Table of Contents

Introduction to the South African PPA Market

The article delves into the recent regulatory changes designed to streamline PPA transactions in South Africa and the current South African PPA market dynamics. One of the changes in 2023 involves the elimination of the licensing requirement for Renewable Energy (RE) generation projects with a capacity of up to 100 MW. This change is expected to increase private investment in renewable energy projects, particularly solar and wind projects, with more than 9000 MW of new capacity.

It is also worth mentioning that the prevailing types of corporate Power Purchase Agreements (PPAs) in South Africa commonly take the form of either on-site or off/near-site private wire agreements or are offsite physical PPAs structured on a wheeled basis. While Virtual Power Purchase Agreement (VPPA) structures hold potential appeal to maximise PPA energy volume offtake for corporate buyers, it’s important to note that such arrangements are presently unavailable in the current market landscape in South Africa.

The new regulation should also streamline PPA transaction processes. Getting permission for the environment used to take more than 100 days, but now it only takes 57 days. The registration process has also become faster, going from four months to just three weeks. Additionally, changes have been made so that independent power producers (IPPs) can get approval to connect to the power grid within six months of applying.

Eskom’s Demand Response Programme

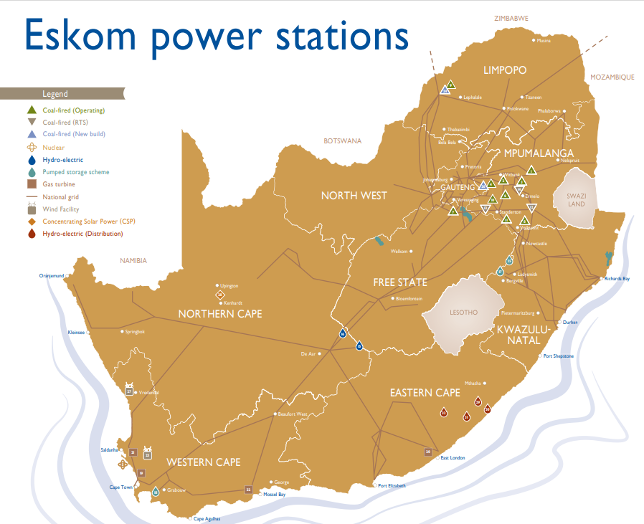

Eskom is the state-owned electricity supplier in South Africa. It plays a crucial role in the country’s energy market, serving as both a generator and distributor of electricity. Eskom owns and operates a significant portion of South Africa’s power generation infrastructure. This includes coal-fired, gas, hydroelectric, and some renewable energy plants.

It is the largest electricity producer in South Africa and is responsible for a substantial portion of the country’s total power capacity. It also manages the national electricity grid, overseeing the transmission and distribution of electricity across the country. The company is responsible for maintaining and expanding the electricity infrastructure to meet the growing power demand.

As one of the latest market developments, Eskom plans to introduce a fresh initiative that rewards businesses that use less electricity during peak hours. Although specific details haven’t been shared yet, it is anticipated that this initiative will be a part of Eskom’s Demand Response Programme. This program typically provides compensation to big businesses that cut down on their electricity usage when demand is at its highest.

Due to the high reliance on coal and oil for power generation, South Africa is one of the leading carbon dioxide emitters. South Africa supplies two-thirds of Africa’s electricity and is one of the four cheapest electricity producers in the world.

The South African electricity industry has seen a dramatic price increase over the past few years. The huge piles of debt and government obligation to invest in future carbon-low infrastructure are likely to require Eskom to continue to increase electricity prices to remain functioning and sustain itself economically. Therefore, corporate PPAs can offer a unique economic advantage vs the state-imposed electricity tariff by Eskom, even though the cost of electricity in South Africa, particularly in the industrial sector, has been among the lowest in the world.

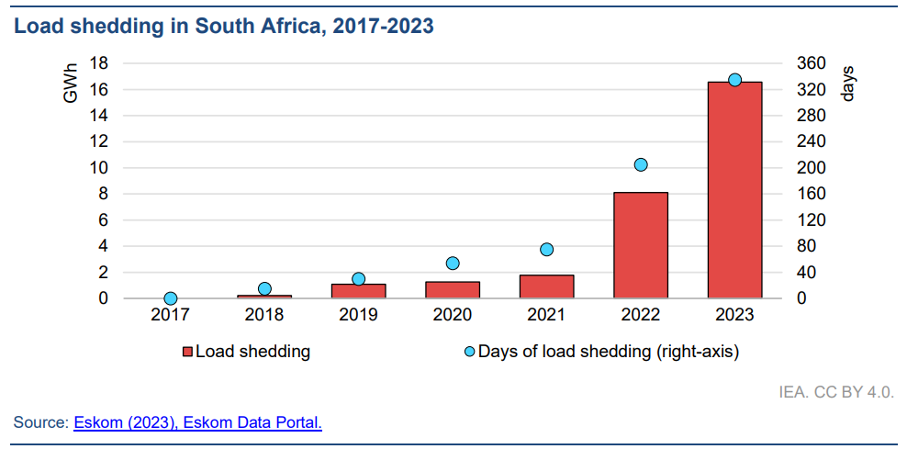

Load Shedding

The power sector continues to be plagued by load shedding due to a shortage of power capacity as the availability of its ageing coal fleet has degraded further. The load shedding has long stood as one of the most significant challenges in South Africa. South Africa’s current heavy reliance on coal constitutes 80% of its power generation and results in daily power cuts.

However, the recent regulatory relaxation in the Power Purchase Agreement (PPA) market is poised to attract new players, including PPA corporate buyers and Independent Power Producers (IPPs). As new renewable energy capacities are getting connected to the grid, they hold the potential to significantly reduce the risk of load shedding, marking a crucial step toward a more stable and resilient energy future for South Africa.

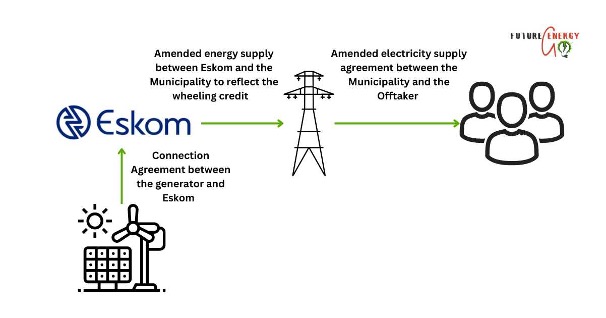

Wheeling agreements

The term wheeling describes the transportation of power through the grid from the seller to the buyer. It deals with the use of electricity networks and related costs. Wheeling charges (or network use charges) reflect the costs of using the network, including connection costs, maintenance, operations, refurbishment, customer services, and administration, as well as surcharges, such as electrification and rural subsidy charges.

Wheeling helps more renewable energy get used in South Africa. It lets private power producers send their electricity to customers through the national grid. To use wheeling, the customer must be connected to a medium-voltage (MV) or higher-voltage network and be on a time-of-use (TOU) tariff.

Wheeling costs in SA vary from municipality to municipality. However, in response to the corporate demand for Power Purchase Agreements (PPAs) in South Africa, there has been an active exploration of a new, simplified concept known as “virtual wheeling.” This aims to connect multi-site corporate buyers and low-voltage buyers with renewable energy sources.

Eskom Electricity Tariff

In the past, ESKOM tariffs in South Africa have exhibited a historical trend of annual increases surpassing inflation. However, the emergence of Corporate Power Purchase Agreements (PPAs) in the market, spanning 10 to 20 years, presents an energy cost savings opportunity for corporate buyers. The rates offered in these corporate PPAs are considerably lower than the historically escalating ESKOM tariffs.

There are currently multiple local and global PPA energy market players in the market. One private company, POWERX (previously Amatola Green Power), holds a NERSA-issued licence to trade electricity countrywide. The company buys Wind, Hydro, Solar, Biogas, Biomass, or any other green power from IPPs and sells it to consumers. The company offers the IPPs long-term PPAs of up to 20 years. POWERX also negotiates and pays wheeling fees to the owners of the transmission and distribution grids.

PPA Offer Structure in South Africa

Typical PPA offer structure in South Africa includes:

- Physical PPA Contract Architecture wheeled through Eskom and municipalities

- No compensation for excess energy is foreseen, i.e. production should match consumption

- Contract Tenure of 15 years or longer

- CPI indexation with or without CAP

- Fixed or Eskom tariff-linked pricing

- Solar PV technology is the most common

- No BESS storage solution

- Time-of-use PPA price structure

- Pay-as-Produced PPA Generation Profile

What to consider in PPA negotiations in South Africa?

- Eskom wheeling credit requirement as a buyer pays for all the energy that is produced by the IPPs and Eskom refunds the buyer with a 45 days payment term.

- The type of energy attribute certificates (EACs) provided within the PPA supply. Often, local renewable energy certificates are included instead of the iREC standard typically required by RE100/CDP international standards.

- Define clear roles and responsibilities on who, how and when Eskom and municipality wheeling agreements are negotiated. Please note that the process varies from municipality to municipality, so regional energy market specifics are to be considered.

- Ensure you have received necessary details about renewable assets, including details about grid connection and necessary permits, including the developer’s experience in the local market.

- Ensure that Eskom and the municipality where the physical site is located are engaged in a billing reconciliation process for wheeling charges where the wheeling credit method is employed. Some municipalities might not use the wheeling credit method, and instead, real-time electricity bill adjustments are made to account for renewable energy purchased.

- Credit position requirements, if any.

Conclusions

The latest energy market statistics and news reflect a positive trend, indicating a growing appetite for sustainable energy solutions, with CPPA transactions gaining traction in the South African energy market over the past year. Although the market is still emerging.

Therefore, a cautious approach is imperative as corporate buyers increasingly explore these agreements to meet their renewable energy goals. Despite the encouraging news about the adoption of PPAs in South Africa, corporate buyers must be aware of the associated risks embedded in these contracts.

Comprehensive due diligence, contract risk assessment, and a nuanced understanding of market dynamics are prerequisites for navigating the intricacies of PPAs. As the South African energy market evolves, staying informed and proactive will be essential for corporate buyers. If this article has resonated with you, we encourage you to share these insights with your friends and family. Thank you!

Curious to learn more about PPAs? Our guide offers a concise roadmap to navigate Power Purchase Agreements (PPAs). Learn more here.