2022.

The rising price of GOs

In 2023, the corporate demand for GOs continued to grow. The prices fell from the last year’s historical highs and stabilized at levels well above historical averages, surpassing 7 EUR per unit—a staggering sevenfold increase.

The remarkable uptick in corporate interest in GOs is driven by several factors:

- Evolving Sustainability Goals: Many companies have committed to ambitious sustainability targets, including achieving carbon neutrality and sourcing a significant portion of their energy from renewablesby 2030, 2040 and 2050

- Regulatory and Reporting Requirements: Governments and regulatory bodies in various regions have started to mandate or incentivize the use of renewable energy. GOs are a crucial component in meeting these compliance requirements and accessing renewable energy incentives.

- Consumer Demand: As environmentally conscious consumers seek products and services from eco-friendly companies, businesses are motivated to procure renewable energy and showcase their commitment through GOs.

While the rising prices of GOs may pose challenges for some businesses, they also serve as an important signal of the accelerating transition towards renewable energy sources. As the demand for clean energy continues to grow, it is likely that prices will remain elevated, encouraging further investments in renewable energy infrastructure.

The demand for International Renewable Energy Certificates (iRECs) has also witnessed a significant increase in 2023.

What is iREC?

iREC stands for International Renewable Energy Certificate. It is a standardized certificate system that provides proof of the renewable attributes of electricity generation. iRECs are issued for electricity generated from renewable sources such as wind, solar, and hydro, and they serve as a means to track and verify the environmental attributes of this energy. Similar to Gos, which is the European GO system, iRECs is the international standard.

The surge in demand for iRECs in 2023 can be attributed to several key factors:

- Expanding Global Adoption: An increasing number of countries are recognizing the importance of international harmonization in renewable energy tracking and trading. As more nations adopt the iREC framework, the demand for these certificates naturally grows.

- Growing Cross-Border Trade: With the globalization of energy markets, businesses and countries are increasingly looking to source renewable energy from various locations. iRECs enable them to reliably trace the origin of this renewable energy, making cross-border transactions more transparent and efficient.

- China’s Entry into iREC: An especially notable development in 2023 is the establishment of China’s first accredited iREC issuer. As the world’s largest emitter of greenhouse gases, China’s entry into the iREC system signifies a significant step towards promoting renewable energy and reducing carbon emissions on a global scale.

GO Consumption Matching Requirements

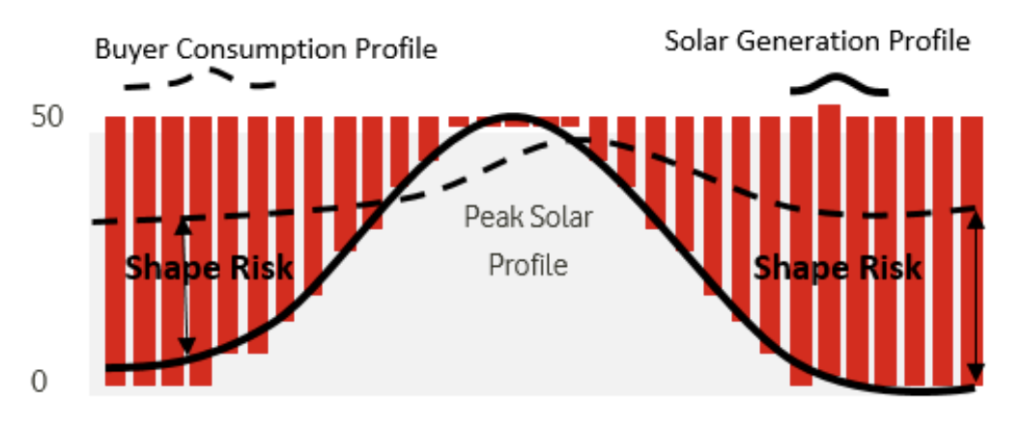

One of the notable future trends to closely observe in the renewable energy certificate market is the emergence of new reporting and regulatory requirements. These requirements aim to ensure that the volumes of Guarantees of Origin (GOs) procured by businesses match their actual energy consumption patterns on a more granular level, such as a monthly or even a 24/7 hourly basis. While this development aligns with the goal of achieving greater transparency and accuracy in renewable energy reporting, it presents a substantial challenge to market participants.

As an example, today, corporate buyers are only required to align their purchase of renewable energy certificates with an annual consumption over 12-month basis, allowing them to make claims of being “100% renewable.” This method is widely endorsed by current certificate standards and is in line with the Green House Gas (GHG) Protocol Scope 2 guidance. However, this requirement can be soon modified to more granular reporting requirement.

Annual matching, in practice, allows consumers to buy all their certificates within a 12-month period, such as those originating from a solar PV plant during the summer, and apply them to their energy consumption throughout the year, even during nighttime in the winter. This requirement may sound quite relaxed. This means that buyers may wait out for better market opportunities rather than paying real-market supply demand prices when they actually consume.

Google and Microsoft have both made commitments to reach ‘24/7 clean energy’ by 2030. Other organizations have since announced interest in and commitment to 24/7 clean energy sourcing. Regulatory policies are also indicating a future preference for more granular reporting. Another factor pointing out the changing trend from national market price to zonal market pricing for both EAC and Energy.

Also, this means that PPAs with baseload profile products may no longer be sufficient to enable corporations to claim zero carbon emissions. Although, a grandfathering rule will likely apply to signed PPAs.

Finally, the forthcoming RED III regulation within the European Union is poised to eliminate the 1 MWh fixed size requirement for Guarantees of Origin (GOs), which is the case today. This significant change signifies a clear roadmap indicating that GOs amounts procured will have to be aligned to actual energy consumed on a more granular basis.

GO Forward Market

As the worth of certificates becomes increasingly significant, stakeholders in the market will explore options to mitigate their price volatility. Similar to how forward markets exist in power markets, the establishment of forward markets for Guarantees of Origin (GOs) will become essential, offering both buyers and sellers a valuable instrument for hedging and effectively managing price fluctuations.

The establishment of a Guarantees of Origin (GOs) market will create opportunities for smaller consumers to acquire time-stamped GOs, verifying their use of environmentally friendly electricity. This eliminates the need for these smaller consumers to engage in a complex and expensive Power Purchase Agreement (PPA) process, which has typically been accessible only to larger consumers due to financial considerations.

Furthermore, this will empower smaller consumers to make a significant environmental contribution without the necessity of assuming long-term financial risks related to price or volume, as the increasing demand for GOs will incentivize the integration of more renewable resources into the grid. At the same time, larger corporate consumers will be able to offer the immediate and flexible renewable energy supply option to their entire supply chain).

In countries where support mechanisms like Contracts for Difference (CfD) are in place, it’s crucial for the CfD framework to incorporate certificate prices. This means that power producers engaging in CfDs should have certificate issuance (like in the UK today) and free trade for certificates from subsidised renewable installations. As an example, Spain historically has forbidden export of GOs outside of Spain for subsidised assets.

A fifteen-year commissioning or re-powering date limit

The introduction of a fifteen-year commissioning or re-powering date limit by RE100 last year has shaken the renewable energy landscape, impacting dynamics of Guarantee of Origin certificates (GOs). This new policy, aimed at encouraging companies to invest in more recent and technologically advanced renewable energy projects.

The crucial aspect of this policy is the time limit of fifteen years. To be eligible for certain benefits or recognition, a renewable energy project must have been commissioned (built and put into operation) or re-powered (significantly upgraded) within the past fifteen years. Projects that exceed this time limit would not qualify.

From a demand perspective, the new date limit has stirred greater interest among businesses committed to achieving 100% renewable energy goals. These organizations, part of the RE100 initiative, must now adapt their procurement strategies to align with the policy. As a result, they are actively seeking GOs from eligible projects, thereby driving up demand for GOs associated with renewable facilities commissioned or repowered within the specified timeframe.

If you want to learn more about RE100 Market Boundary Rules and what has changed in 2022, you can follow this article.

Characteristcs to consider with Renewable Energy Certifficates

- Environmental Attributes: High-quality EACs always convey RE usage claims, though some also contain additional attributes, such as avoided emission benefits.

- Location: Proximity of renewable generation to electricity consumption.

- Technology: Type of renewable resource, including solar, wind, geothermal, biomass, and hydro.

- Co-benefits: Additional benefits provided by projects beyond environmental attributes, such as creating jobs in a local community or maintaining pollinator habitats.

- Registration: Electronic tracking systems that exist in many markets to track the ownership of an EAC. Different regions may use different tracking systems to validate ownership.

- Regulatory Interaction: The regulatory environment of each market can influence the impact of EAC procurement. For example, some market structures allow voluntary purchasing to be incremental to generation required by government mandates.

- Reporting Value: Reporting platforms (e.g. CDP and RE100) and voluntary certifications (e.g. Green-e® and LEED) may require EACs to meet specific criteria, such as those relating to geography, vintage, facility age, and third-party certification.

- SDGs: EACs may meet the criteria for specific UN Sustainable Development Goals (SDGs).

Future GO Price Outlook

For the price of Guarantees of Origin (GO) certificates to decrease, a significant surge in renewable energy supply would be required. However, the current challenge lies in the fact that investments in renewable energy projects are not keeping pace with the high demand for renewable energy.

Analysts at S&P Global Commodity Insights forecast average solar and wind GO prices in the range Eur5-8/MWh from 2023-2030. However, I would not be surpised to see spikes even above 10 EUR/MWh level.

Thank you for taking the time to read our article on the renewable energy certificates market in 2023. I hope you found it informative. If you enjoyed this article and found it valuable, please share with your friends and family.

There is also a range of books and professional materials to help businesses navigate the world of renewable energy procurement.

Together, we can make a positive impact on our environment and promote the adoption of renewable energy solutions. Thank you for being a part of this important journey towards a greener future.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.

Excellent presentation.

I am curious about the possibility for solar and wind plant to sell besides Carbon Credits also GOs certificate. ( I am advising several developers to finance the structuring the Authorization process; i support investors to arrange the financial resources to construct the plants )

It is intuitive that it is possible to benefit either from Carbon Credits either from GOs. If this is confirmed how it is possible to sell GOs – conventienly certified- on the “ compliance market “ and not on the voluntary market?