The International Energy Agency (IEA) has published a new Electricity Market Report as of January 2022, where they share the latest industry trends, news, and future outlook. In this article, we will review the main highlights of the 118-page report, so you can save your time and get only the most important out there. You can also learn about the most important future energy market trends in the article here.

Main Energy Market Highlights 2021:

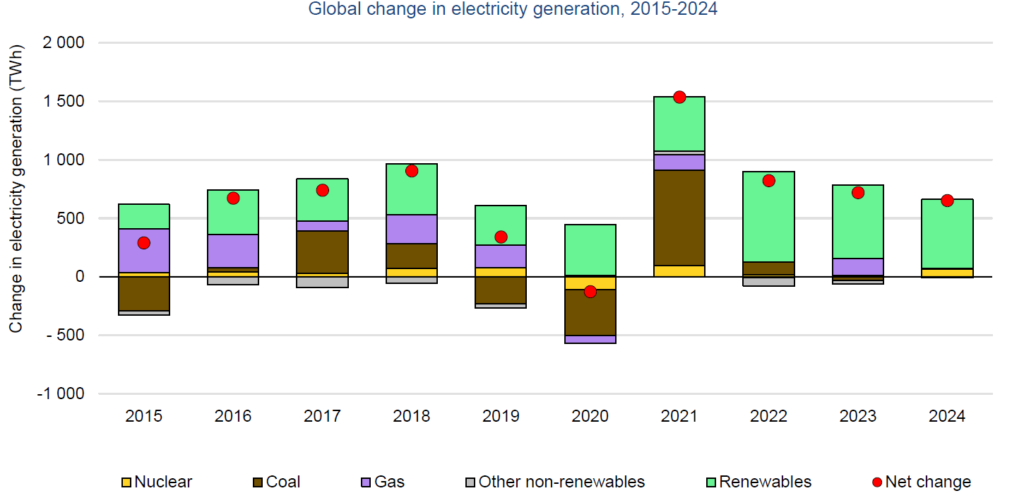

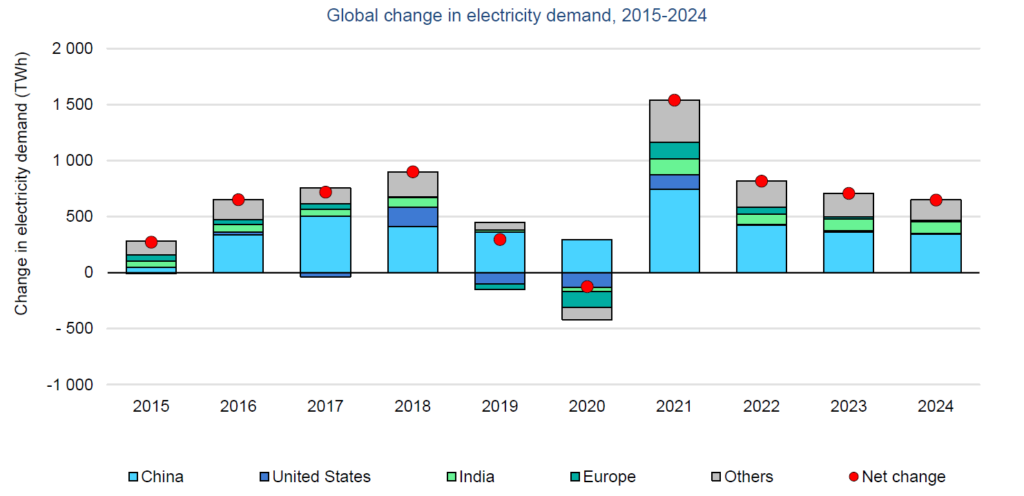

- The global electricity demand increased 6% in 2021 vs. 2020, the highest increase since the financial crisis in 2010. China and India were the leading this growth.

- The IEA projects that the global electricity demand will grow 2.7% p.a. for the next few years. And the growth will be met mainly due to increasing renewable capacities. The demand is slowing down after 2022 as the post-Covid recovery effects disappear.

- Despite unfavorable weather conditions, absolute growth in renewable electricity generation was the highest in history (up 6%). In the future, IEA projects renewable generation to grow 8% p.a, wherein has 1/3 of the world’s electricity is supplied by renewable energy in 2024

- The greater need for coal and natural gas generation in 2021 pushed wholesale electricity prices higher. Coal met more than half of the increase in global demand.

- As a result of the increase in fossil fuels power generation, CO2 emissions from electricity increased by over 7%, reaching a new high. And the emission is projected to remain the same over the next few years

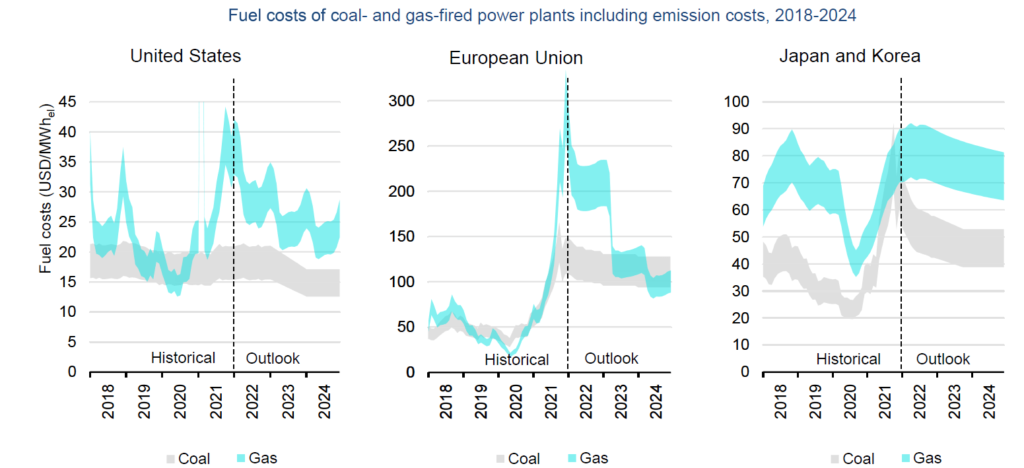

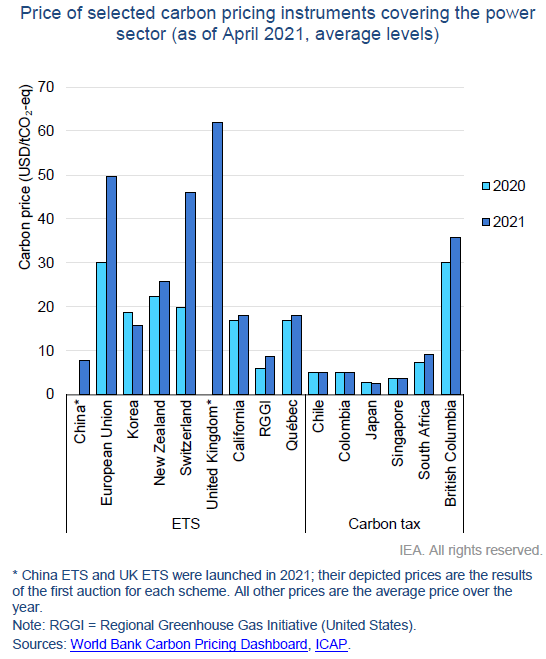

- Gas prices rose substantially from the end of 2020 to the second half of 2021, outpacing the rise in coal costs. As a result, the high gas-to-coal switching rate throughout 2021 led to higher demand for the EU ETS carbon allowances in Europe. Coal Power generators need to buy EU CO2 allowances to offset their GHG footprint. This trend supported the increase in carbon emissions costs in 2021.

- Due to higher emission costs and commodity prices, in the fourth quarter of 2021, average wholesale electricity costs were more than four times higher than the average from 2015 to 2020.

- The IEA sees European electricity prices for the Cal22-24 -5% less expensive on average than those in 2021. Average power generation costs of gas-fired and forecasted to be around 100-130 EUR/MWh on average in Europe. Gas Power plants are also expected to play a more significant role in the energy system flexibility.

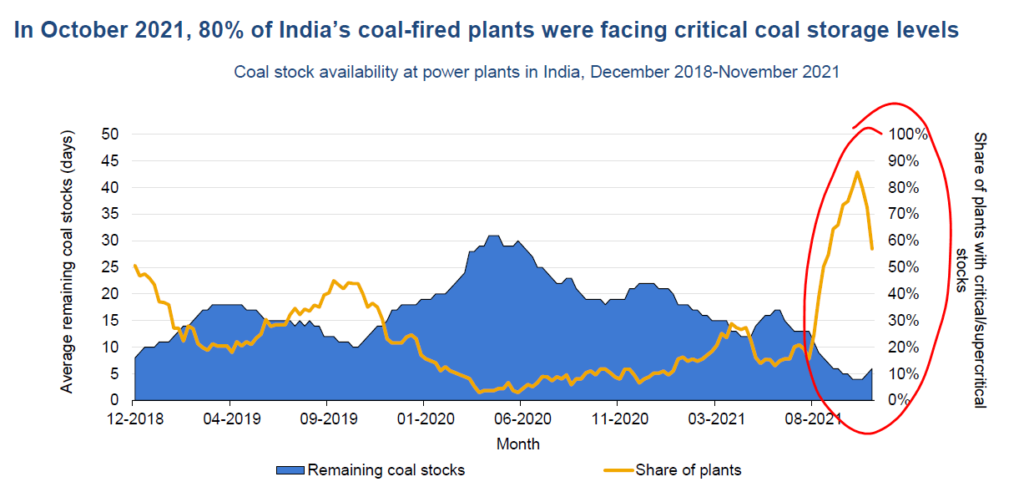

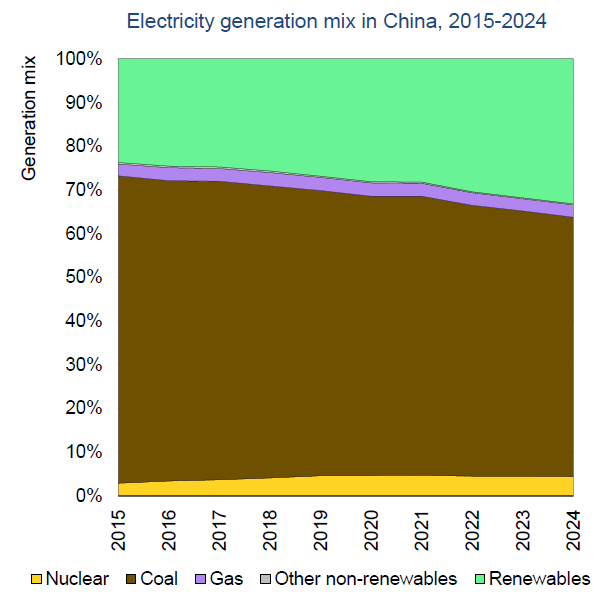

- High coal imports from China and India and reduced coal exports from Indonesia and Australia are other factors of the high electricity price in 2021. China and India rely 60% to 70% on coal in their electricity generation mix. At the same time, domestic coal production was reduced in 2021 due to heavy rains. The power supply did not keep pace with rising demand.

- The industrial sector accounts for 60% of China’s electricity consumption and nearly 40% of India’s. Summer 2021 temperatures in China were more extraordinary than usual, especially in September, when monthly cooling degree days exceeded average values for 2010-2020 by 30%. Increased cooling demand put further strain on the already tight system.

- Various governments made the first moves toward implementing carbon pricing tools in their electrical sectors in 2021. Ukraine stated its desire to build an ETS in 2025 to eventually link it to the EU ETS. Other states around the world are also considering introducing different market/tax-based schemes to fight the GHG emission

- China, Japan, Korea, and the G20 promised to stop providing money for new coal power generation abroad by the end of 2021. Moreover, at COP26, several banks and financial institutions pledged to stop funding coal.

- Extreme weather conditions in 2021 caused significant disruption in the power generation sector. For example, due to near-record low water levels at key dams, Brazil called for demand response measures in September to preserve energy. The risk of climate hazards to remain high in the coming years.

- Renewable generation in Germany declined for the first time in more than 20 years (down 4.5%) due to low wind power output in 2021. By the end of 2022, Germany’s remaining nuclear capacity, which supplied around 12% of total power in 2021, will be phased offline. Approximately 4.3 GW will be decommissioned in two stages, at the end of 2021 and 2022. Coal and gas-fired generation are expected to stay at similar levels in 2022 as they were in 2021.

- In Turkey, the strong electricity demand increase in 2021 was accompanied by a sharp drop in hydro generation (down nearly 30%) due to a severe drought. Turkey’s electricity demand is predicted to expand at a rate of over 4% per year between 2022 and 2024. Renewable energy generation is expected to grow at 13% per year on average, owing to improved hydro availability. With a capacity of 1.2 GW, the first unit at Akkuyu, the country’s first nuclear power plant, is expected to come online in 2023/24. Thermal generation is forecasted to diminish gradually, with its contribution falling from roughly 64% in 2021 to close to 50% by 2024.

Charts

To learn more about the European gas market crisis and future power risks/opportunities associated with that, please read my other article here.

To get weekly electricity market reports, including the latest power market news and trends, check the articles here. And if you want to understand the likely consequences of the European gas market without Russian piped gas, please check this article.