Why are electricity prices rising today?

According to the Council of the European Union, the high cost of power and skyrocketing gas prices have demonstrated the insufficiency of the present market structure for electricity, primarily focused on the marginal cost of the most costly source, currently natural gas.

This market structure was implemented to promote the growth of renewable energy sources while those sources were still in their beginnings. However, the current energy crisis has highlighted the need to uncouple electricity prices from skyrocketing gas prices and to adopt a new market model that makes distinctions between resources that operate when available and do not require demand and on-demand resources based on their respective contributions to the electricity mix.

Given that on-demand sources (such as natural gas) make up just around one-third of the power mix and are expected to lose share as the energy transition accelerates, this may guarantee about 50% reduced electricity costs.

Rethinking the current energy market model is necessary

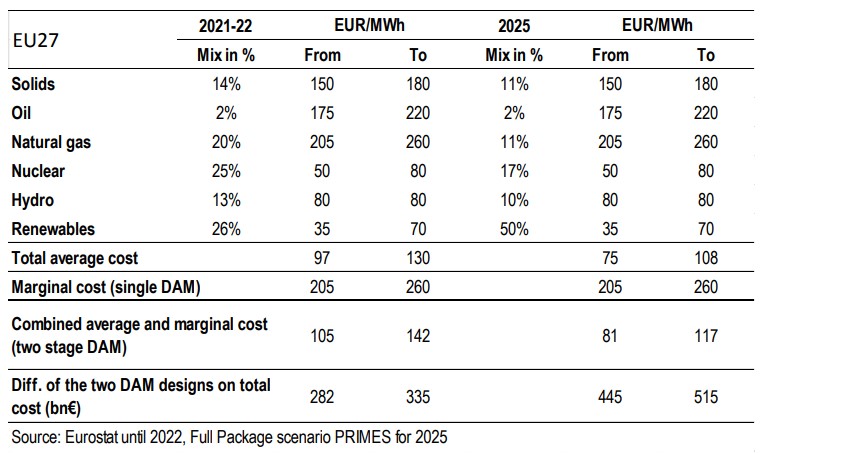

Less than 20% of the total electricity generated in EU Member States comes from natural gas, yet it controls most of the marginal price. The most costly electricity generator depends on natural gas since it is frequently required to maintain system balance and offer ancillary services. For instance, the wholesale market electricity price is about 220 EUR/MWh for a natural gas price of 100 EUR/MWh and an EU ETS price for carbon dioxide of 80 EUR/t.

The actual average cost of power is, however, far lower. Nearly two-thirds of the electricity in EU Member States is generated by nuclear, renewable energy sources, and hydropower, with a total levelized cost, including capital expenses, of less than 100 EUR/MWh.

Any income that is received in excess of these total expenses is considered an additional profit that would not have been made in an efficient market. In other words, the marginal cost is consistently between 50 and 60 percent less than the overall average cost of electricity generation. The latter, however, is what determines market clearing prices and eventual consumer payments.

When the system is dominated by low carbon and zero marginal cost resources, it is evident that a market based on marginal cost of production does not serve the intended goal.

The Council suggests having a two-stage DAM: The first stage performs the acceptance and aggregation of the volume-based offers by the resources that operate when available and not on demand (renewables, nuclear, high-efficiency co-generation, hydro, electricity storage bundled with intermittent renewables). The second stage performs market-clearing of the net load (after subtracting the accepted volumes from the load) using the bids of the on-demand resources (fossil fuel plants, hydropower plants operating at peak load times, demand response, and electricity storage unbundled from RES). The intra-day and balancing markets remain unchanged.

The net load is met by employing resources that operate when available and not on demand, and the suppliers and customers pay a weighted average of those two prices. The former displays the overall levelized expenses of the resources used when they are available rather than when they are needed. The latter is in line with pricing at marginal costs and might represent natural gas prices.

As a result, the consumer would pay (2/3 x 80)+(1/3 x 350) = 170EUR/MWh, or about 50% less than the cost of electricity when using the current market design. The current market price in Germany for the supply in 2023 is around 350 EUR/MWh today. However, roughly two-thirds of electricity consumption has an average cost of 80 EUR/MWh.

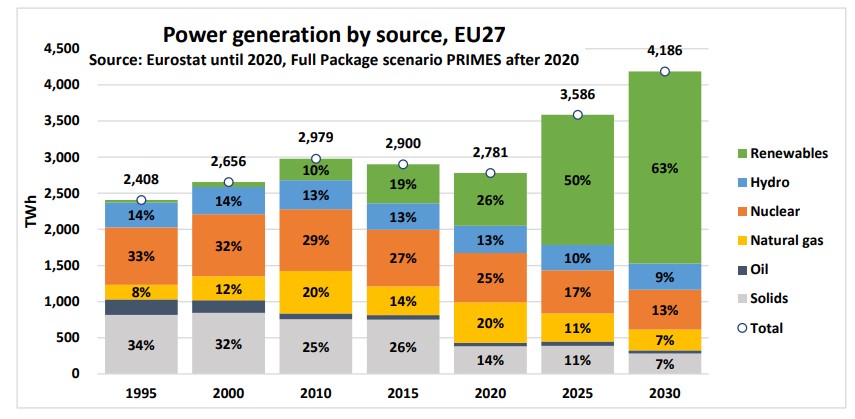

The power generation mix according to Eurostat statistics and its future projection according to the Fit-for-55 scenario, using the PRIMES model. The graphic shows that natural gas generation is only 20% of the total. This share will likely decrease considerably in the next few years, in the context of the carbon emissions reduction policies.

The second table calculates the total average generation costs and compares them to marginal costs. It shows two marginal costing cases: the first corresponds to the current market design, where all resources get remuneration at the system marginal costs; the second illustrates the case where the volumes of nuclear, hydro, and renewables are not part of the marginal cost remuneration and, consequently, the price of electricity is a weighted sum of average costs while the price of the fossil fuels generation is remunerated at the marginal cost. The combined average and marginal cost remuneration are a result of the two-stage DAM market design proposed.