In this article, you will discover a detailed breakdown and structure of electricity costs, providing a comprehensive understanding of the factors influencing how electricity bills are calculated.

The focus is on identifying the key components that contribute to the overall cost of electricity. Additionally, the article reveals which European country stands out for having the highest electricity bills, shedding light on the factors that contribute to this distinction.

Overall, you can expect to gain insights into the intricacies of electricity pricing and the variations observed across different European countries.

Table of Contents

A Brief Overview of Electricity Costs in Europe

Over the past decade, Europe has witnessed a notable shift towards renewable energy sources, impacting the cost structures of electricity. Countries like Germany have spearheaded this transition, exemplifying a commitment to sustainability.

Organisations, in particular, find it crucial to comprehend and control their electricity-related expenditure. As electricity costs constitute a significant portion of operational expenses, understanding the intricacies allows businesses to optimise resource allocation, enhance energy efficiency, and ultimately foster financial sustainability.

In an era where environmental responsibility and fiscal prudence go hand in hand, organisations navigating the European market must grasp the nuances of electricity costs to stay competitive and responsible.

The liberalisation and decentralisation of European electricity markets have marked a transformative era, influencing the landscape of electricity cost breakdown. Since these markets were opened to competition, various factors have played pivotal roles in shaping the components of an electricity bill.

Traditionally, a typical electricity bill consists of three main elements, each responding to market dynamics and regulatory decisions.

| Cost Element | Description |

| Pure Energy Cost | The profit margin of the entity supplying electricity to end-users influenced by market competition and the efficiency of retail suppliers. |

| Retail Supplier Margin | The expenses related to the transmission and distribution network, including physical infrastructure, to deliver electricity from production to consumption points. |

| Grid Costs | The profit margin of the entity supplying electricity to end-users is influenced by market competition and the efficiency of retail suppliers. |

| Taxes and Levies | Taxes and levies in the context of electricity costs refer to additional charges imposed by regulatory authorities and government entities, often related to energy policies, infrastructure development, or environmental initiatives. |

Firstly, the pure energy cost is a fundamental component representing the expenses associated with the actual generation of electricity. This is influenced by the cost of the energy sources used, whether it be fossil fuels like coal and natural gas or renewable sources such as wind and solar.

The second involves the retail supplier margin, reflecting the profit margin of the entity supplying electricity to end-users. This component is subject to market competition and can vary based on the efficiency and competitiveness of retail suppliers. This cost component is, however, the smallest one—usually less than 5% of the electricity bill.

The third and crucial element encompasses grid costs, which include the expenses related to the transmission and distribution network. It encompasses the physical infrastructure.

Taxes and Levies are mandatory financial contributions imposed by governmental bodies. In the context of electricity costs, taxes are applied to support public services, infrastructure development and other government initiatives. The specific taxation policies can vary widely among different regions and countries, and the collected funds contribute to the government’s overall revenue.

However, the recent geopolitical events have introduced an unprecedented layer of complexity into this cost breakdown. The outbreak of war in Ukraine in 2022 has sent shockwaves through the European electricity market, causing disruptions and fluctuations in traditional cost structures.

The reliance on natural gas, particularly impacted by the conflict, has led to increased volatility in energy prices. This has not only affected the cost of fuel for electricity generation but has also prompted a reassessment of the broader energy security framework.

This, in turn, may lead to adjustments in grid costs and potential changes in regulatory dynamics, taxes and levies. Organisations navigating the European energy landscape find themselves amidst a rapidly evolving scenario where geopolitical events intersect with market forces to shape the future breakdown of electricity costs. The understanding and adaptation to these dynamics become paramount for businesses seeking resilience and sustainability in this challenging environment. As the energy market continues to respond to geopolitical shifts, organisations must remain agile in their strategies to navigate the complexities of electricity cost structures and ensure a sustainable and cost-effective energy future.

At Future Energy Go, we specialise in providing energy market intelligence tailored to the specific needs of businesses.

Importance of Understanding Electricity Cost Breakdown

A profound understanding of the breakdown of electricity costs is not just a financial necessity but a strategic imperative. Organizations can benefit significantly from dissecting the various components that contribute to their electricity expenses. Take, for instance, the pure energy costs, that are linked to the type of energy sources employed. Businesses leveraging renewable sources, like wind or solar, often find themselves not only contributing to environmental sustainability but also potentially mitigating long-term energy expenses.

Further, challenging retail supplier margins unveil opportunities for cost optimisation. As market dynamics evolve, understanding the competitive landscape can empower businesses to negotiate favourable terms, potentially leading to substantial savings.

Looking ahead, the landscape of grid costs, taxes, and levies, is poised to undergo significant changes marked by potential cost inflation. This shift can be attributed to the escalating need for higher infrastructure investments in the energy sector. As the world transitions towards sustainable energy sources, there’s a growing demand for robust and modernised grid systems capable of accommodating renewable energy integration and ensuring grid reliability.

Recent geopolitical events, such as the war in Ukraine, have added a layer of urgency to the importance of understanding electricity cost breakdowns. The resulting fluctuations in energy markets underscore the need for businesses to stay nimble in their decision-making, adapting to a landscape where global events can swiftly impact local costs.

Businesses that actively manage their electricity costs through comprehensive breakdown analysis often experience notable reductions in overall expenses. Furthermore, staying informed about the evolving energy market dynamics is not only a risk mitigation strategy but also a proactive approach towards aligning economic prudence with environmental responsibility.

Factors Influencing Electricity Costs

The ongoing European transition away from dependence on Russian gas sources adds a significant layer of complexity to the factors influencing electricity costs. As nations strive to diversify their energy mix and reduce reliance on fossil fuels, particularly Russian gas, the transition necessitates extensive investments in alternative energy infrastructure. This shift has a direct impact on grid costs, as upgrading and expanding the electricity grid to accommodate renewable energy sources and ensure a seamless energy transition demands substantial financial commitments.

Moreover, the geopolitical undertones, especially in the aftermath of the war in Ukraine, have accelerated the urgency to secure energy independence, prompting governments to levy higher taxes and impose additional levies to fund these strategic shifts.

One noteworthy consequence is the likelihood of an increase in end-consumer electricity bills. The higher grid costs incurred to facilitate the integration of renewable energy into the grid are anticipated to be passed on to consumers. Simultaneously, there is a need for increased funding to support the broader energy transition goals.

The increasing integration of renewable sources, such as solar and wind, into the energy mix introduces another factor influencing electricity costs, specifically pure energy costs. While the shift towards renewables is pivotal for achieving sustainability goals, it also brings about a heightened level of market price volatility. Unlike traditional energy sources that offer more consistent and controllable output, renewable energy production is subject to natural fluctuations, dependent on weather conditions and time of day.

This increased market price volatility, influencing the pure energy costs component of electricity bills. These fluctuations impact market dynamics, affecting the pricing mechanisms for electricity.

The integration of renewables, while a positive step towards sustainability, underscores the need for adaptive strategies to mitigate the potential impacts of increased market volatility of pure energy costs.

The current market situation poses challenges for businesses and consumers alike, as they grapple with the dual pressures of transitioning to renewable energy sources and absorbing the associated economic ramifications. Navigating this intricate landscape necessitates a comprehensive understanding of these interconnected factors, empowering stakeholders to make informed decisions amidst the evolving dynamics of the European energy market.

At Future Energy Go, our expertise lies in providing tailored energy market intelligence, empowering businesses to make informed decisions amidst shifting market dynamics.

Breaking Down the Electricity Bill Cost Structure

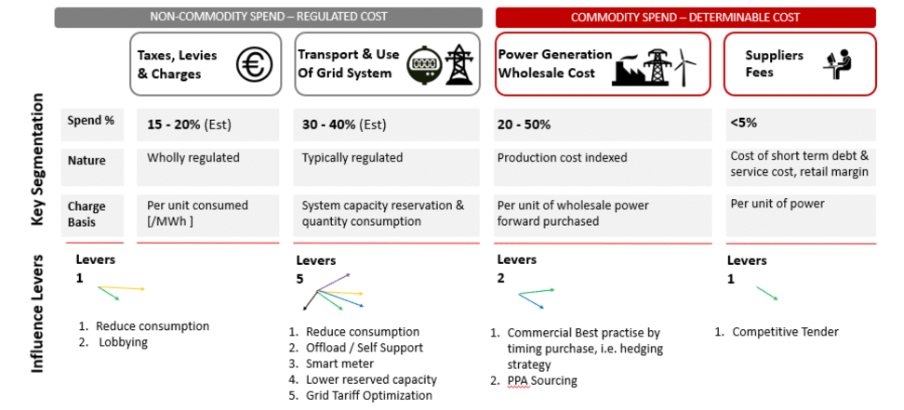

Breaking down the electricity bill cost structure unveils a difference between fixed and variable costs, each playing a pivotal role for businesses.

Fixed vs. Variable Costs

Fixed costs, often comprising regulated industry charges and levies like grid costs, remain relatively stable. They may depend on consumption levels, voltage levels and location, but overall, they don’t change over the course of a year. These charges are associated with maintaining and upgrading the essential infrastructure, ensuring a reliable electricity supply.

On the other hand, variable costs are directly tied to consumption and are driven by commodity prices. This dynamic category includes the pure energy costs influenced by factors such as the integration of renewable sources.

Impact of Renewable Energy Investments

The impact of renewable energy investments on taxes and levies cannot be overstated. As nations strive to meet sustainability targets and transition towards cleaner energy, governments often incentivise renewable investments through tax breaks and subsidies. This underscores the need for businesses to stay informed and strategically manage their energy consumption.

At Future Energy Go, we provide the intelligence necessary to navigate these intricacies, empowering businesses to make informed decisions in an evolving energy market landscape.

Comparative Analysis of European Countries

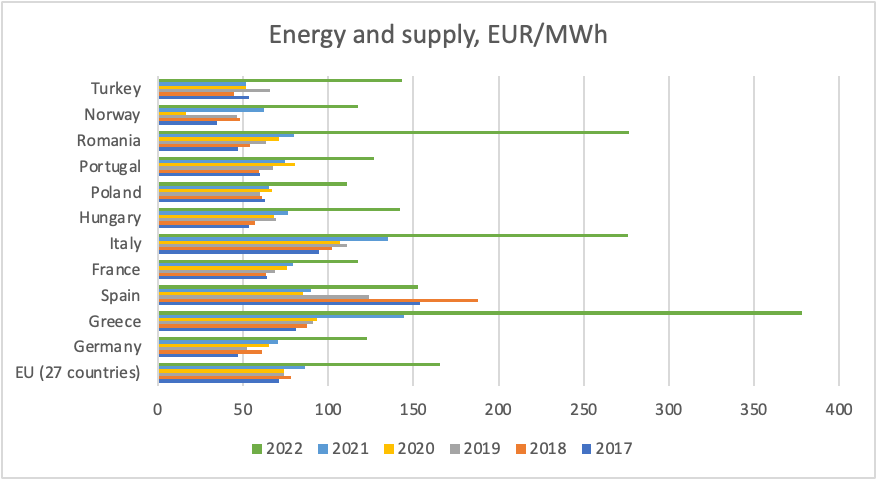

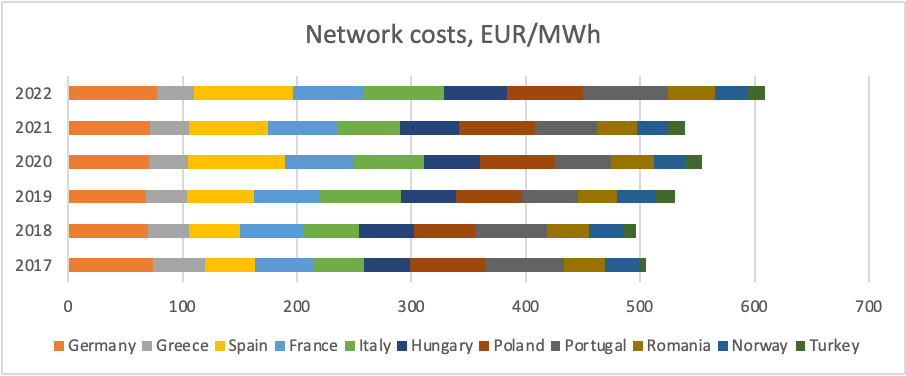

In conducting a thorough comparative analysis of electricity prices for non-household consumers in European countries, Future Energy Go utilised Eurostat’s annual data, specifically focusing on electricity price components.

This comprehensive analysis concentrated on non-household consumers falling within band IA, characterized by an annual electricity consumption of less than 20 MWh, aligning with the average energy needs of SMEs. The data spans the last six calendar years, offering a perspective from 2017 to 2022.

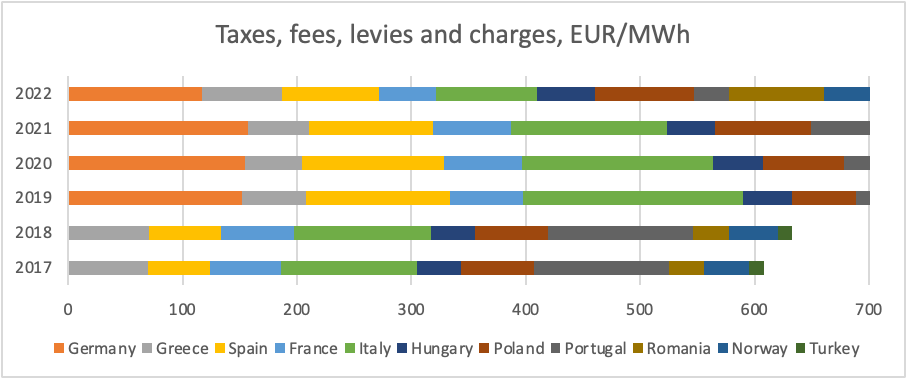

A noteworthy observation emerged in 2022, where, on average, network-regulated energy costs experienced an increase across European markets. In contrast, taxes, fees, levies, and charges showed a decrease. However, this decline is anticipated to be a temporary phenomenon, as the path to achieving the EU net-zero targets will likely drive a recovery of taxes and levies to historical levels and further growth in the future.

Conclusion

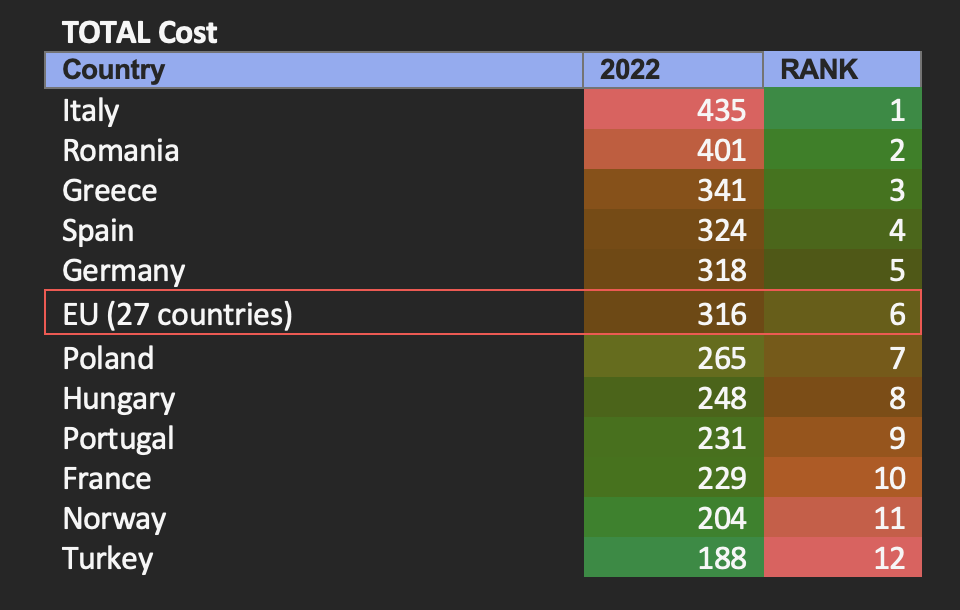

In concluding our exploration of the electricity bill cost structure and its comparative analysis across European countries, the question of which country tops the charts for the highest electricity bills depends on various factors and elements.

The electricity bill cost structure, comprising pure energy costs, supplier margin, grid costs, and taxes and levies, collectively contributes to the Total Cost of Ownership (TCO) in EUR/MWh.

Drawing on Eurostat data, our comparative analysis identifies Italy, Romania, Greece, Spain, and Germany as topping the EU average list in terms of electricity bills for non-household consumers. This insight underscores the importance of understanding and dissecting these cost components, particularly when preparing a Power Purchase Agreement (PPA) energy business case.

As the energy landscape continues to evolve, staying attuned to these factors becomes imperative for businesses seeking both financial efficiency and sustainability in their energy procurement strategies. Future Energy Go remains dedicated to providing businesses with the intelligence needed to navigate this intricate terrain effectively.

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.

Links to Relevant Reports

In this article, we delve into the essential topic of electricity bill supplier reporting, offering valuable insights and practical tips to empower you to better control your energy spend. We also provide Excel templates for ease of use.

What is Pure Energy Cost?

The expense associated with generating electricity, influenced by the cost of energy sources like coal, natural gas or renewables.

What is Retail Supplier Margin?

The profit margin of the entity supplying electricity to end-users, influenced by market competition and the efficiency of retail suppliers.

What are Grid Costs?

The expenses related to the transmission and distribution network, including physical infrastructure to deliver electricity from production to consumption points.

What are Electricity Taxes and Levies?

Taxes and levies in the context of electricity costs refer to additional charges imposed by regulatory authorities and government entities, often related to energy policies, infrastructure development, or environmental initiatives.