Electricity Market Prices at a Glance

The electricity market prices have been on the rise since 2021. The situation has significantly worsened following the war outbreak in Ukraine in Feb’22. As a result, electricity market prices have increased to unprecedented levels, with German Cal23 baseload future contract trading above 1.000 EUR/MWh. Since the end of Aug’22, wholesale electricity market prices in Europe fell about 50% from their peak, which is still 7 times higher than the historical electricity price level! To learn more about the European electricity market prices history, you can visit this article.

The evolution of German Cal23 Future Power Contract in 2022, EUR/MWh

While gas and electricity market prices came down since the end of August, they remain very high and put heavy pressure on people and companies. The EU Commission is therefore proposing several measure to cope with the high electricity prices.

What is Europe doing about the energy crisis?

- Secure new routes of LNG gas supply, i.e., Norway, USA, Qatar, under a new type of long-term agreement;

- To develop an intervention to limit prices in the natural gas market via an implementation of a new LNG market price index;

- To limit the impact of gas prices on wholesale electricity market prices via an introduction of a “temporarily” price cap;

- Investment into energy efficiency measures and new infrastructures.

- Continue working on the structural reform of the electricity market design. By the end of the year, the EU commission plan to present the first plans for the future energy market design;

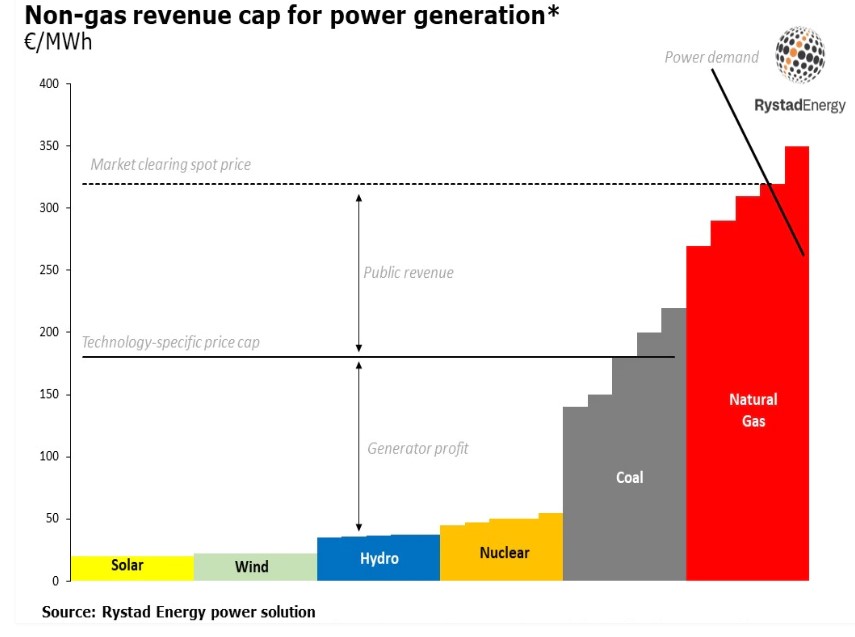

- Introduction of a price cap for non-gas energy generation companies to redistribute excess profits the companies generate.

In one of the previous articles, we already discussed the price cap on non-gas generation sources and its likely impact on the market. You can learn more here.

Alternative sources have come under investigation due to Europe’s rising anxiety about the security of its gas supply in the wake of Russia’s invasion of Ukraine, particularly in neighboring North Africa because of its closeness as well as the LNG gas.

LNG Supply Disruption

The number of LNG supply interruptions hit all-time highs in 2020 and 2021 and continued to rise in the first eight months of 2022, causing the global LNG market to become more constrained and raising worries about supply security. Nearly 37 bcm of LNG production was lost in the first eight months of 2022 due to planned or unforeseen incidents. The biggest outage in 2022 was the fire-related protracted shutdown of the 20 bcm Freeport LNG plant.

1/5 of all US LNG exports before the incident came from Freeport, the second-largest liquefaction facility in the US. According to the operator’s most recent advice, the plant will only restart partial operations beginning in mid-November and return to full service in March 2023.

What’s next?

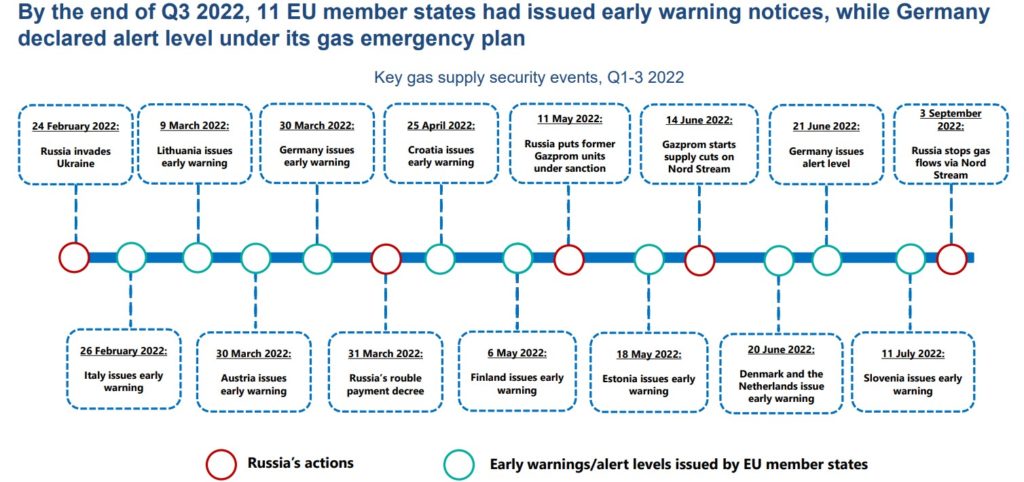

One of the remaining operational Russian gas supply channels to Europe might be closed if Moscow follows through on its threat to penalize Ukrainian energy company Naftogaz, worsening the energy situation as the critical winter heating season gets underway. Gazprom may stop transit gas through Ukraine after noises about sanctions.

So far, Europe has received a sufficient amount of LNG gas from the USA and Qatar. However, due to several new contracts signed since the beginning of 2021 and a colder-than-average winter, China’s LNG imports are predicted to increase in 2023, bolstering competition in the global LNG market.

Risks:

- Return of China to the LNG spot market

- French nuclear concerns, lower renewable generation

- Disruption of US LNG exports

Conclusions

- The pace of return of the French nuclear reactors and hydropower availability will be crucial for the upcoming winter;

- Over the next 10 years, LNG should be able to cover more than 50% of das demand in Europe. But in the short term, in 3 to 5 years, the US and Qatar won’t be able to compensate for the collapse of Russian gas fully;

- High market price volatility causes lower liquidity. Extreme price swings and higher prices have caused rising margin costs;

- We must wait until 2025-26 before seeing the supply side peaking up again without Russian gas;

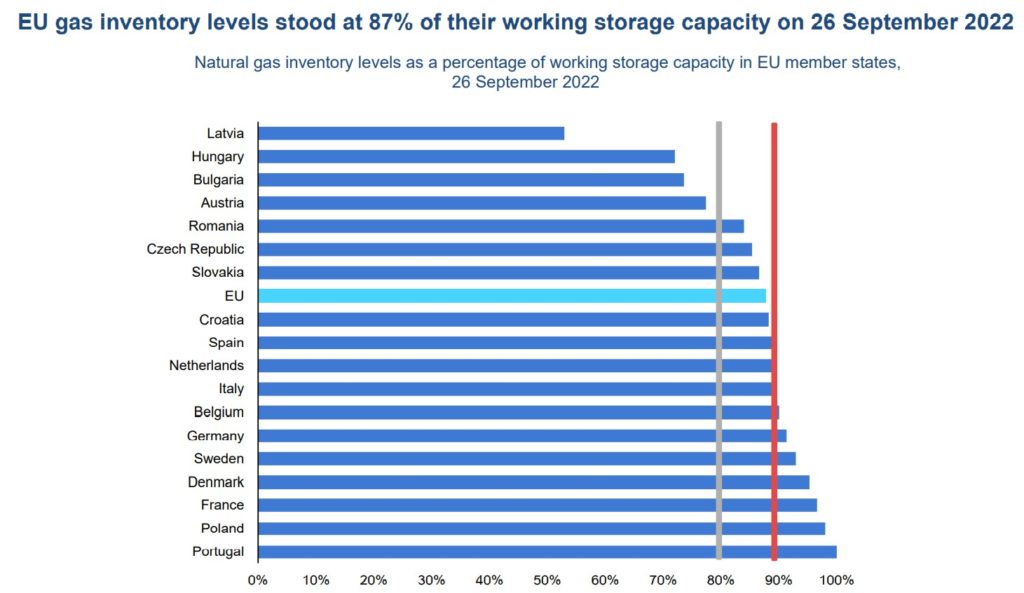

- Weather is a core uncertainty for the upcoming winter. Cold spikes can drive higher consumption and depletion of the EU gas storage. Unless the winter is mild, there’s a further need for demand disruption;

- Russian gas has been entering Europe only through Ukraine and the Turkish pipelines since the end of Aug. The flows can be interrupted anytime now, which will be very bad for the EU this winter.