European power prices rise since the post-covid recovery. The main reasons are:

- Post-Covid pandemic recovery

- China’s demand

- Low renewable production

- The war in Ukraine

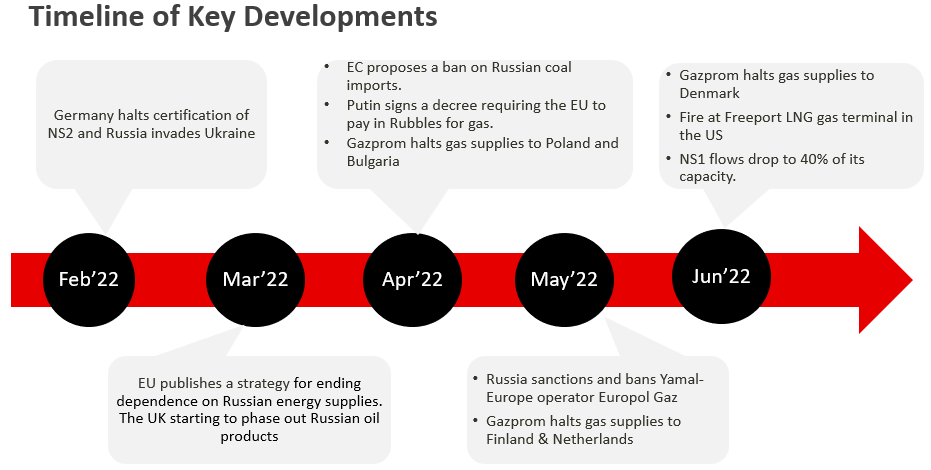

The war in Ukraine has obviously pushed gas and power market prices to a new historical high level never seen before. The market price volatility has also increased from 20-30% to above 60%. Let’s take a look at the key market developments post the war outbreak in Ukraine below.

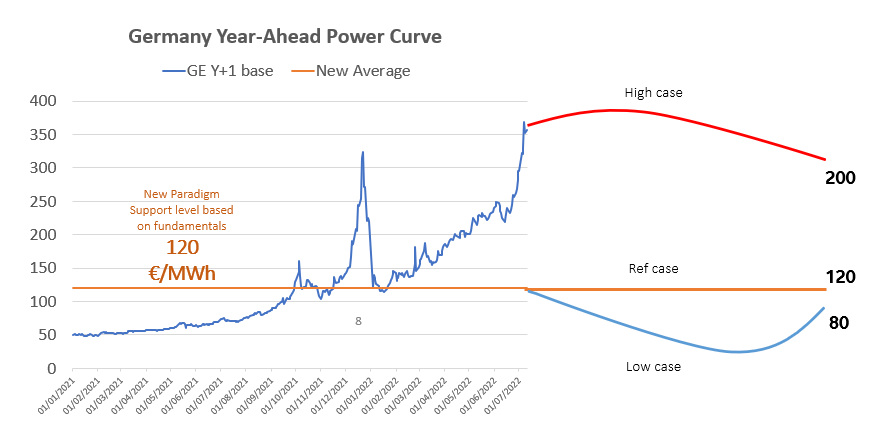

A combination of the above factors has led electricity prices from 50-60 EUR/MWh historically to above 300 EUR/MWh on the market today. The latest news about the explosion at one of the biggest US liquefied natural gas export terminals and the further reduction of Russian gas supply through the Nord Steam to 40% capacity has created a lot of panic on the market.

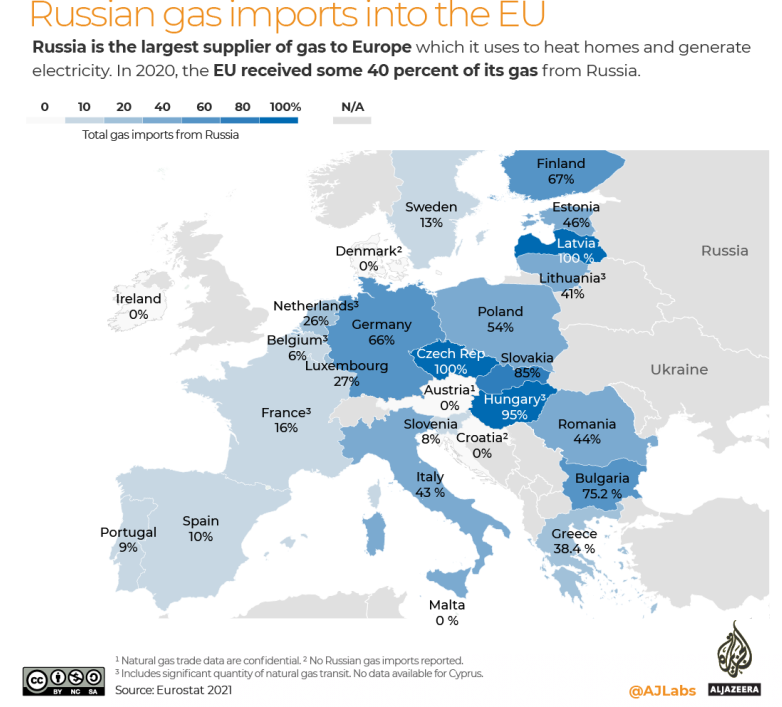

Moreover, the Nord Stream will be completely shut down from 11th to 21st of July because of planned maintenance, and there’s a risk that flows will not return after that. This is major news for the European Union because more than 40% of its total gas consumption, 27% of its oil imports, and 46% of its coal imports came from Russia. The EU imported €99 billion worth of energy from Russia or 62% of its total imports in 2021. Gas still remains a critical energy fuel for sustainable and secure decarbonization of the global energy system.

As a result of the reduced Russian gas flows to EUrope, in July 2022, the TTF Y+1 gas market price has risen approximately 50% only in the past 6 trading days, breaking above the prior historical high at 140 EUR/MWh, and there’s no stopping of the bullish trend in sight for now.

Therefore, considering the above factors, when we look forward, we don’t foresee much bearish news for this year. Market analysts expect that if Europe were to permanently lose Russian gas this year, the gas prices can reach well above 200 EUR/MWh. With the gas price at that level, the power price will be around 400-500 EUR/MWh unless the EU disconnects the power from gas prices and/or regulates gas market prices. This will be almost a 10x price increase since Jan’21.

Besides the complete loss of the Russian gas, we can observe the following risks:

- The gas refilling rate;

- French nuclear availability;

- Natural disasters at global commodity production centres & Hot summer in Assia;

- The rise of CO2 emission cost as per Fit for 55 EU legislation.

With that said, a new historical Average Power Curve won’t be the same due to:

- The expected higher gas market price for the next 1-3 years as supplied from Russia declining. Europe doesn’t have a sufficient capacity of LNG terminals to replace the Russian gas in the short to medium term;

- The rising emission costs as a part of the EU FiT for 55 legislation.

The current Cal23 forward price in Germany is 360 EUR/MWh vs 50-60 EUR/MWh in the past. The reference case scenario forecast for the next 3-5 years is ~120 EUR/MWh subject to the Russian-Ukrainian conflicts ending soon and Russian gas continues to flow to the EU. However, if 40% of Russian gas supplies to the EU are lost, we can see the market average price over the next 5 years well above 200 EUR/MWh. The recession will obviously lead to market price relief but is limited to around 80 EUR/MWh in the best-case scenario.

Bearish factors would be:

- Thee possible price cap for gas/power markets by the EU;

- The prolonged pandemic in China and other big economies;

- Deterioration of the world economy leads to a strong reduction in demand;

- Renewable capacities continue to grow but not materially in the short term;

- Strong LNG send-outs to Europe from USA and Qatar;

- Increased French nuclear availability.

Outlook

The European energy system remains highly fragile with the upcoming winter period. Europe will likely see above the historical average power prices even if the War in Ukraine were to end today and even if there’s a recession.

In the event of an immediate halt to Russian gas imports, power prices in Europe could double from here by the end of 2022. Germany, Italy, Czech Republic and Hungary would be impacted the most due to their high reliance on Russian gas share. Industrial demand can be turned down even further.

If you want to learn more about the European power market drivers, please check my next article here. Because in the previous article we have already talked about the power prices rise as the war in Ukraine can be sustained.