Table of Contents

IEA Energy Market Introduction

The energy landscape is shifting faster than ever before, and the International Energy Agency’s (IEA) 2023 Energy Market Review is your main source to get the latest insights about latest industry trends, challenges and solution. Yet, at 134 pages long, the IEA report can be an overwhelming read for many. That’s why this article is here to provide you with a concise and insightful summary of the main highlights so that you can save some time.

Did you know that in 2023, renewable energy sources are set to surpass fossil fuels as the primary global energy source for the first time in history? But the IEA’s report doesn’t stop at celebrating the triumphs of clean energy. It delves deep into the challenges that lie ahead. As we steer towards a greener future, we must navigate obstacles like energy storage, grid reliability, and the economic implications of this transformation.

To read the previous IEA Energy Market Review, you can find the report here.

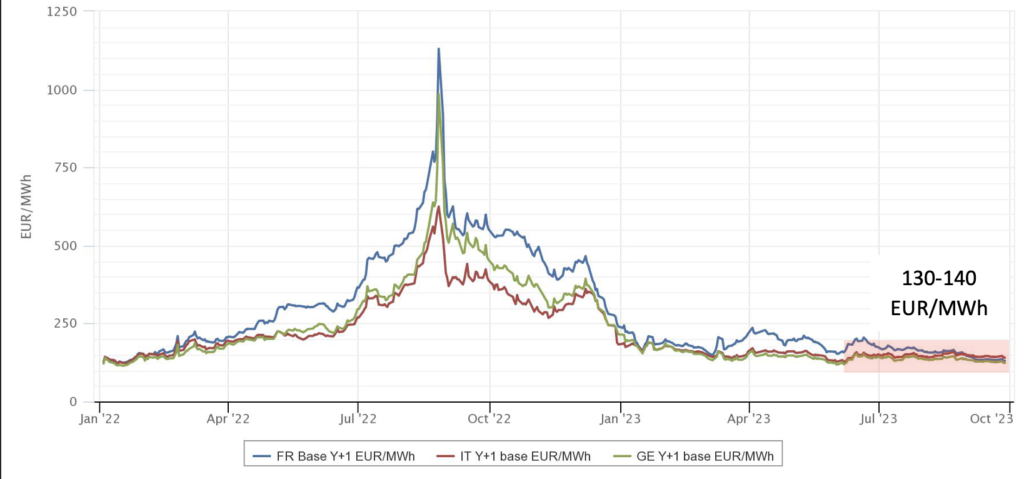

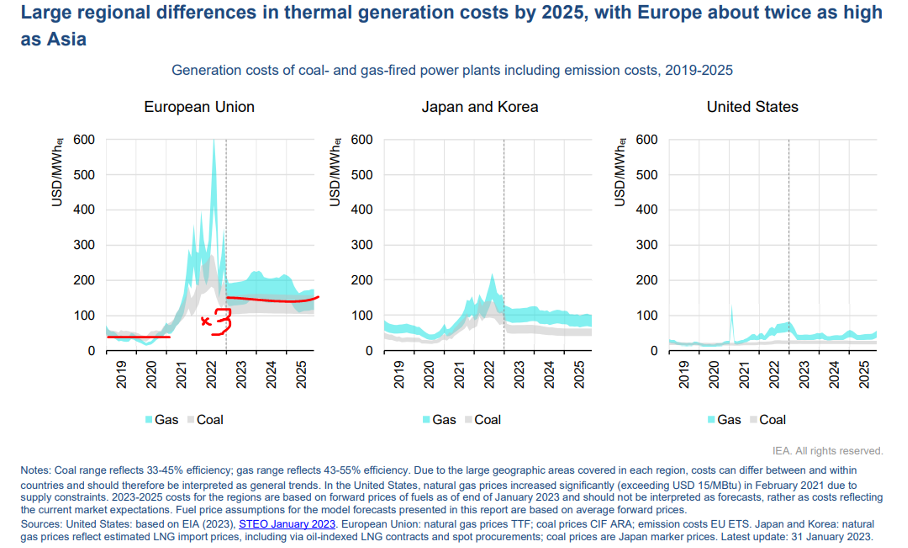

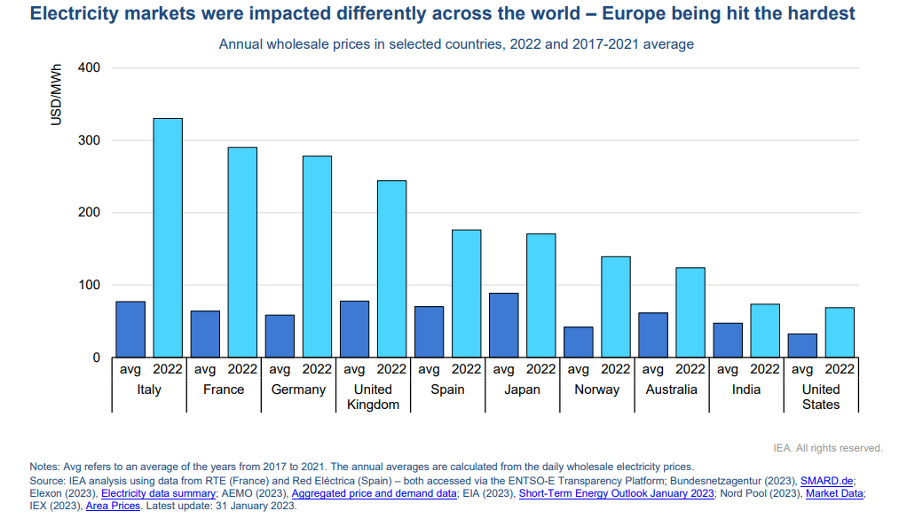

Energy market prices have declined in 2023, primarily due to the mild winter in Europe. This may seem like good news, but it’s important to note that they remain, at least, double the historical market levels, consolidating at around 130-140 EUR/MWh for the next year delivery (2024). These pricing dynamics highlight the volatility and complexity of the energy market, and the IEA’s report dives deep into the factors at play.

EIA Energy Market Report 2023 – Main Highlights

- Global electricity generation from both natural gas and coal is expected to remain broadly flat between 2022 and 2025. As a result, IEA expects the market power prices and forward curves to stay inflated by then.

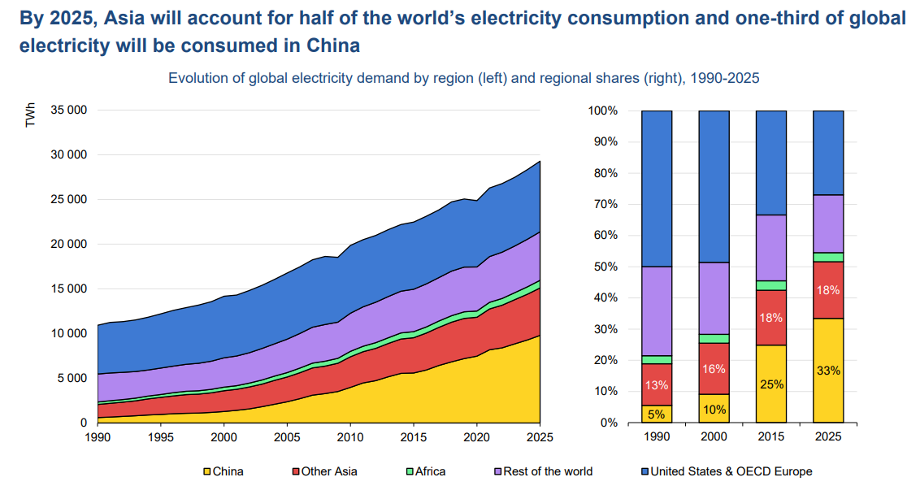

- Chinese role in the energy market becomes more important as China’s share of global electricity consumption is forecast to rise to one-third by 2025, compared with one-quarter in 2015.

- Global electricity demand is going to accelerate and grow by 3% p.a. from 2023 to 2025

- The share of renewables in the global power generation mix is forecast to rise from 29% in 2022 to 35% in 2025

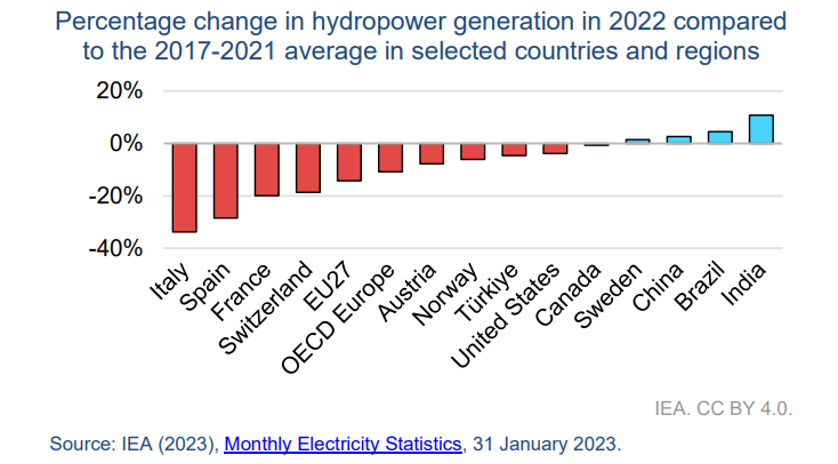

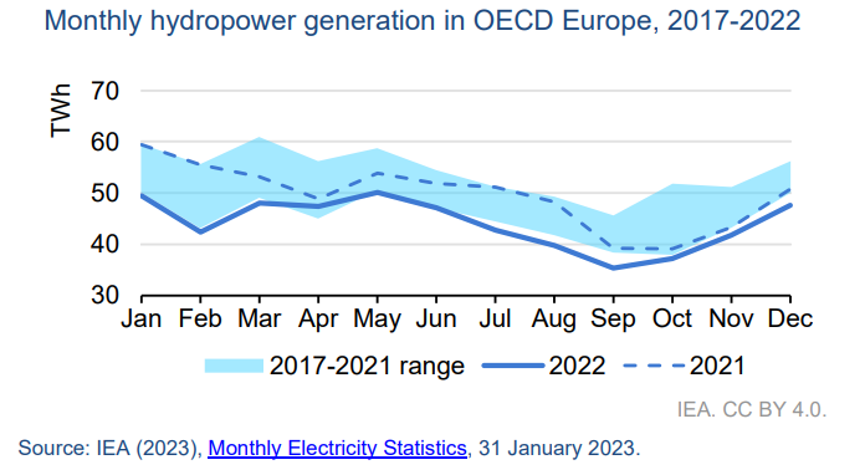

- European Hydropower generation was historically law in 2022 that contributed to higher market prices for both power and GOs. Europe saw its worst drought in 500 years in 2022.

- Nuclear Power Generation was also at a historical low in 2022 due to close and unavailability of several nuclear plants in France

- As renewable capacities grow and nuclear generation recover, the IEA expects that power generation emissions are expected to decline about 10% p.a. going forward

- IEA sees new price spike risks for the upcoming winter 2023/24

- The exceptionally mild winter in 2022/23 in Europe has helped to avoid the energy crisis. On top of that, the EU has undertaken the following measures to help mitigate the impact of skyrocketing energy market prices:

- Setting caps on wholesale and retail energy market priceRevenue caps on inframarginal technologies, i.e. renewables, nuclear etcReduction of energy taxes and VATReduction of regulated system transmission and grid costs

- Direct Subsidies

- The role of Nuclear Power became more important following the Ukraine-Russia war. China, India, Japan and Korea lead the nuclear power expansion.

- Industrial electricity demand plummeted to historic lows in multiple countries in 2022. The highest decline was in Spain and the United Kingdom

- As the share of variable renewables increases in the generation fleet, their successful integration into the power system will increasingly become more challenging. IEA believes that For the balancing of variable generation, apart from expanding storage capacities and increasing demand-side flexibility, having sufficient dispatchable capacity will be crucial.

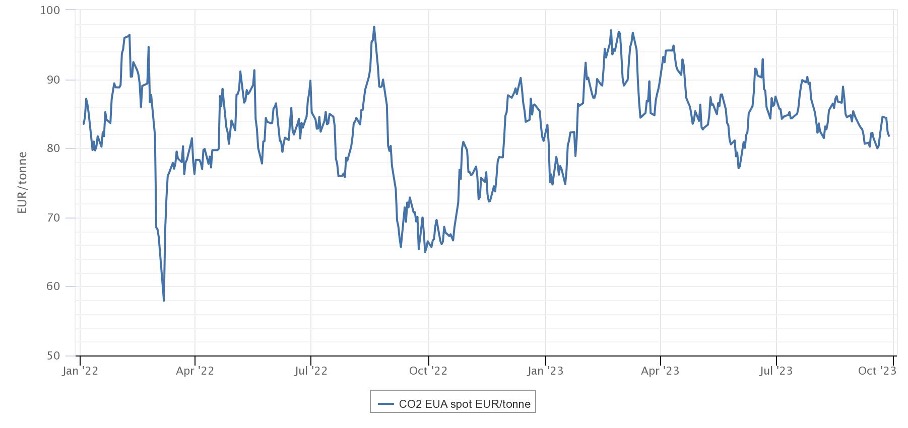

- The price of the emissions allowances (EUA) on the EU Emissions Trading System (EU ETS) saw record highs, reaching almost EUR 100/t CO2 in August 2022. The surge in emission prices was mainly driven by the increase in coal-fired generation, resulting in stronger demand for the allowances. If you want to learn more about new long-term energy market price averages, please read this article.

CO2 EU ETS Price Evolution

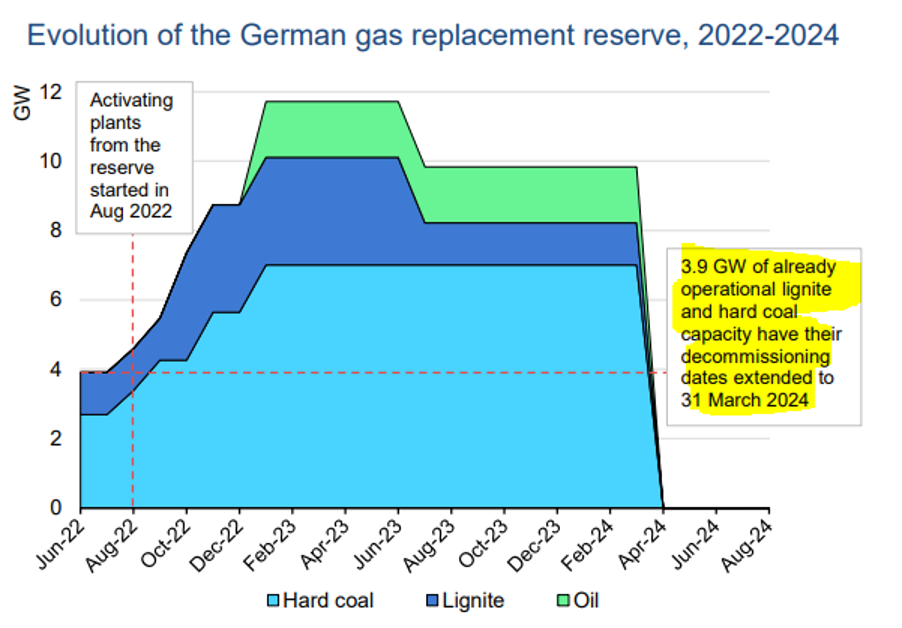

- In 2024-2025, IEA expects Germany to fully return to its coal phase-out plan and, hence, coal-fired power generation to decline.

- In 2022, France became a net importer of electricity for the first time in more than two decades.

- More than half of the Ukrainian energy infrastructure was destroyed at the end of 2022.

I hope this summary has provided valuable insights and a glimpse into the future of energy. If you’ve enjoyed this article and want to be part of the ongoing conversation surrounding renewable energy, please share your thoughts in the comments below and consider joining our renewable energy market research community. Thank you for being a part of this transformative journey.