Table of Contents

A few words about Energy crisis 2022/23

Energy market prices have begun the new year considerably down as mild winter weather and global economic concerns weigh on the market. The situation is opposite to the one in 2022 when Russia’s invasion of Ukraine sparked fears about energy supply, sending prices skyrocketing. European natural gas has been a special emphasis since Russia cut off practically all pipeline exports to the area.

The benchmark European gas contract, Dutch TTF, plummeted more than -75% from its peak in Aug 2022.

One can describe such a big downward correction that the market is confident that should another cold snap materialize over the following several months, there is enough gas in storage and flows in liquefied natural gas to see us through this winter.

While a European energy crisis is unlikely to occur this winter, market players are worried about the winter of 2023/24. Traders are concerned that as China’s economy reopens following the end of its zero-covid policies, Europe will struggle to access the same amount of LNG.

But will Europe be able to withstand no gas next winter?

The IEA has written a paper on How to Avoid Gas Shortages in the European Union in 2023. You can find more details here. This article will summarize the main recommendations IEA proposed to avoid an energy crisis next winter 2023/24.

European and global natural gas markets are not yet out of danger created by Russia’s cuts to pipeline deliveries of gas. Mild weather has played a big part in compensating for the missing Russian deliveries this winter.

Several key factors could make 2023 even more challenging for Europe:

- Russian supplies may have a further fall. Total gas volumes delivered by pipeline from Russia to the European Union throughout 2022 are set to be around 60 bcm. However, the deliveries can be zero in 2023.

- Supplies of liquified natural gas (LNG) might be tight. The European Union as a whole is set to add an estimated 40 bcm of LNG import capacity by the end of 2023. However, only around 20 bcm of additional LNG supply is expected to come onto the market over the year. Meanwhile, Chinese import demand could recover from the unusually low levels seen in 2022, intensifying competition for LNG cargoes.

- The unseasonably mild temperatures seen at the beginning of winter may not last. There is no guarantee that temperatures will be as forgiving for the remainder of the winter or 2023.

Suppose pipeline imports to the European Union from Russia drop to zero in 2023, and Chinese LNG demand rebounds to 2021 levels. In that case, the European Union faces a severe supply-demand gap opening in 2023.

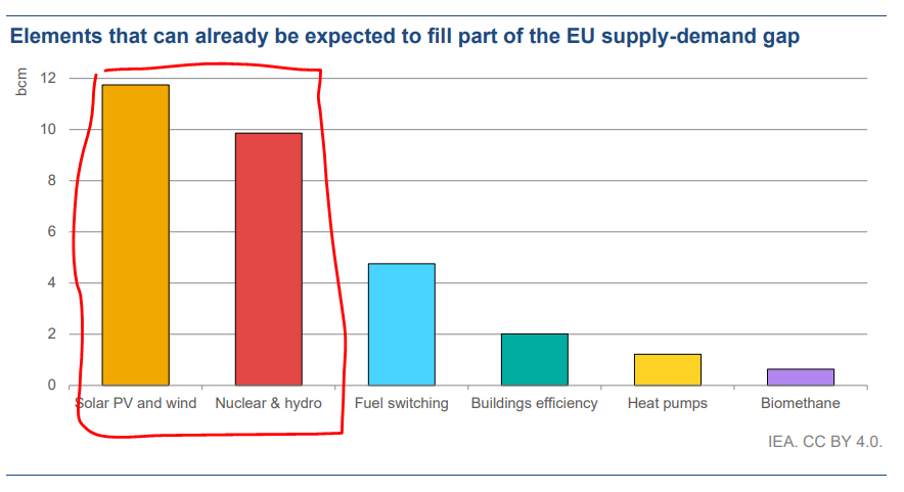

IEA predicts that there can be around 57 bcm of gas supply shortage in 2023, where 30 bcm is already covered by actions. A recovery in nuclear and hydropower output from the decade low levels in 2022 may help to lower the gap. Still, it remains to be discovered, considering the recent unreliable forecasts by EDF.

The additional actions that IEA foresees for the EU to lower the gas supply gap will require around EUR 100 billion in investments.

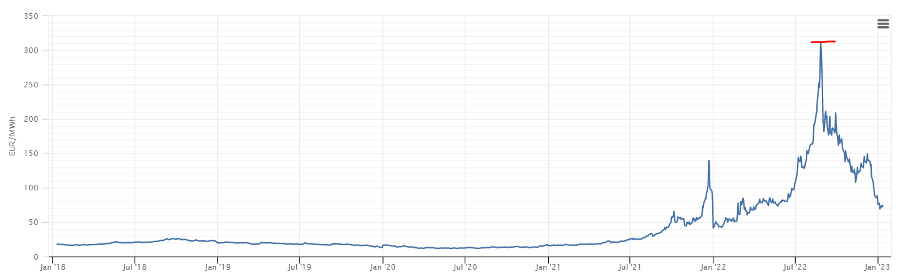

Russian pipeline shipments of natural gas to the European Union have been reduced by more than half since it invaded Ukraine. Russian pipeline supplies are anticipated to plummet from 140 bcm in 2021 to about 60 bcm in 2022, significantly impacting several power markets. Natural gas prices on European hubs reached record highs due to the supply shock brought on by Russia. During 2022, TTF Y+1 forward price benchmark reached 312 EUR/MWh vs 25 EUR/MWh historically, more than 12 times higher than the historical average.

TTF Y+1 Forward Gas Contract

Prices at these levels encouraged greater exports of LNG gas to the European Union. The amount of LNG imported by the EU is anticipated to rise by around 60% (or 50 bcm) in 2022 compared to 2021. The majority of this extra LNG supply came from the United States. As a result, Europe became much more dependent on the worldwide LNG market.

China’s decreased LNG imports, which are projected to fall by 20% (or over 20 bcm) in 2022 from levels in 2021 due to slower economic development and Covid-induced lockdowns, helped to contribute to the high LNG inflows to Europe in 2022.The energy crisis has also significantly affected the European Union’s gas demand, which is anticipated to decline by more than 10% (or around 50 bcm) in 2022. The major causes of this include lower gas use in the commercial, industrial, and residential sectors due to fuel switching, decreased output, behavioral reactions to high costs, warmer-than-average weather, and efficiency improvements. However, gas demand in power generation increased in 2022 vs. 2021 due to historically low nuclear and hydropower generation output.

The European Union has been able to build its gas storage levels by a record amount so far in 2022 thanks to a combination of decreased consumption, a significant rise in non-Russian gas supply, and unusually warm weather through early October and December.

High storage levels and lesser demand pushed natural gas prices lower, reducing the possibility of physical gas supply shortages during the 2022-2023 heating season. However, the situation can change by 180% degree in 2023. This is because several factors supported the European gas victory in 2022:

- Russia reduced deliveries significantly in 2022 but provided the European Union with 60 billion cubic meters through the pipeline during last year.

- China imported less LNG than historically due to prolonged Covid lockdowns.

- Unreasonably mild weather in the first half of winter 2022/23

Will hydropower and nuclear generation bounce back in 2023?

Hydropower in the European Union is expected to fall by about 20% in 2022 compared to the previous year, mainly owing to decreasing output in southern European markets. IEA expects the hydropower output to rebound to its five-year average in 2023, increasing electricity supply by 45 terawatt-hours (TWh) and decreasing gas consumption by about 8 bcm.

Nuclear generation is expected to drop roughly 20% in 2022 compared to the previous year, mainly due to reduced generation in France and Germany. Nuclear power generation in France fell by a quarter due to facility maintenance and unscheduled outages. Under the country’s plan to progressively phase down nuclear power, nuclear generation in Germany is scheduled to drop to half its 2021 level in 2022 (a loss of 30 TWh).

Germany’s three remaining nuclear power stations, Emsland, Isar 2 and Neckarwestheim, have a combined capacity of 4 gigatonnes (GW), and their shutdown has been delayed from the end of 2022 to mid-April 2023. Belgium has also reconsidered the timetables for shutting down several of its existing nuclear facilities.

Overall, increased French nuclear power output in 2023 is expected to be significantly countered by decreases in Germany and plant closures in Belgium (Doel 3 in September 2022 and Tihange 2 in February 2023). IEA anticipates that EU nuclear power output will grow by roughly 2% (or 10 TWh) in 2023, saving only 2 billion cubic meters of gas.

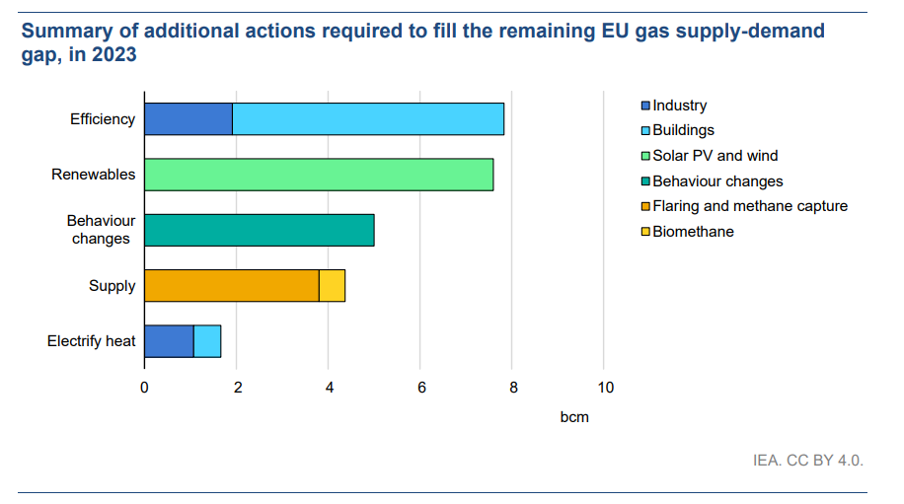

This leaves a gap of 27 billion cubic meters that must be filled with further efforts to meet the criteria of refilling gas storage levels to 95% and ensuring gas supply security until the spring of 2024 without putting an excessive burden on markets and European consumers.

According to the IEA, these five categories do not reflect a comprehensive agenda for advancing energy transitions. The purpose here is more specific: to add 27 billion cubic meters to the European Union’s gas balance by 2023 in methods consistent with the EU’s energy and climate objectives. The majority of the answers will be found through reduced demand for natural gas, increased efficiency, quicker deployment of renewables, behavioral changes, and heat electrification.

If you liked this article, please leave your comment below.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.