Table of Contents

Introduction: Renewable Electricity Market Analysis

Welcome to Future Energy Go – the renewable energy market research community that strives to advance knowledge and understanding of the renewable energy market through data-driven research and analysis. This article offers a deep and comprehensive analysis of recent trends and developments in the electricity market and provides a forecast for 2024 onwards.

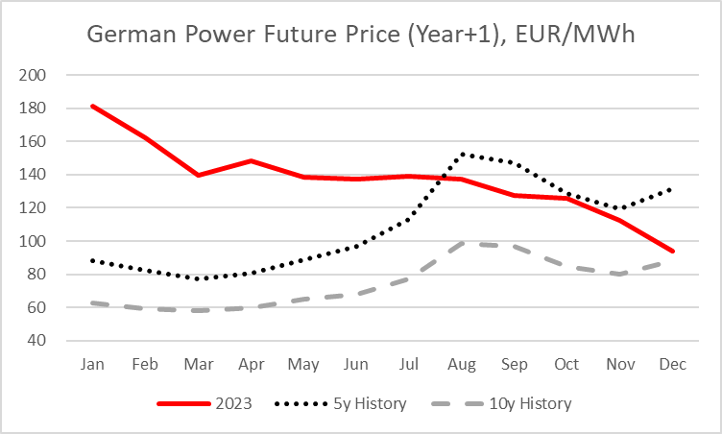

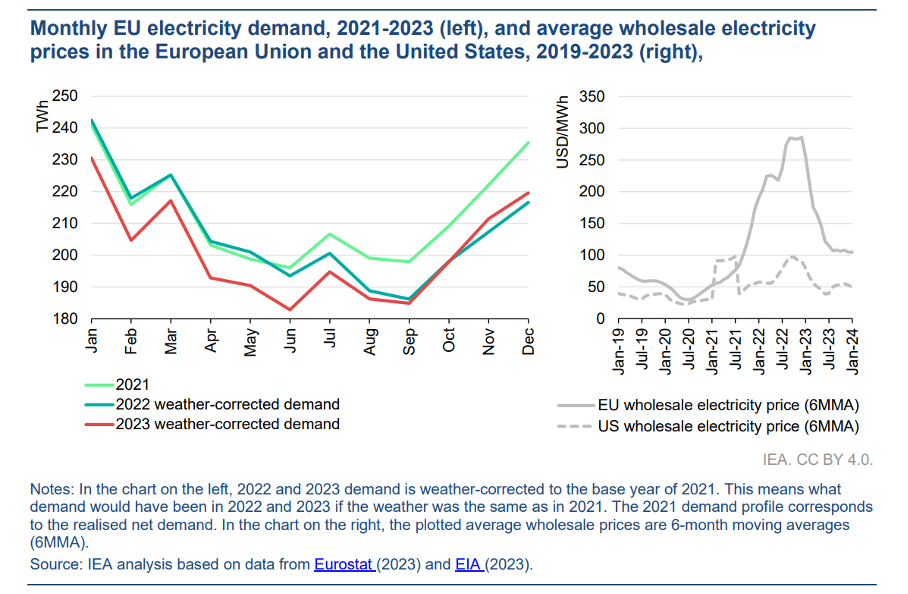

Throughout the course of 2023, the European wholesale electricity market has experienced a decline, although the market price is still at levels that exceed those seen in historical records. German Y+1 contract fell below the important price level of 100 EUR/MWh at the end of 2023. It trades at 73 EUR/MWh as of February 15th, 2024. These price levels are more in line with the pre-war historical level. Shall we act on this opportunity? First, it is important to understand macroeconomics, including the latest electricity demand projections and other market price drivers.

Electricity Demand & Consumption Projections

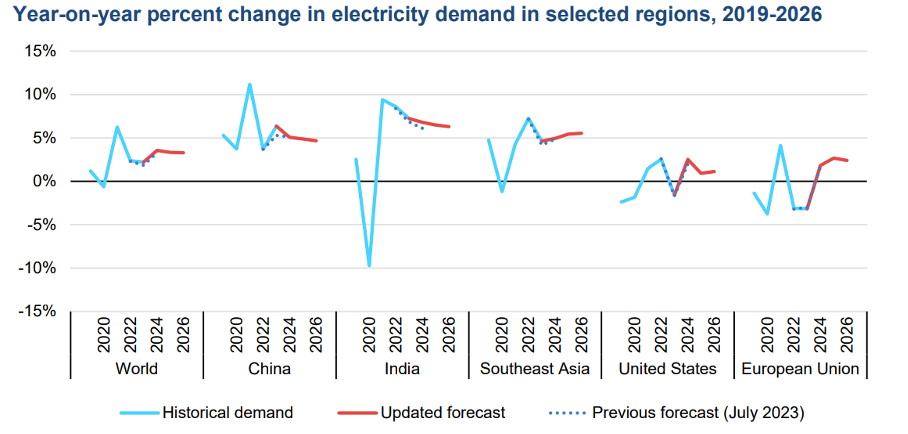

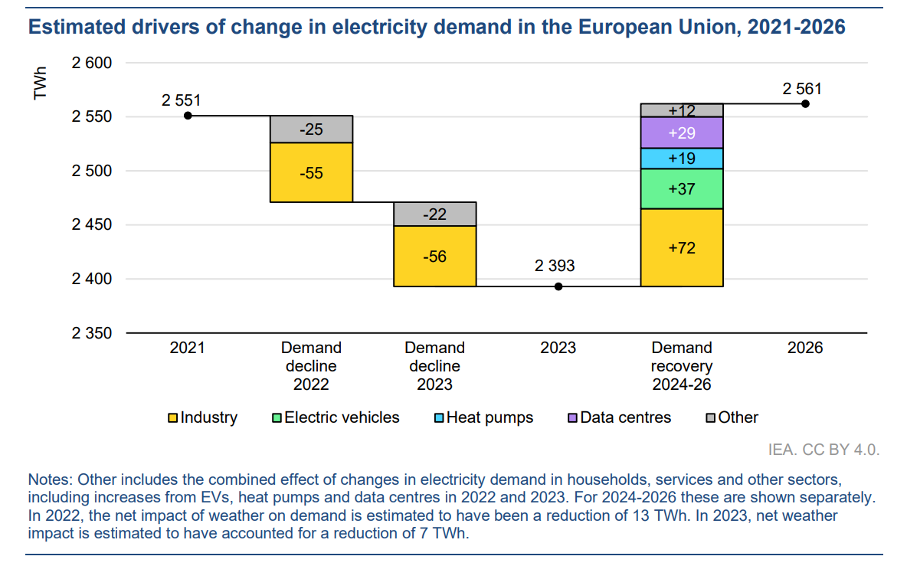

The IEA projects that electricity demand will increase fast in both developed and developing countries. Especially in advanced countries like those in Europe and the United States, and in China, more and more people are using electricity in their homes and for transportation. Additionally, there is a big growth in the number of data centres, which also contributes to the higher demand for electricity. However, in Europe, electricity demand is not projected to recover to 2021 level before 2026. From 2026 onwards, the demand will increase, supported by heatmaps, electric vehicles and data centers.

The amount of electricity used by data centres, artificial intelligence (AI), and the cryptocurrency industry might double by 2026A. Data centers play a big role in using more electricity in many parts of the world. In 2022, they used about 460 terawatt-hours (TWh) globally, and it’s expected to go up to over 1,000 TWh by 2026, IEA projects. To put it in perspective, that’s around the same amount of electricity that Japan uses.

The IEA also states that after a 3.1% decrease in 2022, the European Union’s (EU) electricity demand dropped by 3.2% compared to the previous year in 2023, reaching levels not seen in the past two decades. Just like in 2022, the main reason for this decline was lower consumption in the industrial sector. Even though energy prices went down, they stayed higher than before the pandemic. There are signs that some of the reduced industrial demand in Europe might be permanent, especially in industries like chemicals and metal production that need a lot of energy. These sectors will remain sensitive to sudden increases in energy prices in the future.

Energy Prices 2023

In 2023, the cost of electricity for industries that use a lot of energy in the European Union was nearly twice as much as in the United States and China. Even though there was a 50% decrease in prices in the European Union from 2022 to 2023, industries that need a lot of energy still had much higher electricity expenses compared to those in the United States and China. This situation persisted due to challenges following Russia’s invasion of Ukraine. As a result, the competitiveness of EU energy-intensive industries is expected to remain under pressure.

Also, jydropower generation was reduced in 2023 in numerous regions due to weather impact.

The Growth in Renewable Energy & Nuclear

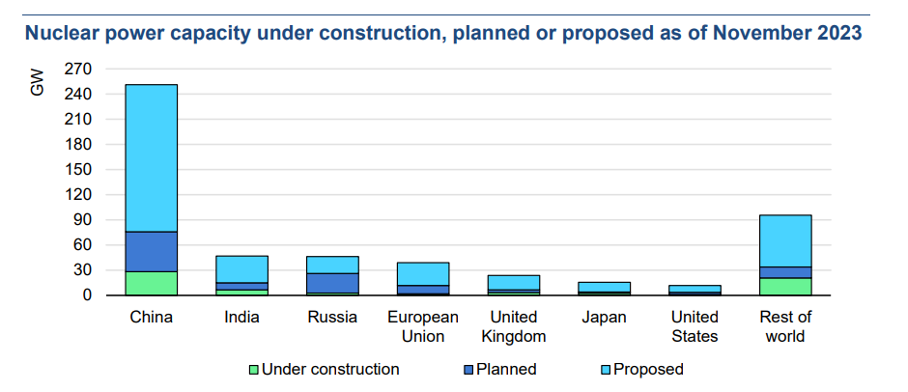

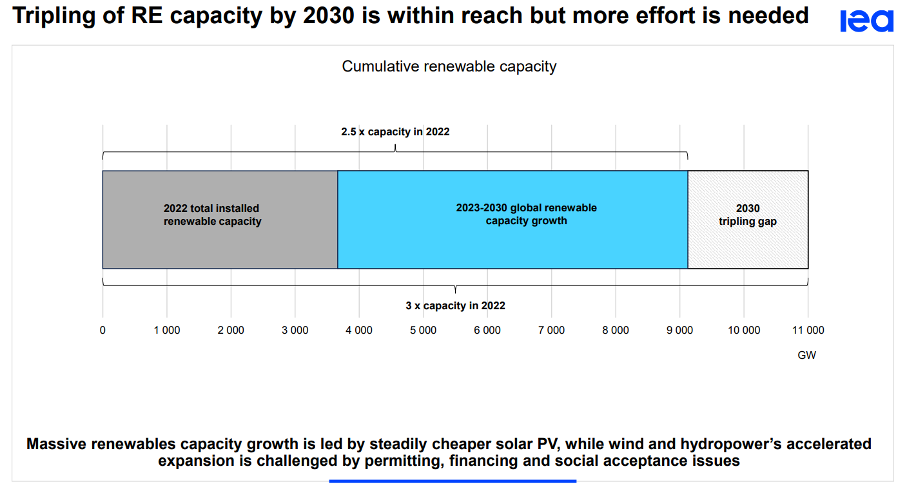

The IEA also states that the clean electricity supply is forecast to meet all of the world’s demand growth through 2026. Nuclear energy will also continue to play a major role in the power sector. R&D & Financial support in small modular reactors (SMR) is picking up.

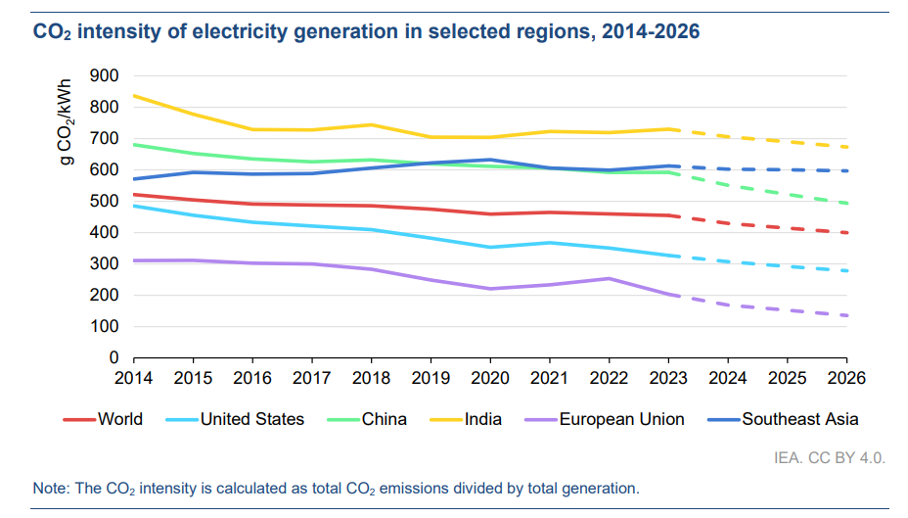

At the COP28 climate change conference that concluded in December 2023, more than 20 countries signed a joint declaration to triple nuclear power capacity by 2050. Momentum is also growing behind small modular reactor (SMR) technology. As a result, the worldwide carbon dioxide (CO2) emissions from producing electricity are predicted to decrease by over 2% in 2024, following a 1% increase in 2023.

Japan continue to restart its nuclear reactors post Fukushima:

- Mihama 3 in September 2022: 780 MW

- Takahama 1 in August 2023: 780 MW

- Takahama 2 in September 2023: 780 MW

- Shimane 2 to restart in August 2024: 790 MW

- Onagawa 2 to restart in August 2024: 800 MW

- Tokai 2 to restart in July 2025: 1060 MW

The EIA also predicts that three turning points characterise the period out to 2026 with regard to low-carbon electricity sources.

- First, renewables are expected to generate more than one-third of the world’s electricity in 2025, overtaking coal as the largest source of supply.

- Second, low-carbon sources – renewables and nuclear together – are expected to account for 46% of the world’s electricity generation by the end of 2026, rapidly approaching the halfway mark, up from 39% in 2023.

- And finally, on a global scale, low-carbon generation is set to meet all the additional demand growth towards 2026.

What to watch out for in 2024?

- Central Bank interest rate policy

- The evolution of new RE technologies

- Banks are becoming more interested in PPA risk management services, i.e. shaping and balancing

- The EU economic activity and power prices

- The increasing nuclear generation

- Stronger renewable generation in 2024 vs 2023 supported by hydro

- Supply of LNG to Europe

On the bullish side, we can highlight the following risks: a) the shutdown of Russian gas transit via Ukraine; b) unplanned gas production outages in Norway; and c) outages at LNG production facilities, i.e. USA, Qatar

Conclusions

Declining gas prices are progressively favouring gas-fired power generation over the more emitting coal ones, which means potentially lower emissions in 2024 vs 2023. Price of EAC CO2 carbon allowances is expected to remain under pressure in 2024 due to higher supply. Analysts expect it to range between 60 to 80 EUR/t.

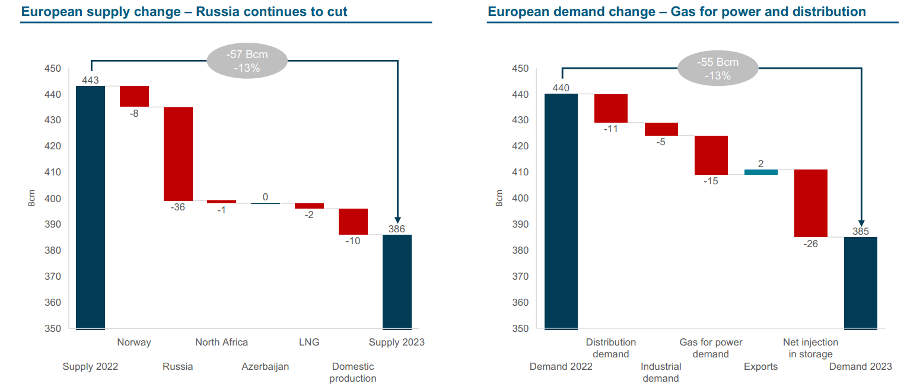

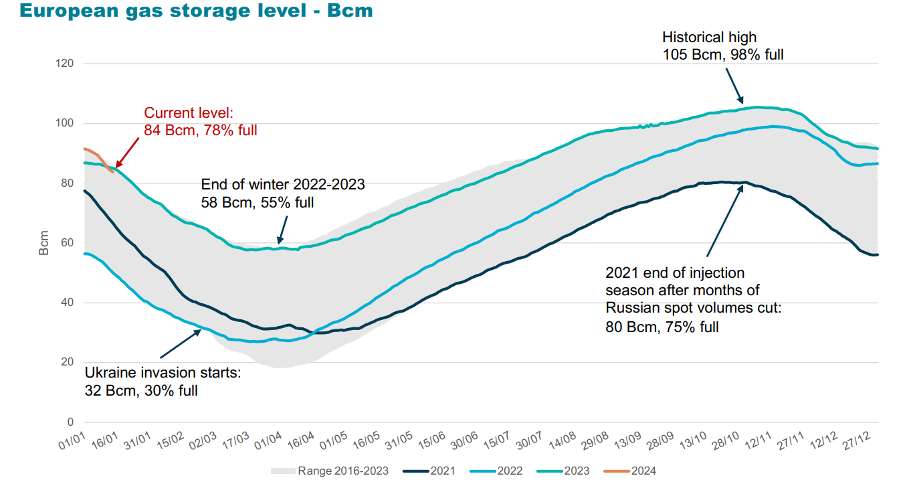

The further decrease in Russian gas supply in 2023 has mainly been covered by lower demand and less storage injection needs. European power demand remains well below 2021, and long-term average gas storage levels were at historical levels at 2023 due to the decline in demand and mild winter 2023/24.

Analysts expect that natural gas demand in Europe is expected to stay low due to a) higher nuclear generation in France, b) Recovering Hydro Power Fundamentals, c) Increasing Renewable Energy Generation, such as Wind and Solar, and d) the macroeconomic outlook remains uncertain. Also, Europe is not threatened by a potential recovery of Asian gas demand.

Thus, assuming the price of CO2 at 60 – 80 EUR/t and an average TTF Gas price forecast of 35 EUR/MWh, we can expect the European power prices to oscillate between 100 and 110 EUR/MWh in 2024-25.

“Power price setting is still dominated by gas in the EU. Germany will phase out nuclear and coal by 2040. By looking at the latest analysts’ long-term reference forecast for gas, analysts see values around 35 EUR/MWh (i.e. +10 EUR/MWh premium vs historical) for TTF. The premium drops along the forecasted 10y curve, with gas market prices forecasted to remain slightly above the historical average (i.e., carrying a premium of +5 EUR/MWh).

Another market price driver is the cost of carbon CO2; if the latest forecast of 60 to 80 EUR/t in 2024 is true, then we should see electricity market prices around 100 to 110 EUR/MWh. With that said, it’ss also expected that near-team prices may remain under 100 EUR/MWh and even through 2030 as renewable generation capacities increase. This, however, will lead to increased PPA shaping premiums and PPA price gap widening between Solar and Wind technologies. This we discuss more in our PPA journal here.“

Analysts expect that recession can be avoided in the US and Europe, or is short-lived.

If you found the article useful, please consider sharing it with your friends and family. Your support helps spread valuable information to others who might benefit from it. Additionally, feel free to leave a comment below to share your thoughts or start a discussion about the topic. Your feedback is always appreciated!