Table of Contents

Welcome to our quarterly PPA Price Trends series, where we discuss the ever-evolving landscape of renewable energy markets. In this Q1 2024 edition, we’re excited to unveil the most current trends and insightful observations on Power Purchase Agreement (PPA) price trends in Q1 2024. If you want to read our previous articles on this topic, please check it out here.

Before, however, we embark on our in-depth exploration of the Q1 2024 PPA price trends, it’s crucial to understand the broader energy market dynamics. As the conventional energy market forces often have a profound influence on the PPA prices. Therefore, by understanding the wider energy landscape, we can better know the context in which PPA market dynamics unfold.

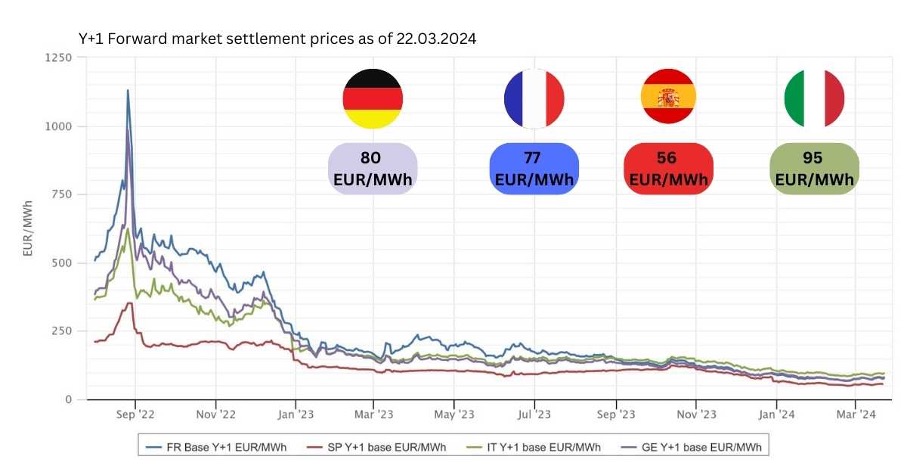

The evolution of forward energy market prices in Europe

Energy prices continued its decline into the first quarter of 2024. The trend is mainly attributed to healthy EU gas storages after the warm winter of 2023/24, declined industrial demand due to the energy crisis and economic slowdown in the EU and the recovery in renewable and nuclear generation.

However, despite that, the volatility of energy market prices remains at historically high levels. Over the span of two years, we’ve witnessed a remarkable transition from all-time market highs to all-time lows, underscoring the price risks within the energy sector.

Energy Market Price (Y+1) Evolution, EUR/MWh

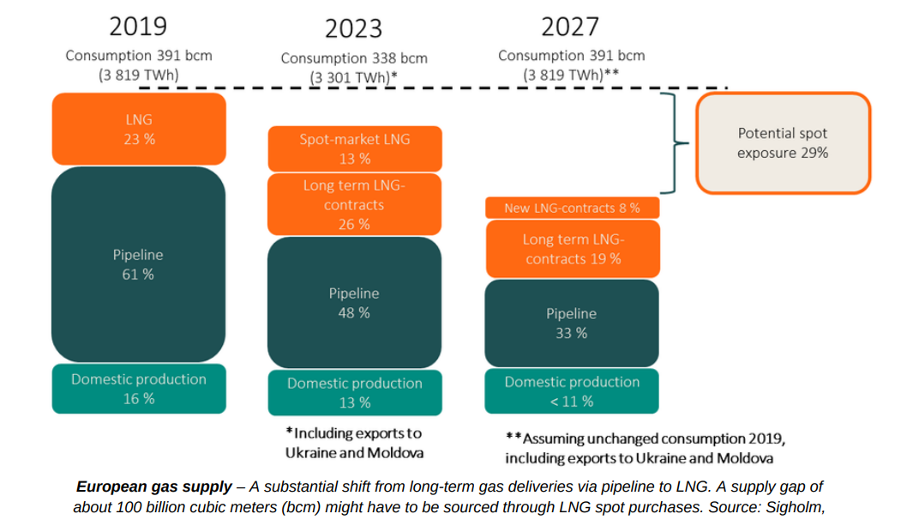

Energy market prices have descended from historical highs to levels closer to market norms. Yet, they still remain above historical levels (before the war in Ukraine) in the forward market by approximately 15 to 25 EUR/MWh. The sustained premium can indicate that we have entered into the new energy market price paradigm where the new normal considers the risks associated with LNG gas supply to Europe and raises global regulatory market pressure on CO2 emission. In the previous article, we discussed the direct impact of CO2 EU ETS system on long-term power prices.

Despite the decline in CO2 EUA prices from their peak of 100 EUR/t to approximately 60 EUR/t currently, the impending rollout of the Fit for 55 package over the coming years will have significant implications. Starting in 2026, there will be a notable reduction in the supply of free allowances to the market. This reduction is expected to drive up carbon costs for coal and gas power generation. Therefore, while current CO2 EUA prices may have decreased, the long-term impact of regulatory changes suggests a potential for increased carbon costs in the future.

While energy market prices may experience further declines, the likelihood of upside potential remains elevated due to Europe’s continued dependence on gas for power generation. And despite Europe having implemented strategic measures to reduce its dependence on Russian gas, achieving complete independence from it remains a challenge that is likely to take a few more years. Analysts expect the price of CO2 EUA allowances to be well above 100 EUR/t by 2030.

Q1 2024 PPA Market Trend Observations

- The decline in PPA price level that is influenced by forward power curves

- The rising investment costs for renewable projects as a result of higher interest rates and inflation

- Solar remains one of the main technologies for offer in the corporate PPA market, yet the cannibalisation risks continue to increase

- The shaping and balancing risk in PaP PPA structures remain high

- Falling battery costs are encouraging market participants to consider integrations especially with Solar PV plants to minimise shaping and balancing costs

- RE project grid connection lead times are increasing as more and more renewable projects are built while available grid capacity is declining.

- The change from national to time-zonal pricing in EU markets where it is applicable is adding another layer of complexity to PPA contract negotiations.

PPA Energy Market Price Update

The continued decline in conventional energy market prices in Q1 2024 put downward pressure on Power Purchase Agreement (PPA) prices, as explained in the previous article here.

| Market | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q3 2023 | Q4 2023 | Q1 2024 |

| 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | 10y “pay-as-produced” PPA, EUR/MWh | |

| France | 95 | 130 | 90 | 70 | 85 | 80 | 60 |

| UK | 100 | 100 | 100 | 85 | 90 | 85 | 70 |

| Germany | 85 | 100 | 90 | 80 | 85 | 80 | 55 |

| Italy | 80 | 90 | 85 | 75 | 85 | 80 | 70 |

| Poland | 140 | 150 | 90 | 55 | 95 | 90 | 85 |

| Portugal | 44 | 45 | 50 | 45 | 43 | 42 | 42 |

| Spain | 44 | 45 | 48 | 45 | 40 | 40 | 40 |

Despite the decline in Power Purchase Agreement (PPA) prices across various energy technologies in Europe during Q1 2024, with an average reduction of 15% compared to Q4 2023, the further decline can be tempered by the evolving regulatory landscape and the anticipation of a rebound in market sentiment.

Final Words

In conclusion, the first quarter of 2024 has presented a bearish landscape for Power Purchase Agreement (PPA) price trend in Europe.

As a result, the recent decline in PPA prices could incentivise corporate buyers, particularly those within the RE100 initiative, to engage in transactions aligning with their sustainability goals and 2030 targets. Therefore, the year 2024 is likely to be associated with new records in PPA volume transactions in Europe.

However, the increased energy market price volatility stemming from geopolitical tensions, notably the Russian-Ukraine war, coupled with regulatory uncertainties, introduces additional complexities into PPA contract negotiations.

Navigating this evolving landscape requires a delicate balance between seizing cost-saving opportunities and mitigating risks. This underscores the importance of strategic decision-making and adaptability in the pursuit of sustainable energy procurement strategies. For inquiries about power purchase agreement procurement, visit our services here.

If this article has resonated with you, we encourage you to share these insights with your friends. Thank you!

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.