Table of Contents

Introduction

In a pivotal move toward a more sustainable future, RE100, the global initiative committed to promoting corporate renewable energy use, made a significant announcement on October 24, 2022. The organization revealed substantial changes to its technical criteria, marking a big moment for companies striving to achieve 100% renewable energy consumption.

Effective from January 1, 2024, RE100 companies are now mandated to procure Guarantees of Origin (GO) certificates exclusively from facilities that have been in operation for less than 15 years.

This transformative shift sets a clear trajectory for businesses worldwide in their pursuit of renewable and more environmentally responsible operations.

Last month, the European Council embraced REDIII, elevating the target for the proportion of renewables in the EU’s minimum gross energy consumption from at least 32% to 42.5% by the year 2030. This also impacts the dynamics of Guarantees of Origin GO market prices.

Developments of Guarantees of Origin GO Market Prices

As we look ahead, specifically 2024, the European Guarantees of Origin (GO) market reveals a complex scenario marked by a pronounced oversupply, primarily attributed to the influx of Nordic Hydro GOs. The Nordic region, renowned for its abundant hydroelectric resources, has witnessed a surge in GO issuance, creating a surplus that has put GO market prices under pressure. This oversupply is anticipated to persist as several power plants, once excluded from GO eligibility due to public subsidy supports, will soon be eligible for the GO issuance.

Another contributor to the market dynamics is the recent implementation of a GO ban by the United Kingdom. This move has introduced a regulatory constraint, further amplifying the oversupply and sustaining a bearish trend in the EU GO market. The UK’s decision to restrict EU GO imports impacts not only the domestic market, where UK REGO prices reached above 20 £/MWh, but also the broader European context.

Despite the backdrop of oversupply, the demand for GOs is poised for an upswing, notably from members of the RE100 initiative. As companies within the RE100 collective intensify efforts to fulfill their commitment to 100% renewable energy sourcing, the demand for GOs is expected to rise.

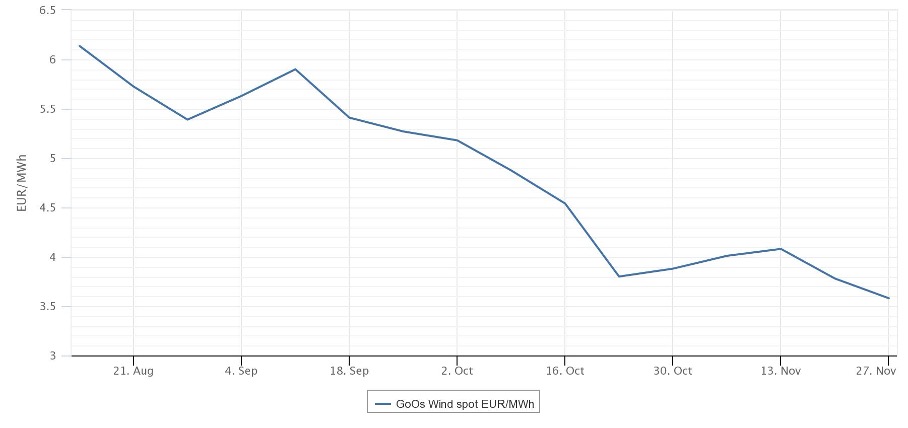

GO Wind Spot Price

In light of these intricate market dynamics, the price of GOs (especially from new built Wind and Solar assets) is anticipated to oscillate between 5 and 6 EUR/MWh throughout 2024. This range reflects the ongoing tension between an oversupplied market and the increasing demand from companies striving to meet their renewable energy goals. In later years, the demand is expected to increase more rapidly. Hence, corporates should shift the focus from short to long-term GO procurement practices.

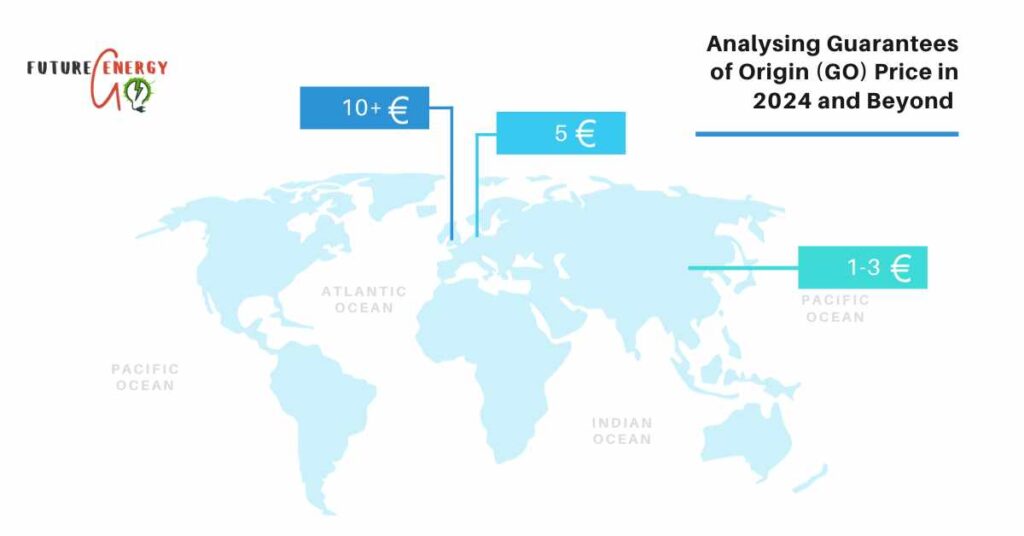

iREC Asian Market Price

The Asian market, specifically represented by International Renewable Energy Certificates (iRECs), averages around 1 EUR.

However, a demand shift is underway as more international companies pivot their focus towards Scope 3 emission reduction strategies. As sustainability practices become increasingly integral to corporate agendas worldwide, the increased attention on Scope 3 emissions may contribute to the price spread narrowing down between the European Guarantee of Origin GO market and its Asian counterparts.

The evolution of global sustainability priorities is poised to influence market dynamics, potentially narrowing the price differential and fostering a more interconnected and harmonised international landscape for renewable energy certificates.

Implementing a Hedging Strategy for GOs

As the value of Guarantees of Origin (GOs) has undergone a remarkable surge, experiencing a tenfold to twentyfold increase in recent years, the associated market dynamics have introduced a high level of exposure and risk for corporates engaged in renewable energy procurement.

Given the substantial financial implications at stake, a strategic response is imperative. Recognising this need, corporates may consider implementing robust hedging strategies tailored to the unique intricacies of the GO market. These strategies aim to provide a proactive approach to managing procurement practices and mitigating potential financial impacts from market fluctuations.

Future Energy Go offers comprehensive solutions for implementing effective hedging policies aligned with companies’ risk profiles and renewable energy goals, fostering resilience and stability in the face of market uncertainties.

RE100 Technical Criteria Update

Electricity must be procured from new power generation facilities, and GO certificates must be purchased from facilities in operation for 15 years or shorter, with the directive allowing for an exemption of up to 15% of a company’s total electricity consumption. Contracts with operational commencement before January 1, 2024, are also exempt.

The changes in technical criteria, specifically the requirement for RE100 companies to procure Guarantees of Origin GO certificates from facilities operational for 15 years or less. Given that a substantial portion of Hydro certificates currently originates from Norwegian hydro-powered plants, many of which surpass the 15-year threshold – considering that the average age of hydropower and dam infrastructure stands just below 50 years – a notable shift in demand for GOs from solar and wind sources is expected within the EU.

While these changes are to take effect from 2024 onward, the disclosure of certificate cancellations by RE100 companies is scheduled for 2025, adhering to an annual reporting cycle. This could bolster demand for new renewable electricity capacity among members.

Renewable Energy Directive (RED III)

On October 13, the Council officially adopted the Renewable Energy Directive (RED III), with its primary objective being the elevation of the renewable energy share in the European Union’s gross energy consumption.

This ambitious goal aims to raise the minimum from 32% to 42.5% by the year 2030. The directive introduces a mandate for Member States to establish supportive frameworks and measures, fostering the adoption of renewable Power Purchase Agreements (PPAs).

The main changes are:

- Defining the standard size of a Guarantee of Origin (GO) as 1 MWh/GO, with the flexibility to use fractions in multiples of 1 Wh when applicable.

- Clearer expiration rules: a 12-month transaction period and an 18-month cancellation period before the GO expires.

- Mandating gas suppliers (and other Renewable Fuels of Non-Biological Origins, or RFNBOs) to cancel GOs.

- Streamlining the registration process for small production devices.

- Modifying Power Purchase Agreements (PPAs) to eliminate barriers, enabling a more extensive range of potential off-takers to engage in these contracts.

- Establishing a monitoring plan to assess the balance between supply and demand in the GO market.

This shift is anticipated to result in an upsurge in Guarantees of Origin (GO) certificates associated with energy production. Noteworthy revisions include the introduction of a timestamp on certificates, aligning production with consumption on an annual basis, with GOs having a 12-month transaction period and an 18-month cancellability period before expiration. Member States are also obligated to disclose their residual mix, encompassing expired GOs. Lastly, RED III emphasizes the encouragement of ‘temporal granularity’ and real-time information on GOs, allowing EU member states the flexibility to issue certificates with smaller production periods down to hourly or quarter-hour intervals.

European Sustainability Reporting Standards (ESRS)

Commencing on January 1, 2024, the regulations set forth by the Corporate Sustainability Reporting Directive (CSRD) will usher in a new era of transparency. This directive mandates a comprehensive reporting framework, compelling covered entities to divulge a nuanced spectrum of information. Notably, organisations falling under the purview of the CSRD will be obligated to disclose both location-based and market-based emissions resulting from purchased electricity, heating and cooling.

Such reporting requirements are poised to catalyse a more accurate and holistic comprehension of the environmental impact of organisational activities, thereby fostering accountability and steering entities towards sustainable practices.

- GOs are the primary tool for recording renewable energy usage, as per the directive. The directive insists on using contractual instruments, including GOs, to demonstrate renewable energy consumption.

- Both market-based and location-based methods are required.

- More companies will need to report under CSRD rules in the upcoming years.

Carbon Border Adjustment Mechanism (CBAM)

The transitional phase of CBAM commenced on October 1, 2023. Industries importing goods into the EU with high carbon intensity are now required to adhere to European reporting regulations.

In the future, these industries will need to acquire CBAM allowances, priced similarly to EU ETS. Sectors currently covered by the directive include cement, iron and steel, fertilisers, electricity, aluminium, and hydrogen. Further details on CBAM can be found here.

Other Highlights

The Chinese government declared the broadening of Green Energy Certificates (GECs) as the exclusive Environment Attribute Certificates (EACs) permissible in the country. An ongoing investigation is in progress regarding the operational dynamics of these certificates in conjunction with I-RECs, adding an element of uncertainty to Chinese policy procedures.

GO Market Outlook & Conclusions

The forthcoming years are poised to witness an upward trajectory in Guarantees of Origin (GO) prices, predominantly propelled by the recent mandate imposed by the RE100 new technical criteria. The revised requirement stipulates that RE100 companies are prohibited from utilising GO certificates obtained from facilities that have been operational for 15 years or longer.

Therefore, a transformative shift in demand dynamics is inevitable. Notably, the average age of Norwegian hydropower and dam infrastructure, a significant source of GOs today, hovers around 50 years. This restriction redirects the focus of RE100 companies towards alternative, newer renewable energy sources. Consequently, the demand landscape is set to pivot towards smaller available capacities of solar and wind assets, as these emerge as the preferred choices to meet the stringent criteria laid out by RE100.

As a result, the GO market is poised to experience a surge in demand for Solar and Wind assets, laying the foundation for a potential increase in GO prices in the coming years.

Moreover, it is essential to recognize that the trajectory of Guarantees of Origin (GO) prices may experience further acceleration due to the implementation of the ESRS reporting standard. This standard mandates large and medium-sized public companies to report their emissions, introducing a broader spectrum of entities into the realm of emissions transparency. As these organizations comply with the ESRS reporting requirements, an anticipatable consequence is a notable surge in overall demand for GO certificates, particularly within the timeframe spanning 2025 to 2027.

The Guarantees of Origin (GO) market relies heavily on renewable electricity production, with hydropower representing over half of the issued certificates. The market’s trajectory and pricing dynamics are intricately tied to hydropower conditions. Recognising this dependence is crucial in the GO market.

Therefore, it is anticipated that due to the new RE100 rules, Guarantees of Origin (GO) prices from newly established assets, i.e. wind and solar, may persist above the 5 EUR/MWh threshold. In contrast, EU Hydro GOs may exhibit a downward trend, potentially reaching the 2-3 EUR/MWh range.

While the Guarantees of Origin (GO) prices in 2024 may exhibit a degree of stagnation, the outlook for GO prices from Calendar Year 2025 onwards appears to be on a distinctly upward trajectory.

It’s important to note that alongside the anticipated surge in demand for Guarantees of Origin (GO) certificates, the supply of GOs is also expected to increase in the coming years. This uptick in both demand and supply dynamics should serve as a mitigating factor against significant and volatile swings in GO prices. Therefore, it is anticipated that the market price volatility will be moderated.

While the evolving landscape, driven by new regulations and sustainability initiatives, may propel demand upward, the parallel increase in the availability of GOs can act as a stabilising force.

This balanced growth in supply and demand underscores a potential scenario where, despite heightened market activity, GO prices may experience more gradual and controlled fluctuations, fostering a more stable pricing environment in the renewable energy certificate market.

The information provided above is for informational purposes only and should not be construed as official advice. Market dynamics are subject to various unpredictable factors, and individual circumstances may vary. Please seek professional advice and conduct thorough assessments before making any financial or strategic decisions.

If you found this article insightful and informative, we encourage you to share it with your friends and colleagues. Additionally, we welcome your comments and thoughts below. Feel free to share your insights, opinions, or any questions you may have. Your engagement is instrumental in creating a more collaborative and informed community. Thank you!

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.