Table of Contents

What is a Power Purchase Agreement (PPA)?

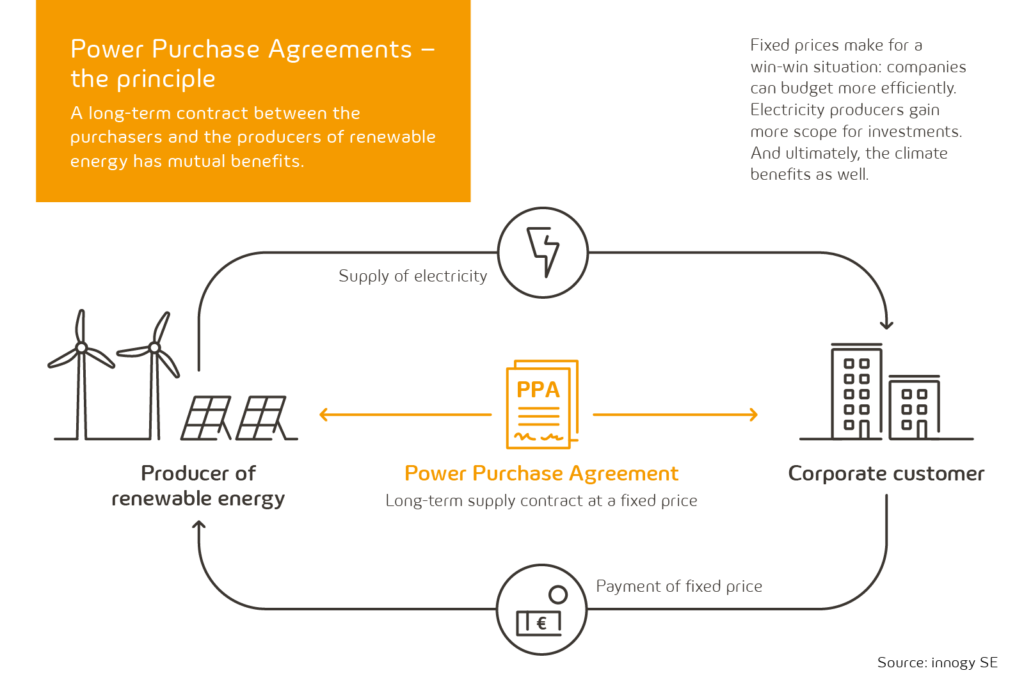

Power Purchase Agreement (PPA) allows companies to purchase renewable energy directly from a renewable generator or supplier. They are typically relatively long-term, fixed-price offtake agreements that provide the generator with longer-term revenue certainty and the corporate with longer-term electricity cost predictability and renewable credentials. There are several different types of PPAs and many different types of assets that can be contracted through a PPA. The standard procurement power purchase agreement templates, including general heads of terms, can be found here.

Why is PPA an attractive energy supply solution for corporates?

- Cost Competitiveness. Potential to reduce costs for companies’ energy procurement strategies, both in wholesale energy prices as well as transactional costs. PPA can act as a hedge at a fixed price for a number of years.

- Corporate Responsibility. Ability to meet companies’ 100% renewable energy objectives. PPAs offer the opportunity to be directly associated with renewable assets for a stronger PR.

- Management Control. Potential reduction in operational contract management complexity via the long-term PPA contract relationship. PPAs also offer cost certainty across a longer horizon than the conventional energy procurement strategy in wholesale organized power exchanges.

The difference between PPA baseload price and “pay-as-produced”?

The gap between the production cost of renewable electricity and energy market prices today is significant, which unlocks an opportunity to secure market cost advantage savings for many corporate buyers. Several studies show that a 10-years fixed PPA price can generate 10-20% discount vs conventional power forward hedging strategies. Therefore, corporates need to consider this type of power purchase agreement as a main part of their energy procurement strategy long-term.

The most common approach for assessing the competitiveness of a PPA proposal is to compare the price vs the forward market baseload power curve projection. However, it’s still important to understand typical PPA price structures to assess their competitiveness and make a calculated decision.

In general, there are 2 main PPA price structures available in the market: Baseload or Pas-as-produced (“non-baseload”) PPA price concepts.

Baseload power means a fixed amount of electricity production over a certain period of time. Large coal, hydro or nuclear plants are generally called baseload power generation assets because they are able to produce the same amount of energy every day without being affected by external weather conditions.

However, renewables are intermittent generation, and as a result volume amount is different every hour as it’s linked to the sun’s radiation or how the wind is blowing. Therefore, there’s always a generation volume risk that comes with renewable assets.

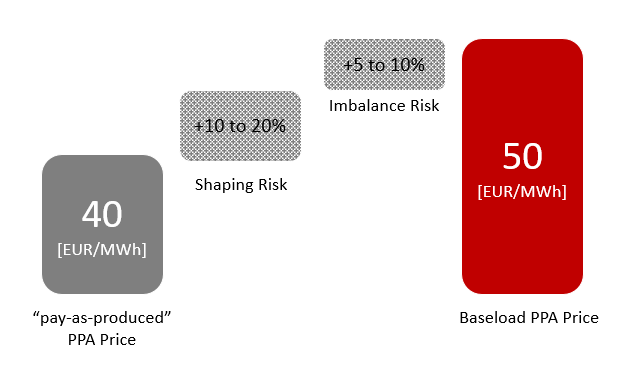

When talking to a renewable power producer about a long-term off-take PPA proposal, you usually receive a “pay-as-produced” price quotation. But this price can’t be compared with the conventional baseload wholesale power because of the different value components included. Therefore, in order to be able to compare a “pay-as-produced” or “pay-as-generated” PPA proposal, it’s key to understand PPA baseload power conversion risks. The add-on costs to be considered in order to covert “pay-as-produced” into baseload power are:

- Shaping Risk (Hourly Profile Costs)

- Imbalance Risk (electricity volume generation risk)

If you are looking for an all-in-one guide for managing shaping and imbalance PPA risks, please check the PPA Head-of-Terms (HoT) Playbook.

Shaping Rik. This is the difference between a customer’s volume demand vs renewable asset generation supply. For example, a typical solar PV installation would have its peak production during daytime hours, while a restaurant business may have its demand peaking during after-work hours. Therefore, the mismatch between power generation and consumption demand shall be managed at the intra-day power market prices. When power generation volume doesn’t have much customer demand, the company runs the risk of having to make up the difference at a time when the spot price may be much higher.

Imbalance Risk. This extra cost is incurred by intermittent generation assets such as Solar or Wind. The electricity market regulator would typically require submitting a generation output forecast the day ahead of the production. Then, if there’s a difference between actual production the next day and the day-ahead forecast, this leads to the market imbalance and therefore constitutes a system cost, which needs to be paid to the electricity system operator in the form of imbalance charges. And with the increasing penetration of renewable assets into the market, it’s likely the imbalance charges will continue to increase into the future. On the one hand, improving forecasting technologies could help reduce balancing costs.

To conclude, a customer may choose to manage the shaping/imbalance risks by himself or try to pass it to the PPA provider. This depends on PPA contract architecture and supplier profile you deal with. A general rule of thumb is to add 10-20% on top of a PPA “pas-as-produced” price in order to get an indicative PPA baseload value that could be later compared with the wholesale electricity price forecast. To learn more about PPA contract risks and how to address them, please check the next article here.

Shall you need help with an evaluation and benchmarking of PPA proposals received, including PPA cost teardown, feel free to reach out to me via the contact form. For comments/questions, please leave them below.

If you want to learn more about different types of Power Purchase Agreements (PPA), please check my next article here. Comments below if you liked this article. This means a lot to me. Thank you!

For those interested in delving deeper into the procurement of renewable electricity through Power Purchase Agreements, there’s a comprehensive book available for further exploration of the topic.

What is a Power Purchase Agreement (PPA)?

Power Purchase Agreement (PPA) is a long-term agreement for procuring renewable electricity directly from a renewable asset owner, typically wind or solar.

Why PPA an attractive energy supply solution for corporates?

Power Purchase Agreements (PPAs) can help buyers reduce their electricity cost basis, improve budget certainty over a longer period, and enable them to meet corporate sustainability objectives.

What is the difference between PPA baseload price and “pay-as-produced”?

In an annual baseload PPA, a buyer agrees to buy a determined volume of energy for every hour over the year, while “pay-as-produced” PPA price structure gives the buyer intermittent renewable output from the asset.

Pingback: (2022) How To Prepare PPA Head Of Terms To Lead Negotiations? | Futrue Energy Go

Pingback: (2022) The Universal Guide To Renewable Certificates Procurement To Achieve 100% Renewable Electricity Target For Corporates | Futrue Energy Go